Permanent Broker

Moderator: Global Moderator

Permanent Broker

I want to set up a stock account for my kids where we auto purchase and manually purchase mostly stocks mostly VTI and reinvest dividends.

I want this to be broker that they can use forever. I’m looking for things like ease of use, customer support, on-site locations, etc, etc…

Currently I am thinking Vanguard or Fidelity although I don’t have any experience with them for my taxable accounts. And my experience with Fidelity is that the site is not the best.

Would love to hear everyone’s suggestions.

I want this to be broker that they can use forever. I’m looking for things like ease of use, customer support, on-site locations, etc, etc…

Currently I am thinking Vanguard or Fidelity although I don’t have any experience with them for my taxable accounts. And my experience with Fidelity is that the site is not the best.

Would love to hear everyone’s suggestions.

Re: Permanent Broker

I vouch for Fidelity with both hands. They offer tons of stuff including cash management account (it's a brokerage account with FDIC-insured core scattered over multiple banks and it includes debit card), HSA account where you can buy anything, good cash back credit card, excellent US-based customer service, lots of research tools, great lineup of zero-ER index funds.

There are topics about Fidelity on Bogleheads, so I won't write a long post here. Let me know if you have any specific questions.

There are topics about Fidelity on Bogleheads, so I won't write a long post here. Let me know if you have any specific questions.

"Let every man divide his money into three parts, and invest a third in land, a third in business, and a third let him keep in reserve."

- Talmud

- Talmud

Re: Permanent Broker

Is it easy to see purchase history IE price paid date of purchase and current price. And are you able to sell specific shares?

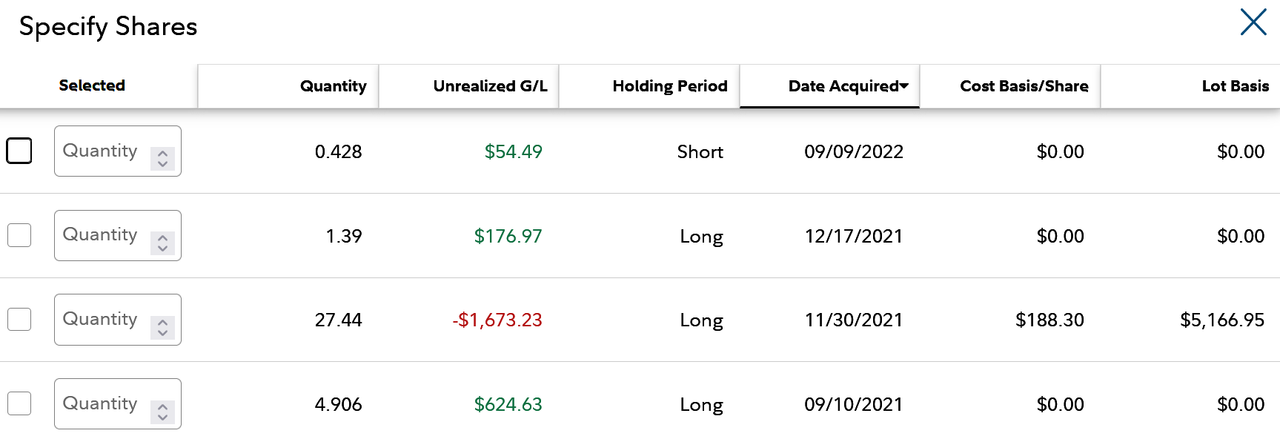

The reason I ask this is - say they have been buying VTI for 25 30 years and each purchase starts a dividend reinvestment machine of its own. This will become a monster to manage at a few million dollars if it’s not a very solid interface.

I am imaging the drop down menu when they click on VTI to be thousands of entries when they are ready to retire.

The reason I ask this is - say they have been buying VTI for 25 30 years and each purchase starts a dividend reinvestment machine of its own. This will become a monster to manage at a few million dollars if it’s not a very solid interface.

I am imaging the drop down menu when they click on VTI to be thousands of entries when they are ready to retire.

Re: Permanent Broker

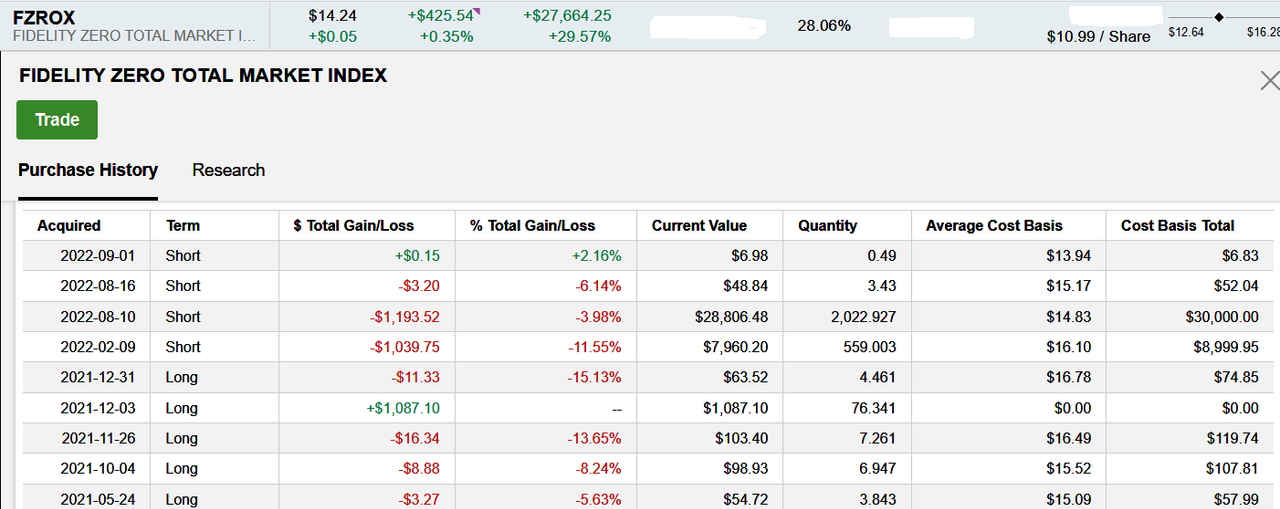

Yes, you click on the ticker in the list of positions in the account and it will open the purchase history with dates, cost basis, current value etc.

And yes, you can sell specific shares.

"Let every man divide his money into three parts, and invest a third in land, a third in business, and a third let him keep in reserve."

- Talmud

- Talmud

- dualstow

- Executive Member

- Posts: 15719

- Joined: Wed Oct 27, 2010 10:18 am

- Location: searching for the lost Xanadu

- Contact:

Re: Permanent Broker

What did you dislike about it?

I was born into using Vanguard, and for about ten years it was a good online experience.

However, whenever they ask for feedback I urge them to make their site more like Fidelity’s. This is going back several years now.

Whistling tunes / We hide in the dunes by the seaside

Whistling tunes / We're kissing baboons in the jungle

Whistling tunes / We're kissing baboons in the jungle

Re: Permanent Broker

I use both (Vanguard for IRA's, Fidelity for taxable and HSA's). Both are fine. I think I slightly prefer the additional info on Fidelity, but nothing that would tempt me to go through the hassle of moving my vanguard accounts to Fido.

Plus I wouldn't feel particularly great if all of my investments were brokered in one institution.

HOWEVER - I'm not a power user. I go in, buy stuff, get out. Pay whatever taxes the brokerages say I should pay at the end of the year.

Plus I wouldn't feel particularly great if all of my investments were brokered in one institution.

HOWEVER - I'm not a power user. I go in, buy stuff, get out. Pay whatever taxes the brokerages say I should pay at the end of the year.

1/n weirdo. US-TSM, US-SCV, Intl-SCV, LTT, STT, GLD (+ a little in MF)

Re: Permanent Broker

Vanguard is currently soliciting me to participate in a survey. I think I have to let them know by midnight tonight.

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

Re: Permanent Broker

I've been with Fidelity for at least 25 years and they've been great overall. My ONLY issue with them in that time is that they will not "host" a Solo 401(k) Roth account. Wife and I are both self-employed and had to go to another firm (we choose TDA) to open those a while back.

I'm also interested to know what you don't like about the Fido website as I think it's great. Customer service over the years has been terrific... quick to answer the phone, friendly, and knowledgeable about a lot of things. Had to move the aforementioned Solo 401(k) Roth account to Etrade from TDA recently and I had call waits over an hour while sorting out that transfer.

Have seen some on Bogleheads bemoan a decline in customer service with Vanguard but have no personal experience with them.

I'm also interested to know what you don't like about the Fido website as I think it's great. Customer service over the years has been terrific... quick to answer the phone, friendly, and knowledgeable about a lot of things. Had to move the aforementioned Solo 401(k) Roth account to Etrade from TDA recently and I had call waits over an hour while sorting out that transfer.

Have seen some on Bogleheads bemoan a decline in customer service with Vanguard but have no personal experience with them.

Re: Permanent Broker

barrett wrote: ↑Mon Jan 30, 2023 3:42 am

I've been with Fidelity for at least 25 years and they've been great overall. My ONLY issue with them in that time is that they will not "host" a Solo 401(k) Roth account. Wife and I are both self-employed and had to go to another firm (we choose TDA) to open those a while back.

I'm also interested to know what you don't like about the Fido website as I think it's great. Customer service over the years has been terrific... quick to answer the phone, friendly, and knowledgeable about a lot of things. Had to move the aforementioned Solo 401(k) Roth account to Etrade from TDA recently and I had call waits over an hour while sorting out that transfer.

Have seen some on Bogleheads bemoan a decline in customer service with Vanguard but have no personal experience with them.

I have a Solo 401(k) Roth account at Vanguard. However, what I recently found out was that a Solo 401(k) Roth account IS subject to the Required Minimum Distributions. That led me to transferring it to a Rollover Roth IRA account.

Vanguard's customer service has definitely declined over the last few years.

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

Re: Permanent Broker

That's unsurprising given what I've heard over the past year, but a disappointing since they were great fifteen years ago when I was first getting into investing and trying to set thing sup.

1/n weirdo. US-TSM, US-SCV, Intl-SCV, LTT, STT, GLD (+ a little in MF)

- dualstow

- Executive Member

- Posts: 15719

- Joined: Wed Oct 27, 2010 10:18 am

- Location: searching for the lost Xanadu

- Contact:

Re: Permanent Broker

When you posted this I was thinking who cares, but I just realized I missed my chance to take the survey. Boo.

Whistling tunes / We hide in the dunes by the seaside

Whistling tunes / We're kissing baboons in the jungle

Whistling tunes / We're kissing baboons in the jungle

Re: Permanent Broker

I just felt like the site was a little clunky and busy compared to other brokers like Schwab and etrade. But the customer service is excellent. I’m think Fido may be the winner and they have a lot of physical locations.

Re: Permanent Broker

For a lot of my emails if I'm interested in them but they will take any time to look at ... I'll put them aside for looking at later.

In the case of this one I did see "it would take 15 minutes" but, for some reason, I thought it was a live one for which I had to make an appointment. Two barriers to taking it.

Today when I finally got to the email (two days late) I saw that it was strictly an online survey, which I would have done if I had known that. They needed to have allowed more time between the invitation and the deadline.

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

- dualstow

- Executive Member

- Posts: 15719

- Joined: Wed Oct 27, 2010 10:18 am

- Location: searching for the lost Xanadu

- Contact:

Re: Permanent Broker

Agree. It’s just one more shitty thing about Vanguard.

Btw, I would have done it immediately, but a lot of things don’t work on the ipad so it’s best to wait for the desktop. I was on an ipad and, well, I had a cat on my lap.

Btw, I would have done it immediately, but a lot of things don’t work on the ipad so it’s best to wait for the desktop. I was on an ipad and, well, I had a cat on my lap.

Whistling tunes / We hide in the dunes by the seaside

Whistling tunes / We're kissing baboons in the jungle

Whistling tunes / We're kissing baboons in the jungle

Re: Permanent Broker

I'll raise you right now having two rats on my lap! (But no cats in sight!)

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

Re: Permanent Broker

Found one issue with the broker I chose, Fidelity charges $75 per VTSAX purchase. So...no automated purchases are going to happen. That could be a serious problem if I want to set VTSAX and forget it for the kids. I would be happy for an auto VTI purchase (would prefer that) but there is no option for ETF auto purchase. At least I believe there is no option. If anyone one on this threads knows differently, let me know.

I would select a Fidelity Total Equity fund but I would prefer VTI (automated) or VTSAX because I hear they have a unique structure that does not create capital gains on their trades.

I would select a Fidelity Total Equity fund but I would prefer VTI (automated) or VTSAX because I hear they have a unique structure that does not create capital gains on their trades.

Re: Permanent Broker

True enough as far as it goes....but their patent on this structure expires in mid-May of 2023....which happens to be in about <checks calendar> ten days from now.ppnewbie wrote: ↑Tue May 02, 2023 3:12 pm Found one issue with the broker I chose, Fidelity charges $75 per VTSAX purchase. So...no automated purchases are going to happen. That could be a serious problem if I want to set VTSAX and forget it for the kids. I would be happy for an auto VTI purchase (would prefer that) but there is no option for ETF auto purchase. At least I believe there is no option. If anyone one on this threads knows differently, let me know.

I would select a Fidelity Total Equity fund but I would prefer VTI (automated) or VTSAX because I hear they have a unique structure that does not create capital gains on their trades.

Give it maybe six to twelve months after that and hopefully any fund company that offers both ETF/MF share classes of the same underlying fund will be able to provide similar features (at least in their ETFs, anyway).

Re: Permanent Broker

Was just reading about that in the Bogleheads forum. Although it was speculation on the thread, someone mentioned that the believed new funds attempting to use this method would have a very slow approval process and the dual share class tax advantage may eventually be taken away (again speculation). Anyway that is a very interesting thought though, that Fido may offer the same thing soon, which would be great.D1984 wrote: ↑Tue May 02, 2023 4:25 pmTrue enough as far as it goes....but their patent on this structure expires in mid-May of 2023....which happens to be in about <checks calendar> ten days from now.ppnewbie wrote: ↑Tue May 02, 2023 3:12 pm Found one issue with the broker I chose, Fidelity charges $75 per VTSAX purchase. So...no automated purchases are going to happen. That could be a serious problem if I want to set VTSAX and forget it for the kids. I would be happy for an auto VTI purchase (would prefer that) but there is no option for ETF auto purchase. At least I believe there is no option. If anyone one on this threads knows differently, let me know.

I would select a Fidelity Total Equity fund but I would prefer VTI (automated) or VTSAX because I hear they have a unique structure that does not create capital gains on their trades.

Give it maybe six to twelve months after that and hopefully any fund company that offers both ETF/MF share classes of the same underlying fund will be able to provide similar features (at least in their ETFs, anyway).

This has some information on the tax differences of VTSAX vs FSKAX

https://www.whitecoatinvestor.com/vtsax-vs-vti/

-

Jack Jones

- Executive Member

- Posts: 748

- Joined: Mon Aug 24, 2015 3:12 pm

Re: Permanent Broker

Index funds are so abstract. I would do this w/ low-risk, household name, securities that pay dividends, e.g. UPS.

Low-risk: you want them to see their investment going up, even if it's slowly.

Household name: When the UPS truck pulls into the driveway, it's becomes a meaningful experience. They are part owners of this enterprise. The company does something they understand: delivers packages.

Dividends: Income is more familiar (similar to allowance) and more enjoyable than capital gains.

- dualstow

- Executive Member

- Posts: 15719

- Joined: Wed Oct 27, 2010 10:18 am

- Location: searching for the lost Xanadu

- Contact:

Re: Permanent Broker

I can’t believe you’re steering someone away from index funds, Jack.

Well, he did say “mostly.” Room for both.

Well, he did say “mostly.” Room for both.

Whistling tunes / We hide in the dunes by the seaside

Whistling tunes / We're kissing baboons in the jungle

Whistling tunes / We're kissing baboons in the jungle

Re: Permanent Broker

It's funny I was thinking the same thing about Jack's post. Individual stocks are NOT what I am trying to achieve with a one time set it and forget it approach for a foundation of their investing lives. But i am happy to take any and all input. After further thought and some confirmation I think Fidelity is the best place for their "permanent broker" even if VTSAX is problematic. I am going to go with VTI plus FSKAX if I do automated invested. Hopefully, an ETF / Mutual fund tax advantaged dual share class will emerge for Fidelity's fund in the future but its OK if it does not.

Also, happy to have Gold, LTTs,Cash,SCV in their tool box further down the road for them.

@Jack - BTW good point about Index funds being abstract and you have prompted me to show my kids the break down of the fund components so they can understand the underlying components and why it makes sense to invest in market beta returns.