Good piece on cash by Cullen Roche

Moderator: Global Moderator

Good piece on cash by Cullen Roche

Here's a new post by a guy well worth following, IMHO:

https://disciplinefunds.com/2023/04/26/ ... lunch-end/

Brokerages certainly count on their customers being oblivious about cash but of course PP'ers tend not to be. But outside of our little echo chamber I'm amazed to see how many friends keep big chunks of money in non-Treasury MM accounts without realizing that they're taking on unnecessary risk while also paying state and local taxes on their "high" yield accounts.

The only thing Roche doesn't address here is the possibility of a default in the next few months due to the debt ceiling circular firing squad antics in Congress. Because of that I'm going to wait to pull the trigger on locking in some high yields with a T Bill ladder until after the clown car has left town - which may not be until this fall.

https://disciplinefunds.com/2023/04/26/ ... lunch-end/

Brokerages certainly count on their customers being oblivious about cash but of course PP'ers tend not to be. But outside of our little echo chamber I'm amazed to see how many friends keep big chunks of money in non-Treasury MM accounts without realizing that they're taking on unnecessary risk while also paying state and local taxes on their "high" yield accounts.

The only thing Roche doesn't address here is the possibility of a default in the next few months due to the debt ceiling circular firing squad antics in Congress. Because of that I'm going to wait to pull the trigger on locking in some high yields with a T Bill ladder until after the clown car has left town - which may not be until this fall.

Re: Good piece on cash by Cullen Roche

Out of curiosity, where do you plan to park your cash before you put it in a T-bill ladder? You mentioned Treasury MMFs, but those would also be affected by a default on US Treasuries.Kevin K. wrote: ↑Thu Apr 27, 2023 9:25 am The only thing Roche doesn't address here is the possibility of a default in the next few months due to the debt ceiling circular firing squad antics in Congress. Because of that I'm going to wait to pull the trigger on locking in some high yields with a T Bill ladder until after the clown car has left town - which may not be until this fall.

Re: Good piece on cash by Cullen Roche

What is the highest probability anyone here would assign to a U.S. Treasuries default?

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

Re: Good piece on cash by Cullen Roche

Hi Tortoise,Tortoise wrote: ↑Thu Apr 27, 2023 11:59 amOut of curiosity, where do you plan to park your cash before you put it in a T-bill ladder? You mentioned Treasury MMFs, but those would also be affected by a default on US Treasuries.Kevin K. wrote: ↑Thu Apr 27, 2023 9:25 am The only thing Roche doesn't address here is the possibility of a default in the next few months due to the debt ceiling circular firing squad antics in Congress. Because of that I'm going to wait to pull the trigger on locking in some high yields with a T Bill ladder until after the clown car has left town - which may not be until this fall.

The reason I'm using a money market fund is that the duration is so short (13.8 days right now for Schwab's SNSXX for example). I'm expecting lots of volatility before this soap opera ends and of course will just live with it for my ITT's (I don't own any LTT's) but see no reason to go out further on the maturity curve (e.g. my normal 13 and 26 week T bills set on auto-roll) right now. I need cash for living expenses and want dry powder in case there are some buying opportunities as this unfolds.

Re: Good piece on cash by Cullen Roche

I keep wondering if the clown car keeps driving around for a few months if there might be some medium-term rates (say maybe 3-5 years) that might be worth locking in. So maybe embrace the clown show.Kevin K. wrote: ↑Thu Apr 27, 2023 9:25 am The only thing Roche doesn't address here is the possibility of a default in the next few months due to the debt ceiling circular firing squad antics in Congress. Because of that I'm going to wait to pull the trigger on locking in some high yields with a T Bill ladder until after the clown car has left town - which may not be until this fall.

But then I keep coming back to the obvious possibility (fact?) that the debt ceiling is going to be a constant political weapon going forward... which would seemingly mean that the US just increases its borrowing costs forever as it becomes an ever less sure place of holding cash. "Backed by the intermittent faith and credit of the US."

Certainly an interesting time for anyone who holds US Treasuries which is certainly not just this small PP-inspired group.

As to Vinny's question about the odds of a default, the market for Treasuries seems to indicate at the moment that it's not a high-probability event. At least not so far. Xan, would you mind expanding on your thoughts that the chances are virtually zero that holders of Treasury debt will experience any impact?

Re: Good piece on cash by Cullen Roche

If the US defaults on its Treasury debt, I think you can comfortably assume that the stock market will drop precipitously. Presumably, interest rates will also rise and more banks will fail. So that means that the following asset classes will all be devastated: stocks, bonds, and cash.

That leaves gold, which you hopefully hold as a PP adherent and which will undoubtedly go shooting up in this scenario.

So can I assume then, that instead of buying Treasury bills you plan to plow all your cash savings into gold?

I suggest buying the T bills AND gold, sticking with your investment plan, and let the chips fall where they may. I would guess that the US Treasury will go to great lengths to avoid a default for all the above reasons, so you really can't predict what's going to happen.

That leaves gold, which you hopefully hold as a PP adherent and which will undoubtedly go shooting up in this scenario.

So can I assume then, that instead of buying Treasury bills you plan to plow all your cash savings into gold?

I suggest buying the T bills AND gold, sticking with your investment plan, and let the chips fall where they may. I would guess that the US Treasury will go to great lengths to avoid a default for all the above reasons, so you really can't predict what's going to happen.

- mathjak107

- Executive Member

- Posts: 4763

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Good piece on cash by Cullen Roche

even a treasury mmf that is involved in repos can get caught up in a bank crisis .

i only use ones that do no repos

i only use ones that do no repos

-

boglerdude

- Executive Member

- Posts: 1571

- Joined: Wed Aug 10, 2016 1:40 am

- Contact:

Re: Good piece on cash by Cullen Roche

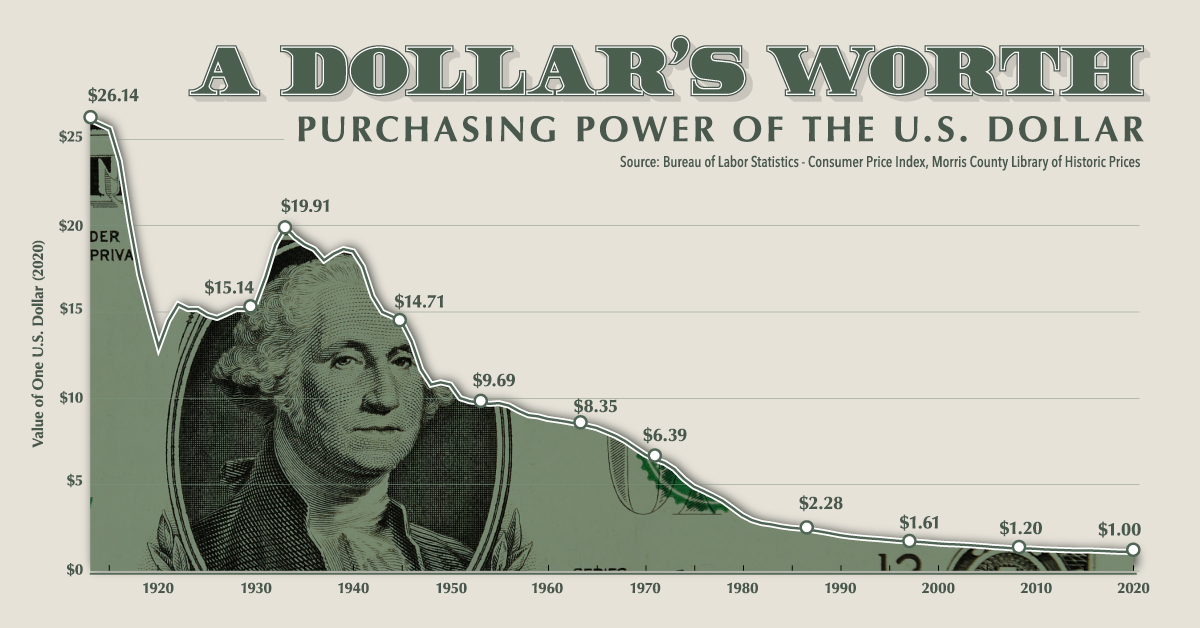

We default through inflation and did so in 2020

Re: Good piece on cash by Cullen Roche

and/or taxation. Really inflation is just another form of taxation. When one can print/spend money that devalues all other notes in circulation, is as though holders of all the other notes paid a bit of tax on those notes (micro-taxation, that under large magnitudes can amount to more meaningful amounts of taxation).

All fiat currencies default, indeed even gold standards periodically default. The main difference is the frequency and scale. Under gold standard its more a case of less frequent larger amounts, under fiat the progression is more progressive/smaller amounts, but that at times can become distorted requiring a larger/more-rapid adjustment.

Wont lead to a total failure, as its fractal. Present day dollar might buy 100 times more now than what a dollar might buy in a century/whatever time. As might a dollar in a century time buy 100 times more than what a 200 year from now dollar might buy, ad infinitum.

- mathjak107

- Executive Member

- Posts: 4763

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: Good piece on cash by Cullen Roche

if we could plot our income over the decades i bet many of us are ahead. i know i was ..

we grow our income not by doing the same job function but by advancing ….so many of us stayed way ahead over decades of time

we grow our income not by doing the same job function but by advancing ….so many of us stayed way ahead over decades of time

-

boglerdude

- Executive Member

- Posts: 1571

- Joined: Wed Aug 10, 2016 1:40 am

- Contact:

Re: Good piece on cash by Cullen Roche

One problem with hard/deflationary currency is you get a burger flipper making $50/hour after a few years. Wages (and mortgages) cant adjust down to meet reality. Economic realities are "mean" according to the communists