Mirroring the Market?

Moderator: Global Moderator

Mirroring the Market?

I invested pretty much 100% in the PP, toward the beginning of the month. I'm since down about 2.5% ... about the same as I'd be down, if I was just invested in SPY, I guess?

What is the likelihood that these asset groups are really more correlated than we think?

What is the likelihood that these asset groups are really more correlated than we think?

"Now remember, when things look bad and it looks like you're not gonna make it, then you gotta get mean. I mean plumb, mad-dog mean. 'Cause if you lose your head and you give up then you neither live nor win. That's just the way it is. "

Re: Mirroring the Market?

There have been times when the assets have dropped together. But there are many more times when they haven't. In the long run I find it unlikely the assets will be correlated. I just think there are very fundamental economic reasons why this is so. The only free lunch we have is diversification. Any concentrated bet carries its own (more significant) risks. IMO.

Last edited by craigr on Tue Nov 16, 2010 8:11 pm, edited 1 time in total.

Re: Mirroring the Market?

First of all congratulations on making the move to PP. As a holder of a 4-month old PP I felt nervous at the beginning too. But really you can't gauge the performance based on 1 month. As of today's market close my PP is up about 3% - given that my LTT position is down 7%. Last Thursday My PP was up 5.8% (with even a bigger drop in LTTs).

I think it makes sense to look at PP performance starting with at least 12 month periods.

I think it makes sense to look at PP performance starting with at least 12 month periods.

"Let every man divide his money into three parts, and invest a third in land, a third in business, and a third let him keep in reserve."

- Talmud

- Talmud

Re: Mirroring the Market?

I know the academic arguments about market timing... yet I still worry that I bought in, at the peak. LOL.

"Now remember, when things look bad and it looks like you're not gonna make it, then you gotta get mean. I mean plumb, mad-dog mean. 'Cause if you lose your head and you give up then you neither live nor win. That's just the way it is. "

Re: Mirroring the Market?

As another new PP investor, I am a little troubled by the idea of adjusting my investments based on prior year performance. This seems a little like performance chasing and timing the market - but then I suppose periodically rebalancing to the 25% level for each investment could be viewed as a contra-performance chasing. I really appreciate the work that Clive has assembled looking at portfolio alternatives - but for a newbie I am not sure I can comprehend the alternatives while also working to accept buying GLD and TLT at such pricey levels.

All in all, I am trying to remain committed to DCA as I transform my existing 25-75 portfolio into the PP. I was down 12% in 2008 and while I have worked my way back above the 2007 close, I would like to try and avoid that level of drawdown in the future especially when I start taking monthly withdrawals from the IRA in 2012.

Bob

All in all, I am trying to remain committed to DCA as I transform my existing 25-75 portfolio into the PP. I was down 12% in 2008 and while I have worked my way back above the 2007 close, I would like to try and avoid that level of drawdown in the future especially when I start taking monthly withdrawals from the IRA in 2012.

Bob

Last edited by rwc356 on Wed Nov 17, 2010 6:55 am, edited 1 time in total.

Re: Mirroring the Market?

Keep in mind that we all have different investing temperaments. It's presumptive of me to describe another person in this way, but I think it's fair to say that Clive is from the "brilliant tinkerer" mold of investor. He's unafraid to experiment boldly.

That ain't me. Like, at all.

I like one strategy (the simpler, the better) that I can completely understand and analyze. I then like to stick to and study that strategy. For me, this removes emotion from the equation. When the markets are roiling and panicky, I have to be sure that I'll be able to avoid making a stupid mistake. This is the fundamental underpinning to any Boglehead Portfolio or Permanent Portfolio in my opinion.

I also don't believe that the markets can be timed. If they could be, there would be some evidence of this. And even if there was some strategy that worked now, the markets would encapsulate that knowledge and make it much less likely to work in the future. (Craig talked about this in his most recent podcast.)

So keep in mind that a strategy that appeals to the "brilliant tinkerer" persona (Clive) could be a very poor choice for the "lazy, conservative beard-stroker" persona (Lone Wolf).

Clive, on the issue of the Japanese PP, I was under the impression that such a beast could not be easily constructed. Weren't long-term treasuries (presumably one of the better bets for a deflationary environment) not really available in Japan? I think missing these would damage a PP's returns very badly. What does your data reflect?

That ain't me. Like, at all.

I like one strategy (the simpler, the better) that I can completely understand and analyze. I then like to stick to and study that strategy. For me, this removes emotion from the equation. When the markets are roiling and panicky, I have to be sure that I'll be able to avoid making a stupid mistake. This is the fundamental underpinning to any Boglehead Portfolio or Permanent Portfolio in my opinion.

I also don't believe that the markets can be timed. If they could be, there would be some evidence of this. And even if there was some strategy that worked now, the markets would encapsulate that knowledge and make it much less likely to work in the future. (Craig talked about this in his most recent podcast.)

So keep in mind that a strategy that appeals to the "brilliant tinkerer" persona (Clive) could be a very poor choice for the "lazy, conservative beard-stroker" persona (Lone Wolf).

Clive, on the issue of the Japanese PP, I was under the impression that such a beast could not be easily constructed. Weren't long-term treasuries (presumably one of the better bets for a deflationary environment) not really available in Japan? I think missing these would damage a PP's returns very badly. What does your data reflect?

Re: Mirroring the Market?

Again the only free lunch investors get is with diversification. I wish I knew what was going to happen going forward but nobody does. The only option that has worked in the past is to diversify and ride out the markets. Like many, I am relying on my savings to pay for my living expenses. So clearly this issue is important to me and something that I spend a lot of time thinking about. Is the Permanent Portfolio the best going forward? We just don't know. But it was a lot better than other options I've explored which all have their own issues.

Today the Fed is doing many unprecedented things in the market and throwing many assets out of whack. Gold is going higher. Bonds have been going higher. Stocks have been going higher. Real Estate has been going higher. Etc. There is no asset that I would think is a screamingly good buy no matter what portfolio strategy people are using. But that, to me, means all the more reason to stay very widely diversified. I don't know where the next torpedo is going to strike and I don't feel comfortable gambling in any particular area to make a concentrated bet. The only option I see is to stay diversified.

Re: Backtested performance

I personally look at backtesting primarily as a way to disprove theories. The Permanent Portfolio has had decent results in the past, but more importantly it's weathered some very bad market storms without much damage. This doesn't promise good returns going forward, but does show the framework can be very robust. What I most like about the approach is that it gives me options to respond to unprecedented events if I have to. Keep in mind that the portfolio holds assets but the portfolio strategy doesn't move the markets. The assets it holds have very little in common with each other economically. Even if the assets all drop at once, I don't think the condition will continue indefinitely. I also don't know what other investing approach will be doing much better.

Today the Fed is doing many unprecedented things in the market and throwing many assets out of whack. Gold is going higher. Bonds have been going higher. Stocks have been going higher. Real Estate has been going higher. Etc. There is no asset that I would think is a screamingly good buy no matter what portfolio strategy people are using. But that, to me, means all the more reason to stay very widely diversified. I don't know where the next torpedo is going to strike and I don't feel comfortable gambling in any particular area to make a concentrated bet. The only option I see is to stay diversified.

Re: Backtested performance

I personally look at backtesting primarily as a way to disprove theories. The Permanent Portfolio has had decent results in the past, but more importantly it's weathered some very bad market storms without much damage. This doesn't promise good returns going forward, but does show the framework can be very robust. What I most like about the approach is that it gives me options to respond to unprecedented events if I have to. Keep in mind that the portfolio holds assets but the portfolio strategy doesn't move the markets. The assets it holds have very little in common with each other economically. Even if the assets all drop at once, I don't think the condition will continue indefinitely. I also don't know what other investing approach will be doing much better.

Last edited by craigr on Wed Nov 17, 2010 11:08 am, edited 1 time in total.

Re: Mirroring the Market?

I have begun to see that indexing and attaining the market return year in and out is all you can reasonably expect to achieve - otherwise you are guessing (speculating) on which manager / investment concept will have the hot hand for the next few years. Seems like PP is similar in that the indexing and correlation of the four investments should allow you to float with the market return and does not rely upon us picking the guru with the "hot hand". Since I don't know what the economic conditions will be next year or the year after, I have to pay my money and take my chances. I'm trying to increase my odds through the use of the PP but I realize it may not work in all conditions - so we monitor and be prepared to tweak the concept if underlying assumptions change - assuming I am smart enough to realize that if/when it occurs.

Re: Mirroring the Market?

Perhaps you addressed this, but I was under the impression that due to deflation, living expenses have gone down over the years in Japan. In real terms, wouldn't a lackluster Japanese PP still provide growing purchasing power? After all, the Yen has gotten so strong, you'd think that it would buy more goods as the Deflation got worse.Clive wrote:Good point Lone Wolf. I used the Japanese data that someone posted on the Boogle original thread and if I recall correctly it was based on 10 year treasuries not 20+ year treasuries. The way the Japanese markets zig and zag wildly perhaps anything over 10 years is long term to themLone Wolf wrote: Clive, on the issue of the Japanese PP, I was under the impression that such a beast could not be easily constructed. Weren't long-term treasuries (presumably one of the better bets for a deflationary environment) not really available in Japan? I think missing these would damage a PP's returns very badly. What does your data reflect?

Over the 1990's in Japan, ST's went from 8% gains down to near 0% gains, which implies that interest rates might have been on the decline over that period and which would have favoured stocks and bonds. Those 10 year returns aren't too different to what LT's averaged over similar high to low base rate transitions, so perhaps the difference might not be as large as you might suspect. As an example LT's would have had to average 15% more than 10 year T's in each and every year over ten years in order to have avoided that 40% drawdown example I posted earlier.

Last edited by Gumby on Thu Nov 18, 2010 10:21 am, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: Mirroring the Market?

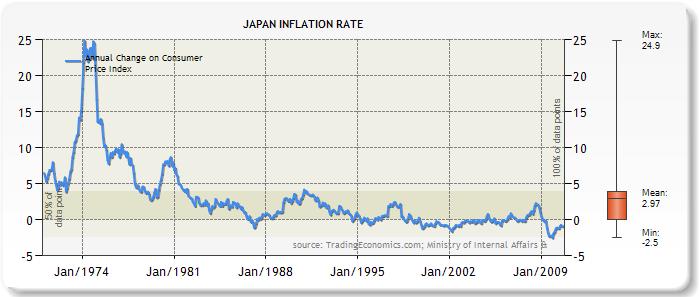

My apologies for my inability to follow this. My confusion lies in your red line. You show Japanese inflation slowly rising from 1972 to 2008 to annualized rate of 2.9%. My understanding is that Japanese inflation spiked in 1974 to 20.81% and has dropped ever since. I'm seeing that they had an annualized inflation rate of -2.023% in 2008.Clive wrote:Japan was one of the lower earners over the last few decades and for most other countries that I've tested the PP/BB provided marginally less than the PP, but still generally provided 4% or higher income withdrawal rates with inflationary uplift over time (4% income and inflationary uplift is a common objective amount targeted by investors).

Hope this helps rather than making it more confusing Gumby.

http://www.wolframalpha.com/input/?i=ja ... since+1970

Do you mind explaining (in layman's terms) why you show 2.9% for the 2008 annualized inflation rate instead of -2.023%?

Last edited by Gumby on Thu Nov 18, 2010 2:42 pm, edited 1 time in total.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: Mirroring the Market?

Thank you. I found a Japanese inflation chart that is a little more detailed. It shows the same "mean" inflation that you displayed in your charts. I understand now. Thanks again.Clive wrote: Gumby, I've uploaded a copy of the Excel spreadsheet/worksheet for Japan PP/BB versus inflation

http://www.jfholdings.pwp.blueyonder.co.uk/gumby.xls

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

Re: Mirroring the Market?

Good article in today's WSJ by Jason Zweib about close correlation between commodities and stocks.

"Now remember, when things look bad and it looks like you're not gonna make it, then you gotta get mean. I mean plumb, mad-dog mean. 'Cause if you lose your head and you give up then you neither live nor win. That's just the way it is. "

Re: Mirroring the Market?

Clive your work is amazing and truly very helpful. In your numbers though the LT lost in the 20's not 12 last yr?