Challenge Buffet

Moderator: Global Moderator

-

Thomas Hoog

- Executive Member

- Posts: 176

- Joined: Thu Nov 22, 2012 5:33 am

Challenge Buffet

AMSTERDAM (Belegger.nl) - Investor Warren Buffet is despite the price increase is still positive on equities and stock market expert stated still shares. Shares now offer a good value and are currently cheaper than other investments. This allows Buffett in an interview with CNBC. Buffett buys shares because he is at current price a good value in return. "Stocks are not as cheap as four years ago, but now you get more value for money compared to other asset classes. At this time we buy shares, not because we expect that the shares will increase in value, but because we feel that we get good value for the shares, "said Buffett.

An investment that investors are especially should make is buying government bonds "the dumbest investment is in my opinion a long term government bond.

An investment that investors are especially should make is buying government bonds "the dumbest investment is in my opinion a long term government bond.

Life is uncertain and then we die

Re: Challenge Buffet

Buffett also says to be greedy when others are fearful and fearful when others are greedy.

If people are fearful about government bonds, what does that suggest we should be doing using Buffett's own logic?

If people are fearful about government bonds, what does that suggest we should be doing using Buffett's own logic?

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

Re: Challenge Buffet

He also says to buy good value with a large margin of safety.MediumTex wrote: Buffett also says to be greedy when others are fearful and fearful when others are greedy.

If people are fearful about government bonds, what does that suggest we should be doing using Buffett's own logic?

Re: Challenge Buffet

That would have made his own company a bad investment for the past 13 years or so, since stocks have little margin of safety during secular bear markets.AgAuMoney wrote:He also says to buy good value with a large margin of safety.MediumTex wrote: Buffett also says to be greedy when others are fearful and fearful when others are greedy.

If people are fearful about government bonds, what does that suggest we should be doing using Buffett's own logic?

Buffett is just a sales guy. He's always selling something, usually Berkshire Hathaway stock.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: Challenge Buffet

Buffett continues to get on my nerves. His folksy schtick is B.S..

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: Challenge Buffet

Yup.MachineGhost wrote: Buffett continues to get on my nerves. His folksy schtick is B.S..

He also says that most investors should just buy index funds.

You cannot put his public pronouncements into any kind of coherent set... You have to just assume he is talking to different audiences or thinking of a different context.

Lately I think he is losing his mind, but it might just be a new act...

- dualstow

- Executive Member

- Posts: 15688

- Joined: Wed Oct 27, 2010 10:18 am

- Location: searching for the lost Xanadu

- Contact:

Re: Challenge Buffet

I wonder what Warren Buffett would think of the long bonds in the context of the pp, though. That is, I wonder what he thinks of the pp. I think he's ok with index funds for the average investor, and by average I really mean most of us.

I have to add, Mr van Nes, your name produces an amazing amount of anagrams.

Do you know how many English words can be made from rearranging the letters in "GERARDVANNESS"?

Dozens upon dozens, including the word ARRANGED!

It would make a great follow-up to Iron Chef. Great concept, and the title is already written!TennPaGa wrote: I thought this thread was going to be about a TV show about competitive eating.

I have to add, Mr van Nes, your name produces an amazing amount of anagrams.

Do you know how many English words can be made from rearranging the letters in "GERARDVANNESS"?

Dozens upon dozens, including the word ARRANGED!

Last edited by dualstow on Wed Mar 06, 2013 7:32 pm, edited 1 time in total.

Whistling tunes / We hide in the dunes by the seaside

Whistling tunes / We're kissing baboons in the jungle

Whistling tunes / We're kissing baboons in the jungle

- Pointedstick

- Executive Member

- Posts: 8886

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: Challenge Buffet

"Darn Avengers!"dualstow wrote: I have to add, Mr van Nes, your name produces an amazing amount of anagrams.

Do you know how many English words can be made from rearranging the letters in "GERARDVANNESS"?

Dozens upon dozens, including the word ARRANGED!

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

- dualstow

- Executive Member

- Posts: 15688

- Joined: Wed Oct 27, 2010 10:18 am

- Location: searching for the lost Xanadu

- Contact:

Re: Challenge Buffet

HAH! For this crowd, I had just written Rand Avengers on my list. :-)Pointedstick wrote:"Darn Avengers!"dualstow wrote: I have to add, Mr van Nes, your name produces an amazing amount of anagrams.

Do you know how many English words can be made from rearranging the letters in "GERARDVANNESS"?

Dozens upon dozens, including the word ARRANGED!

Whistling tunes / We hide in the dunes by the seaside

Whistling tunes / We're kissing baboons in the jungle

Whistling tunes / We're kissing baboons in the jungle

-

Thomas Hoog

- Executive Member

- Posts: 176

- Joined: Thu Nov 22, 2012 5:33 am

Re: Challenge Buffet

No, I have never thought about that. It is just a name.dualstow wrote: I wonder what Warren Buffett would think of the long bonds in the context of the pp, though. That is, I wonder what he thinks of the pp. I think he's ok with index funds for the average investor, and by average I really mean most of us.

It would make a great follow-up to Iron Chef. Great concept, and the title is already written!TennPaGa wrote: I thought this thread was going to be about a TV show about competitive eating.

I have to add, Mr van Nes, your name produces an amazing amount of anagrams.

Do you know how many English words can be made from rearranging the letters in "GERARDVANNESS"?

Dozens upon dozens, including the word ARRANGED!

I have only quoted Buffet, to show how useless reading financial news most of the time is.

Life is uncertain and then we die

Re: Challenge Buffet

I guess I don't even really see my 30 year Treasury bonds as an "investment." I see them as an amazing hedge with respect to equities that happens to have a small expected return.

everything comes from somewhere and everything goes somewhere

Re: Challenge Buffet

Ooh, I want to play: "Danger Ravens"Pointedstick wrote:"Darn Avengers!"dualstow wrote: I have to add, Mr van Nes, your name produces an amazing amount of anagrams.

Do you know how many English words can be made from rearranging the letters in "GERARDVANNESS"?

Dozens upon dozens, including the word ARRANGED!

Re: Challenge Buffet

They certainly take some of the fear out of buying stocks when the market is down for me.melveyr wrote: I guess I don't even really see my 30 year Treasury bonds as an "investment." I see them as an amazing hedge with respect to equities that happens to have a small expected return.

- dualstow

- Executive Member

- Posts: 15688

- Joined: Wed Oct 27, 2010 10:18 am

- Location: searching for the lost Xanadu

- Contact:

Re: Challenge Buffet

Even though they are probably only the 3rd most likely to hit the 35% band -- have they ever hit in the history of the pp? -- I still think of them as an investment. But, when my naysayer friends complain about yields and imminent interest rate hikes, I refer to them as protection.melveyr wrote: I guess I don't even really see my 30 year Treasury bonds as an "investment." I see them as an amazing hedge with respect to equities that happens to have a small expected return.

P.S. GRANDER NAVES

Whistling tunes / We hide in the dunes by the seaside

Whistling tunes / We're kissing baboons in the jungle

Whistling tunes / We're kissing baboons in the jungle

Re: Challenge Buffet

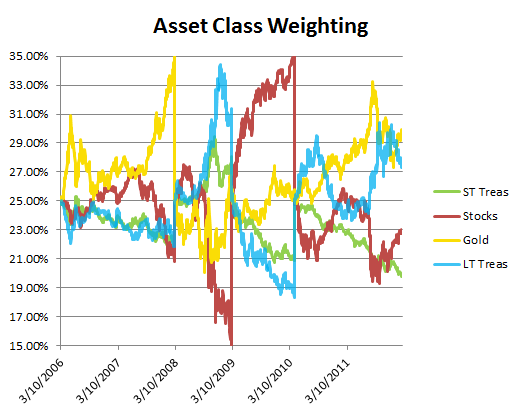

A long time ago I looked at intra-year rebalancing using 15/35 bands for the recent crisis and here is the chart:dualstow wrote:Even though they are probably only the 3rd most likely to hit the 35% band -- have they ever hit in the history of the pp? -- I still think of them as an investment. But, when my naysayer friends complain about yields and imminent interest rate hikes, I refer to them as protection.melveyr wrote: I guess I don't even really see my 30 year Treasury bonds as an "investment." I see them as an amazing hedge with respect to equities that happens to have a small expected return.

P.S. GRANDER NAVES

Although they didn't quite kiss the 35% band in this test, it all depends on your starting point. I imagine that lots of PPs would have had Treasuries reaching 35% during this period.

everything comes from somewhere and everything goes somewhere

Re: Challenge Buffet

My observations about Buffett are as follows:

• He is a very good businessman and is able to judge the value of a business

• He is able to play the media well with his “folksy wisdom”?

• This and the fact that he usually has a lot of cash enables him to make some excellent deals with good companies that are temporarily in trouble- witness his deal with GE in 2009

• Still, his recent performance (BRK_A) since Jun 1996 is not extraordinary(I used this date to compare with the earliest data I had for PRPFX)

o CAGR 10.1%

o Std Dev 20.9%

o MAX DD -44.5%

• The Stdev and MAXDD are more than twice that of PRPFX. I believe the pure HB portfolio does even better in terms of volatility and MAXDD. It would be hard to stomach a 44% decline in my portfolio.

• The main performance boost Buffett gets is in being extremely aggressive when the market is about to recover after it has tanked – witness results in 2009 and in 2011. Buffett appears to be a good judge of that.

• However, he is very poor at predicting when the market will tank. He does very poorly. Basically it is clear that no one can predict. It’s a fool’s game.

• Yes, he is greedy when others fear and is able to wait for a big margin of safety which is usually obtained after a market has tanked. This often makes up for his disasters.

• He is a very good businessman and is able to judge the value of a business

• He is able to play the media well with his “folksy wisdom”?

• This and the fact that he usually has a lot of cash enables him to make some excellent deals with good companies that are temporarily in trouble- witness his deal with GE in 2009

• Still, his recent performance (BRK_A) since Jun 1996 is not extraordinary(I used this date to compare with the earliest data I had for PRPFX)

o CAGR 10.1%

o Std Dev 20.9%

o MAX DD -44.5%

• The Stdev and MAXDD are more than twice that of PRPFX. I believe the pure HB portfolio does even better in terms of volatility and MAXDD. It would be hard to stomach a 44% decline in my portfolio.

• The main performance boost Buffett gets is in being extremely aggressive when the market is about to recover after it has tanked – witness results in 2009 and in 2011. Buffett appears to be a good judge of that.

• However, he is very poor at predicting when the market will tank. He does very poorly. Basically it is clear that no one can predict. It’s a fool’s game.

• Yes, he is greedy when others fear and is able to wait for a big margin of safety which is usually obtained after a market has tanked. This often makes up for his disasters.

- dualstow

- Executive Member

- Posts: 15688

- Joined: Wed Oct 27, 2010 10:18 am

- Location: searching for the lost Xanadu

- Contact:

Re: Challenge Buffet

Thanks, Ryan. That's how I remembered it (but I didn't trust my memory of your post).

Even if I never get to rebalance, this sure is a smoother ride than when I was 90+% in equities. Well worth the sounder sleep.

Even if I never get to rebalance, this sure is a smoother ride than when I was 90+% in equities. Well worth the sounder sleep.

Whistling tunes / We hide in the dunes by the seaside

Whistling tunes / We're kissing baboons in the jungle

Whistling tunes / We're kissing baboons in the jungle