I grew up (if you can call it that) in Orange County, CA, the epicenter of the subprime disaster... I saw first hand the madness that went for real estate...

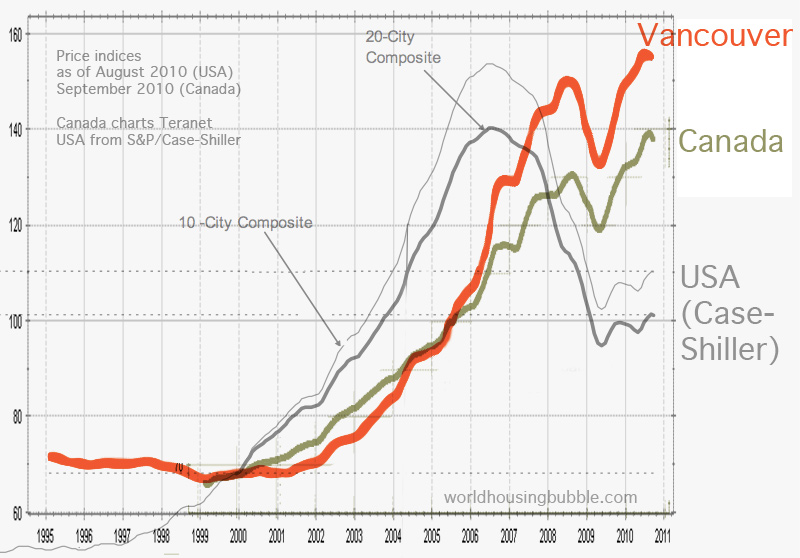

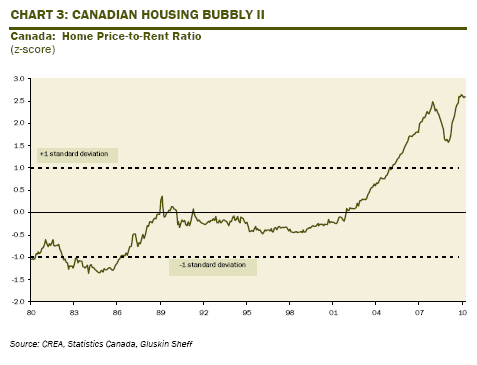

Unless this Vancouver home has a great ocenaview (and it doesn't), I am afraid Canada may be in for some "Maple Madness" in the near future...

Of course, this time it maybe different...

2119 East 3rd Ave, Vancouver

MLS® Number V934050

Listing Price: $899,500

Description: "This 1 ? story home has been extensively renovated over the last few years. The spacious kitchen has birch cabinets and Soapstone counters and opens to a 20x12' deck. On this level are 2 B/Rs and a modern 4pce bath. Upstairs has an office/den area, a 4pce bath and a big master B/R with a W/I closet and 12x8 view deck. The bsmt has a 1 B/R suite rented at $960 P.M. and the attached garage has been converted to a workshop with French doors opening to the fenced garden, with B/I bench, a patio and a kid's sandbox. "

2119 East 3rd Ave, Vancouver

MLS® Number V934050

Listing Price: $899,500

Description: "This 1 ? story home has been extensively renovated over the last few years. The spacious kitchen has birch cabinets and Soapstone counters and opens to a 20x12' deck. On this level are 2 B/Rs and a modern 4pce bath. Upstairs has an office/den area, a 4pce bath and a big master B/R with a W/I closet and 12x8 view deck. The bsmt has a 1 B/R suite rented at $960 P.M. and the attached garage has been converted to a workshop with French doors opening to the fenced garden, with B/I bench, a patio and a kid's sandbox. "