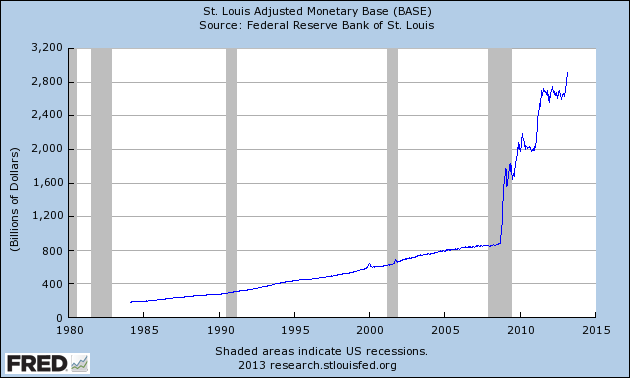

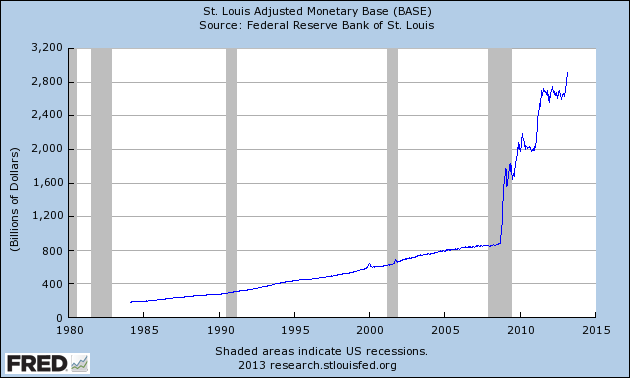

For a Short Term View of the Monetary Base go here...

http://research.stlouisfed.org/publicat ... /page3.pdf

Excess Reserves of Depository Institutions

HT: Libertarian Investments Blog

http://libertarianinvestments.blogspot. ... lodes.html

Moderator: Global Moderator

I other words, keep your eye on private credit. That's the real bulk of our money supply — many, many, many times over.Richard Werner wrote:“There are different types of money. The first is legal tender paper money. This is mainly used by the public for petty transactions and amounts to only about 3 per cent of the total money supply. Another type of money also created by the central bank is solely for the use of its clients, the banks. This is reserve money. It stays in the banks’ accounts at the BoE to settle their claims against each other. If one bank reduces its reserves, this raises those of another bank, leaving the total amount of this closed-loop money unchanged. It normally also amounts to about 3 per cent of the money supply, but it never circulates in the economy and as such is not really money. So what about the money that is used for most transactions and accounts for the bulk of the actual money supply?

As Martin Wolf has pointed out, it is created by profit-oriented companies, the banks, when they do what is commonly referred to as “lending money”?. But they don’t lend existing money. Instead, they newly invent the money that they lend…”?

Source: http://pragcap.com/richard-werner-explains-our-money

I agree. As a non-libertarian I see merit in libertarians desire to push for freedom and self responsibility, but the macro analysis that most of them publish is so backwards that it makes it hard for me take the movement seriously and I would never want to be associated with it.Pointedstick wrote: I feel that this fundamental misunderstanding of the credit-based fiat monetary system we have is something that holds Libertarianism back. You don't have to approve of it, just understand it. There's still lots of room to oppose government once you understand how the monetary system works, and in fact, your opposition can be more informed and accurate.

Hey melveyr,melveyr wrote:I agree. As a non-libertarian I see merit in libertarians desire to push for freedom and self responsibility, but the macro analysis that most of them publish is so backwards that it makes it hard for me take the movement seriously and I would never want to be associated with it.Pointedstick wrote: I feel that this fundamental misunderstanding of the credit-based fiat monetary system we have is something that holds Libertarianism back. You don't have to approve of it, just understand it. There's still lots of room to oppose government once you understand how the monetary system works, and in fact, your opposition can be more informed and accurate.

That's like saying that my partical physics is a lot more accurate when you take trillions of those particals together to form an object and ask me to tell you how that object will behave given stimuli. In fact, that's not partical physics anymore, that's Newtonian physics.Pointedstick wrote: Their macro analysis is a lot more accurate when made about families, individual states, or the poor EU nations. They're mostly confused about the difference between currency users and currency issuers.

I can't say I agree. You and I are individually Micro, to be sure, but how many of us make a Macro? Does it take a village? A state? Why is a currency-issuing nation the smallest unit of Macro? Why shouldn't we say that the entire world economy is the smallest unit of Macro?moda0306 wrote:That's like saying that my partical physics is a lot more accurate when you take trillions of those particals together to form an object and ask me to tell you how that object will behave given stimuli.Pointedstick wrote: Their macro analysis is a lot more accurate when made about families, individual states, or the poor EU nations. They're mostly confused about the difference between currency users and currency issuers.

Those are micro issues.

Pointedstick wrote:I can't say I agree. You and I are individually Micro, to be sure, but how many of us make a Macro? Does it take a village? A state? Why is a currency-issuing nation the smallest unit of Macro? Why shouldn't we say that the entire world economy is the smallest unit of Macro?moda0306 wrote:That's like saying that my partical physics is a lot more accurate when you take trillions of those particals together to form an object and ask me to tell you how that object will behave given stimuli.Pointedstick wrote: Their macro analysis is a lot more accurate when made about families, individual states, or the poor EU nations. They're mostly confused about the difference between currency users and currency issuers.

Those are micro issues.

Yeah I guess it's a matter of degree. I think it may often be individual countries, but if they are so small they don't control their currency and buy a ton of their stuff from other countries I don't know how well macro holds up.Pointedstick wrote: Their macro analysis is a lot more accurate when made about families, individual states, or the poor EU nations. They're mostly confused about the difference between currency users and currency issuers.

I'm not afraid of the Fed, I'm afraid of Congress. The Fed is just tasked with the semi-impossible job of making Congress's illiterate-level decisions work monetarily, which is why they end up looking to stupid and reactionary. When it comes down to it, I think Congress is the driver and the Fed is the ass.craigr wrote: The main critique for me is that the people running the Central Banks are just incompetent to manage a large and complex economy. Nobody can really do it. So the Fed goes from crisis to crisis (after having a large hand in causing each) and are always trying to fight the last war. Then when the next crisis comes about they step in to do something totally new and cause another problem later.

No, it's really about managing the economy and allowing government spending to greatly expand. The arguments for the creation of the Fed centered around stabilizing the economy, ending market panics, etc. It was sold on management.moda0306 wrote: Having fiat money isn't about managing an entire economy, it's about managing a floor price level on debt to maintain a stable real economy.

As for non-monetary problems, well that's not really accurate because a lot of domestic problems are caused from monetary problems as the kernel. Look at the countries in the EU having problems with "austerity" and the issues of riots and instability. The kernel there was the government entitlement spending propped up by central bank management enabled the entire situation. Or there are other issues surrounding government largesse enabled with debt financing that kick off civil wars, armed conflicts, etc. These events can all lead to hyper-inflations or at the minimum, severe instability in the currency.Also, we've looked at these hyperinflations, and they're almost always caused by some underlying non-monetary problem... problems that it's hard to imagine the US having if dozens of other countries aren't having them first.

Plenty of front-running currencies went into the toilet and no aliens landed. It all happened due to normal human mis-management, loss of market confidence, foreign and civil wars, etc. So if I'm placing my bets for the long term, it's that the U.S. dollar will have a problem one day, and it will happen for reasons that nobody thought were possible, and finally it will happen so quickly that nobody will be able to really stop it.I'm definitely a little weary of the possibility, but I think we'd disagree on what would cause it. You might think some kind of Galt withdrawal and quantitative easing might cause it. I tend to think it might be an alien invasion or something I can't even think of yet that threatens the very foundation of our productive capacity or political stabiliy (though I think it would be inherantly non-monetary in nature... hyperinflation would be the effect, not the cause).

Honestly, they're all asses.Pointedstick wrote: When it comes down to it, I think Congress is the driver and the Fed is the ass.

Well MR certainly acknowledges the possibility of inflation and hyperinflation... I just think it has a very well-rounded look at what brings it about... but I'll agree that your point about government-run money making war-financing easier and leading to more currency collapses is a chicken/egg combo I hadn't thought of.craigr wrote:No, it's really about managing the economy and allowing government spending to greatly expand. The arguments for the creation of the Fed centered around stabilizing the economy, ending market panics, etc. It was sold on management.moda0306 wrote: Having fiat money isn't about managing an entire economy, it's about managing a floor price level on debt to maintain a stable real economy.

But they are horrible managers. At least, no better than a piece of yellow metal would have been. And perhaps a lot worse because the paper system enables a lot of troubles in terms debt financing for funding wars, domestic spending expansion, etc.

As for non-monetary problems, well that's not really accurate because a lot of domestic problems are caused from monetary problems as the kernel. Look at the countries in the EU having problems with "austerity" and the issues of riots and instability. The kernel there was the government entitlement spending propped up by central bank management enabled the entire situation. Or there are other issues surrounding government largesse enabled with debt financing that kick off civil wars, armed conflicts, etc. These events can all lead to hyper-inflations or at the minimum, severe instability in the currency.Also, we've looked at these hyperinflations, and they're almost always caused by some underlying non-monetary problem... problems that it's hard to imagine the US having if dozens of other countries aren't having them first.

A problem in the U.S. dollar would affect many countries for certain, but at the same time there is no reason to believe those countries would lead first and take the dollar with them. It is far more likely the opposite would happen. In fact, it could even be those dependent countries leaving the dollar that could instigate the whole mess. There are simply too many factors to consider.

Plenty of front-running currencies went into the toilet and no aliens landed. It all happened due to normal human mis-management, loss of market confidence, foreign and civil wars, etc. So if I'm placing my bets for the long term, it's that the U.S. dollar will have a problem one day, and it will happen for reasons that nobody thought were possible, and finally it will happen so quickly that nobody will be able to really stop it.I'm definitely a little weary of the possibility, but I think we'd disagree on what would cause it. You might think some kind of Galt withdrawal and quantitative easing might cause it. I tend to think it might be an alien invasion or something I can't even think of yet that threatens the very foundation of our productive capacity or political stabiliy (though I think it would be inherantly non-monetary in nature... hyperinflation would be the effect, not the cause).

With so many dollars around the planet it wouldn't take much to cause a major catastrophe in the currency. In a way, the wide distribution of dollars in the market does not make the currency more stable. It acts as a form of leverage because you now have so many people that can panic sell that aren't connected to the country directly. The risks of problems in the dollar is actually very much magnified, not diminished, because your exposure to billions of market participants is extremely large and uncontrollable.

Finally, to kind of bring this home, the idea of paper money and debt is as old as the hills. There is really nothing "Modern" about Modern Monetary Theory. And yet we can look at these past events and find that even if the theory sounded fine, in practical application it has always blown up in virtually every case. So why should a rational observer think it would work out for the U.S. long-term when it has never worked anywhere else in all of human history? I certainly don't believe it will.

I expect in the future as in the past, the eggheads will come up with a somewhat plausible excuse to shift the blame to something/someone else. Most people won't see thru it.craigr wrote:Eventually, they'll just cause Chernobyl. When people look at the root cause of the accident they will see people that thought they knew what they were doing were really overconfident incompetent eggheads.

The question really isn't what I'd do because I don't have a say in the matter. The real question is that it's going to happen eventually anyway (voluntarily or not), so how can we as investors protect ourselves if it happens on our timeline? For me, that is the gold part I hold and then assess the situation as it unfolds if it does happen.moda0306 wrote: I guess here's my question for you, since you're predicting this as a far off event unlike some libertarians...

- What spending would you have the federal government cease right now if you could have them do so?

It sounds like you are describing the exact Achilles' heel of the PP, the Minksy Moment: https://en.wikipedia.org/wiki/Minsky_momentcraigr wrote: With so many dollars around the planet it wouldn't take much to cause a major catastrophe in the currency. In a way, the wide distribution of dollars in the market does not make the currency more stable. It acts as a form of leverage because you now have so many people that can panic sell that aren't connected to the country directly. The risks of problems in the dollar is actually very much magnified, not diminished, because your exposure to billions of market participants is extremely large and uncontrollable.

It's more of that moment in time when market confidence slides so much that the mass of people heading for the exits simply cannot be contained, controlled or predicted.MachineGhost wrote:It sounds like you are describing the exact Achilles' heel of the PP, the Minksy Moment: https://en.wikipedia.org/wiki/Minsky_moment

What promises does the government need to be good for to keep our currency in tact? It sounds like you basically are saying that if our debt gets too high and we "print money" that will cause this lack of confidence.craigr wrote:It's more of that moment in time when market confidence slides so much that the mass of people heading for the exits simply cannot be contained, controlled or predicted.MachineGhost wrote:It sounds like you are describing the exact Achilles' heel of the PP, the Minksy Moment: https://en.wikipedia.org/wiki/Minsky_moment

Paper currencies rely on confidence of the markets to remain valuable and if that confidence vanishes, or is abused too long, the markets will extract a heavy penalty. It's not something that can be easily managed except to make people continue to believe you're good for your promises. Fundamentally, free markets work on trust and if investors don't trust a stock, bond, etc. then it goes away. If they don't trust a currency, same thing.

I don't think you can ever pin a monetary crisis onto a single cause. Probably you won't be able to prevent one by likewise elimination of a single cause.moda0306 wrote: What promises does the government need to be good for to keep our currency in tact? It sounds like you basically are saying that if our debt gets too high and we "print money" that will cause this lack of confidence.

Of course it can happen that way. If the markets don't think the issuing government is good for the debt or there are fundamental problems in whether the currency obligations will be honored in other ways (e.g. civil war), then the whole thing can collapse. AgAuMoney points out correctly that people and their reactions cannot be inserted into a formula. Their behaviors are unpredictable and each new crisis, even if it looks like a former one, will result in new outcomes. People learn from their mistakes and collectively they will make decisions for their own interests and that may not be what the economic planners think will happen.moda0306 wrote: What promises does the government need to be good for to keep our currency in tact? It sounds like you basically are saying that if our debt gets too high and we "print money" that will cause this lack of confidence.

Maybe I'm just dense, but I don't see how that is the Achilles' heel of the PP. It seems much more like the Achilles' heel of any paper-based investment scheme. If any asset is resistant to such an event, it would be physical gold, which aside from its lack of counterparty risk, accounts for approximately 0% of most investors' assets, and is therefore less vulnerable to mass selling than other, more widely held, assets such as stocks and bonds.MachineGhost wrote:It sounds like you are describing the exact Achilles' heel of the PP, the Minksy Moment: https://en.wikipedia.org/wiki/Minsky_momentcraigr wrote: With so many dollars around the planet it wouldn't take much to cause a major catastrophe in the currency. In a way, the wide distribution of dollars in the market does not make the currency more stable. It acts as a form of leverage because you now have so many people that can panic sell that aren't connected to the country directly. The risks of problems in the dollar is actually very much magnified, not diminished, because your exposure to billions of market participants is extremely large and uncontrollable.

Nobody is saying debt doesn't matter. It's simply that it has to be looked at in context of what it really is. Monetary Realism is mainly a description of our monetary system. It's just that many people that see these mechanics for what they are agree that QE is pretty useless in a balance sheet recession because it doesn't improve balance sheets.craigr wrote:The question really isn't what I'd do because I don't have a say in the matter. The real question is that it's going to happen eventually anyway (voluntarily or not), so how can we as investors protect ourselves if it happens on our timeline? For me, that is the gold part I hold and then assess the situation as it unfolds if it does happen.moda0306 wrote: I guess here's my question for you, since you're predicting this as a far off event unlike some libertarians...

- What spending would you have the federal government cease right now if you could have them do so?

But the core issue is that these ideas that debt doesn't matter I feel are just are an ex-post smokescreen for the bad habits that have developed. Just because it sounds logical on the surface doesn't mean unexpected repercussions can't show up in the future. And if you look at the history of these things, unexpected repercussions always happen eventually.