One way to align the dollar with gold is to ... buy or sell gold. There's 120+ times more paper gold than there is physical gold, and within that a big buyer (Treasury/Fed) could buy (or sell) 10x leveraged gold derivatives in order to 'direct' the price of gold ...closer into alignment with the dollar. Dollar down, sell (short) sizeable amounts of 10x gold and the price of gold is inclined to decline such that in terms of gold the dollar remained stable. Dollar up, buy 10x gold.

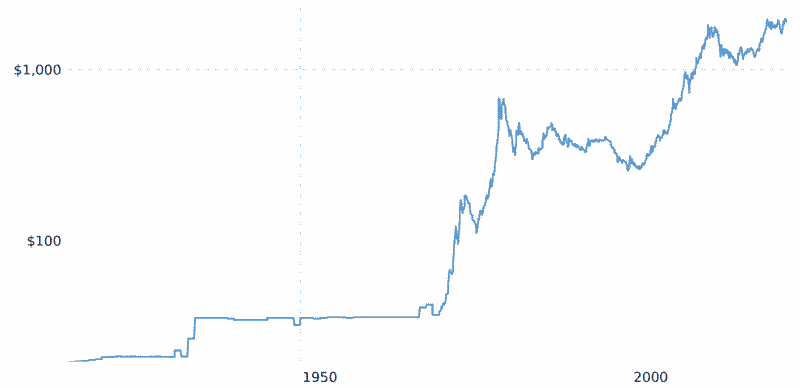

What would be inclined to arise out of such policy/controls would be for prolonged periods of the price of gold broadly being flat, and periodic spikes as circumstances depicted that the dollar be repegged to a higher price. Which is quite similar to what we actually see with gold price motions. Give or take interim noise across 'flat' periods (more a general art that a precise mathematical peg).

What that induces is the tendency for many to flock into gold after its spiked sharply up, but then become dissatisfied with the subsequent prolonged flat period and selling gold to buy other 'better' alternatives (stocks/bonds). Buy high, sell low practice. Gold is a long term asset, that could take decades to step-up, beyond individuals remaining lifetimes for some. But could step up in a year or two time, typically at a time of stress. A factor is that such stresses are inclined to occur more frequently with time. Increased leveraging (derivatives) and other factors induce higher probabilities of periodic distress.

The BRIC's looking for alternatives to the dollar for international trade settlement, when the dollar already somewhat pegs to gold anyway, bar periodic resets that naturally have to occur, are unlikely to find success. Part of the original agreement that got multiple countries adopting the dollar instead of gold for international trade settlements was that the US would peg the dollar to gold, that even today it still mostly does, but in a evolved manner that caters for the need to periodically reset things.

1930 step (Wall St Crash), 1970 step (high inflation/high cost of Vietnam war), 2000 step (dot com bubble), 2008 financial crisis continues the rise.

Doesn't look like a Covid 2020+ step has yet occurred, so the next step might be closer rather than distant. Perhaps within the next decade.