A worthwhile read for all PP'ers

Moderator: Global Moderator

- dualstow

- Executive Member

- Posts: 15714

- Joined: Wed Oct 27, 2010 10:18 am

- Location: searching for the lost Xanadu

- Contact:

Re: A worthwhile read for all PP'ers

There can be unlimited crypto threads in the VP section, but if enough people feel strongly enough about a subsection (in VP) for all things crypto, in the name of organization, why not. Seems to be a popular topic.

Whistling tunes / We hide in the dunes by the seaside

Whistling tunes / We're kissing baboons in the jungle

Whistling tunes / We're kissing baboons in the jungle

Re: A worthwhile read for all PP'ers

I vote for a subsection of the Variable Portfolio.

-

johnnywitt

- Senior Member

- Posts: 147

- Joined: Fri May 08, 2020 6:06 pm

Re: A worthwhile read for all PP'ers

mkdir Crypto

...

mv Crypto/* /dev/null

...

mv Crypto/* /dev/null

- bitcoininthevp

- Executive Member

- Posts: 480

- Joined: Fri Sep 25, 2015 8:30 pm

Re: A worthwhile read for all PP'ers

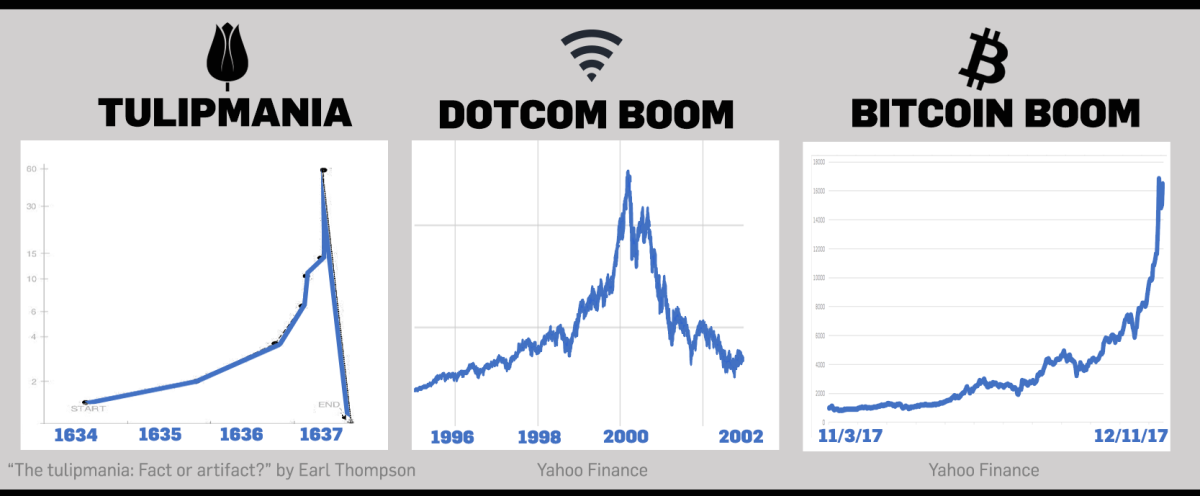

You see this BTC chart ends in 2017 right?

bitcoininthevp wrote: ↑Sat Aug 21, 2021 10:49 am Honestly this kind of 2014-era beanie baby thing is lazy thinking at this point.

How many giant bubbles did beanie babies or tulips have? Bitcoin, over 10 years: $30->$1, $260->$40, $1200->$200, $19k->$3k. Now at $50k.

Imagine thinking a novel digital money would increase in value in a straight linear pattern.

Re: A worthwhile read for all PP'ers

Over a long timeframe gold seems to working as an inflation hedge.

Dollar Purchasing power - Not sure if the chart is completely accurate but I think its directionally correct

Gold Price

It also seems to be a chaos hedge. If all hell breaks loose. Gold first collapses as the over leveraged hedge fund leeches sell the only thing left with value to cover their short falls. Then it rebounds (IMHO).

Dollar Purchasing power - Not sure if the chart is completely accurate but I think its directionally correct

Gold Price

It also seems to be a chaos hedge. If all hell breaks loose. Gold first collapses as the over leveraged hedge fund leeches sell the only thing left with value to cover their short falls. Then it rebounds (IMHO).

Re: A worthwhile read for all PP'ers

I've heard of many concerning things in the last few weeks as I am doing my research into crypto in general. Like this huge decentralized thing like ether was basically rolled back by the group that controls it. Tether is a potential fraud. BTC is traded mostly in tether, BTC is concentrated in 10000 wallets, Two organizations are the counterparties to most BTC trades (Cumberland Global and Alameda Research). These are thinly traded assets. The market cap might by nearly a trillion but there possibly only about 50 billion dollars in the system.

Parties can trade with themselves or just fake a trade completely. It currently seems to act like a risk on asset as opposed to a store of value. Binance and FTX operations in the US could basically be dollar extraction schemes. We "partner" with a US based company using our name and they pay us an enormous amount of their dollar profits to use our "platform". Parent company gets dollars and no obligation to follow US laws.

Some of the details above may be slightly off but are still cautionary flags to say the least.

I think 1 percent allocation is a good idea in case it takes off.

Parties can trade with themselves or just fake a trade completely. It currently seems to act like a risk on asset as opposed to a store of value. Binance and FTX operations in the US could basically be dollar extraction schemes. We "partner" with a US based company using our name and they pay us an enormous amount of their dollar profits to use our "platform". Parent company gets dollars and no obligation to follow US laws.

Some of the details above may be slightly off but are still cautionary flags to say the least.

I think 1 percent allocation is a good idea in case it takes off.

- bitcoininthevp

- Executive Member

- Posts: 480

- Joined: Fri Sep 25, 2015 8:30 pm

Re: A worthwhile read for all PP'ers

Some validity to most of these, likely. But while these have potential short/mid issues in price, in the big long term picture none of these invalidates Bitcoins network operation, protocol, or value proposition.ppnewbie wrote: ↑Wed Feb 02, 2022 1:29 pm I've heard of many concerning things in the last few weeks as I am doing my research into crypto in general. Like this huge decentralized thing like ether was basically rolled back by the group that controls it. Tether is a potential fraud. BTC is traded mostly in tether, BTC is concentrated in 10000 wallets, Two organizations are the counterparties to most BTC trades (Cumberland Global and Alameda Research). These are thinly traded assets. The market cap might by nearly a trillion but there possibly only about 50 billion dollars in the system.

Parties can trade with themselves or just fake a trade completely. It currently seems to act like a risk on asset as opposed to a store of value. Binance and FTX operations in the US could basically be dollar extraction schemes. We "partner" with a US based company using our name and they pay us an enormous amount of their dollar profits to use our "platform". Parent company gets dollars and no obligation to follow US laws.

Some of the details above may be slightly off but are still cautionary flags to say the least.

I think 1 percent allocation is a good idea in case it takes off.

Re: A worthwhile read for all PP'ers

You could be right. In wish I could just buy 100k worth of ibonds a year (at 7.12 percent).

- dualstow

- Executive Member

- Posts: 15714

- Joined: Wed Oct 27, 2010 10:18 am

- Location: searching for the lost Xanadu

- Contact:

Re: A worthwhile read for all PP'ers

This 10K limit is bullshit. I wish I had been able to take advantage of the higher limit in the early aughts. Didn’t have the money!

Whistling tunes / We hide in the dunes by the seaside

Whistling tunes / We're kissing baboons in the jungle

Whistling tunes / We're kissing baboons in the jungle

Re: A worthwhile read for all PP'ers

It would be interesting to see how much retail money would be sucked out of the market if they increased the limit on ibond purchases significantly. I would be sleeping much better at night if I could put more money in.