frugal wrote: ↑Fri Apr 04, 2025 5:21 pm

After 10 years, these short-term bonds have produced either very low returns or even negative real returns when adjusted for inflation. Not exactly the capital protection I was hoping for.

Yes, I did find it challenging to hold cash during the many years of interest rate repression. But while real returns may have been negative at times, cash never loses money in nominal terms. And when measured in that way, cash did provide capital protection.

frugal wrote: ↑Fri Apr 04, 2025 5:21 pm

Many people I know simply chose time deposits at the bank instead. Honestly, that might have been the better option during this prolonged low interest rate period—at least they offered slightly more predictable yields.

Hmm, banks in the US are rather stingy when it comes to CDs. You definitely have to shop around and make sure the one you buy does not have call risk. Also must keep below FDIC $250K limit. Possibly some might have liquidity restrictions. In the US, government money market funds are very safe, very liquid.

frugal wrote: ↑Fri Apr 04, 2025 5:21 pm

Can we still justify holding short-term government bonds in a modern permanent portfolio?

Yes, the allocation to cash in the PP is for times when the dominant economic environment is "tight money" recession.

frugal wrote: ↑Fri Apr 04, 2025 5:21 pm

Wouldn’t high-quality corporate bonds be a more reasonable substitute today?

Still relatively safe, still short duration—but potentially more rewarding.

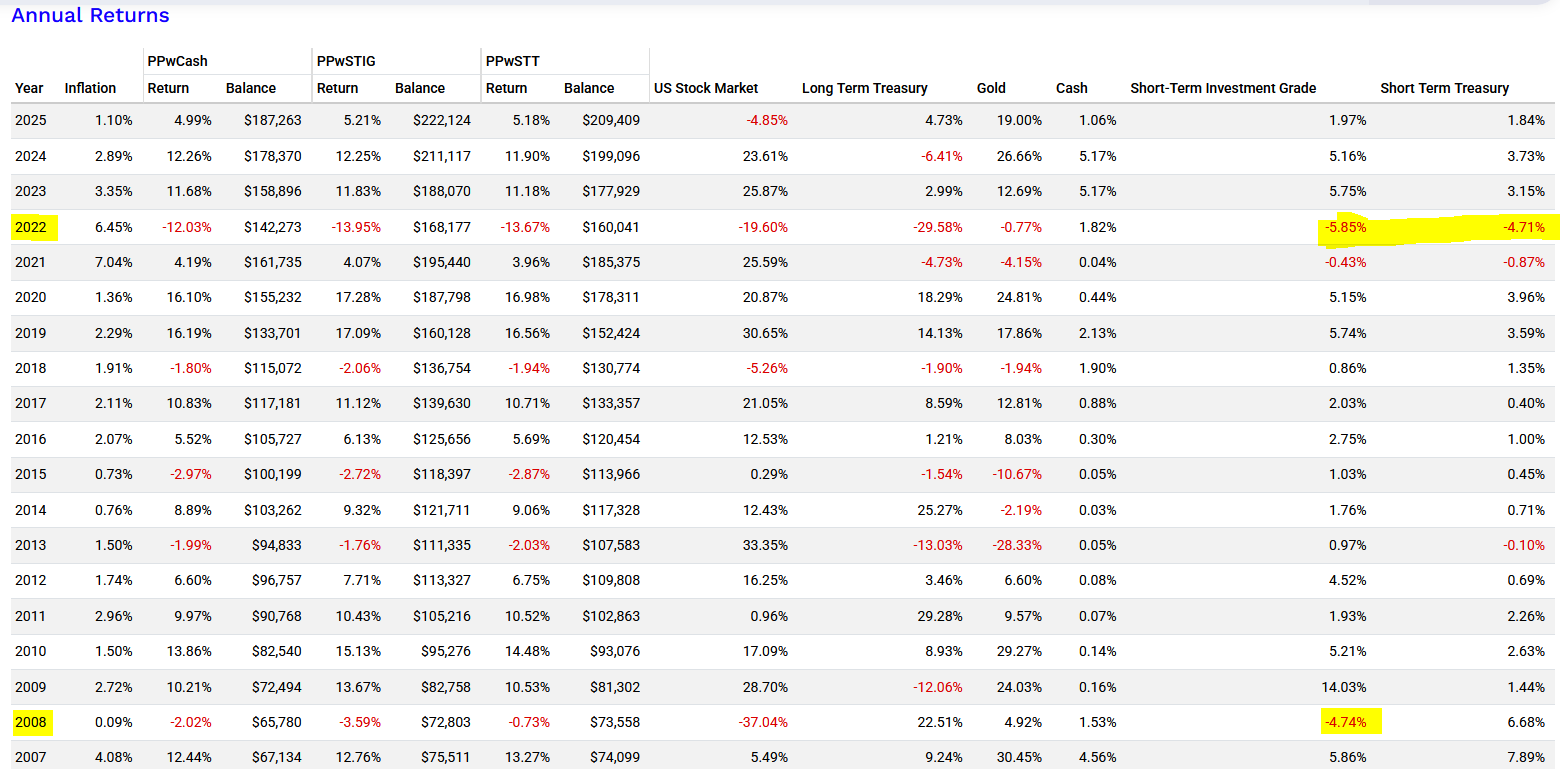

Agreed - still relatively safe and normally more rewarding in terms of return. However, I disagree with "a more reasonable substitute today". The corporate nature of investment grade bonds may cause them to be more correlated to stocks in times of economic stress (see year 2008 below, credit risk!). And Harry Browne cautioned against going too long in duration when it comes to cash (see year 2022 below, both STIG and STT underperformed cash). The year 2022 I was very thankful for cash allocation. While I do value total return, I also value peace of mind.

Portfolio Visualizer comparison of standard PP (cash) vs PP (w/short term investment grade substitute) vs PP (w/short term treasury substitute), 1983 to present:

- PP-Cash-vs-STIG-vs-STT-Returns.PNG (128.84 KiB) Viewed 9269 times

frugal wrote: ↑Fri Apr 04, 2025 5:21 pm

What do you think? Is anyone already making this shift?

I am sticking with cash in the form of government (T-bill) money market fund. At least cash is paying around 4% nominal these days.

Also, I once came across this description of cash that I like:

"Cash is essentially a universal put option on all assets at their current prices, and instead of paying for a put option, cash earns interest."