Adam1226 wrote:Since we tend to buy gold when demand is low and sell when it's high, won't the premium discrepancy tend to work on our favor?

There's no way to know. But, I was really referring to first-time buyers — since that's really what this discussion is about. First-time buyers shouldn't be trying to time the assets, so one would have to be careful to make their first GTU purchase at a discount.

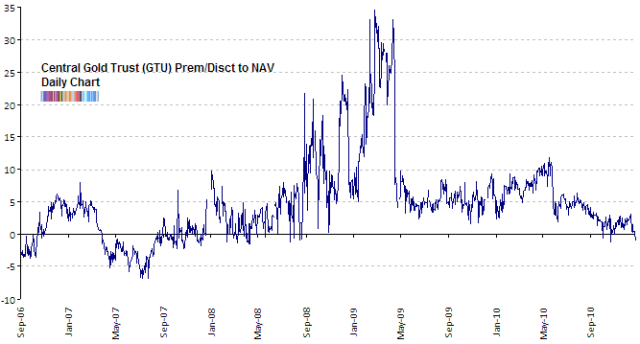

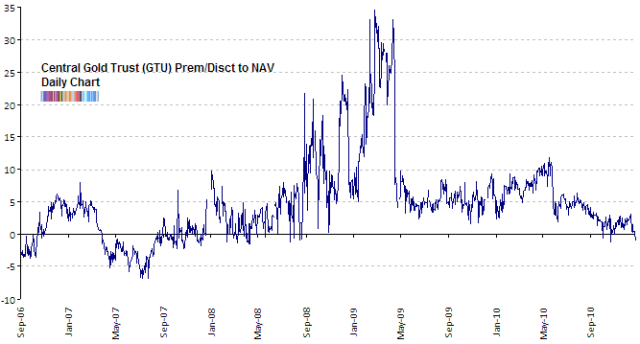

For example, one could easily have started their PP exactly two years ago with a first-time purchase of GTU and been in a lackluster situation today (see my previous chart) if you hit a rebalancing band (say, on stocks).

I'll also point out that gold is near an all time high, but GTU's premium is relatively low right now. You'd think it would be selling at a high premium due to the high demand for gold. It's not.

The premium is all over the place. Some people might see this as a great buying opportunity. I see a poor track record in the way arbitrage has been handled. A first-time buyer could get hosed by buying in at the wrong time. Anyone who bought GTU over the past two years is underperforming right now — and this is while gold is in high demand.

I totally get that GTU has a lot going for it. But it seems you need to make your first purchase at a discount to make it worth it. The potential for tax errors, tax penalties, or tax law changes, makes it much less appealing to me — particularly since very few accountants even understand Form 8261.

For the record, I'm not a big fan of any gold fund. I don't think you can really trust any of them to survive a significant crisis.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.