Hurry, PPers! Get This Deal While It's Hot

Moderator: Global Moderator

-

goodasgold

- Executive Member

- Posts: 387

- Joined: Tue Jan 01, 2013 8:19 pm

Hurry, PPers! Get This Deal While It's Hot

Now I know why St. Harry told us not to fall for corporate debt (even though the value of the U.S. dollar seems to be headed toward the crapper.) Check out this unbelieveable corporate lunacy:

Ecuador Re-Elects Correa on Vow to Spend Amid Record Deficit

"Rafael Correa was re-elected as Ecuador’s president yesterday after pledging to boost spending on the poor while the country runs up its biggest-ever budget deficit.... The self-described socialist revolutionary, who dubbed foreign bondholders 'true monsters' when he defaulted on $3.2 billion of debt in 2008, may now return to overseas credit markets...

"Finance Ministry officials... are in talks with Citigroup Inc. and JPMorgan Chase & Co. to sell debt in international markets, Chief Executive Officer Efrain Vieira said...

" 'While Ecuador will have difficulty persuading investors to trust it after defaulting twice in a decade, global demand for higher-yielding assets means the government will probably find buyers willing to take the risk,' Carl Ross, a managing director at Oppenheimer & Co., said.

“ 'Ecuador is about as rogue a borrower as you really get, but this is the kind of market where maybe even an Ecuador can issue,' Ross said in a telephone interview from Atlanta. 'In this market, with the low interest rates that we have, almost anything is possible.' ”?

http://www.bloomberg.com/news/2013-02-1 ... ficit.html

Ecuador Re-Elects Correa on Vow to Spend Amid Record Deficit

"Rafael Correa was re-elected as Ecuador’s president yesterday after pledging to boost spending on the poor while the country runs up its biggest-ever budget deficit.... The self-described socialist revolutionary, who dubbed foreign bondholders 'true monsters' when he defaulted on $3.2 billion of debt in 2008, may now return to overseas credit markets...

"Finance Ministry officials... are in talks with Citigroup Inc. and JPMorgan Chase & Co. to sell debt in international markets, Chief Executive Officer Efrain Vieira said...

" 'While Ecuador will have difficulty persuading investors to trust it after defaulting twice in a decade, global demand for higher-yielding assets means the government will probably find buyers willing to take the risk,' Carl Ross, a managing director at Oppenheimer & Co., said.

“ 'Ecuador is about as rogue a borrower as you really get, but this is the kind of market where maybe even an Ecuador can issue,' Ross said in a telephone interview from Atlanta. 'In this market, with the low interest rates that we have, almost anything is possible.' ”?

http://www.bloomberg.com/news/2013-02-1 ... ficit.html

Re: Hurry, PPers! Get This Deal While It's Hot

Is the U.S. dollar headed toward the crapper?goodasgold wrote: Now I know why St. Harry told us not to fall for corporate debt (even though the value of the U.S. dollar seems to be headed toward the crapper.) Check out this unbelieveable corporate lunacy:

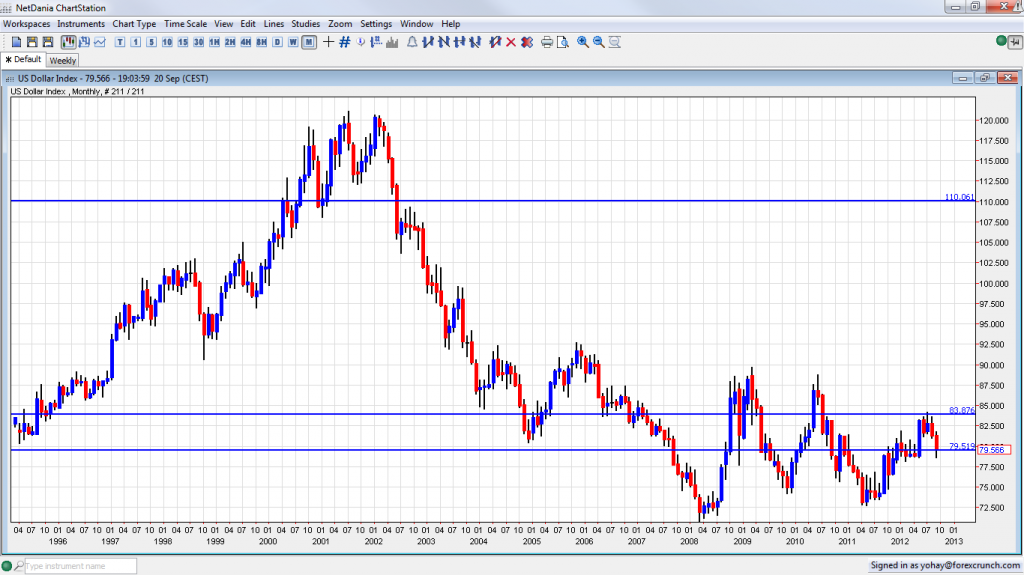

Here is a 17 year (or so) chart of the U.S. dollar index:

That looks like a multi-decade trading range to me.

All world currencies are always in the process of being devalued. I'm not sure there is anything all that special about the U.S. dollar in that regard.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

-

goodasgold

- Executive Member

- Posts: 387

- Joined: Tue Jan 01, 2013 8:19 pm

Re: Hurry, PPers! Get This Deal While It's Hot

I am not an alarmist by nature, but our future is bleak unless we focus on the need to cut spending and raise taxes. On a long-term basis, the U.S. and other developed nations are racing toward bankruptcy due to massive, and ever-growing, unfunded liabilites.

America's bankruptcy won't be the Ecuadorian solution of telling our creditors to go stuff themselves. Rather, barring an urgently needed national focus on curing our fiscal woes, our children or grandchilden will probably experience a "soft bankruptcy" caused by soaring interest rates and a crushing drop in the dollar's value. The printing presses at the Treasury will run around the clock, resulting in debt slavery and the end of the U.S. dollar as the world's reserve currency.

We have a chance to avoid this disaster, but we are not yet at a point where politicians will even acknowledge that the problem exists.

For details, an essential book on this subject is Kotlikoff and Burns' "Coming Generational Storm: What You Need to Know About America's Economic Future."

Kotlikoff and Burns are not persuasive in all respects. For example, they recommend that readers buy gold stocks instead of the the real stuff. But their book is still an eye opener. I am not a praying person, but in this case I will make an exception and pray that we, as a nation, have the courage and foresight to change course before it is too late.

America's bankruptcy won't be the Ecuadorian solution of telling our creditors to go stuff themselves. Rather, barring an urgently needed national focus on curing our fiscal woes, our children or grandchilden will probably experience a "soft bankruptcy" caused by soaring interest rates and a crushing drop in the dollar's value. The printing presses at the Treasury will run around the clock, resulting in debt slavery and the end of the U.S. dollar as the world's reserve currency.

We have a chance to avoid this disaster, but we are not yet at a point where politicians will even acknowledge that the problem exists.

For details, an essential book on this subject is Kotlikoff and Burns' "Coming Generational Storm: What You Need to Know About America's Economic Future."

Kotlikoff and Burns are not persuasive in all respects. For example, they recommend that readers buy gold stocks instead of the the real stuff. But their book is still an eye opener. I am not a praying person, but in this case I will make an exception and pray that we, as a nation, have the courage and foresight to change course before it is too late.

Re: Hurry, PPers! Get This Deal While It's Hot

The bond market will decide when the politicians need to figure out the US budget.

As long as the market buys low yield bonds, there's no incentive.

The US is far from a default.

As long as the market buys low yield bonds, there's no incentive.

The US is far from a default.

Re: Hurry, PPers! Get This Deal While It's Hot

Or if the market doesn't buy, the Fed steps in.

Still no incentive.

I think if we don't restrain the gov't politically and legally, it will self-annihilate and take us all with it.

Still no incentive.

I think if we don't restrain the gov't politically and legally, it will self-annihilate and take us all with it.

- Pointedstick

- Executive Member

- Posts: 8886

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: Hurry, PPers! Get This Deal While It's Hot

Personally, I am far more outraged on the government's assaults on my liberties than I am its sale of risk-free assets with guaranteed coupon payments.

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

Re: Hurry, PPers! Get This Deal While It's Hot

Nothing is risk free and I agree, the government no longer protects liberties but intrudes on them.

Re: Hurry, PPers! Get This Deal While It's Hot

You think that raising taxes and cutting government spending will solve our problems?goodasgold wrote: I am not an alarmist by nature, but our future is bleak unless we focus on the need to cut spending and raise taxes. On a long-term basis, the U.S. and other developed nations are racing toward bankruptcy due to massive, and ever-growing, unfunded liabilites.

I need an MMR medic, stat!!!

Where is Gumby?

Here is a question about your proposed fix: If the government has the ability to print as much money as it wants, why does it need to tax private citizens to raise money? Why can't it just print up its own money and spend that? At some point such a practice would be inflationary, of course, but we probably aren't anywhere near there right now considering that wages have been static in most industries for years (and since we know that prices can't continue rising for long if wages aren't rising in tandem).

(Welcome to the forum, BTW.)

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

- Pointedstick

- Executive Member

- Posts: 8886

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: Hurry, PPers! Get This Deal While It's Hot

goodasgold, can you tell me specifically why the government needs to cut spending and raise taxes? Is it because people (who?) will stop buying our bonds? Or because having a budget deficit causes inflation (then where's the inflation?)?

Can you tell me what effect cutting spending would have on the treasury market?

Is the government the sole source of money? If not, who else issues money?

Is inflation purely a monetary phenomenon? Could you have significant inflation if the money supply was increasing but wages were falling for most people? In what circumstances?

As someone who used to believe the very things you've been saying, I leave you to ponder these questions.

Can you tell me what effect cutting spending would have on the treasury market?

Is the government the sole source of money? If not, who else issues money?

Is inflation purely a monetary phenomenon? Could you have significant inflation if the money supply was increasing but wages were falling for most people? In what circumstances?

As someone who used to believe the very things you've been saying, I leave you to ponder these questions.

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

-

goodasgold

- Executive Member

- Posts: 387

- Joined: Tue Jan 01, 2013 8:19 pm

Re: Hurry, PPers! Get This Deal While It's Hot

Forty years before the Civil War, the storm clouds over the growing slavery dispute caused even an atheist like Thomas Jefferson to lament prophetically: "I tremble for my country when I reflect that God is just, that his mercy cannot be stayed forever..."Pointedstick wrote: goodasgold, can you tell me specifically why the government needs to cut spending and raise taxes? Is it because people (who?) will stop buying our bonds? Or because having a budget deficit causes inflation (then where's the inflation?)?

Can you tell me what effect cutting spending would have on the treasury market?

Is the government the sole source of money? If not, who else issues money?

As for an alternative to issuing money, why do PPers persist in holding a "worthless" yellow metal, much to the scorn of central bankers (even as the bankers themselves continue to hold gold reserves too?)

A timeframe for the meltdown by developing nations is notoriously tricky. As someone has said, we can ignore reality, but eventually we will not be able to ignore the consequences of reality. Jefferson's prophecy of war required 40 years to be fulfilled.

Even Kotlikoff and Burns jumped the gun, forecasting in the 2004 edition of their book that Greenspan's eventual departure may set off what they call the "big whammy." But even in 2004 they correctly forsaw that Europe and Japan were facing a crisis in advance of our own..

Here is the sequence of events they forsee in "The Coming Generational Storm," as ever increasing deficits force us to face reality:

"bond traders, who, truth be told, can be as thick as bricks, [my note: as proof, just look how traders are getting ready to loan even *more* money to Ecuador and Argentina!] may start to react to our official deficit that is now running at almost 5 percent of GDP.... Greenspan leaves. The dollar slides. Long-term interest rates rise. The CBO issues a warning... Long-term interest rates rise some more. Inflation picks up owing to higher import prices, which is due to an even weaker dollar. Long-term interest rates move into the double-digit range. The stock market tanks. The Federal Reserve prints money to lower rates, but this raises long-term rates even further. The economy moves into recession. Deficits hit 7 percent of GDP. Inflation hits double digits. The government cuts taxes in a desperate attempt to stimulate economic activity. Japan and theEU look shaky. And we are off to the races."

Re: Hurry, PPers! Get This Deal While It's Hot

I think they are simply replaying the financial meltdown experience they observed when they were younger in the 1970s.goodasgold wrote: Here is the sequence of events they forsee in "The Coming Generational Storm," as ever increasing deficits force us to face reality:

"bond traders, who, truth be told, can be as thick as bricks, [my note: as proof, just look how traders are getting ready to loan even *more* money to Ecuador and Argentina!] may start to react to our official deficit that is now running at almost 5 percent of GDP.... Greenspan leaves. The dollar slides. Long-term interest rates rise. The CBO issues a warning... Long-term interest rates rise some more. Inflation picks up owing to higher import prices, which is due to an even weaker dollar. Long-term interest rates move into the double-digit range. The stock market tanks. The Federal Reserve prints money to lower rates, but this raises long-term rates even further. The economy moves into recession. Deficits hit 7 percent of GDP. Inflation hits double digits. The government cuts taxes in a desperate attempt to stimulate economic activity. Japan and theEU look shaky. And we are off to the races."

To date, none of that stuff has happened, and I would be very surprised if any of it actually played out that way.

Deflation is the threat right now, and it is going to be the threat every time you have a credit fueled asset bubble pop at the same moment in time that your country is seeing a dramatic demographic shift like we are with the baby boomers exiting the workforce.

The entire narrative you are offering above is, IMHO, the economic equivalent of someone saying that our biggest threat to national security right now is a Japanese attack on Pearl Harbor.

I understand the appeal of the arguments you are making, and I used to find them persuasive. The thing is, though, at some point you have to account for why the narratives being offered by the inflation crowd never seem to actually show up in actual events.

The U.S. has been spending more than it takes in in taxes for the last 30 years, and interest rates have been falling the whole time, and the higher the deficits have gotten, the lower interest rates have gone.

Another question to ponder is who will be winning if the U.S. is losing? In other words, if the U.S. sees a meltdown it will be because people are selling U.S. assets (including dollars, treasuries, U.S. stocks and U.S. real estate) and moving their capital elsewhere. Where do you think people would be moving their capital to in such a scenario?

As I look around the world I don't see any country that is obviously in much better economic shape than the U.S., but I see a whole bunch of countries that are a lot worse off.

The U.S. is in many ways like a beautiful neurotic woman who looks in the mirror and sees a fat girl that nobody likes, even as she is surrounded by courters and admirers.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

Re: Hurry, PPers! Get This Deal While It's Hot

But the government can't print money. The only thing it can do is borrow money from the Federal Reserve Bank. So any time the government needs more money, it necessarily creates debt (and interest obligations) along with the money created.MediumTex wrote: If the government has the ability to print as much money as it wants, why does it need to tax private citizens to raise money?

The only money truly created or issued by the government is coins.

Re: Hurry, PPers! Get This Deal While It's Hot

Xtal,

The fed is part of our government. It's obviously linked to the private sector, but it's a government entity and its dance with the treasury and member banks needs to be seen for what it truly is.

We live in a world where T-bills are essentially cash with a velocity-slowing mechanism built into them, taxes are essentially a way to create demand for money, and banks can essentialy mint currency with certain soft constraints. It's tough to tell when you look at each individual piece, but when you step back and see the relationships for what they are, this is what you get.

Even if we look at the fed as seperate, its sole job is to promote monetary stability. Allowing the federal government to go bankrupt would hardly contribute to that goal.

I think people have to get over looking at the amount of M0 as some sort of sacred number. If we really wanted to, we could probably start using mutual fund/etf shares as money. Financial assets in such a computer driven world would make a reasonable medium of exchange. And that's exactly what money really is... just another (stable/liquid) financial asset. Treasury bonds are as well. The only difference between cash/t-bills, and other financial assets, is that other financial assets are usually representative of some claim on productive property, while cash & t-bills can imply be used to clear those obligations. The real question is, do we have to many "clearing" financial assets in our economy in relation to productive property. The answer is reflected in our balance sheets, and is clearly "no."

Inflation isn't just a monetary phenomenon. And even if it were, what constitutes "money" is becoming more and more difficult to define.

The fed is part of our government. It's obviously linked to the private sector, but it's a government entity and its dance with the treasury and member banks needs to be seen for what it truly is.

We live in a world where T-bills are essentially cash with a velocity-slowing mechanism built into them, taxes are essentially a way to create demand for money, and banks can essentialy mint currency with certain soft constraints. It's tough to tell when you look at each individual piece, but when you step back and see the relationships for what they are, this is what you get.

Even if we look at the fed as seperate, its sole job is to promote monetary stability. Allowing the federal government to go bankrupt would hardly contribute to that goal.

I think people have to get over looking at the amount of M0 as some sort of sacred number. If we really wanted to, we could probably start using mutual fund/etf shares as money. Financial assets in such a computer driven world would make a reasonable medium of exchange. And that's exactly what money really is... just another (stable/liquid) financial asset. Treasury bonds are as well. The only difference between cash/t-bills, and other financial assets, is that other financial assets are usually representative of some claim on productive property, while cash & t-bills can imply be used to clear those obligations. The real question is, do we have to many "clearing" financial assets in our economy in relation to productive property. The answer is reflected in our balance sheets, and is clearly "no."

Inflation isn't just a monetary phenomenon. And even if it were, what constitutes "money" is becoming more and more difficult to define.

Last edited by moda0306 on Tue Feb 19, 2013 3:45 pm, edited 1 time in total.

"Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds."

- Thomas Paine

- Thomas Paine

Re: Hurry, PPers! Get This Deal While It's Hot

The point I am making is that if the U.S. government essentially has a credit card with no limit (which it does), what reason would there be to increase the amount of money collected from the private sector in the form of taxes, especially in a time when aggregate demand was weak?Xtal wrote:But the government can't print money. The only thing it can do is borrow money from the Federal Reserve Bank. So any time the government needs more money, it necessarily creates debt (and interest obligations) along with the money created.MediumTex wrote: If the government has the ability to print as much money as it wants, why does it need to tax private citizens to raise money?

The only money truly created or issued by the government is coins.

Since all money in circulation started with the government inserting it into the private sector at some point (how else would it have gotten into the private sector?), why would the government ever need to confiscate money from the private sector to meet its own spending needs? Answer: it wouldn't.

The purposes of taxes are really to legitimize and standardize a currency, help cool down or heat up an economy (as needed), and help control inflation in some situations by pulling excess money out of circulation through confiscation. None of those purposes have anything to do with revenue collection.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

Re: Hurry, PPers! Get This Deal While It's Hot

That all is fine and good from a philisophical perspective, but when we're left with deciding how to invest with the money we're allowed to keep, it would serve us well to understand the currency we use as a society, and how those evils will manifest themselves.Kshartle wrote: The purpose of taxes is to transfer the wealth and productivity of slaves to their masters. Some of the money goes to pay off voters, some goes to pay the enforcers, some goes to squash the master's enemies.

I don't usually like holocaust anaologies, but I'm sure the victims were far less concerned with the moral side of their delemma (they knew they were victims of a horrible genocide) than how to stay alive long enough to be rescued. We can disagree on the morality of taxes, but their role in our currency game we'd best seek to understand... especially if it helps us realize that lowering taxes doesn't have the fiscal consequences some fear

"Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds."

- Thomas Paine

- Thomas Paine

- Pointedstick

- Executive Member

- Posts: 8886

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: Hurry, PPers! Get This Deal While It's Hot

That's easy. I can think of a bunch of explanations:MediumTex wrote:The point I am making is that if the U.S. government essentially has a credit card with no limit (which it does), what reason would there be to increase the amount of money collected from the private sector in the form of taxes, especially in a time when aggregate demand was weak?Xtal wrote:But the government can't print money. The only thing it can do is borrow money from the Federal Reserve Bank. So any time the government needs more money, it necessarily creates debt (and interest obligations) along with the money created.MediumTex wrote: If the government has the ability to print as much money as it wants, why does it need to tax private citizens to raise money?

The only money truly created or issued by the government is coins.

1) Because you don't understand the nature of the system.

2) You do understand, but know that it would terrify and confuse the voters to act on it.

3) You do understand, but don't care because you see taxes as a weapon to be wielded against groups you don't like.

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: Hurry, PPers! Get This Deal While It's Hot

The absolute stupidest thing about the current system is returning income taxes on transfer payments from the Treasury.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: Hurry, PPers! Get This Deal While It's Hot

Yes... until you realize that somehow the government has to "means test" social security without the hen noticing it's being plucked. Then, it makes perfect sense... even if just from an "inflation control" point of view.MachineGhost wrote: The absolute stupidest thing about the current system is returning income taxes on transfer payments from the Treasury.

"Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds."

- Thomas Paine

- Thomas Paine

Re: Hurry, PPers! Get This Deal While It's Hot

Cut spending & unfunded liabilities = Yesgoodasgold wrote: I am not an alarmist by nature, but our future is bleak unless we focus on the need to cut spending and raise taxes. On a long-term basis, the U.S. and other developed nations are racing toward bankruptcy due to massive, and ever-growing, unfunded liabilites.

Raise taxes = No

You can't tax yourself into prosperity.

The whole aim of practical politics is to keep the populace alarmed (and hence clamorous to be led to safety) by menacing it with an endless series of hobgoblins, all of them imaginary.

- H. L. Mencken

- H. L. Mencken

Re: Hurry, PPers! Get This Deal While It's Hot

And you can slash spending on base needs for the elderly and have that result in prosperity?rocketdog wrote:Cut spending & unfunded liabilities = Yesgoodasgold wrote: I am not an alarmist by nature, but our future is bleak unless we focus on the need to cut spending and raise taxes. On a long-term basis, the U.S. and other developed nations are racing toward bankruptcy due to massive, and ever-growing, unfunded liabilites.

Raise taxes = No

You can't tax yourself into prosperity.

Seems to me we're probably just talking about prosperity for different groups of people.

"Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds."

- Thomas Paine

- Thomas Paine

Re: Hurry, PPers! Get This Deal While It's Hot

Who said anything about the elderly? Slash gov't waste, the military, all the obvious things. Then phase down unfunded liabilities like Social Security and Medicare by allowing people to opt out of the system if they want and invest that money themselves.moda0306 wrote:And you can slash spending on base needs for the elderly and have that result in prosperity?

Seems to me we're probably just talking about prosperity for different groups of people.

But since you mentioned the elderly, this notion that the elderly are all destitute and can only survive with gov't handouts is largely nonsense. Most elderly are far better off than younger people. And why shouldn't they be -- they've had an entire lifetime to save and invest. Where did people get the idea that when people get old they suddenly get poor?

The whole aim of practical politics is to keep the populace alarmed (and hence clamorous to be led to safety) by menacing it with an endless series of hobgoblins, all of them imaginary.

- H. L. Mencken

- H. L. Mencken

- Pointedstick

- Executive Member

- Posts: 8886

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: Hurry, PPers! Get This Deal While It's Hot

Yes, yes, a thousand times yes!rocketdog wrote:Who said anything about the elderly? Slash gov't waste, the military, all the obvious things. Then phase down unfunded liabilities like Social Security and Medicare by allowing people to opt out of the system if they want and invest that money themselves.moda0306 wrote:And you can slash spending on base needs for the elderly and have that result in prosperity?

Seems to me we're probably just talking about prosperity for different groups of people.

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

Re: Hurry, PPers! Get This Deal While It's Hot

That is a naive fantasy and totally inverts reality.moda0306 wrote: The fed is part of our government. It's obviously linked to the private sector, but it's a government entity and its dance with the treasury and member banks needs to be seen for what it truly is.

The Federal Reserve is a private entity with a very weak link to the public sector. The Federal gov't has no more control over the Federal Reserve than they do any other corporation.

The Federal Reserve Board of Governors is the political entity, and staffed by political nominees. However, as the candidates for each position are in all practical and actual terms provided by the member banks, the banks control the Board.

Financially, the Fed is independent of D.C., except they pay a 100% tax on all profits in excess of 6%. Since they control the money supply, and can create money and lend it to foreign institutions at will, they can program their desired income. Then they can spend whatever they want as a cost of doing business, and keep 6% of what is left as a dividend. The deal is fantastically better than most corporations, including the postal service.

Legally, the Fed is required to be independent of D.C. So unless the law is changed, the Fed makes its own rules. (hence "audit the fed"). The same is true for any business in the country and really, each of us individually as well.

The Fed was created as, still exists as, and currently operates as a private, for profit, business independent of the Federal Gov't.

Re: Hurry, PPers! Get This Deal While It's Hot

I don't think the law has been changed to read that way.Xtal wrote: But the government can't print money. The only thing it can do is borrow money from the Federal Reserve Bank.

The Executive Branch (i.e. the president and the Treasury dept) are legally allowed to print as much money as they have gold and silver to back it.

The law allows the president to set the price of gold and this was done almost daily by FDR and by Nixon. It may allow setting the price of silver similarly, but of this I am not sure.

Therefore the President could simply declare the price of gold to be whatever he wanted to allow sufficient dollars to be printed.

Similarly, Congress also has horribly overcomplicated the law authorizing the mint to produce coins from precious metals. It was simple in the late 1980's, but has become a gross monstrosity over the years, and in the section dealing with platinum coins they missed a crucial part. And yes, it does allow the mint to make a platinum coin with any face value they would like it to have, with no tie or relationship to its weight. So the mint could produce a platinum coin, even a one-off, and make the value $50Trillion instead of $50. Or even $50 Quadrillion. The sky is the limit.

Well, the sky and public perception... There might be detrimental effects on the dollar if any of these parties take full advantage of the power they legally have. At least, if they do it suddenly.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: Hurry, PPers! Get This Deal While It's Hot

A vast majority aren't poor anymore because of SS and Medicare. Early recipients got a fantastic largesse far commensurate past what they contributed. Don't conflate the current increased social security of the elderly (that allowed them to take greater risks in life to achieve greater wealth) with their previously destitute brethen.rocketdog wrote: But since you mentioned the elderly, this notion that the elderly are all destitute and can only survive with gov't handouts is largely nonsense. Most elderly are far better off than younger people. And why shouldn't they be -- they've had an entire lifetime to save and invest. Where did people get the idea that when people get old they suddenly get poor?

So what do you want to do about those that don't fit into your definition of "most"? Like my Gma who recives a whopping $800 a month from SS.

Last edited by MachineGhost on Thu Mar 14, 2013 11:08 pm, edited 1 time in total.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!