If US flirts with default, here's what I will do with my cash

Moderator: Global Moderator

If US flirts with default, here's what I will do with my cash

It's a given that if the entire Federal house burns down, both T-Bills and FDIC insured bank deposits are going to be unavailable for liquidation and use to buy the necessities of daily life. But that's in the extreme.

But let's back off a few steps from the extreme. I have heard (mostly on Reddit) in reply to someone asking about these things, "if the Federal government defaults on its obligations, you'll have worse things to worry about". No, that's catastrophizing. It's not helpful. I think there is another way to think about it.

I think if the government actually defaults on a given set of CUSIPs, and you directly hold those CUSIPs, the brokerage may (I'm guessing) execute a sale before maturity, but then you will wait for your cash. The same as if you held to maturity a CUSIP - you will wait for your cash. You wait until Congress re-liquifies the Treasury.

Now let's think about a Money Market Mutual Fund holding Treasuries or Governments (Fidelity SPAXX, Schwab SNSXX), or at ETF like BIL or SGOV. If there is a run on those funds, I do not believe they are stress-tested to survive a run, and they will gate or even stop redemptions. They hold a variety of CUSIPs, but if they can't redeem embargoed CUSIPs either, same as you, then they will run into the same problem... they will have to wait for the cash.

My plan is to sell my SPAXX and put it into FDIC insured bank sweep at Fidelity Cash Management, because at least the program banks there are explicitly stress-tested for liquidity. You can see the stress test results on a variety of bank rating website. Deposit Accounts grades the banks. Who knows about SPAXX, SNSXX, SGOV, BIL? Maybe they can handle a run, maybe not, its that bit of opacity around non-bank deposits that gives me pause, at least for my money for paying the bills.

But let's back off a few steps from the extreme. I have heard (mostly on Reddit) in reply to someone asking about these things, "if the Federal government defaults on its obligations, you'll have worse things to worry about". No, that's catastrophizing. It's not helpful. I think there is another way to think about it.

I think if the government actually defaults on a given set of CUSIPs, and you directly hold those CUSIPs, the brokerage may (I'm guessing) execute a sale before maturity, but then you will wait for your cash. The same as if you held to maturity a CUSIP - you will wait for your cash. You wait until Congress re-liquifies the Treasury.

Now let's think about a Money Market Mutual Fund holding Treasuries or Governments (Fidelity SPAXX, Schwab SNSXX), or at ETF like BIL or SGOV. If there is a run on those funds, I do not believe they are stress-tested to survive a run, and they will gate or even stop redemptions. They hold a variety of CUSIPs, but if they can't redeem embargoed CUSIPs either, same as you, then they will run into the same problem... they will have to wait for the cash.

My plan is to sell my SPAXX and put it into FDIC insured bank sweep at Fidelity Cash Management, because at least the program banks there are explicitly stress-tested for liquidity. You can see the stress test results on a variety of bank rating website. Deposit Accounts grades the banks. Who knows about SPAXX, SNSXX, SGOV, BIL? Maybe they can handle a run, maybe not, its that bit of opacity around non-bank deposits that gives me pause, at least for my money for paying the bills.

Re: If US flirts with default, here's what I will do with my cash

I asked someone about this who is highly experienced in the financial industry. Here is his response (in part). Excuse the spurious characters that my ancient Eudora email program throw in.ochotona wrote: ↑Wed Mar 05, 2025 9:59 am It's a given that if the entire Federal house burns down, both T-Bills and FDIC insured bank deposits are going to be unavailable for liquidation and use to buy the necessities of daily life. But that's in the extreme.

But let's back off a few steps from the extreme. I have heard (mostly on Reddit) in reply to someone asking about these things, "if the Federal government defaults on its obligations, you'll have worse things to worry about". No, that's catastrophizing. It's not helpful. I think there is another way to think about it.

I think if the government actually defaults on a given set of CUSIPs, and you directly hold those CUSIPs, the brokerage may (I'm guessing) execute a sale before maturity, but then you will wait for your cash. The same as if you held to maturity a CUSIP - you will wait for your cash. You wait until Congress re-liquifies the Treasury.

Now let's think about a Money Market Mutual Fund holding Treasuries or Governments (Fidelity SPAXX, Schwab SNSXX), or at ETF like BIL or SGOV. If there is a run on those funds, I do not believe they are stress-tested to survive a run, and they will gate or even stop redemptions. They hold a variety of CUSIPs, but if they can't redeem embargoed CUSIPs either, same as you, then they will run into the same problem... they will have to wait for the cash.

My plan is to sell my SPAXX and put it into FDIC insured bank sweep at Fidelity Cash Management, because at least the program banks there are explicitly stress-tested for liquidity. You can see the stress test results on a variety of bank rating website. Deposit Accounts grades the banks. Who knows about SPAXX, SNSXX, SGOV, BIL? Maybe they can handle a run, maybe not, its that bit of opacity around non-bank deposits that gives me pause, at least for my money for paying the bills.

"I dont agree at all with the suggested action, not even debatable.

Banks are highly leveraged companies and no matter how relatively “safe†and stress tested they may be, just remember it’s only relative to other banks. If FDIC is no longer functioning, a bank deposit becomes an extremely risky investment. I would keep only just enough to pay current bills in checking, spread across at least 2 banks, and no real savings.

If anything, today corporate bonds can be safer. Depends on the issuer, but for a low leverage highly rated issuer, these likely will pay during a gov shutdown. The market value will plummet due to market panic, but a well run corporation will continue to pay interest to bond holders, and eventually the price will recover if the crisis is averted. I think munis in the right state may pay interest in a similar manner. I trust NY and MA to do what is right regardless of federal gov. In the end it is true that when the Federal gov defaults nothing will function well.

And the comments claim you can sell a US treasury and eventually get the cash. That is ridiculous. When a broker sells, there is a buyer and they must pay by next day, period. Nothing to so with Federal Gov. The feds get involved only when interest is due or at maturity, this has nothing to do with trading at all."

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

Re: If US flirts with default, here's what I will do with my cash

I have often thought the same about highly rated corporates. I might look into A-rated very short term corporate bond ETFs. Haven't thought about Munis, good idea to investigate. Regarding the last point, of course your contact is right, I was conflating hold-to-matury and selling on the secondary market. Thanks for getting the perspective.yankees60 wrote: ↑Wed Mar 05, 2025 11:31 am If anything, today corporate bonds can be safer. Depends on the issuer, but for a low leverage highly rated issuer, these likely will pay during a gov shutdown.

I think munis in the right state may pay interest in a similar manner. I trust NY and MA to do what is right regardless of federal gov. In the end it is true that when the Federal gov defaults nothing will function well.

And the comments claim you can sell a US treasury and eventually get the cash. That is ridiculous. When a broker sells, there is a buyer and they must pay by next day, period. Nothing to so with Federal Gov. The feds get involved only when interest is due or at maturity, this has nothing to do with trading at all."

Re: If US flirts with default, here's what I will do with my cash

He followed up with:ochotona wrote: ↑Wed Mar 05, 2025 3:48 pmI have often thought the same about highly rated corporates. I might look into A-rated very short term corporate bond ETFs. Haven't thought about Munis, good idea to investigate. Regarding the last point, of course your contact is right, I was conflating hold-to-matury and selling on the secondary market. Thanks for getting the perspective.yankees60 wrote: ↑Wed Mar 05, 2025 11:31 am If anything, today corporate bonds can be safer. Depends on the issuer, but for a low leverage highly rated issuer, these likely will pay during a gov shutdown.

I think munis in the right state may pay interest in a similar manner. I trust NY and MA to do what is right regardless of federal gov. In the end it is true that when the Federal gov defaults nothing will function well.

And the comments claim you can sell a US treasury and eventually get the cash. That is ridiculous. When a broker sells, there is a buyer and they must pay by next day, period. Nothing to so with Federal Gov. The feds get involved only when interest is due or at maturity, this has nothing to do with trading at all."

"So as I say, without FDIC insurance to rely upon, banks are absolutely NOT safer places to keep your money. There was a reason FDIC was created, and that was due to mass bank failures during the 1930s. Happened again 50 years later, and then again 20 years later when Citi collapsed.

Your holdings in a brokerage are legally segregated from the brokerage itself. If the brokerage goes bankrupt, your holdings are not touched. But your bank deposits are NOT segregated from a bank's own assets, and when the bank fails it is ONLY the FDIC that will save you, nothing else. So the only discussion here should be which brokerage assets are likely to remain liquid and lose the least value. CDs are NOT that. Debatable what is best, but almost anything but CDs are better than an FDIC HYSA for your savings in such a federal crisis. "

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

Re: If US flirts with default, here's what I will do with my cash

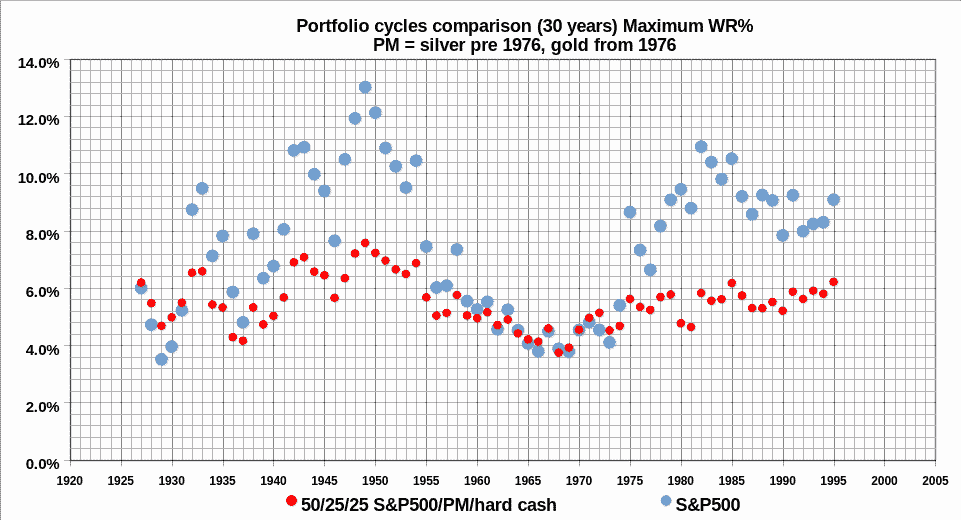

PP with the Treasury Bills/cash and Long dated Treasury's swapped out for hard cash (in hand Dollar Bills) and stocks, 50/25/25 stock/gold/hard-cashyankees60 wrote: ↑Wed Mar 05, 2025 6:33 pmHe followed up with:ochotona wrote: ↑Wed Mar 05, 2025 3:48 pmI have often thought the same about highly rated corporates. I might look into A-rated very short term corporate bond ETFs. Haven't thought about Munis, good idea to investigate. Regarding the last point, of course your contact is right, I was conflating hold-to-matury and selling on the secondary market. Thanks for getting the perspective.yankees60 wrote: ↑Wed Mar 05, 2025 11:31 am If anything, today corporate bonds can be safer. Depends on the issuer, but for a low leverage highly rated issuer, these likely will pay during a gov shutdown.

I think munis in the right state may pay interest in a similar manner. I trust NY and MA to do what is right regardless of federal gov. In the end it is true that when the Federal gov defaults nothing will function well.

And the comments claim you can sell a US treasury and eventually get the cash. That is ridiculous. When a broker sells, there is a buyer and they must pay by next day, period. Nothing to so with Federal Gov. The feds get involved only when interest is due or at maturity, this has nothing to do with trading at all."

"So as I say, without FDIC insurance to rely upon, banks are absolutely NOT safer places to keep your money. There was a reason FDIC was created, and that was due to mass bank failures during the 1930s. Happened again 50 years later, and then again 20 years later when Citi collapsed.

Your holdings in a brokerage are legally segregated from the brokerage itself. If the brokerage goes bankrupt, your holdings are not touched. But your bank deposits are NOT segregated from a bank's own assets, and when the bank fails it is ONLY the FDIC that will save you, nothing else. So the only discussion here should be which brokerage assets are likely to remain liquid and lose the least value. CDs are NOT that. Debatable what is best, but almost anything but CDs are better than an FDIC HYSA for your savings in such a federal crisis. "

Re: If US flirts with default, here's what I will do with my cash

I need to think outside the box. Maybe some non-US short-term sovereign bonds. I don't have ANY non-US fixed income. ISHG is the iShares 1-3 Year International Treasury Bond ETF. I really have enough gold. Yeah, I could go and get a few thousand more in paper currency.

Re: If US flirts with default, here's what I will do with my cash

Tomorrow I'm going to sell US Treasuries and go buy some developed market short term treasuries, munis. I'll keep the short-term corporates I have and will let the one jumbo CD I have roll off. Today was one of those "years happens in minutes" days for me. I had to let go of the assumption that the Federal government is going to be as reliably creditworthy as it has been in the past. That completely sucks, it puts risks on all of our heads... it matters not to billionaires, but it matters a lot to ordinary investors. It sets my teeth on edge.

Re: If US flirts with default, here's what I will do with my cash

Given that Trump is pretty much excusing Russian atrocities, intentional targeting of civilians, civilian infrastructure, dams, mass murders of women/children, chemical weapons (Putin has even deployed chemical weapons in the UK in the not so distant past) - international conventions are pretty much being thrown out - a independent biological/chemical weapons race start gun. Far easier to deploy (such as via a single vile) and as such more likely the preferred choice over nuclear weapons development along with ICBM type delivery mechanisms.

The US is the only country that's actually invoked the NATO agreement, yet when others are now asking for US backstop as per NATO agreement - the US is in effect saying no. Leaves all NATO members in a position of having to go down the path of independent deterrent developments (US now being considered as totally untrustworthy).

The increased global risks Trump is inducing makes the risk of a potential US default look almost trivial.

The US is the only country that's actually invoked the NATO agreement, yet when others are now asking for US backstop as per NATO agreement - the US is in effect saying no. Leaves all NATO members in a position of having to go down the path of independent deterrent developments (US now being considered as totally untrustworthy).

The increased global risks Trump is inducing makes the risk of a potential US default look almost trivial.

Re: If US flirts with default, here's what I will do with my cash

What do you say to all of that except "buy gold?" Ooops wrong Forum category

Re: If US flirts with default, here's what I will do with my cash

"The increased global risks Trump is inducing "seajay wrote: ↑Fri Mar 07, 2025 6:06 am Given that Trump is pretty much excusing Russian atrocities, intentional targeting of civilians, civilian infrastructure, dams, mass murders of women/children, chemical weapons (Putin has even deployed chemical weapons in the UK in the not so distant past) - international conventions are pretty much being thrown out - a independent biological/chemical weapons race start gun. Far easier to deploy (such as via a single vile) and as such more likely the preferred choice over nuclear weapons development along with ICBM type delivery mechanisms.

The US is the only country that's actually invoked the NATO agreement, yet when others are now asking for US backstop as per NATO agreement - the US is in effect saying no. Leaves all NATO members in a position of having to go down the path of independent deterrent developments (US now being considered as totally untrustworthy).

The increased global risks Trump is inducing makes the risk of a potential US default look almost trivial.

Frightening!

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

Re: If US flirts with default, here's what I will do with my cash

The US has thrown away the USD being the predominant international trade settlement currency (killed by sanctions). Trump is now throwing away the US being the head of NATO - relegated NATO in place of raised domestic developments. Recently the UK has raised its "biological security" spendingyankees60 wrote: ↑Fri Mar 07, 2025 10:28 am"The increased global risks Trump is inducing "seajay wrote: ↑Fri Mar 07, 2025 6:06 am Given that Trump is pretty much excusing Russian atrocities, intentional targeting of civilians, civilian infrastructure, dams, mass murders of women/children, chemical weapons (Putin has even deployed chemical weapons in the UK in the not so distant past) - international conventions are pretty much being thrown out - a independent biological/chemical weapons race start gun. Far easier to deploy (such as via a single vile) and as such more likely the preferred choice over nuclear weapons development along with ICBM type delivery mechanisms.

The US is the only country that's actually invoked the NATO agreement, yet when others are now asking for US backstop as per NATO agreement - the US is in effect saying no. Leaves all NATO members in a position of having to go down the path of independent deterrent developments (US now being considered as totally untrustworthy).

The increased global risks Trump is inducing makes the risk of a potential US default look almost trivial.

Frightening!

likely with that being reflected in many other countries. With proliferation and bad actors could for instance far more easily attack the US, UK, wherever, to devastating effect, via undetectable viles perhaps flown in (across borderlines) using drones for internal collection and deployment in major cities.Our mission: To implement a UK-wide approach to biosecurity which strengthens deterrence and resilience, projects global leadership

Our vision is that, by 2030, the UK is resilient to a spectrum of biological threats, and a world leader in responsible innovation

Trump has advanced the doomsday clock to seconds before midnight. What best to invest in in reflection of that - isn't gold (a one ounce gold coin might buy/barter for a bar of soap).

Re: If US flirts with default, here's what I will do with my cash

So my stockpile of bars of soap in my basement might garner me much gold??!!

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

Re: If US flirts with default, here's what I will do with my cash

All I have in that area is a BB rifle with some associated BB's that I bought around 1982!

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."