stone wrote:

Is it foreign denominated debt?

It is. The Euros are

loaned to the Fed (as part of the swap). It's an MMT red flag. If all goes well, it won't be a problem for the Fed to pay those Euros back to complete the swaps. But, if the Euro restructures or vaporizes, it could be impossible for the swaps to be completed — particularly since the swaps are

unsecured.

stone wrote:Isn't it printing fresh USD and then sequestering some euros away in the fed in exchange?

Well, it's still a debt that must be paid back. If those Euros became worthless, or restructured, the Europeans could demand payment in some sort of new Super-Euros in order to send the Fed's printed dollars back.

And, don't forget that the Fed changed the rules this time around, so that it can loan out those Euros to US banks who may need them. In other words, the Euros probably won't be sequestered. And even if they were sequestered, the problem is that the Fed needs a way to get the freshly printed dollars back by completing the swap. If the Eurozone vaporizes, the swap goes bad and they just printed way too much money.

stone wrote:I suppose they think that those freshly printed USD in euro banks don't matter because the need for them has come about because US banks are keeping USD at the Fed instead of lending them to the European banks as they normally would. So European banks actually just have the amount of USD that they used to have

Not exactly. You are correct that the dollars don't matter during a deflationary crunch. The swap lines are actually necessary because they

reduce the cost of attaining dollars

for everyone during a liquidity crisis. That's important.

However, more importantly, the implications of those dollars

do matter after the deflationary crunch. Why? Because those dollars must eventually be destroyed (i.e. returned to the Fed) when the deflationary crunch is over — otherwise they would become highly inflationary. The problem wouldn't be a few billion dollars here or there. The problem is that there is the

potential for a Trillion dollars or multi-Trillion dollars getting released into the open market with no way to bring it back to the Fed. That would be bad. It's a very small risk, but theoretically it could happen.

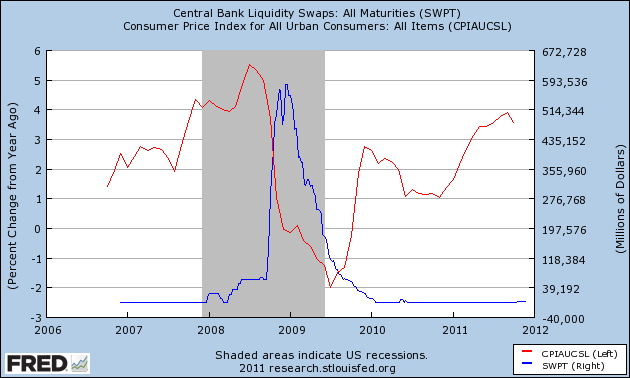

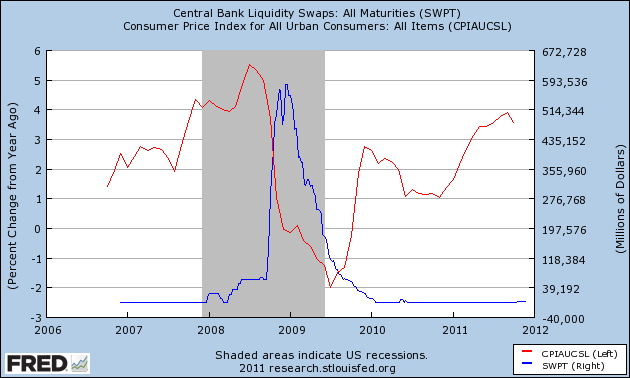

Here's what happened to the CPI when the 2008-2009 swap lines were in play (the swaps are in blue; the CPI is in red):

[align=center]

[/align]

As you can see, swaps filled the liquidity void nicely during the deflationary crunch. But, if those dollars hadn't been destroyed after the swaps were completed, the moderate rise of inflation would likely have been a large jump as those dollars entered the open market.

In order for the Fed to retrieve its swapped dollars when the deflationary crunch is over, it needs the Euro to still exist so that it can complete the

unsecured swap. If the swap can't be completed, those dollars become stuck in the money supply and will need to be destroyed somehow to control inflation.

The Fed could have avoided this dilemma if they had

secured the swaps (i.e. demanded German Gold if the dollars were never paid back). But since this is a dollar liquidity crisis (or at least a bailout for US banks, in disguise), the Fed really had no choice but to flood the world with liquidity. You can see the Fed is starting to get backed into a corner.

Nothing I say should be construed as advice or expertise. I am only sharing opinions which may or may not be applicable in any given case.

[/align]

[/align]