Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

Moderator: Global Moderator

-

Bonafede

Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

Just wanted to post an interesting article/post I came across on Mebane Faber's website. Not sure I'd agree completely, but interesting all the same.

http://www.mebanefaber.com/2010/10/28/t ... bernstein/

-b

http://www.mebanefaber.com/2010/10/28/t ... bernstein/

-b

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

I am pretty sure that Clive tried something like this for a few months, but rejected it due to the whip-sawing between assets.

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

Exactly what kind of timing is Faber referring to? Using moving averages on each component to determine "in" or "out?"

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

Basically yes, he uses MAs. There's a pretty detailed article on the same website: http://www.mebanefaber.com/timing-modellongeyes wrote: Exactly what kind of timing is Faber referring to? Using moving averages on each component to determine "in" or "out?"

"Let every man divide his money into three parts, and invest a third in land, a third in business, and a third let him keep in reserve."

- Talmud

- Talmud

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

New to looking at this (and this link). Just so I understand, you can take any portfolio composition and apply his 10MA, re-evaluated monthly for each of the asset classes you hold, and then enter or exit if you are above or below the line of death?foglifter wrote:Basically yes, he uses MAs. There's a pretty detailed article on the same website: http://www.mebanefaber.com/timing-modellongeyes wrote: Exactly what kind of timing is Faber referring to? Using moving averages on each component to determine "in" or "out?"

How do you know what asset classes you should hold or be considering in the first place and in what quantity should you hold them? The chart shows 5 classes but I see mentions of other portfolio packages that contain more or fewer, even the PP.

And this occurs regardless of the total % in equities your portfolio contains?

I printed out his 2006 .pdf article (can't access the update) and will read it. I've heard of 200dma before just never really analyzed any academic work pertaining to them.

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

The chart shows 5 asset classes because these are the ones that constitute Faber's Ivy portfolio. My understanding is he maintains that his model could be applied to any other "lazy" portfolio. As I understand it you don't decide which asset to apply the MA to - you mechanically buy/sell any asset based on where it is at the month end compared to its 10-mo MA.Roy wrote:New to looking at this (and this link). Just so I understand, you can take any portfolio composition and apply his 10MA, re-evaluated monthly for each of the asset classes you hold, and then enter or exit if you are above or below the line of death?foglifter wrote:Basically yes, he uses MAs. There's a pretty detailed article on the same website: http://www.mebanefaber.com/timing-modellongeyes wrote: Exactly what kind of timing is Faber referring to? Using moving averages on each component to determine "in" or "out?"

How do you know what asset classes you should hold or be considering in the first place and in what quantity should you hold them? The chart shows 5 classes but I see mentions of other portfolio packages that contain more or fewer, even the PP.

And this occurs regardless of the total % in equities your portfolio contains?

I printed out his 2006 .pdf article (can't access the update) and will read it. I've heard of 200dma before just never really analyzed any academic work pertaining to them.

You might find interesting another Faber's article on combining his model with asset rotation: http://www.mebanefaber.com/2009/06/25/c ... ng-systems

As a side note, recently Faber's firm launched an actively-managed ETF GTAA based on his method, although the ETF is a crazy soup of dozens of ETFs with some overlapping and high expense ratio.

"Let every man divide his money into three parts, and invest a third in land, a third in business, and a third let him keep in reserve."

- Talmud

- Talmud

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

If you followed his timing approach last year you sold out of stocks near the bottom. Probably around last Spring. Stocks then recovered and posted big gains for the year.

Market timing doesnt work.

Edit: look at the chart on his site:

http://www.mebanefaber.com/timing-model/

Completely whipsawed last spring. You sold, then you locked in losses as things recovered. Timing doesn't work.

Market timing doesnt work.

Edit: look at the chart on his site:

http://www.mebanefaber.com/timing-model/

Completely whipsawed last spring. You sold, then you locked in losses as things recovered. Timing doesn't work.

Last edited by craigr on Thu Jan 13, 2011 3:59 pm, edited 1 time in total.

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

Moving averages came back in fashion after 2008. IMO. I've been reading about the ideas for many years and they are not consistent and able to be reliably acted upon. Last spring there was a very clear moving average sell signal. Those that sold out missed the upside movement by and large.

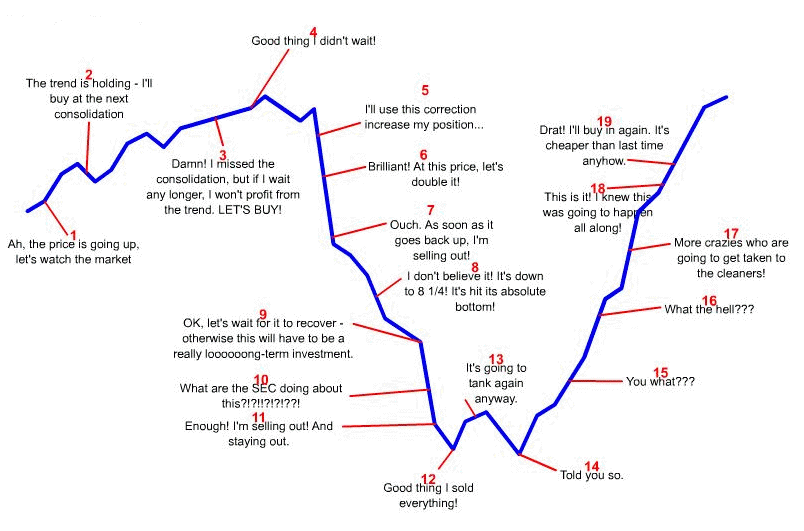

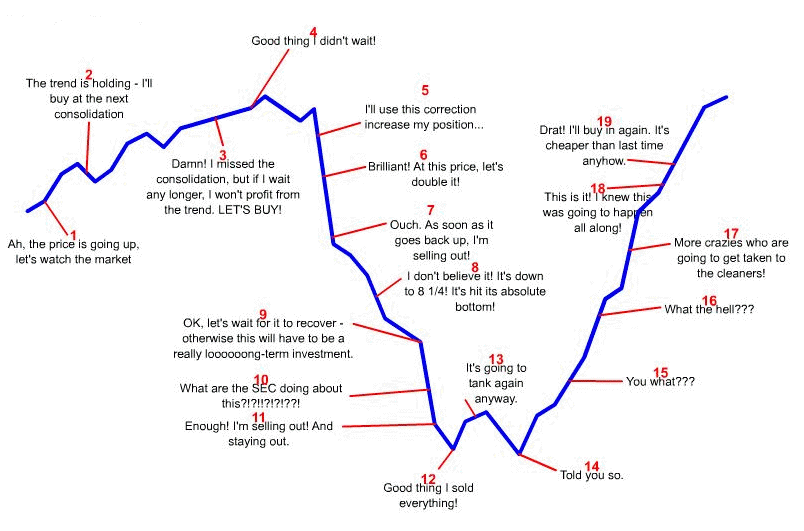

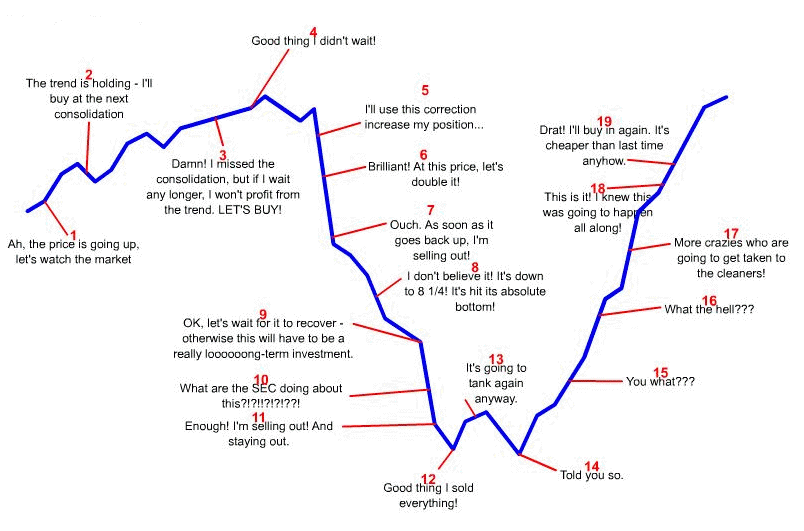

People aren't machines so it may be easy to plot a sell signal and a buy signal. But actually executing on both is hard. Every time a decision like that is needed it allows an investor to question the decision. Should I wait longer to be sure it's really a buy? How long? Did I really miss a big drop? The market seems to go back up since I sold! Maybe I should buy back in! But it could just be a false signal! Etc.

Why expose oneself to such torture?

But if you just buy hold and rebalance you avoid all these decision points and questioning your signals. It is a better strategy from an investor psychology point of view and I think far more likely to produce actualized returns.

People aren't machines so it may be easy to plot a sell signal and a buy signal. But actually executing on both is hard. Every time a decision like that is needed it allows an investor to question the decision. Should I wait longer to be sure it's really a buy? How long? Did I really miss a big drop? The market seems to go back up since I sold! Maybe I should buy back in! But it could just be a false signal! Etc.

Why expose oneself to such torture?

But if you just buy hold and rebalance you avoid all these decision points and questioning your signals. It is a better strategy from an investor psychology point of view and I think far more likely to produce actualized returns.

Last edited by craigr on Thu Jan 13, 2011 5:05 pm, edited 1 time in total.

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

I am glad to hear it is working for you. But I still think most investors will have a hard time pulling it off. If you're a taxable investor, this kind of portfolio churn will have a very high tax load that would erase any theoretical advantage. IMO.

Also I just don't think human nature works so cleanly on the buy sell points. In the chart he has in 2010 you'd sell at around 55. Then the market goes down and you feel like a genius. Then it goes up and crosses the buy line again. So you buy. Then it immediately falls again! Damn, I lost money! Time to sell. But then it goes back up! Damn! Time to buy, but I don't want to lose money again so I'll wait. Besides, all these gurus say it's a "dead cat bounce". So they wait. It's now 55, then 57, then 60! Damn! I have to buy again, but suppose it falls now? I can't buy now! It's gone up too much! I'll wait for a pull back! Yeah, that's it! A pull back! Now it's 65 what to do?

That's why these things just don't work. People have emotions and these strategies allow emotions to play a huge part which is not a good idea from my experience.

Also I just don't think human nature works so cleanly on the buy sell points. In the chart he has in 2010 you'd sell at around 55. Then the market goes down and you feel like a genius. Then it goes up and crosses the buy line again. So you buy. Then it immediately falls again! Damn, I lost money! Time to sell. But then it goes back up! Damn! Time to buy, but I don't want to lose money again so I'll wait. Besides, all these gurus say it's a "dead cat bounce". So they wait. It's now 55, then 57, then 60! Damn! I have to buy again, but suppose it falls now? I can't buy now! It's gone up too much! I'll wait for a pull back! Yeah, that's it! A pull back! Now it's 65 what to do?

That's why these things just don't work. People have emotions and these strategies allow emotions to play a huge part which is not a good idea from my experience.

Last edited by craigr on Thu Jan 13, 2011 5:28 pm, edited 1 time in total.

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

Clive wrote: Another stat is that on average you're 70% IN and 30% OUT (in cash), so the approach might also be considered as a form of 70% stock, 30% cash type blend (but that has very low year on year draw-downs). Personally I see buy-and-hopehold (not timing) to be a far riskier approach.

Clive,

To keep it simple, using only stocks and cash as an example, when you decide you go into stocks how much do you go in? Are you 100% in stocks, when your mechanic says it is OK and then 100% out when you re-cross the line of death? Can you give me a working example of this (using moving average or the 7% stop loss)? What does 7% stop loss mean? When does it apply?

You seem to have used many timing models. Ever tried one based on Shiller's PE/10? Even there, and he being an academic, he was waiting for PE/10 back in March 2009 (think it got to PE/12). He waits still.

Not sure I see how the buy and hold approach is riskier, unless one has a high equity allocation. And given how the PP has run—so well for so long—I don't see the motivation to use a timing method over it (or a number of low beta portfolios), even as Mebane ran a "better" backtest of it. I note that Mebane himself says that most don't do well with this (timing). And presumably that is just using mechanical methods. Once one adds intuition to those trends as they become "clearer" (as KevD suggests), I fear things might get more problematic,

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

I email with a professional trader who makes his living on technical timing signals and has been for years. He does use moving averages and other indicators and doesn't like to trade obvious breakouts anymore. He'll see a breakout and look for a retest to confirm the direction. Works well. Also, what's been relayed to me is that timing and technical trading does work, but the market eventually catches on to new signals after a while--forcing the trader to adapt. Traders will routinely set traps around obvious signals like moving averages, channels, triangles, head and shoulders, etc to get novice traders to bite. Then they'll put a heavy move on to scalp bps on a quick reversal where scared money can get stopped out. These are institutional guys & computers that can push a lot of volume setting the traps. It's routine for some traders to make money timing the market, but John Q Public is usually not the one who makes the money.KevD wrote: Moving averages work pretty well IMO. The key is to not buy or sell 100% at the crossings. Instead, do partial sells and buys until the trend becomes clearer. That avoids falling 100% prey to the whipsaws.

I think investors have a natural inclination to go all in or all out at trading signals, and selling 1/4 or 1/2 doesn't even cross their mind. Once they're told they don't "have" to sell everything, it's like Duh!

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

I would only market time and technical trade with money I could afford to lose.

-

LNGTERMER

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

MA do not work. They have two inherent weaknesses:

1- They lag

2- They flatten out on a ranging market.

This last one is the problem with even many MA used simultaneously.

The thing is if any one tells you, you can trade by simply following a simple line they are lying, plain and simple. The price moves crossing the line are usually markets gapping up or down so the price movements are larger than several multipliers to a trending gain. The result is those whipsaws when the line catches up to the price usually eat up huge percentages of the gains, and that is if you already made money with a prior trend.

Timing might work but it requires passion, dedication and hard work just like any thing else in life. I would not advice any one to venture into it unless you spend tremendous effort learning and paper playing first. I would also stay away from any one selling the latest hot system. You are buying into the perils of timing coupled with third party risks. Having said that I do agree with Clive, I much prefer using technical analysis rather than pray and hope or following the gospel of just follow the market. One needs to understand though that technical analysis is a huge field and not limited to MAs, it's also a mixture of art and science. Using it is akin to the people you see in movies who follow some one's foot steps when they walked yesterday and no one else can see them. It's a skill you develop after years of practice. There are no quick fixes.

1- They lag

2- They flatten out on a ranging market.

This last one is the problem with even many MA used simultaneously.

The thing is if any one tells you, you can trade by simply following a simple line they are lying, plain and simple. The price moves crossing the line are usually markets gapping up or down so the price movements are larger than several multipliers to a trending gain. The result is those whipsaws when the line catches up to the price usually eat up huge percentages of the gains, and that is if you already made money with a prior trend.

Timing might work but it requires passion, dedication and hard work just like any thing else in life. I would not advice any one to venture into it unless you spend tremendous effort learning and paper playing first. I would also stay away from any one selling the latest hot system. You are buying into the perils of timing coupled with third party risks. Having said that I do agree with Clive, I much prefer using technical analysis rather than pray and hope or following the gospel of just follow the market. One needs to understand though that technical analysis is a huge field and not limited to MAs, it's also a mixture of art and science. Using it is akin to the people you see in movies who follow some one's foot steps when they walked yesterday and no one else can see them. It's a skill you develop after years of practice. There are no quick fixes.

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

This image shows what I think about Investing Psychology and Market timing

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

And the PP—which is buy-and-hold—hasn't turned out too badly! Of course, it is just one type of rebalancing, and an infrequent one at that.Clive wrote: In many respects the PP is also a timed approach, with clear indicators as to when to add (<15% weights) and when to reduce (>35% weight) and the longer term indications are that such timing has added value (rebalanced PP has relatively out-performed the buy-and-hold/non-rebalanced PP).

I imagine if enough of these other timing models worked, there would be many more tactical asset allocators/managers who beat simple indexes, but that does not appear to be true, once costs are considered.

Thanks for the detailed descriptions.

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

I love that chart.steve wrote: This image shows what I think about Investing Psychology and Market timing

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

I should have mentioned in the earlier post that this trader does not use MA's exclusively. He'll typically use a combination of 2 or 3 indicators in a swing trading style. He just won't trade the breakout. He also knows when he puts a trade on, he's going to lose some of the time. So he'll set predetermined stops to control emotions. Successful traders are skilled at eliminating emotions. Most novice investors just can't stomach the constant grind. It wears you out. But just like most other skills where the majority are unsuccessful, there are those who have the right combination of intelligence, discipline and personality style to be successful. In many ways, it's comparable to poker players. There are elements of chance, but solid money management and execution get you to long term profitability. The trick is not getting worn out in the process. While I find observing what he does fascinating, I've reconciled it's not something I'm interested in pursuing for myself.Lngtermer wrote: MA do not work. They have two inherent weaknesses:

1- They lag

2- They flatten out on a ranging market.

This last one is the problem with even many MA used simultaneously.

The thing is if any one tells you, you can trade by simply following a simple line they are lying, plain and simple. The price moves crossing the line are usually markets gapping up or down so the price movements are larger than several multipliers to a trending gain. The result is those whipsaws when the line catches up to the price usually eat up huge percentages of the gains, and that is if you already made money with a prior trend.

Timing might work but it requires passion, dedication and hard work just like any thing else in life. I would not advice any one to venture into it unless you spend tremendous effort learning and paper playing first. I would also stay away from any one selling the latest hot system. You are buying into the perils of timing coupled with third party risks. Having said that I do agree with Clive, I much prefer using technical analysis rather than pray and hope or following the gospel of just follow the market. One needs to understand though that technical analysis is a huge field and not limited to MAs, it's also a mixture of art and science. Using it is akin to the people you see in movies who follow some one's foot steps when they walked yesterday and no one else can see them. It's a skill you develop after years of practice. There are no quick fixes.

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

I side with the theory of secular cycles between financial and hard assets lasting roughly 16-18 years--also called Benner cycles. Some people go too far and try to predict the exact year, month and day of tops and bottoms. I don't believe that can be predicted--only general tidal changes in collective moods.Clive wrote:

The PP therefore potentially has some quite long cycles (such as 1980 to 2000 type relatively poor performance), and/or might have endured specific circumstances historically that might not be repeated in the forward time direction.

1982-1999 was a period of prosperity. Hard asset portfolios would lag their peers with no hard assets. But for secular bull markets in hard assets like 1966-1980 and 2001-present, portfolios such as Harry Browne's shine brightly. I would say 1972-2009 is a good time frame to evaluate the PP since it includes an entire bull market in financial assets (18 years from 82-99), 2 partial bull markets in hard assets (18 years from 72-80 & 01-09) plus 2 transition years (1981 & 2000).

Secular markets rely on fairly predictable human emotions leading to fairly predictable human actions. While modern central banking was intended to subdue the boom/bust cycle, it actually served to magnify it. It seems to me the PP does a nice job at harvesting economic output during prosperous times while protecting purchasing power/value/capital from devaluation during lean times.

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

Why should cycles be present in the markets? The periods you point out in your example all have rational economic explanations for them. The 1970s were a period after the gold standard broke. Inflation raged. It wasn't a cycle. Then in the early 1980s the Fed finally got serious and stopped the chaos through some serious rate tightening. Again, this was not a cycle. Periods before were pockmarked with world events like wars, depressions, etc. During WWII commodities probably would have done great. Too bad they were being price controlled though for the war effort. How could a cycle predict these things or explain them?Wonk wrote:I side with the theory of secular cycles between financial and hard assets lasting roughly 16-18 years--also called Benner cycles. Some people go too far and try to predict the exact year, month and day of tops and bottoms. I don't believe that can be predicted--only general tidal changes in collective moods.Clive wrote:

The PP therefore potentially has some quite long cycles (such as 1980 to 2000 type relatively poor performance), and/or might have endured specific circumstances historically that might not be repeated in the forward time direction.

1982-1999 was a period of prosperity. Hard asset portfolios would lag their peers with no hard assets. But for secular bull markets in hard assets like 1966-1980 and 2001-present, portfolios such as Harry Browne's shine brightly. I would say 1972-2009 is a good time frame to evaluate the PP since it includes an entire bull market in financial assets (18 years from 82-99), 2 partial bull markets in hard assets (18 years from 72-80 & 01-09) plus 2 transition years (1981 & 2000).

Secular markets rely on fairly predictable human emotions leading to fairly predictable human actions. While modern central banking was intended to subdue the boom/bust cycle, it actually served to magnify it. It seems to me the PP does a nice job at harvesting economic output during prosperous times while protecting purchasing power/value/capital from devaluation during lean times.

Even if there was a gold cycle, why would it matter to Americans that could not own gold between 1933-1974 and was price controlled? And before 1933 there was not a gold cycle in the US because it was all price controlled also and was legal money anyway.

I'm not trying to be abrasive, but I just don't see how any of this stuff could possibly work in a real world investing strategy.

Last edited by craigr on Fri Jan 14, 2011 12:53 pm, edited 1 time in total.

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

Cycles are present because of the high probability of humans repeating the same or similar actions towards capital allocation and misallocation. Sure, the periods all have rational explanations, but does that invalidate the thesis or suggest that eventually fundamentals always win one way or the other?craigr wrote: Why should cycles be present in the markets? The periods you point out in your example all have rational economic explanations for them.

Why did the gold standard break? Because gold was increasingly worth more on the open market in London than at the gold window in Washington. Countries were draining U.S. reserves so either the U.S. went broke or the U.S. devalued. Maximum optimism in equities ended in 1966 which began a period of rising pessimism for the dollar's value vis a vis gold. The U.S. allowed the dollar to devalue vs gold through the 70s which ended with maximum pessimism in January 1980.The 1970s were a period after the gold standard broke. Inflation raged. It wasn't a cycle.

Then in the early 1980s the Fed finally got serious and stopped the chaos through some serious rate tightening. Again, this was not a cycle.

But why in the early 80s? Random occurrence or as a result of rapidly escalating inflation at over 14% to start the decade? I say the latter. And what did Volker's interest rates do to equities? It crushed them along with the inflation. The tight money recession led to incredibly attractive valuations for equities in 1982, which provided a driver for increased investment again.

Haven't wars typically been started because of economic upheaval? Aren't depressions started because valuations have become so high that eventually the market realizes its mistake en masse? The main point I am making is that people collectively go through a routine cycle that runs something like:Periods before were pockmarked with world events like wars, depressions, etc.

Ultra low optimism in paper: fantastic valuations, little investor participation

Low optimism in paper: good valuations, some investor participation

Undecided: fair valuations, even bulls/bears

High optimism in paper: expensive valuations, lots of investor participation

Highest optimism in paper: stratospheric valuations, nearly all investor participation

It's the same cycle in reverse for hard assets. When bubbles pop in paper assets, investors will increasingly run to the safest of all forms of money: gold. When pessimism becomes so great in paper assets, the maximum amount of investors will have their value in money/gold. Since this is not productive (gold is a shiny rock, remember), investors will again start to invest in paper once the coast is clear.

Things become more cloudy in a fiat system. When bubbles pop, you have two choices: crash or devalue. It's more politically palatable to devalue the currency to support asset values. The 30s and 70s give us great case studies in the two sides of the spectrum. In 1933, gold was money. Stocks crashed to gold because nominal was real value. Stocks didn't create another liftoff event until 1947--after the war was over and the U.S. had massive inflows of gold which it could leverage the money supply on. In 1966, investors turned to gold again in international markets, forcing the U.S. to devalue in real terms. Stocks crashed again in real terms even though the nominal values stayed elevated.

It would matter to Americans from a stocks standpoint. Harry Browne knew this. Sure, he said "awe, shucks, I got lucky" because he wasn't the type to say "yeah, I told you so!" He also didn't want the average investor with little monetary knowledge to get sucked into speculating on such things like he did because he had the knowledge that the average investor doesn't. It's safer for the public to tell the public that he got lucky. I admire his modesty, but I'm afraid that's all it is.Even if there was a gold cycle, why would it matter to Americans that could not own gold between 1933-1974 and was price controlled? And before 1933 there was not a gold cycle in the US because it was all price controlled also and was legal money anyway.

Prior to the Fed in 1913, the boom/bust cycle was still there--but both the booms and the busts weren't as large until after the Fed's existence.

Markets are made of people and people don't learn from history very often--they repeat the exact same mistakes or similar mistakes. They also act collectively most of the time. They routinely see what other people are doing for social proof. They act the same way and they think the same way based on how other people think. No one wants to admit it but its part of human nature. This all feeds into the existence of cycles. If people acted like robots--sure, there wouldn't be cycles.

But seriously, I can't say for certain when the low will be for equities and the high for gold. What I do believe is that at some point in the next 10 years or less, we will find that low point in real terms. Whether we get there via inflation/deflation/stagflation it really doesn't matter. Those are decisions for other people not named Wonk. We will need maximum pessimism in financial assets to get there and we will need maximum optimism in gold to get there. Traditionally, that metric has been gold value in fiat currency = monetary base of the same currency at a minimum from the hard assets side. The metric for U.S. stocks has been PE10 at 10 or below.

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

I also think the years in transition are fantastic for PP investors. You just never know how high is too high for stocks. Investors could have bailed in 1996 and missed all of the bubblicious gains. With the PP, you are invested all the time so you don't miss the moves. I do agree about the prosperous times with regards to stocks. VPs are probably not best suited for calling tops or bottoms, but overweighting the dominant trend in the middle years. We also have to remember that things like the 1987 crash happened right in the middle of a secular bull market in equities!KevD wrote:My thoughts are similar. In a secular bear, the PP could make up one's entire portfolio and one could do well. In a secular bull, maybe go for 1/2 - 3/4 PP and use a variable portfolio to beef up on stocks. In both cases, the PP would be core, but in the latter, you'd overweight stocks since you'd be going with the secular trend that way.Wonk wrote:

1982-1999 was a period of prosperity. Hard asset portfolios would lag their peers with no hard assets. But for secular bull markets in hard assets like 1966-1980 and 2001-present, portfolios such as Harry Browne's shine brightly.

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

Similarly, this beautiful stock market run we are witnessing is likely to be viewed in retrospect as a very nice cyclical bull market unfolding within a secular bear market.Wonk wrote: We also have to remember that things like the 1987 crash happened right in the middle of a secular bull market in equities!

On the subject of cycles generally, I think that history shows that there are clearly patterns to human behavior that seem to track a definite trajectory, roughly along the lines of rising or falling optimism in institutions generally.

The problem, of course, is that the cycle is only apparent in hindsight, and the point at which it begins and ends is much harder to identify when you are living through it with only your wee little mammal brain to help you make sense of things. When you are living through it, the herd is not some abstract school of fish moving through time--it is you, your family, your neighbors, your nation, seemingly working with a new set of challenges each day.

Considering that the greatest gains in any bull market are in the blow off top phase (and the greatest losses are in the crash that follows), it would be tough to know--in real time--how close or far we are from a top, and whether pullbacks along the way are pauses along a continuing trajectory (as with the 1987 crash) or the beginning of a new cycle.

When HB talked about getting lucky with gold, I don't think he meant he was lucky to identify the opportunity in the late 1960s, I think he meant he was lucky in deciding to get out near the top around 1980.

HB talked in his audio course about how simple it seems in retrospect to pick winners. I believe this is called suvivorship bias. For example, when you see the CEO who worked his way up from the mail room, it makes it look like anyone can pull off such a feat. If, however, you looked at all the people who worked in the mailroom and didn't become CEO, this career path looks much different. Imagine if you were required to pick which of the countless mailroom workers over a period of decades would one day become CEO (without having any idea which one, if any, would actually make it)--that sounds a lot harder, doesn't it?

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

-

MeDebtFree

- Full Member

- Posts: 51

- Joined: Mon Aug 16, 2010 10:09 am

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

Clive,

Over time, I have seen you talk about SL7 in a number of different threads. Have you posted any detailed back test (and/or real) results for CAGR, volatility, and max draw down, etc?

If you haven't, would you be willing to share?

If you have, could you perhaps point me to the post(s)?

Thanks,

MDF

Over time, I have seen you talk about SL7 in a number of different threads. Have you posted any detailed back test (and/or real) results for CAGR, volatility, and max draw down, etc?

If you haven't, would you be willing to share?

If you have, could you perhaps point me to the post(s)?

Thanks,

MDF

-

MeDebtFree

- Full Member

- Posts: 51

- Joined: Mon Aug 16, 2010 10:09 am

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

Clive wrote:Hi MDF. I've used SL7 for over a decade, prior to that I'd extensively backtested it against hundreds of years of stock prices and many other asset classes (cotton etc.) with sufficient success to actually start using the method for real. Those old tests are buried deep on hard disks in machines no longer used and the links to data postings long since faded. Sorry.MeDebtFree wrote: ...SL7...Have you posted any detailed back test (and/or real) results for CAGR, volatility, and max draw down, etc?

Drawdown, volatility and CAGR etc data will all be dependant upon what blend of assets are held. For individual cases generally, when income is excluded, SL7 generally endures a saw-tooth type progression with the odd large riser, but more of a stair step type progression when income is included.

Thanks for the post, Clive.

Do you have rough numbers in your head say for the S&P 500 over some time period?

What do you mean by "..odd large riser, ..."?

Last edited by MeDebtFree on Sat Jan 15, 2011 8:06 pm, edited 1 time in total.

-

Bonafede

Re: Timing the Permanent Portfolio (and Ivy, Swensen, Arnott, Bernstein…)

I didn't realize how much response this post would invoke, but some great replies and analysis. I'm in no way advocating market timing, but I did see a lot of replies regarding the emotion invoked by a technique advocated by Mebane Faber. In fairness to his approach, he clearly states in his book that most investors are better off not employing market timing.

However, if you are so interested, then doing market timing should involve no emotion, but rather a clear set of rules/logic to drive the decisions, and sticking by those rules through thick and thin. This is true of any portfolio allocation, including the PP. Many investors tweak their allocation so much they do more harm than good.

All the best!

-b

However, if you are so interested, then doing market timing should involve no emotion, but rather a clear set of rules/logic to drive the decisions, and sticking by those rules through thick and thin. This is true of any portfolio allocation, including the PP. Many investors tweak their allocation so much they do more harm than good.

All the best!

-b