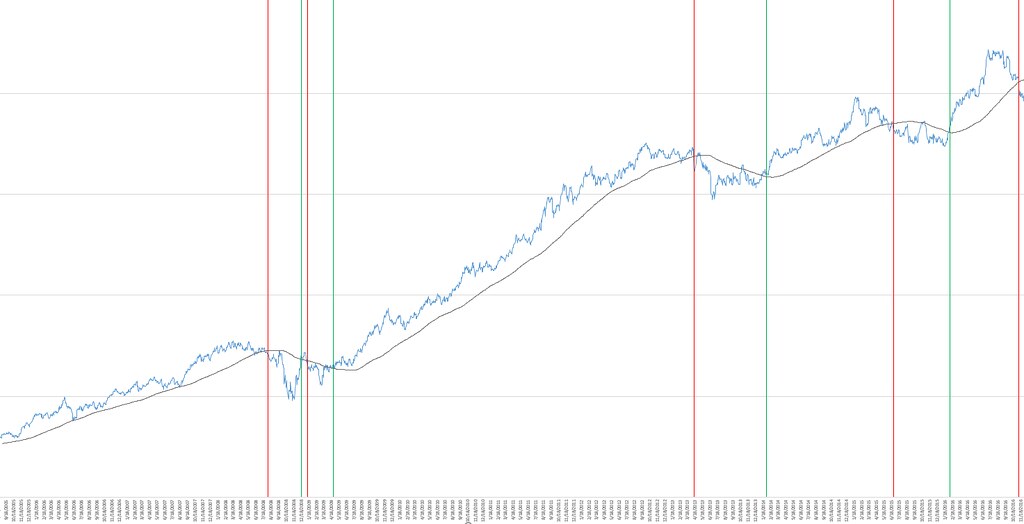

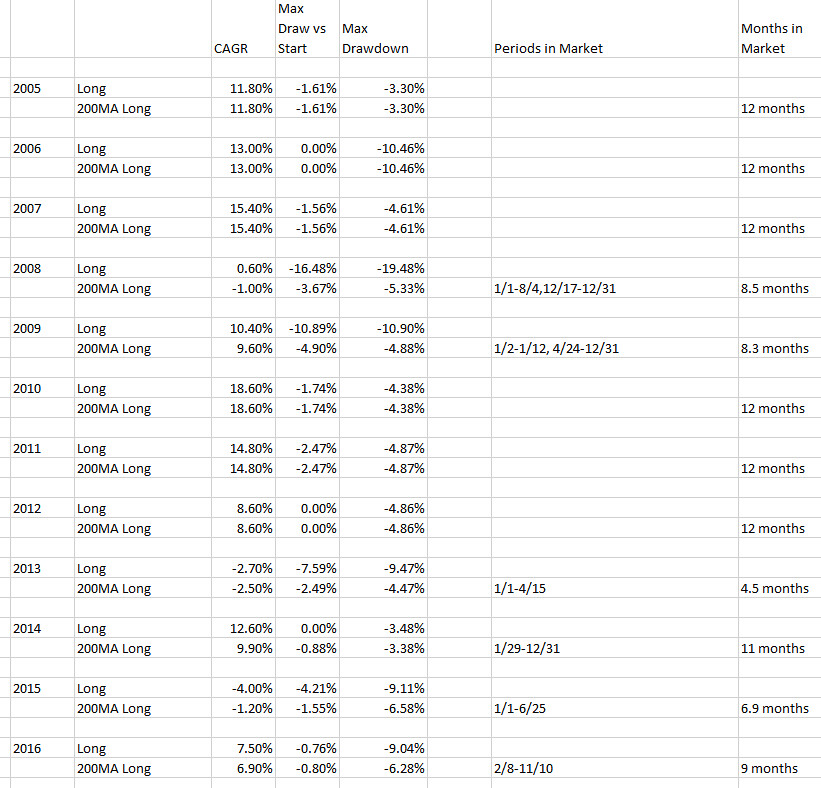

When a 200 day simple moving average is applied looks to me like there are fairly clear entry and exit points (green and red lines). I used a simple rule: long when the portfolio index is at least 1% above the 200MA and go to cash when it's 1% under the 200MA. Using this very basic system drawdowns are reduced (especially 'drawdown vs. start'), making it easier to cope with down periods. That might be especially appealing if using a leveraged portfolio.

One thing I notice is that each of three previous periods below the 200MA lasted approx. 6 months. That suggests to me that we may have to wait until next spring before the PP gets back on an upward trajectory.

Nov. 18, 2004 to Dec. 1, 2016: