Math for LTT purchase.

Moderator: Global Moderator

Math for LTT purchase.

Do I need to do the math when buying LTT's on the secondary marked or are the offerings effectively the same?

If they are effectively the same, why would I pick one bond over the other one? Here is an example of 30 year bonds?

Adding an example of bonds on the secondary market:

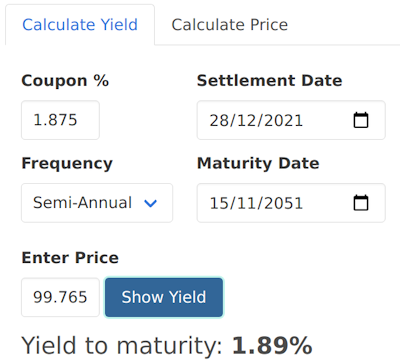

The effective yield is 1.909 vs 1.903 but the price differential is 102.484 vs 99.766. I did the math and the 102.484 (slightly different math because the price change after I did the math and before I got the screen shot so the numbers may be slightly off).

The more expensive bond came out to paying about 90ish dollars more over thirty years. Seems the same(ish). So....back to the original question.

Do I just scroll to the bottom of the offering page, grab the one with the longest duration or do I stare and compare at the offerings of the particular year LTT I want to buy?

If they are effectively the same, why would I pick one bond over the other one? Here is an example of 30 year bonds?

Adding an example of bonds on the secondary market:

The effective yield is 1.909 vs 1.903 but the price differential is 102.484 vs 99.766. I did the math and the 102.484 (slightly different math because the price change after I did the math and before I got the screen shot so the numbers may be slightly off).

The more expensive bond came out to paying about 90ish dollars more over thirty years. Seems the same(ish). So....back to the original question.

Do I just scroll to the bottom of the offering page, grab the one with the longest duration or do I stare and compare at the offerings of the particular year LTT I want to buy?

Re: Math for LTT purchase.

Hoping for a more specific response. Why are they not exactly the same.

Re: Math for LTT purchase.

Being an engineer, I've puzzled through all the maths. What I've come to understand is that there are an army of very smart people and computers that make these calculations constantly and use that information to quickly arbitrage any mismatches that they find. What this means for me (a normal retail investor) is that there is practically zero monetary difference between bonds of the same type and similar maturity dates. So you can just pick the one that makes sense for your portfolio management.

I run a pretty much a straight vanilla GB portfolio (and before that a PP portfolio) using 30 yr gov bonds for the bond portion. The way I manage my LTB portion is that I have two tranches that are 5-years apart in maturity date. As each set hits 20 years until maturity, I sell the whole thing and repurchase a new set at the full 30-year maturity. That way, I keep the average maturity at >25 years while minimizing hassle.

I run a pretty much a straight vanilla GB portfolio (and before that a PP portfolio) using 30 yr gov bonds for the bond portion. The way I manage my LTB portion is that I have two tranches that are 5-years apart in maturity date. As each set hits 20 years until maturity, I sell the whole thing and repurchase a new set at the full 30-year maturity. That way, I keep the average maturity at >25 years while minimizing hassle.

Re: Math for LTT purchase.

I think I see where the difference in the two bonds comes from. Will rerun the math but I am betting they are equal. What I missed was the slightly different maturity date, which makes up the few dollar difference.

-

johnnywitt

- Senior Member

- Posts: 147

- Joined: Fri May 08, 2020 6:06 pm

Re: Math for LTT purchase.

Do you Folks mostly buy on the secondary, or at auction?

Re: Math for LTT purchase.

For me that recent purchase was on the secondary market.

Re: Math for LTT purchase.

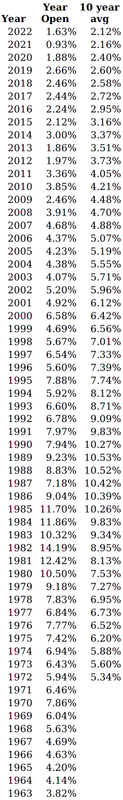

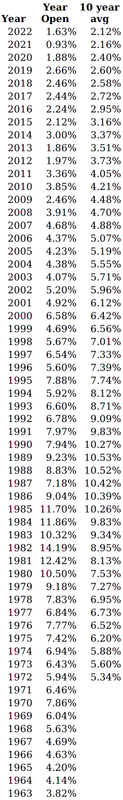

A T-Bill and 20 year T barbell might be expected to broadly compare to a central 10 year bullet (buy a 10.5 year, sell when down to 9.5 years remaining and buy another 10.5 year). As might a 10 year ladder compare ... holding 1, 2, 3, ... 10 year T's and after a year when one matures roll the proceeds into another 10 year T purchase.

A feature with the ladder is that you can ignore ongoing prices/valuations ... not 'mark to market', and the yearly reward can be assumed to be (approximately, as not all rungs will be weighted exactly the same) the average of each bonds 10 year yields.

https://www.macrotrends.net/2016/10-yea ... ield-chart

i.e. 2022 has the 50% PP bonds yielding 2.12%

PV

A feature with the ladder is that you can ignore ongoing prices/valuations ... not 'mark to market', and the yearly reward can be assumed to be (approximately, as not all rungs will be weighted exactly the same) the average of each bonds 10 year yields.

https://www.macrotrends.net/2016/10-yea ... ield-chart

i.e. 2022 has the 50% PP bonds yielding 2.12%

PV

-

flyingpylon

- Executive Member

- Posts: 1172

- Joined: Fri Jan 06, 2012 9:04 am

Re: Math for LTT purchase.

Bonds bought at auction come with that "new bond smell".

Re: Math for LTT purchase.

@seajay - thanks for the calculator.

-

johnnywitt

- Senior Member

- Posts: 147

- Joined: Fri May 08, 2020 6:06 pm

Re: Math for LTT purchase.

So, HB says when buying similar duration bonds on the secondary market that you should counter-intuitively buy the bond with the lower coupon because it's more volatile & you will get the difference back in Capital Gains. Additionally, the Bond, if held in a taxable acct., will cause a lessor tax impact (not so applicable right at the moment).

Re: Math for LTT purchase.

Thanks for the info.johnnywitt wrote: ↑Fri Jan 07, 2022 4:20 pm So, HB says when buying similar duration bonds on the secondary market that you should counter-intuitively buy the bond with the lower coupon because it's more volatile & you will get the difference back in Capital Gains. Additionally, the Bond, if held in a taxable acct., will cause a lessor tax impact (not so applicable right at the moment).

-

johnnywitt

- Senior Member

- Posts: 147

- Joined: Fri May 08, 2020 6:06 pm

Re: Math for LTT purchase.

This is info found on pg. 355 of his hardcover first edition book "Why The Best Laid Plans..."ppnewbie wrote: ↑Sun Jan 09, 2022 12:39 amThanks for the info.johnnywitt wrote: ↑Fri Jan 07, 2022 4:20 pm So, HB says when buying similar duration bonds on the secondary market that you should counter-intuitively buy the bond with the lower coupon because it's more volatile & you will get the difference back in Capital Gains. Additionally, the Bond, if held in a taxable acct., will cause a lessor tax impact (not so applicable right at the moment).