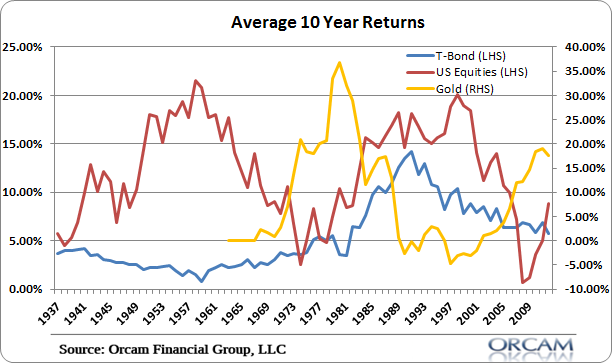

http://pragcap.com/the-long-view-on-asset-class-returns

[align=center]

[/align]

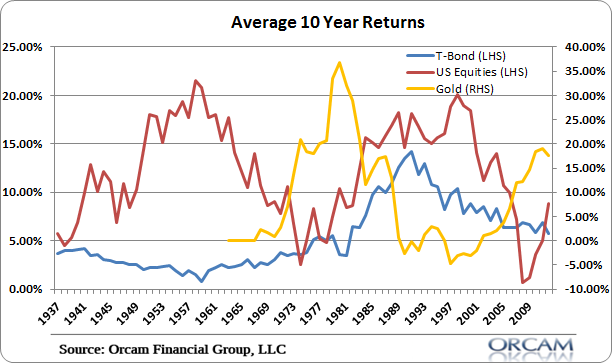

[/align]If you dig through the comments, you'll come across this inflation-adjusted chart...

[align=center]

[/align]

[/align]Pretty neat.

Moderator: Global Moderator

[/align]

[/align] [/align]

[/align]I'm almost certain that Cullen has been reading Harry Browne — or at least using his principles. We know that he reads your blog, so we know he's familiar with the PP and those assets. And Cullen's firm is now suggesting something they are calling the "Savings Portfolio" — which sounds a lot like the Permanent Portfolio concept (doesn't appear to be a product they are selling just yet)...melveyr wrote: I know that Cullen is familiar with the PP and the framework that rests underneath it. Maybe he is moving closer to the PP...

In a recent post, he elaborates...Orcam wrote:At Orcam we believe your saving portolio should achieve two primary goals:

1) It should protect against the potental for permanent loss.

2) It should reduce the risk of purchasing power loss.

We believe most of Wall Street and the media creates false perceptons around portolio design by pitching the saving portolio as an "investment" portolio which results in excessive risk, excessive fees, excessive portolio churn and sub-par performance. Of course, "saving" doesn't sound as sexy as "investng", but when you allocate your unspent income into securites on a secondary market that is indeed what you are doing. At Orcam, we don't believe saving is supposed to be sexy. Your unspent income is saved so you can consume at a future date. If you buy into the "investment" myth you are likely taking on excessive risk and thereby increasing the likelihood that your savings won't be there when you most need it.

At Orcam we view your savings as a repository that results from your primary source of income. It's important not to put the cart before the horse here. Most savers want to protect against the two aforementoned risks so they can then retre and draw on this saving when it is most needed. So you should be thinking about your saving portolio as a repository that flows from your primary source of income. And that means the best investment you'll ever make is in your primary flow of income or your job or specific area of expertse. Instead, many savers fall for the Wall Street myth that your saving portolio will generate returns that make you fabulously wealthy thereby offseting or replacing your primary source of income. This is not the correct way to view your saving portolio and will substantally increase the odds of failing to meet the goals for your savings.

Source: http://orcamgroup.com/wp-content/upload ... _Myth3.pdf

Now, I can't say what assets Cullen is putting in his own "Savings Portfolio," (there doesn't appear to be an Orcam product yet, afaik) but if he's touting the separate PP/VP concept and he's examining the long term assets of gold, Treasuries and stocks — and he's mentioned his opionin on the Permanent Portfolio once or twice — one has to assume that he has learned a thing or two from Harry Browne.Cullen Roche wrote:I think this is a paradigm shift in the way people approach their portfolios. The idea of investing is sold to people to give them the impression they’re actually doing something much sexier than what they probably should be doing.

Investing sounds sexy. Who wants to save? Saving is boring, slow, bleh. But investing is awesome. It’s high performance, sexy, you know, Warren Buffett does it! It’s like buying a Ferrari. It looks sexy, it goes fast and it’s expensive. A Ferrari is the “investing”? equivalent of a hedge fund. The problem is, you’ve got your kids strapped in the back (maybe even in the trunk if you have a big family) and you probably have no idea whether the driver can actually control the vehicle (because you’re obviously not driving when you hire someone else to take care of your portfolio).

The reality is that you’re not investing in a secondary market. You’re allocating your savings. It’s not sexy. It’s not fast, sleek and it shouldn’t be expensive. It’s like driving a Honda Accord. It’s not the Ferrari, but it will get you from point A to point B and it will do it much safer, far less expensively and best of all, you can operate it entirely on your own. But the investment business doesn’t want you in a Honda Accord. They want to sell you the Ferrari because, well, it’s more expensive. 9 times out of 10 you should probably leave the Ferrari in the garage and just take the Honda Accord….

Source: PragCap: A Paradigm Shift — The Savings Portfolio

So it sounds like he's running a 50% PP with a 50% VP.I am not a PP advocate. And no, Harry Browne did not describe the same thing. In fact, in the book that made his approach famous he uses the terms “speculating”? and “investing”?. From a technical sense, Browne is wrong and that technicality is an important point here. The PP is more like Dalio’s All Weather portfolio. I don’t think that approach is wise going forward. See my post on asset class returns for a taste of my thinking there…

Also, the approach the PP uses is totally different from what I use. I would never put 50% of my money in a portfolio that cannot protect against purchasing power loss (cash) and permanent loss (gold).

I agree with many of Browne’s more basic 17 rules, but I am probably closer to Bogle when it comes to this sort of stuff. But my portfolio construction would probably not be advocated by either of them….I am really closer to a combo of Dalio’s all weather and his pure alpha….