Just don't spread your seed too often. Your car and all your devices are listening.

BTC in the PP

Moderator: Global Moderator

- dualstow

- Executive Member

- Posts: 15746

- Joined: Wed Oct 27, 2010 10:18 am

- Location: foot of Mt Belzoni

- Contact:

Re: BTC in the PP

RIP ROBERT DUVALL

Re: BTC in the PP

lmao. Are we still talking about bitcoin?

I recite it in silence in my head. I'm quite paranoid about it. Edward Snowden did us all a favour.

www.ironwealth.org

Re: BTC in the PP

So Trump really did it and signed an executive order for a bitcoin strategic reserve...

...and the price response from bitcoin was flat.

...and the price response from bitcoin was flat.

www.ironwealth.org

Re: BTC in the PP

This is sure to increase its value?

https://www.coindesk.com/policy/2025/03 ... or-bitcoin

As Crypto Summit Nears, White House Maintains Special Status for Bitcoin

The approach to the newly announced bitcoin reserve grants that BTC deserves special treatment among digital assets, a White House official said.

By Jesse Hamilton|Edited by Nikhilesh De, Benjamin Schiller

Updated Mar 7, 2025, 4:21 p.m. UTCPublished Mar 7, 2025, 3:22 p.m. UTC

What to know:

A White House official estimates about 200,000 bitcoin is in the hands of the government currently as a start to the reserve ordered by President Donald Trump, though the government is set to begin an audit to figure out what crypto it has.

President Donald Trump is poised to host a segment of the crypto industry's leadership at a White House summit on Friday afternoon, at which the reserve is expected to be a topic of conversation.

The crypto industry likely read too much into what the president said earlier about a range of non-bitcoin assets to be stockpiled, the official said.

https://www.coindesk.com/policy/2025/03 ... or-bitcoin

As Crypto Summit Nears, White House Maintains Special Status for Bitcoin

The approach to the newly announced bitcoin reserve grants that BTC deserves special treatment among digital assets, a White House official said.

By Jesse Hamilton|Edited by Nikhilesh De, Benjamin Schiller

Updated Mar 7, 2025, 4:21 p.m. UTCPublished Mar 7, 2025, 3:22 p.m. UTC

What to know:

A White House official estimates about 200,000 bitcoin is in the hands of the government currently as a start to the reserve ordered by President Donald Trump, though the government is set to begin an audit to figure out what crypto it has.

President Donald Trump is poised to host a segment of the crypto industry's leadership at a White House summit on Friday afternoon, at which the reserve is expected to be a topic of conversation.

The crypto industry likely read too much into what the president said earlier about a range of non-bitcoin assets to be stockpiled, the official said.

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

Re: BTC in the PP

Hopefully! At this point I'm not surprised about anything... bitcoin spikes on no news, and then tanks on what is ostensibly good news on a regular basis. Just gonna sit back and enjoy the ride.

www.ironwealth.org

Re: BTC in the PP

What a tempting enticement for North Korea to empty the public ledger/blockchain of US reserve bitcoins. Hack the blockchain software release repository to include a obscure but exploitable software bug and !!!

- dualstow

- Executive Member

- Posts: 15746

- Joined: Wed Oct 27, 2010 10:18 am

- Location: foot of Mt Belzoni

- Contact:

Re: BTC in the PP

www.ironwealth.org

- mathjak107

- Executive Member

- Posts: 4763

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: BTC in the PP

it was a big nothing .

the bitcoin in the reserve was forfeited bitcoins already held by the gov .

there was no intention of adding any more at this time .

MEH

the bitcoin in the reserve was forfeited bitcoins already held by the gov .

there was no intention of adding any more at this time .

MEH

Re: BTC in the PP

From a FX perspective, stocks with global earnings might be considered as a form of global fiat currencies set. Gold might also be considered as a global non-fiat currency ... the two, stocks and gold, are inclined to somewhat hedge each other. 25% weighted each along with 50% in domestic currency (Treasury's) and again those two halves hedge each other.coasting wrote: ↑Thu Jan 09, 2025 5:55 pm I don't know which economic regime that bitcoin can be expected to do well in: prosperity, recession, inflation, deflation? How can I place it in the PP if I cannot definitively answer that question? I sometimes hear bitcoin referred to as a form of "digital" gold. Other times I hear bitcoin referred to as a "risk on" asset.

Swap out the stock 25% for a third in a 3x stock, and for FX balance the partner for that might be gold, 8/42/50 3x stock/gold/treasury's. Swap out the 3x stock for bitcoin and that's more like a 5x, 5/45/50 bitcoin/gold/treasury's

Rebalance just once/year and the 5% in bitcoin caps the one year worst case, whilst giving potential upside runs a long period before 'profit taking'.

https://www.portfoliovisualizer.com/bac ... 0a7Z1lHBP2

Swap out gold for silver if you so prefer, and/or a 10 year treasury bullet instead of the STT/LTT barbell

https://www.portfoliovisualizer.com/bac ... ItdbXhFN54

or even cash

https://www.portfoliovisualizer.com/bac ... t7mbxqXKWh

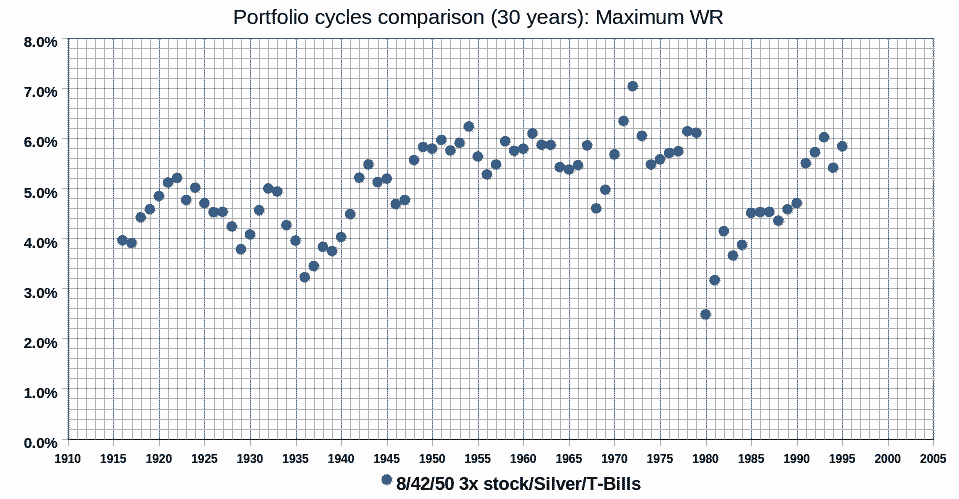

5% in bitcoin, 45% in physical silver (or gold), 50% in Treasury Bills IMO has a element of appeal. Here in the UK however and 3x stock can be held more tax efficiently. From a 'risk' perspective of 30 year SWR (US data)

and 8/42/50 3x stock/silver/T-Bills generally did well, with some exceptions. Noteworthy however is that the two worst cases of 1936 and 1980 start of 30 year runs were preceded with large/fast gains, a 65% real gain up-run in 1933/4/5 and a 165% real gain up-run in 1979, in reflection of which you might have lowered SWR expectations for 1936/37 and 1980/81 start years.

Re: BTC in the PP

They are keeping bitcoin that was captured via law enforcement activities but they are also intending to acquire more. It just has to be in a budget neutral way in order to sidestep congressional approval.

www.ironwealth.org

Re: BTC in the PP

https://www.thefp.com/p/trumps-crypto-fort-knox

Cliff Asness: The New ‘Crypto Fort Knox’ Is as Dumb as It Sounds

To create a sovereign wealth fund dedicated to something five times or more as volatile as straight-up stocks is an awful idea.

By Cliff Asness

03.07.25 — Tech and Business

Cliff Asness: The New ‘Crypto Fort Knox’ Is as Dumb as It Sounds

To create a sovereign wealth fund dedicated to something five times or more as volatile as straight-up stocks is an awful idea.

By Cliff Asness

03.07.25 — Tech and Business

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

Re: BTC in the PP

https://www.citationneeded.news/issue-78/

Crypto recaps

Issue 78 – President on brink of bailout for bitcoin

Trump tries to breathe life back into the crypto markets’ “Trump pump” while federal regulatory agencies wash their hands of any crypto industry oversight

Molly White

02 Mar 2025 — 23 min read

Crypto recaps

Issue 78 – President on brink of bailout for bitcoin

Trump tries to breathe life back into the crypto markets’ “Trump pump” while federal regulatory agencies wash their hands of any crypto industry oversight

Molly White

02 Mar 2025 — 23 min read

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

Re: BTC in the PP

Not gonna read all of the recent reply's, but it's clear you all should have been adding some BTC

Re: BTC in the PP

I'm all in on BTC at $10,000.

If the general stock market takes a nosedive in 2025-2026, BTC will go down by multiples of that.

$100,000 > $10,000... typical BTC behavior.

Its seems to be an amplifier for human emotions... it reveals the worst possible investor behavior. Performance chasing, recency bias.

The volatility is so extreme... it's addictive. It's like a drug. I would own some, but not at any price. I was a whole coiner, took some decent profits. None since.

If the general stock market takes a nosedive in 2025-2026, BTC will go down by multiples of that.

$100,000 > $10,000... typical BTC behavior.

Its seems to be an amplifier for human emotions... it reveals the worst possible investor behavior. Performance chasing, recency bias.

The volatility is so extreme... it's addictive. It's like a drug. I would own some, but not at any price. I was a whole coiner, took some decent profits. None since.

Re: BTC in the PP

All seems accurate!ochotona wrote: ↑Sat Mar 15, 2025 6:34 pm I'm all in on BTC at $10,000.

If the general stock market takes a nosedive in 2025-2026, BTC will go down by multiples of that.

$100,000 > $10,000... typical BTC behavior.

Its seems to be an amplifier for human emotions... it reveals the worst possible investor behavior. Performance chasing, recency bias.

The volatility is so extreme... it's addictive. It's like a drug. I would own some, but not at any price. I was a whole coiner, took some decent profits. None since.

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

Re: BTC in the PP

No thanks!!!! (end of writing by Vinny)

https://www.nytimes.com/2025/03/06/tech ... korea.html

How the Biggest Crypto Heist in History Went Down

The cryptocurrency exchange Bybit lost $1.5 billion to North Korean hackers last month — and it all traced back to an account on a free digital storage service.

https://www.nytimes.com/2025/03/06/tech ... korea.html

How the Biggest Crypto Heist in History Went Down

The cryptocurrency exchange Bybit lost $1.5 billion to North Korean hackers last month — and it all traced back to an account on a free digital storage service.

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

Re: BTC in the PP

https://www.morningstar.com/funds/inves ... m_id=32195

Investors Favor Gold Over Bitcoin ETFs During Recent Market Volatility

Wavering stocks and crypto declines benefited gold ETFs in February.

Adam Sabban

and Margaret Giles

Mar 20, 2025

Investors Favor Gold Over Bitcoin ETFs During Recent Market Volatility

Wavering stocks and crypto declines benefited gold ETFs in February.

Adam Sabban

and Margaret Giles

Mar 20, 2025

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

-

Jack Jones

- Executive Member

- Posts: 753

- Joined: Mon Aug 24, 2015 3:12 pm

Re: BTC in the PP

Bitcoin seemingly uncorrelated to the ongoing carnage, at least in the short term.

Re: BTC in the PP

Dumping dollars also entails selling US stocks. That flows into other assets such as gold, silver, bitcoin. Previously bitcoin was much like a leveraged tech stock index holding, similar in motion to TQQQ for instance - but where under Trump's tariffs there's been a disconnect.Jack Jones wrote: ↑Fri Apr 04, 2025 12:00 pm Bitcoin seemingly uncorrelated to the ongoing carnage, at least in the short term.

When the prior flight to US dollar for safety itself becomes a major risk factor, where to flight-to-safety?

Much of investing is about averaging, average in, out, down. You're generally rewarded for taking on volatility risk - that can be diluted right down by averaging and diversification to mostly just leave the reward without the risk.

Not unreasonable to migrate the PP's bond risk over to the stock side, swap out the 50% in bonds (LTT/STT) for hard cash, up the stock exposure in reflection of that, perhaps a global stock index tracker fund. Also up the gold weighting, perhaps also including some silver. 50/17/17/16 stock/gold/silver/hard-cash.

Swap out the 1x stock for a leveraged stock holding instead, a third in the 3x perhaps, partnered with T-Bills 17/17/17/16/33 3x stock/gold/silver/hard-cash/T-Bills. Maybe even replace the 3x stock with bitcoin instead

https://www.portfoliovisualizer.com/bac ... brSOZN7ry1 (can't set a hard-cash asset in that link, so allocated hard cash to 'cash').

Re: BTC in the PP

A simple but serious question... do you think that Harry Browne would have approved of Bitcoin?

Would he see it as a complement to a portfolio alongside gold? Or perhaps a more extreme view that it was gold's replacement? Or maybe he'd reject it outright like Peter Schiff...

Would he see it as a complement to a portfolio alongside gold? Or perhaps a more extreme view that it was gold's replacement? Or maybe he'd reject it outright like Peter Schiff...

www.ironwealth.org

Re: BTC in the PP

Serious answer... I think Harry Browne would struggle (as I do) to place Bitcoin as a reliable asset in one of the Permanent Portfolio's 4 dominant economic themes: prosperity, recession, inflation, or deflation. So I think he would consider it a speculation that, if one were to invest in, should reside in the Variable Portfolio using money that is not precious to you.Smith1776 wrote: ↑Sat Jun 28, 2025 2:43 pm A simple but serious question... do you think that Harry Browne would have approved of Bitcoin?

Would he see it as a complement to a portfolio alongside gold? Or perhaps a more extreme view that it was gold's replacement? Or maybe he'd reject it outright like Peter Schiff...

In summary: reject as a PP asset, your call as a VP asset.

Release the Epstein Files

Re: BTC in the PP

Hello, everyone

I’m currently looking into ways to invest in Bitcoin through ETFs, and I’m mostly interested in spot Bitcoin ETFs.

These ETFs directly hold Bitcoin and aim to follow its price as closely as possible. Some examples I’ve found are:

• IBIT – iShares Bitcoin Trust

• FBTC – Fidelity Wise Origin Bitcoin Fund

• ARKB – ARK 21Shares Bitcoin ETF

Since these are physically backed, they seem simpler and more transparent than other options like futures or crypto company stocks.

I’d like to hear your thoughts:

• Are you using any of these spot Bitcoin ETFs?

• How has your experience been so far?

• Any risks or practical points I should be aware of, especially for investors based in Europe?

Thanks in advance for any insights you can share.

I’m currently looking into ways to invest in Bitcoin through ETFs, and I’m mostly interested in spot Bitcoin ETFs.

These ETFs directly hold Bitcoin and aim to follow its price as closely as possible. Some examples I’ve found are:

• IBIT – iShares Bitcoin Trust

• FBTC – Fidelity Wise Origin Bitcoin Fund

• ARKB – ARK 21Shares Bitcoin ETF

Since these are physically backed, they seem simpler and more transparent than other options like futures or crypto company stocks.

I’d like to hear your thoughts:

• Are you using any of these spot Bitcoin ETFs?

• How has your experience been so far?

• Any risks or practical points I should be aware of, especially for investors based in Europe?

Thanks in advance for any insights you can share.