Gold goes up

Moderator: Global Moderator

Gold goes up

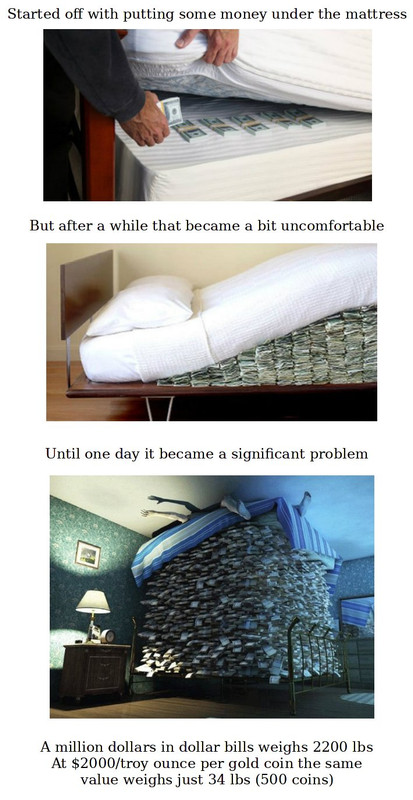

It’s pretty interesting that it takes $1900 to buy a yellow metal coin today that cost 35 dollars not too long ago. It feels like a safe asset to put in the portfolio.

Re: Gold goes up

Once upon a time, gold was all you needed.

1817 British Sovereign gold coin, one Pound legal tender value, was used as both a domestic and international currency. A Sovereign gold coin contains 0.235 troy ounces of gold. Alongside bank notes, where the one Pound note included the wording "I promise to pay the bearer the sum of One Pound" i.e. a gold Sovereign coin worth of gold. Money was gold, gold was money as were Pound note paper currency that could be exchanged for gold.

1817 to 1931 and Pound/US Dollar exchange rate averaged 4.86, relatively consistently holding around that value across those years.

The British Official Gold Price was 4.25 Pounds/ounce, as it had been from 1717 up to and beyond 1931.

Ounces of gold in a Pound = inverse of Official Gold Price = 1 / 4.25 = 0.235 and hence the Sovereign being 0.235 ounces of gold

US/Britain and others traded with a relatively consistent Pound/Dollar exchange rate and where money was gold (and silver)

Inflation 1817 to 1931 was broadly flat, both in the US and Britain, less than 0.1% annualised. Some volatility, 5.2% standard deviation in yearly changes, median 0%, arithmetic average 0.23%. Money was gold, gold is finite.

Short term interest rates averaged around 3.5%.

... rather than holding physical gold in hand (Sovereign one Pound coins), depositing them earned interest, more gold in return, that was in effect a (broad) real rate of return.

Then it all changed. Britain couldn't convert all of paper Pounds into gold in 1931 when the demand to do so was high, so they stopped convertibility. The US followed that lead and compulsory purchased all gold from American's before agreeing internationally for others to trade using US dollars instead of gold and where the US dollar would be pegged to gold. Which kinda worked for a while, up until the late 1960's when fiat in earnest took over. State no longer needs to borrow gold/money, it can just print/spend. Banks don't need depositors gold so they can lend it out to others, they can just credit accounts with money. What interest do they offer those that might lend/deposit? Very little compared to when they needed such loans/deposits, with how little hidden somewhat by taxation and inflation (another form of taxation).

Pre 1930's and generally bonds (your gold lend to banks/state) was good enough for most investors/savers, since the 1930's and its been increasingly more appropriate for savers/investors to hold stocks and gold. Under fiat the broad tendency is for the US dollar to decline relative to gold, at a target 2% central bank remit rate, which is also like a form of wealth taxation, that's called 'inflation'.

1817 British Sovereign gold coin, one Pound legal tender value, was used as both a domestic and international currency. A Sovereign gold coin contains 0.235 troy ounces of gold. Alongside bank notes, where the one Pound note included the wording "I promise to pay the bearer the sum of One Pound" i.e. a gold Sovereign coin worth of gold. Money was gold, gold was money as were Pound note paper currency that could be exchanged for gold.

1817 to 1931 and Pound/US Dollar exchange rate averaged 4.86, relatively consistently holding around that value across those years.

The British Official Gold Price was 4.25 Pounds/ounce, as it had been from 1717 up to and beyond 1931.

Ounces of gold in a Pound = inverse of Official Gold Price = 1 / 4.25 = 0.235 and hence the Sovereign being 0.235 ounces of gold

US/Britain and others traded with a relatively consistent Pound/Dollar exchange rate and where money was gold (and silver)

Inflation 1817 to 1931 was broadly flat, both in the US and Britain, less than 0.1% annualised. Some volatility, 5.2% standard deviation in yearly changes, median 0%, arithmetic average 0.23%. Money was gold, gold is finite.

Short term interest rates averaged around 3.5%.

... rather than holding physical gold in hand (Sovereign one Pound coins), depositing them earned interest, more gold in return, that was in effect a (broad) real rate of return.

Then it all changed. Britain couldn't convert all of paper Pounds into gold in 1931 when the demand to do so was high, so they stopped convertibility. The US followed that lead and compulsory purchased all gold from American's before agreeing internationally for others to trade using US dollars instead of gold and where the US dollar would be pegged to gold. Which kinda worked for a while, up until the late 1960's when fiat in earnest took over. State no longer needs to borrow gold/money, it can just print/spend. Banks don't need depositors gold so they can lend it out to others, they can just credit accounts with money. What interest do they offer those that might lend/deposit? Very little compared to when they needed such loans/deposits, with how little hidden somewhat by taxation and inflation (another form of taxation).

Pre 1930's and generally bonds (your gold lend to banks/state) was good enough for most investors/savers, since the 1930's and its been increasingly more appropriate for savers/investors to hold stocks and gold. Under fiat the broad tendency is for the US dollar to decline relative to gold, at a target 2% central bank remit rate, which is also like a form of wealth taxation, that's called 'inflation'.

Re: Gold goes up

Thanks @seajay!