PP vs buying a home

Moderator: Global Moderator

PP vs buying a home

hi guys,

i am young and saving to buy a home.

i had hypothetical question:

assuming you had a place to live and didn't have to pay rent.

if you had a chance to invest in PP for 10-15 years vs buying a home, what would u do?

which would be a better investment?

i think HB thought homes were a consumption item, so investing in PP would be better? Am i missing something?

thanks

i am young and saving to buy a home.

i had hypothetical question:

assuming you had a place to live and didn't have to pay rent.

if you had a chance to invest in PP for 10-15 years vs buying a home, what would u do?

which would be a better investment?

i think HB thought homes were a consumption item, so investing in PP would be better? Am i missing something?

thanks

Re: PP vs buying a home

You are correct, HB said homes are consumption items and not investments. So comparing them to portfolio investment is apples-to-oranges.

At the risk of being flip, if you can live rent-free then of course spending money on real estate is a worse proposition than investing in a PP.

But, there are lifestyle and emotional factors that might make it worthwhile to own a home. Mathematical calculations don't really help with that kind of decision-making, though.

At the risk of being flip, if you can live rent-free then of course spending money on real estate is a worse proposition than investing in a PP.

But, there are lifestyle and emotional factors that might make it worthwhile to own a home. Mathematical calculations don't really help with that kind of decision-making, though.

Re: PP vs buying a home

Harry Browne's first rule is that most of the money you will have in your life comes from your career. Many young people find that their best career opportunities require a move. From that perspective burdening yourself with a difficult to sell and expensive to maintain house may not be the best choice, especially if you can find reasonable and inexpensive accommodations as a renter. It also seems unlikely that house prices are likely to increase dramatically in the next few years.

Re: PP vs buying a home

thanks for the insight guys. i guess its hard for me stop looking at homes as an investment.

i always have friends and co-workers come up too me ever so often.. saying things:

now is the time to buy a home.

interest rates will start to rise lock in a home now.

buy a home for a tax shelter.

i always have friends and co-workers come up too me ever so often.. saying things:

now is the time to buy a home.

interest rates will start to rise lock in a home now.

buy a home for a tax shelter.

-

Snowman9000

- Associate Member

- Posts: 43

- Joined: Mon Apr 26, 2010 5:44 pm

Re: PP vs buying a home

If you need a home, now is a good time to buy. Home prices and interest rates are very low.

The biggest challenge is figuring out if you need your own home, or if renting will serve you better. Obviously you have some sort of rent free situation, so it's a no brainer economically. Then again, not all decisions should be about money. If it was about money, your parents would never have had you.

DO NOT buy a home as a tax shelter. That's realtor hype, and just plain ignorant these days. There are more/better tax incentives if you are talking rental homes and you fall into a certain class of investor owner. But as a regular home-owner, ignore that tax shelter thinking.

I'll make anyone a better offer than they will get from their mortgage interest and real estate tax deductions "tax shelters". You send me $10,000. I'll pay $6,000 of your taxes. Feel free to increase those numbers in proportion to your desire for a tax shelter. That's a much larger "shelter" than you'll get from your deductions.

The biggest challenge is figuring out if you need your own home, or if renting will serve you better. Obviously you have some sort of rent free situation, so it's a no brainer economically. Then again, not all decisions should be about money. If it was about money, your parents would never have had you.

DO NOT buy a home as a tax shelter. That's realtor hype, and just plain ignorant these days. There are more/better tax incentives if you are talking rental homes and you fall into a certain class of investor owner. But as a regular home-owner, ignore that tax shelter thinking.

I'll make anyone a better offer than they will get from their mortgage interest and real estate tax deductions "tax shelters". You send me $10,000. I'll pay $6,000 of your taxes. Feel free to increase those numbers in proportion to your desire for a tax shelter. That's a much larger "shelter" than you'll get from your deductions.

-

murphy_p_t

- Executive Member

- Posts: 1675

- Joined: Fri Jul 02, 2010 3:44 pm

Re: PP vs buying a home

Don't listen to the hype. If/when interest rates rise, home prices will go down, so now is actually a pretty bad time to buy. You can always refinance later, or put more money down (after growing it with the PP), but the balance on your mortgage is hard to pay off. Put it another way: I'd rather pay $100,000 for a house at 10% interest than $200,000 at 5%.sk55 wrote: i always have friends and co-workers come up too me ever so often.. saying things:

now is the time to buy a home.

interest rates will start to rise lock in a home now.

buy a home for a tax shelter.

The funny thing is, most of the people that are always telling me to buy have purchased sometime in mid 2000s and lost over $100K of equity since then. I guess misery loves company.

"I came here for financial advice, but I've ended up with a bunch of shave soaps and apparently am about to start eating sardines. Not that I'm complaining, of course." -ZedThou

-

murphy_p_t

- Executive Member

- Posts: 1675

- Joined: Fri Jul 02, 2010 3:44 pm

Re: PP vs buying a home

+1Storm wrote:Don't listen to the hype. If/when interest rates rise, home prices will go down, so now is actually a pretty bad time to buy. You can always refinance later, or put more money down (after growing it with the PP), but the balance on your mortgage is hard to pay off. Put it another way: I'd rather pay $100,000 for a house at 10% interest than $200,000 at 5%.sk55 wrote: i always have friends and co-workers come up too me ever so often.. saying things:

now is the time to buy a home.

interest rates will start to rise lock in a home now.

buy a home for a tax shelter.

The funny thing is, most of the people that are always telling me to buy have purchased sometime in mid 2000s and lost over $100K of equity since then. I guess misery loves company.

Re: PP vs buying a home

If you already have a home (paid off or very good mortgage terms), and you have a chunk of cash you're debating between investing in:

1) Investment property

2) Permanent portfolio

Then I'd pick #2.

But if you don't want to miss out if the real estate market booms again, then maybe allocate a part of your "stocks" portion to REITs (e.g. VNQ.)

1) Investment property

2) Permanent portfolio

Then I'd pick #2.

But if you don't want to miss out if the real estate market booms again, then maybe allocate a part of your "stocks" portion to REITs (e.g. VNQ.)

Re: PP vs buying a home

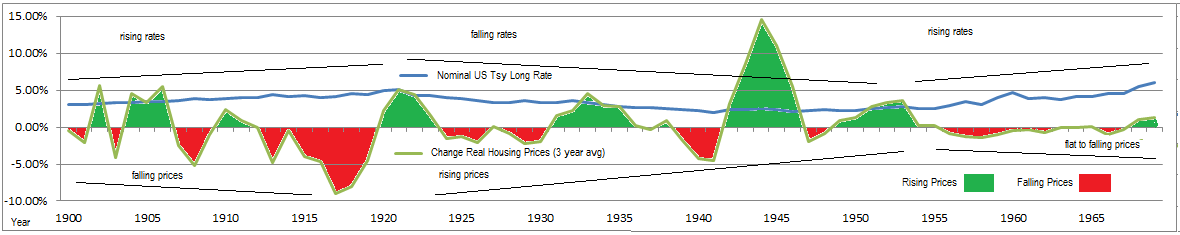

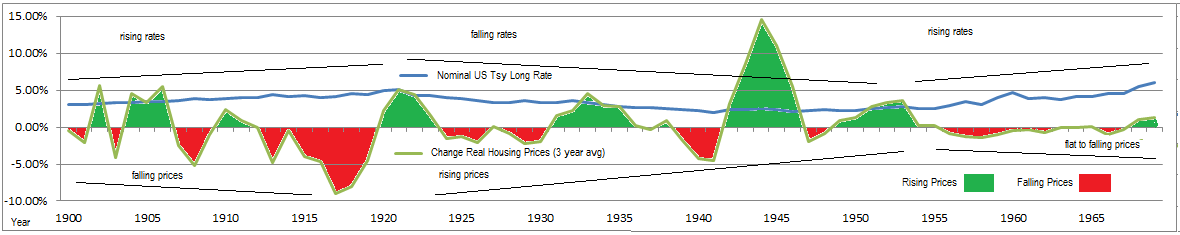

You make a good point about home prices going down when interest rates rise. By the law of supply and demand, the total monthly payment of the average homeowner as a percentage of their income should tend to remain relatively stable as interest rates rise and fall. Ultimately, people can only afford to pay a certain total amount for housing each month, so roughly speaking, mortgage interest rates and home prices should move inversely to each other.Storm wrote:Don't listen to the hype. If/when interest rates rise, home prices will go down, so now is actually a pretty bad time to buy. You can always refinance later, or put more money down (after growing it with the PP), but the balance on your mortgage is hard to pay off. Put it another way: I'd rather pay $100,000 for a house at 10% interest than $200,000 at 5%.sk55 wrote: i always have friends and co-workers come up too me ever so often.. saying things:

now is the time to buy a home.

interest rates will start to rise lock in a home now.

buy a home for a tax shelter.

The funny thing is, most of the people that are always telling me to buy have purchased sometime in mid 2000s and lost over $100K of equity since then. I guess misery loves company.

Several years ago, shortly before the housing market tanked, I had multiple coworkers nagging me constantly that I should buy a house. Like I was obviously a financial simpleton in need of advice because I was still renting an apartment. I just viewed it as a variant of the old "shoe-shiner with a hot stock tip" effect that occurs shortly before a bubble bursts. And sure enough, the bubble burst.

I still rent and plan to continue doing so until I feel more satisfied with my career situation and want to start putting roots down somewhere. Until then, renting is a great convenience for my wife and me. We can pack up and move at a moment's notice when the right opportunity comes along.

"People wish to be settled; only as far as they are unsettled is there any hope for them." – Ralph Waldo Emerson

Re: PP vs buying a home

Since our balance sheet stability currently hinges on housing, I don't see rates really rising unless the economy's pretty stable. Further, on an asset like a home, I think it actually does us more good to look at what the mortgage + maintenance (tax-adjusted) would be and comparing that to renting something similar, rather than looking at the price itself. I'm not usually one to say this (regarding peoples' investments), but in terms of housing, the actual price won't matter until you sell. You could have years of reduced or increased ability to save in other ways as a result of your payments/maintenance being higher or lower than rent before actually realizing a gain/loss on the sale of the home.

I'll add that while I can't speak for other areas, Minnesota rents have continued to climb relatively sharply (with vacancy rates extremely low) all while interest rates and home prices have continued to drop. Right now, at current mortgage rates, buying is pretty attractive. A condo (similar to the apartment I had) can be had for FAR less per month at 4%... though I feel it's more appropriate to compare rents to a 5, 7 or 10 year ARM rate, as 30 year rates have inflation protection built in that renting simply does not.

murphy's link appears to give what I feel is a somewhat incomplete analysis of the situation. First off, at a date when rates were below 4%, the author tried to claim that rates were at 5%... then compared that rate to the 2.5% rental rate. This seems to be pulled out of a hat to some degree, and seems completely innacurate if I use my area as an indication.

Further, his observation of home prices rising as yields fall and falling as yields rise is incomplete. There are a lot of things affecting the housing market, and yields have been dropping from 2006-present, precisely over the same time we've seen huge drops in housing prices. I think housing may still have some more drop to it, but if rental rates keep rising, this is going to start putting huge pressure on people to buy homes at current rates... plus I've read something indicating that if you have that and people see interest rates start to rise, they'll actually feel like they're getting priced out and be more likely to buy.

I'll add that while I can't speak for other areas, Minnesota rents have continued to climb relatively sharply (with vacancy rates extremely low) all while interest rates and home prices have continued to drop. Right now, at current mortgage rates, buying is pretty attractive. A condo (similar to the apartment I had) can be had for FAR less per month at 4%... though I feel it's more appropriate to compare rents to a 5, 7 or 10 year ARM rate, as 30 year rates have inflation protection built in that renting simply does not.

murphy's link appears to give what I feel is a somewhat incomplete analysis of the situation. First off, at a date when rates were below 4%, the author tried to claim that rates were at 5%... then compared that rate to the 2.5% rental rate. This seems to be pulled out of a hat to some degree, and seems completely innacurate if I use my area as an indication.

Further, his observation of home prices rising as yields fall and falling as yields rise is incomplete. There are a lot of things affecting the housing market, and yields have been dropping from 2006-present, precisely over the same time we've seen huge drops in housing prices. I think housing may still have some more drop to it, but if rental rates keep rising, this is going to start putting huge pressure on people to buy homes at current rates... plus I've read something indicating that if you have that and people see interest rates start to rise, they'll actually feel like they're getting priced out and be more likely to buy.

"Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds."

- Thomas Paine

- Thomas Paine

Re: PP vs buying a home

Moda, if you intentionally exclude any decrease in principle from your calculations, you're not making a wise investment decision. You can make that rent/buy comparison, but if you add in principle loss for the last 4 years I would hazard a guess that it's better to rent than buy right now.

Of course, this is not the best comparison to make because the last 4 years have been anything but normal in the housing market. I also don't think it's fair to compare interest rates vs. house prices during the last 4 years when the bubble was deflating. Of course during deflation interest rates fall, at the same time the asset values that were inflated by the bubble are falling. This is not normal, in the sense of a normal healthy market.

There have been hundreds of years of history proving that people will spend an average of 25% of their income on housing - this has been true since the beginning of monetary systems. If the payment consists of principle and interest, it only follows that any increase in interest rate must be offset by a reduction in principle. The laws of supply and demand are immutable - people will not pay more than this.

What's unique about the US housing bubble is that the average consumer seems to have been brainwashed to a certain extent, that paying more than 25% of their income for housing is completely normal and actually healthy, since you could make such a huge profit from housing. Now that this illusion has been brutally shattered by the reality that housing is not fundamentally worth more than 25% of any household's income, expect reality to set back in. This process will unfold over decades, not months or years, as the government continually tries to reflate the asset bubble.

Of course, this is not the best comparison to make because the last 4 years have been anything but normal in the housing market. I also don't think it's fair to compare interest rates vs. house prices during the last 4 years when the bubble was deflating. Of course during deflation interest rates fall, at the same time the asset values that were inflated by the bubble are falling. This is not normal, in the sense of a normal healthy market.

There have been hundreds of years of history proving that people will spend an average of 25% of their income on housing - this has been true since the beginning of monetary systems. If the payment consists of principle and interest, it only follows that any increase in interest rate must be offset by a reduction in principle. The laws of supply and demand are immutable - people will not pay more than this.

What's unique about the US housing bubble is that the average consumer seems to have been brainwashed to a certain extent, that paying more than 25% of their income for housing is completely normal and actually healthy, since you could make such a huge profit from housing. Now that this illusion has been brutally shattered by the reality that housing is not fundamentally worth more than 25% of any household's income, expect reality to set back in. This process will unfold over decades, not months or years, as the government continually tries to reflate the asset bubble.

"I came here for financial advice, but I've ended up with a bunch of shave soaps and apparently am about to start eating sardines. Not that I'm complaining, of course." -ZedThou

Re: PP vs buying a home

Storm,

If you looked at the buy/rent calculations alone (ignoring predictions on where the housing market would go), buying was an abysmal decision, unless you got a 30-year loan and expected rents to start skyrocketing. It also was a bad decision in terms of peoples' debt-to-income ratio (a term I hate, as it should be called debt-service-to-income or something similar).

I am not thinking of what will happen over a 4-year period, but moreso over the time period one expects to own a home. If it's closer to 4 years, concentrating on price is crucial (though I'd actually argue one shouldn't buy a home most likely, looking at finances alone). If someone loves a place/neighborhood and they think it will work for them for 15+ years, I think looking at something as similar as possible in terms of renting should be done. These calculations are difficult, as homeownership includes maintenance & tax benefits, while renting contains an increased inflation risk compared to a 30-year loan.

Further, in areas that are difficult to expand in terms of housing (Manhattan), I wouldn't try to stick too hard to the 25%-of-income rule, as the market might leave that behind, as long as both home ownership and rental are on relatively even footing with each other.

Just as a side not, I find it interesting that the housing market started taking off in 1998... when ST treasury rates were offering amazing positive yields of 2.5-3.5%... meaning borrowing at a rate above that, you'd be borrowing at 5-6% real (guesstimate). These lucrative risk-free rates went about half way into 2001, as the housing boom had 3.5 years of heavy steam. I find it difficult to believe that artificially low rates could have been a driving cause of the housing bubble when we had 3.5 years of boom activity during artificially high rates (using a 0% real risk free rate as a yardstick).

If you looked at the buy/rent calculations alone (ignoring predictions on where the housing market would go), buying was an abysmal decision, unless you got a 30-year loan and expected rents to start skyrocketing. It also was a bad decision in terms of peoples' debt-to-income ratio (a term I hate, as it should be called debt-service-to-income or something similar).

I am not thinking of what will happen over a 4-year period, but moreso over the time period one expects to own a home. If it's closer to 4 years, concentrating on price is crucial (though I'd actually argue one shouldn't buy a home most likely, looking at finances alone). If someone loves a place/neighborhood and they think it will work for them for 15+ years, I think looking at something as similar as possible in terms of renting should be done. These calculations are difficult, as homeownership includes maintenance & tax benefits, while renting contains an increased inflation risk compared to a 30-year loan.

Further, in areas that are difficult to expand in terms of housing (Manhattan), I wouldn't try to stick too hard to the 25%-of-income rule, as the market might leave that behind, as long as both home ownership and rental are on relatively even footing with each other.

Just as a side not, I find it interesting that the housing market started taking off in 1998... when ST treasury rates were offering amazing positive yields of 2.5-3.5%... meaning borrowing at a rate above that, you'd be borrowing at 5-6% real (guesstimate). These lucrative risk-free rates went about half way into 2001, as the housing boom had 3.5 years of heavy steam. I find it difficult to believe that artificially low rates could have been a driving cause of the housing bubble when we had 3.5 years of boom activity during artificially high rates (using a 0% real risk free rate as a yardstick).

"Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds."

- Thomas Paine

- Thomas Paine

Re: PP vs buying a home

Moda, this correlation has been going on for a very long time. I'm not sure that it's really up for debate, although you're clearly welcome to assume that house prices will continue to rise in the face of higher interest rates - I'm not sure where people will get mortgages to pay for them.

The only reason I picked a 4 year term is because you had mentioned that both rates and house prices had fallen during the last 4 years. Of course that term has nothing to do with the ideal length of time you should hold a mortgage.

The only reason I picked a 4 year term is because you had mentioned that both rates and house prices had fallen during the last 4 years. Of course that term has nothing to do with the ideal length of time you should hold a mortgage.

Last edited by Storm on Tue May 08, 2012 11:18 am, edited 1 time in total.

"I came here for financial advice, but I've ended up with a bunch of shave soaps and apparently am about to start eating sardines. Not that I'm complaining, of course." -ZedThou