Of course, now that I am actually looking for her, she's nowhere to be seen. Damn!!

The GOLD scream room

Moderator: Global Moderator

Re: The GOLD scream room

I noticed something funny on the kitco.com site starting a couple of months ago that I wonder if others have been seeing. After checking the spot price, when I move my cursor up to the search bar to go elsewhere, a hot blond woman in a tight red dress frequently pops up. It's as if she's saying "C'mon big boy, stick around and buy something."

Of course, now that I am actually looking for her, she's nowhere to be seen. Damn!!

Of course, now that I am actually looking for her, she's nowhere to be seen. Damn!!

- Cortopassi

- Executive Member

- Posts: 3338

- Joined: Mon Feb 24, 2014 2:28 pm

- Location: https://www.jwst.nasa.gov/content/webbL ... sWebb.html

Re: The GOLD scream room

Hah. Just got it. https://i.imgur.com/148enBf.jpeg

Re: The GOLD scream room

Were you listening to me, Neo? Or were you looking at the woman in the red dress?

Re: The GOLD scream room

And before Michelle Makori, the previous editor-in-chief and lead anchor for Kitco was Daniela Cambone:

I'm sensing a pattern here...

I'm sensing a pattern here...

- mathjak107

- Executive Member

- Posts: 4742

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: The GOLD scream room

i will have to keep abreast of that interview (*)(*)

Re: The GOLD scream room

I was dismayed to learn she was married a while back.

www.allterrainportfolio.com

Re: The GOLD scream room

So when does gold catch a bid? Dow is down -321 right now, 10 year interest rates are down, US Dollar is down, why is gold also down?

- Cortopassi

- Executive Member

- Posts: 3338

- Joined: Mon Feb 24, 2014 2:28 pm

- Location: https://www.jwst.nasa.gov/content/webbL ... sWebb.html

Re: The GOLD scream room

You didn't go to the meeting? :-)

Of course the current excuse is gold is being sold to cover the margin calls of the other holdings or some such like that.

It will start rising when the crap is bad enough that rates start needing to be cut is my guess. Until then, it is a shiny, useless, aggravating, frustrating rock!

Re: The GOLD scream room

It's easier to align (somewhat peg) the US dollar to gold, by driving the price of gold towards the dollar. Gold has and continues to move in a general step/plateau manner, where the steps align with more extreme cases of social/economic conditions that require a 'revision' of the peg rate.Cortopassi wrote: ↑Tue Aug 08, 2023 12:04 pmYou didn't go to the meeting? :-)

Of course the current excuse is gold is being sold to cover the margin calls of the other holdings or some such like that.

It will start rising when the crap is bad enough that rates start needing to be cut is my guess. Until then, it is a shiny, useless, aggravating, frustrating rock!

Consider what it require for a state to align the price of gold to a chosen level/price in a world where there's 120 times more paper gold than physical gold? (Derivatives/leverage).

In nominal dollar terms the price of gold stepped up during the 1970's, 1980/1990 were a plateau, 2000's were a step (dot com bubble, financial crisis), 2010's were a plateau, excepting a relatively small 2020 step (Covid) as part of that.

A nice feature with that is if you blend stocks with gold then for the plateau periods you'll generally be selling some shares to add more ounces of gold as the price remains relatively level in nominal terms (declining in real term), and when a step does occur, economic/social conditions will tend to see the price of stocks decline, gold prices spiking. IIRC 1980 to 1999 50/50 stock/gold yearly rebalanced saw that ending 1999 with six times more ounces of gold being held than at the start of 1980. It's all about averaging in/out where gold shouldn't be looked at in isolation, but as a stock/gold (whatever) asset allocation that has a tendency for one or the other to be doing well/great in a manner that counterbalances and more the other.

Re: The GOLD scream room

Feb 1980 - Aug 2011... 31.5 years peak-to-peak. I sure hope the next peak isn't Feb 2043. I'll be almost 82. It's a nice feature if you're Methusalah. Gold right now to me seems too costly to buy, too cheap to sell. So here I sit.seajay wrote: ↑Tue Aug 08, 2023 1:16 pm In nominal dollar terms the price of gold stepped up during the 1970's, 1980/1990 were a plateau, 2000's were a step (dot com bubble, financial crisis), 2010's were a plateau, excepting a relatively small 2020 step (Covid) as part of that.

A nice feature with that is if you blend stocks with gold then for the plateau periods

Re: The GOLD scream room

ochotona wrote: ↑Tue Aug 08, 2023 2:12 pm

seajay wrote: ↑Tue Aug 08, 2023 1:16 pm

In nominal dollar terms the price of gold stepped up during the 1970's, 1980/1990 were a plateau, 2000's were a step (dot com bubble, financial crisis), 2010's were a plateau, excepting a relatively small 2020 step (Covid) as part of that.

A nice feature with that is if you blend stocks with gold then for the plateau periods

Feb 1980 - Aug 2011... 31.5 years peak-to-peak. I sure hope the next peak isn't Feb 2043. I'll be almost 82. It's a nice feature if you're Methusalah. Gold right now to me seems too costly to buy, too cheap to sell. So here I sit.

A prime example of The Endowment Effect?

https://www.psychologytoday.com/us/blog ... valuations

BIAS

How the Ownership of Something Increases Our Valuations

The psychological biases underlying why we hate to lose

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

Re: The GOLD scream room

Could be longer, could be shorter. A hedge/insurance for when it will be called upon. Stepped in the early 1930's, remained flat until the late 1960's.ochotona wrote: ↑Tue Aug 08, 2023 2:12 pmFeb 1980 - Aug 2011... 31.5 years peak-to-peak. I sure hope the next peak isn't Feb 2043. I'll be almost 82. It's a nice feature if you're Methusalah. Gold right now to me seems too costly to buy, too cheap to sell. So here I sit.seajay wrote: ↑Tue Aug 08, 2023 1:16 pm In nominal dollar terms the price of gold stepped up during the 1970's, 1980/1990 were a plateau, 2000's were a step (dot com bubble, financial crisis), 2010's were a plateau, excepting a relatively small 2020 step (Covid) as part of that.

A nice feature with that is if you blend stocks with gold then for the plateau periods

The intervals do seem to be shortening, more frequent uncertainties inducing where a reasonable peg-rate needs to be reset.

Whilst the price might change little for extended periods, a comfort is more ounces tending to be accumulated (typically by selling some shares to buy more gold).

Takes patience, a increasingly rare quality/character. If you're not in-it for the long term, as most investors in stocks should be, then perhaps best avoided. With the more recent gains, many that were attracted in at relative highs, will likely sell later - disappointed with gold having gone-nowhere or even declined, to chase the next in-vogue (buy-high).

For us its a chunk of value in off-radar, zero taxed, no counter-party risk, commodity currency (instead of fiat currency). Brokerage is like a crypto currency wallet, where the 'coin' within that is backed by stocks/gold - such that over time that 'coin' tends to buy more, increases its purchase power. Cash, domestic currency, is really only for short term holdings, something that is FX'd into from 'coins' in the wallet in order to actually 'barter' (trade) with.

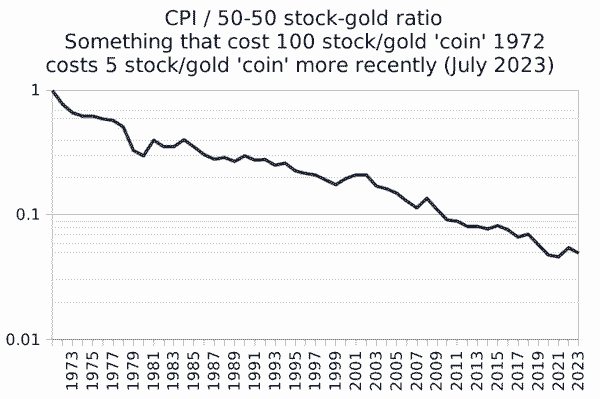

Across 51.5 years prices in stock/gold 'coin' got cheaper at a -5.65% annualized rate, in a reasonably consistent manner/trend.

I look forward to the day when you might see things priced and be able to pay directly in stock-gold 'coins'. Perhaps a ETF that holds/rebalances to 50/50 global stock/gold, where full/partial shares of that can be directly transferred from one account to another, perhaps by touching phones

Re: The GOLD scream room

Long term... I bought gold 2015-2018 at a good price, but I'm giving it until 2030, if no serious step above the past ATHs by then I'm out. Fifteen years is long enough. It will be time for digitization, simplification and streamlining for my heirs and future caregivers to take precedence. It doesn't matter if Dad is rich if no one can lay hands on the assets, and if they don't know how to trade them fairly for fiat in order to pay assisted living bills, for example. If we continue to have significant inflation and gold can't catch a bid, then it's broken. There seems to be every excuse given over the past decade as to why gold is going to shine the day after tomorrow, the conditions are met, and plop.

Re: The GOLD scream room

ochotona wrote: ↑Tue Aug 08, 2023 7:19 pm

Long term... I bought gold 2015-2018 at a good price, but I'm giving it until 2030, if no serious step above the past ATHs by then I'm out. Fifteen years is long enough. It will be time for digitization, simplification and streamlining for my heirs and future caregivers to take precedence. It doesn't matter if Dad is rich if no one can lay hands on the assets, and if they don't know how to trade them fairly for fiat in order to pay assisted living bills, for example. If we continue to have significant inflation and gold can't catch a bid, then it's broken. There seems to be every excuse given over the past decade as to why gold is going to shine the day after tomorrow, the conditions are met, and plop.

I bought my gold on February 21, 2023 at $396 per ounce. It looks like it went straight down after that and did not again achieve that price until about 9 years later. Then it took about four years for it to double in price. Then another four years to double again. In the last 12 or so years it's not gone up that much more since that second doubling.

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

- dualstow

- Executive Member

- Posts: 15683

- Joined: Wed Oct 27, 2010 10:18 am

- Location: searching for the lost Xanadu

- Contact:

Re: The GOLD scream room

Um… that does not add up. Either the year or the price is a typo

Whistling tunes / We hide in the dunes by the seaside

Whistling tunes / We're kissing baboons in the jungle

Whistling tunes / We're kissing baboons in the jungle

Re: The GOLD scream room

yankees60 wrote: ↑Tue Aug 08, 2023 8:09 pm

ochotona wrote: ↑Tue Aug 08, 2023 7:19 pm

Long term... I bought gold 2015-2018 at a good price, but I'm giving it until 2030, if no serious step above the past ATHs by then I'm out. Fifteen years is long enough. It will be time for digitization, simplification and streamlining for my heirs and future caregivers to take precedence. It doesn't matter if Dad is rich if no one can lay hands on the assets, and if they don't know how to trade them fairly for fiat in order to pay assisted living bills, for example. If we continue to have significant inflation and gold can't catch a bid, then it's broken. There seems to be every excuse given over the past decade as to why gold is going to shine the day after tomorrow, the conditions are met, and plop.

I bought my gold on February 21, 1995 at $396 per ounce. It looks like it went straight down after that and did not again achieve that price until about 9 years later. Then it took about four years for it to double in price. Then another four years to double again. In the last 12 or so years it's not gone up that much more since that second doubling.

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

Re: The GOLD scream room

Eagle-eye Dualstow is, of course, correct! 1995, not 2023.

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

Re: The GOLD scream room

50/50 stock/gold yearly rebalanced for each of 2015 through 2018 start years has yielded annualized real rates of return of respectively 5.4%, 7%, 6.8%, 5.5% to the end of July 2023. In most peoples books that's a reasonable rate of return.ochotona wrote: ↑Tue Aug 08, 2023 7:19 pm Long term... I bought gold 2015-2018 at a good price, but I'm giving it until 2030, if no serious step above the past ATHs by then I'm out. Fifteen years is long enough. It will be time for digitization, simplification and streamlining for my heirs and future caregivers to take precedence. It doesn't matter if Dad is rich if no one can lay hands on the assets, and if they don't know how to trade them fairly for fiat in order to pay assisted living bills, for example. If we continue to have significant inflation and gold can't catch a bid, then it's broken. There seems to be every excuse given over the past decade as to why gold is going to shine the day after tomorrow, the conditions are met, and plop.

- dualstow

- Executive Member

- Posts: 15683

- Joined: Wed Oct 27, 2010 10:18 am

- Location: searching for the lost Xanadu

- Contact:

Re: The GOLD scream room

It’s funny, I’ve always thought you didn’t have any gold. I think that’s because you always say one of these days you’re going to implement the permanent portfolio. I guess I thought you just had stocks & bonds.1995, not 2023.

Whistling tunes / We hide in the dunes by the seaside

Whistling tunes / We're kissing baboons in the jungle

Whistling tunes / We're kissing baboons in the jungle

Re: The GOLD scream room

Your perceptions are almost entirely correct. For $2,041.58 on that day ... this is what I purchased:

3-oz AE@395.92,2-oz ML@395.92, 1-1/10 oz AE@41.98,$20 Shipping

Aside from that all I have is one gold stock, Vanguard's equity mutual funds, Vanguard's short-term bond fund, Vanguard's Real Estate fund, Vanguard's Treasury Money Market fund (VUSXX). That is it.

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

- dualstow

- Executive Member

- Posts: 15683

- Joined: Wed Oct 27, 2010 10:18 am

- Location: searching for the lost Xanadu

- Contact:

Re: The GOLD scream room

Ah ok. And it wasn’t a PP buy at the time, right. It was just, “I think I’ll buy some gold” — ?

Whistling tunes / We hide in the dunes by the seaside

Whistling tunes / We're kissing baboons in the jungle

Whistling tunes / We're kissing baboons in the jungle

Re: The GOLD scream room

Close. It was from a newsletter I was following that advised it being a good time to buy then. I wondered for the next 9 years as during that time it was always below what I'd paid for it!

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

Re: The GOLD scream room

If you're near retirement/drawdown, a reasonable gold exit strategy IMO is to spend gold first. 1M portfolio, initially split 50/50 world stock accumulation fund and gold, left to run as-is other than drawing say a 3% SWR (6% SWR from the gold holdings) ... until all spent, leaving the initial stock half to accumulate/grow. If gold does well in the earlier year and sustains more years before all being spent, stocks may have struggled, but given the extra time/years still have done OK. If gold is all-spent quicker, then stocks likely will have done very well in compensation.ochotona wrote: ↑Tue Aug 08, 2023 7:19 pm Long term... I bought gold 2015-2018 at a good price, but I'm giving it until 2030, if no serious step above the past ATHs by then I'm out. Fifteen years is long enough. It will be time for digitization, simplification and streamlining for my heirs and future caregivers to take precedence. It doesn't matter if Dad is rich if no one can lay hands on the assets, and if they don't know how to trade them fairly for fiat in order to pay assisted living bills, for example. If we continue to have significant inflation and gold can't catch a bid, then it's broken. There seems to be every excuse given over the past decade as to why gold is going to shine the day after tomorrow, the conditions are met, and plop.

If you educate heirs in how to periodically take gold coin(s) to a local dealer or wherever as a means to convert to hard cash, they'll soon become proficient in doing that by themselves. Primarily they should be looking to exchange each ounce at around the spot gold price at the time, which is easily referenced. Another factor there is that at the point of spending the last gold coin you've transitioned from 50/50 initial stock/gold to 100/0, time averaged 75/25 stock/gold - which tends to yield satisfactory rewards, whilst also leaving a portfolio more appropriate for younger heirs (stock heavy, where in having averaged-in, any fall backs tend to be more a case of giving back some of gains rather that eating into ones own base capital value).

1972 start year (gold low with hindsight), and 6% SWR applied to that saw gold last to 2017, by which time stock accumulation had grown 500K to 8M real. 1980 start year (gold high) and 6% SWR lasted to mid 1989, by which time 500K in stock had accumulated to over 1.1M real.

Here's a PV example of a 2000 start date (gold low) and where 500K of gold is still around 500K of real gold value in 2023 after 6% SWR. 500K of stock left to accumulate having grown to 1.37M real over those years. For a 2012 start date, perhaps with hindsight a gold high, 500K of gold 6% SWR lasted to 2022 before being all-spent, whilst 500K of initial stock grew/accumulated to 1.37M real to the end of 2022.

Those examples are the more extreme cases, more generally the average case will fall somewhere between gold not lasting long/stocks doing very well and gold lasting long/stocks being mediocre but having had more time to grow in real terms.

Heirs inheriting a single world stock accumulation fund, along with gold coins and having prior experiencing of cashing coin(s) in, is a relatively simple portfolio to inherit IMO. You de-risked early years bad sequence of returns risk for yourself, whilst tending to leave a stock heavy portfolio appropriate for younger heirs to inherit. Or if you pass early then heirs will have the idea of periodically cashing in some gold to perhaps reinvest the proceeds into stocks to progressively build up a stock heavy portfolio that was time-averaged into.

Re: The GOLD scream room

Looks like they're talking about gold again over at the Knuckleheads forum.

www.allterrainportfolio.com

- dualstow

- Executive Member

- Posts: 15683

- Joined: Wed Oct 27, 2010 10:18 am

- Location: searching for the lost Xanadu

- Contact:

Re: The GOLD scream room

Whistling tunes / We hide in the dunes by the seaside

Whistling tunes / We're kissing baboons in the jungle

Whistling tunes / We're kissing baboons in the jungle