That is what I assumed. No recourse for an unfortunate discovery.

The GOLD scream room

Moderator: Global Moderator

Re: The GOLD scream room

That is what I assumed. No recourse for an unfortunate discovery.

Above provided by: Vinny, who always says: "I only regret that I have but one lap to give to my cats." AND "I'm a more-is-more person."

- dualstow

- Executive Member

- Posts: 15757

- Joined: Wed Oct 27, 2010 10:18 am

- Location: foot of Mt Belzoni

- Contact:

Re: The GOLD scream room

I mean if it was something I'd bought recently, I'd alert the vendor. But, nowadays if I buy at all I buy new and I buy from Apmex.

.

-

welderwannabe

- Executive Member

- Posts: 158

- Joined: Sat Jul 20, 2019 12:53 pm

Re: The GOLD scream room

Seajay, Sigma Metalytics has their PMV original model which is < $1K. Is it not as effective as the "PRO" modem for $2K?

Re: The GOLD scream room

Thanks. There's three Sigma versions that I know of, that original model that you mention, that has just a single sensor, so can't test as deeply as the PRO version that has two sensors. There's another mini version that is much the same as the PRO, but uses wifi and your phone/tablet for the control, rather than having the control integral as in the PRO. Ballpark $1K, $1.5K, $2K respective pricing, but as you say can be less than that. You can also get additions such as a separate larger base/test units and 'wands', that you pretty much have to buy at the time of buying the main unit IIRC, for whatever reasons are not available as add-later options.welderwannabe wrote: ↑Fri Dec 30, 2022 1:43 pmSeajay, Sigma Metalytics has their PMV original model which is < $1K. Is it not as effective as the "PRO" modem for $2K?

If you're just into one ounce coins alone then the base units are OK as-is, the wands and other kit is more for bars or smaller sized bars/coins. I believe that the units cannot test gold jewellery.

https://www.sigmametalytics.com/

I've personally only heard of one instance when the Original missed a fake that the PRO picked up, but I don't get around that circle much. I deal with just two trusted outfits, one just a short 30 minute hop away from whom I buy from (Tavex) in person (and use their test kit), the other (Chards) a 500 mile round trip that I tend to sell to (via courier). Typically buy at around spot+4%, sell at spot+0.5%. Both in the UK (London and Blackpool respectively). Accordingly I've not had the need to buy any testers.

-

welderwannabe

- Executive Member

- Posts: 158

- Joined: Sat Jul 20, 2019 12:53 pm

Re: The GOLD scream room

Thanks. Considering a single gold eagle is going for the price of the pro, seems like it may be cheap insurance.seajay wrote: ↑Fri Dec 30, 2022 10:25 pm I've personally only heard of one instance when the Original missed a fake that the PRO picked up, but I don't get around that circle much. I deal with just two trusted outfits, one just a short 30 minute hop away from whom I buy from (Tavex) in person (and use their test kit), the other (Chards) a 500 mile round trip that I tend to sell to (via courier). Typically buy at around spot+4%, sell at spot+0.5%. Both in the UK (London and Blackpool respectively). Accordingly I've not had the need to buy any testers.

- Mark Leavy

- Executive Member

- Posts: 1950

- Joined: Thu Mar 01, 2012 10:20 pm

- Location: US Citizen, Permanent Traveler

Re: The GOLD scream room

Or, you could only do business with trustworthy people.welderwannabe wrote: ↑Sun Jan 01, 2023 8:00 pm Thanks. Considering a single gold eagle is going for the price of the pro, seems like it may be cheap insurance.

Re: The GOLD scream room

That explosive gold discussion on the Knuckleheads forum finally got shut down.

www.ironwealth.org

- Kriegsspiel

- Executive Member

- Posts: 4052

- Joined: Sun Sep 16, 2012 5:28 pm

Re: The GOLD scream room

The action in that thread seems to have quieted down quite a bit.

Too bad. I was having fun munching on popcorn and watching.

Too bad. I was having fun munching on popcorn and watching.

www.ironwealth.org

Re: The GOLD scream room

To borrow the phrasing of dualstow: let 2023 be the year of GOLD.

www.ironwealth.org

- dualstow

- Executive Member

- Posts: 15757

- Joined: Wed Oct 27, 2010 10:18 am

- Location: foot of Mt Belzoni

- Contact:

-

welderwannabe

- Executive Member

- Posts: 158

- Joined: Sat Jul 20, 2019 12:53 pm

Re: The GOLD scream room

Trustworthy people are trustworthy until they are not.Mark Leavy wrote: ↑Sun Jan 01, 2023 10:30 pm Or, you could only do business with trustworthy people.

Ive got a Sigma on order.

- dualstow

- Executive Member

- Posts: 15757

- Joined: Wed Oct 27, 2010 10:18 am

- Location: foot of Mt Belzoni

- Contact:

Re: The GOLD scream room

If gold keeps going up, I’m going to retire and spend my leisure time reading other forums on why gold is a barbarous relic and a poor choice for a portfolio.

.

Re: The GOLD scream room

Does that forum happen to be frequented by Knuckleheads?

www.ironwealth.org

- dualstow

- Executive Member

- Posts: 15757

- Joined: Wed Oct 27, 2010 10:18 am

- Location: foot of Mt Belzoni

- Contact:

Re: The GOLD scream room

— WSJ, Jan 26Gold is starting the year with gains.

Gold purchases by everyone from central banks to institutions and ordinary investors have lifted the precious metal in 12 of the past 16 sessions, according to Dow Jones Market Data.

.

Re: The GOLD scream room

For centuries gold/silver was money. Investors lent money (gold) to the state in return for interest (more gold in return).

Whilst direct convertibility ended in 1933, the US internationally agreed for trade to occur in US dollars, and where the US would peg the US dollar to gold. That held until the late 1960's when Nixon decoupled as a means to help pay down the cost of the Vietnam war. Since then the US has still sought to align the US dollar with gold, Yellen for instance since 2013. To not do so risks loss of faith/trust as the US dollar being the trade currency replacement to gold. Aware of the risks of fiat currency, the US maintains large amounts of gold as the major part of its reserves. Gold was money for centuries, and is still a major factor for many currencies around the world. Those that consider gold to be a relic are those that have total trust in pure fiat currencies - that left alone tend to fail relatively quickly.

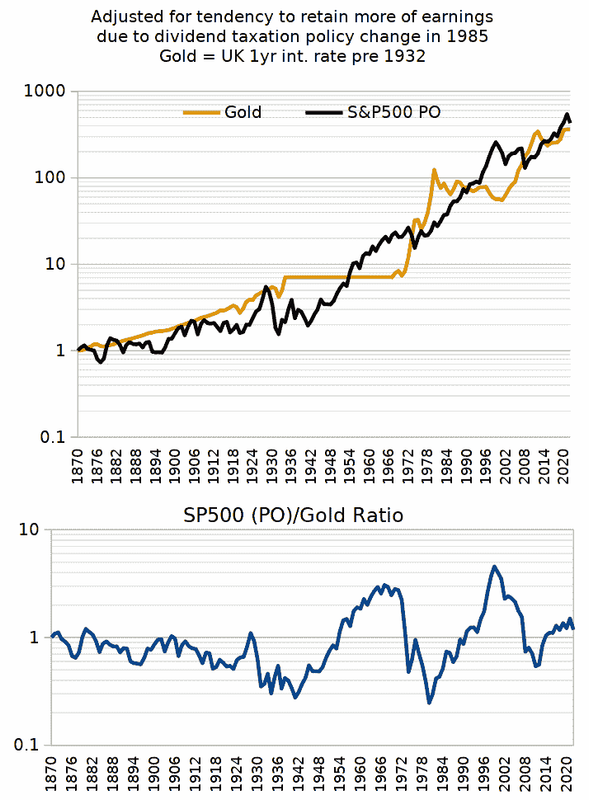

Investors pre 1932 might not have been inclined to hold gold (coins/money) but instead have lent that money to the state for more gold in return and safe storage (state paid investors for it to securely store their gold). In the mid 1980's the US changed taxation policy to more heavily tax dividends, so the inclination was for firms to retain more of earnings.

Adjust for circumstantial changes and ...

That chart is pretty similar if instead of rotating into gold from 1932 you instead continued to lend (hold treasuries) up to 1968.

Fundamentally shares (price only), gold, treasuries, house prices ...etc. will tend to broadly pace inflation over time, as otherwise the prices would either rise to excessively expensive, or excessively cheap. Holding gold is similar to holding bonds, you forego the dividends that stocks provide. As a alternative to bonds however that tend to correlate more with stocks, gold tends to have a element of inverse correlation to both stocks and bonds, is the better diversifier.

The recent indications are for stock and gold price alignment, neither seems excessively expensive or cheap. In contrast to the late 1960's and again in late 1990's when stocks were relatively expensive/gold cheap. Late 1970's and stocks were cheap/gold expensive.

I see 2023 as a year with 50/50 probability of either stocks or gold being up/down. Such that starting the year with equal amounts of both is as good-as-any a choice. One thing for sure is that one will do better than the other. But equally 67/33 stock/gold is a reasonable choice as historically since 1793 stocks were the years best performer in around two-thirds of years, gold was similar to bonds - the years best asset in around a third of years.

- dualstow

- Executive Member

- Posts: 15757

- Joined: Wed Oct 27, 2010 10:18 am

- Location: foot of Mt Belzoni

- Contact:

Re: The GOLD scream room

I’ve never been able to hold enough gold. For the pp, yes, but not for pp+vp.(seajay)I see 2023 as a year with 50/50 probability of either stocks or gold being up/down. Such that starting the year with equal amounts of both is as good-as-any a choice

Your post is heartening.

.