I really appreciate all the responses to my original post. Here is my current reasoning (no decisions yet made), and I'd really appreciate any additional thoughts on it.

After one starts taking RMDs at age 72, the only differences between Tax Deferred and After Tax (often called "taxable") accounts seem to be:

1) one is required to take money out of one's Tax Deferred accounts every year in the form of RMDs whereas one isn't required to take money out of one's After Tax accounts (obvious)

2) Realized long term gold gains (whether physical or ETFs) in After Tax accounts are taxed at your regular tax rate, but not more than 28% (thank you stuper1!); whereas, realized long term gains in Tax Deferred accounts are taxed at one's regular tax rate (including long term gold gains)

3) Basis in Tax Deferred accounts is taxed, but basis in After Tax accounts has already been taxed and so is not taxed again.

4) Long term capital gains taxes, which are less than income tax, are charged for After Tax gains. Income tax is charged for Tax Deferred gains.

After I am required to start taking RMDs in 2024 when I turn 72, my wife and I won't need the RMDs, but they are "required." Our annual spending is such that our Social Security and several small pensions will meet all our spending needs. However, our RMDs will drive up our income such that we will be well into the 22% (25% after 2025), and perhaps into the 24% (28% after 2025) marginal tax bracket (MTB). Over time, RMDs increase, and likely will drive us to the 24% (28% after 2025) MTB if we're not there already. If our Tax Deferred does well, then our RMDs will increase even more, perhaps driving our income to the 33% (after 2025) MTB.

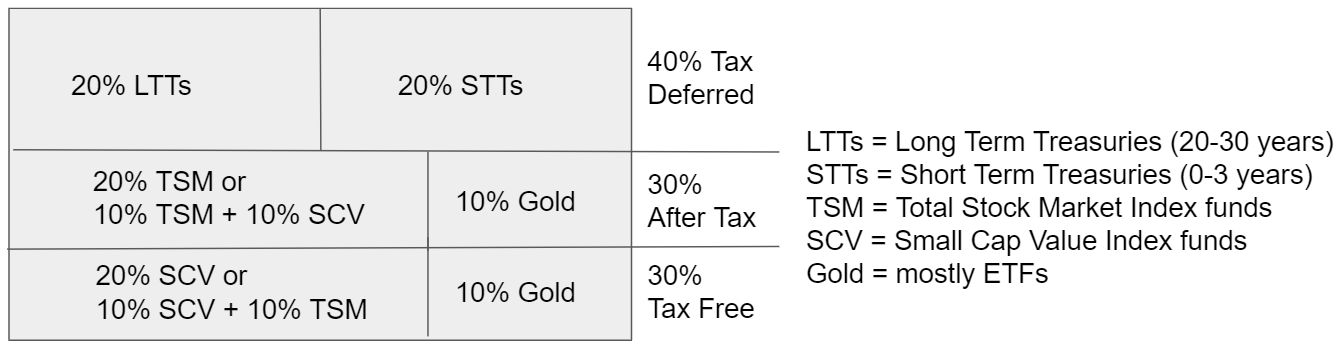

Given the above, it seems best to minimize growth in tax deferred accounts, so as to minimize RMDs (since they are not needed). That is why I'm thinking it best to put all the STTs (Short Term Treasuries = cash) in tax deferred. For the remaining 20% to fill out the 40%, I then have a choice between LTTs (Long Term Treasuries = bonds) and Gold, or some of each. With LTT returns being so low these days, and with interest rates rising driving existing LTT values down, and the continuing fears of inflation in which, if realized, presumably gold would have a lot of growth, it seems that LTTs should make up the other 20% of the Tax Deferred, and that gold should go in Tax Free.

However, as I mentioned in an earlier post, I'm stuck with half the gold (10% of our portfolio) in After Tax because its value is so much higher than its basis. Since realized gold gains in After Tax are taxed as income tax (not capital gains tax) to a max of 28%, it seems best to place the rest of the gold in Tax Free.

Now, to fill the remaining 20% in After Tax and 20% in Tax Free, from my reading half to all of the SCV (Small Cap Value) should go in Tax Free, and half to all of the TSM (Total Stock Market) should go in After Tax.

The above approach would seem to minimize our un-needed RMDs into the future. Were we to instead put TSM and SCV into Tax Deferred, then the value of the Tax Deferred account would grow faster and therefore be larger than were we to place STT and LTT in Tax Deferred. With a larger account value, our unneeded RMDs would be greater, as would our taxes. Therefore, I'm having a hard time understanding why one would want to put TSM and SCV into Tax Deferred.

I look forward to your finding holes in this, my current reasoning.

Here is a graphic showing the results of the above reasoning.

- 20210425_TrgtAsstLctn.PNG (59.22 KiB) Viewed 10066 times