+1upside wrote:You have my vote for adding a post like the one you describe. I'd be very interested in reading it.Tyler wrote:I've been 100% Permanent Portfolio for several years now. It works very well for me personally, and conversations on this board inspired many of the tools on my site. I've debated several times starting a small VP with a few alternative assets, but to date I've just stayed the PP course.upside wrote: Tyler,

Excellent website you've built. I'm about halfway through the interview, which is really interesting. If you don't mind me asking, which portfolio are you currently using?

Your question is pretty common, and I've considered eventually writing a detailed post on the site explaining how and why I personally invest the way I do. I've intentionally avoided it to date simply because I don't want to create the perception that I'm advocating for a certain asset allocation. (Because I'm not!) Obviously I'll argue in favor of the PP on the PP forum, but I'm not selling anything. I truly believe everyone needs to find a portfolio they are comfortable with, and there's more than one good way to invest. I like to think of PC as a collection of good options for all types of investors.

The PP Interviews

Moderator: Global Moderator

Re: The PP Interviews

Live healthy, live actively and live life!

Re: The PP Interviews

Ditto here. I think a fresh perspective would really be helpful to many of us. This forum is a tremendous resource for delving into political and financial matters in detail, but I think several of us have ended up getting bogged down in these details and perhaps overly pessimistic about our financial futures.AdamA wrote: I'm looking forward to hearing it.

"Democracy is two wolves and a lamb voting on what to have for lunch." -- Benjamin Franklin

Re: The PP Interviews

Any investor who can fully comprehend the PP and then deviate from it while getting superior risk-adjusted returns is IMHO an outstanding investor.Desert wrote:I like that. I've learned a lot about diversification and portfolio design from the PP, even though I no longer hold the traditional 4x25. Even though I don't like the asset choices, I think the Bogleheads' 3-fund portfolio concept is very good. The basic funds are prescribed, but the proportions are largely left to the individual. I think the PP thought process could benefit from a similar approach. Not everyone needs to stick with 25% equity, for example. Or 25% cash.Tyler wrote:I've been 100% Permanent Portfolio for several years now. It works very well for me personally, and conversations on this board inspired many of the tools on my site. I've debated several times starting a small VP with a few alternative assets, but to date I've just stayed the PP course.upside wrote: Tyler,

Excellent website you've built. I'm about halfway through the interview, which is really interesting. If you don't mind me asking, which portfolio are you currently using?

Your question is pretty common, and I've considered eventually writing a detailed post on the site explaining how and why I personally invest the way I do. I've intentionally avoided it to date simply because I don't want to create the perception that I'm advocating for a certain asset allocation. (Because I'm not!) Obviously I'll argue in favor of the PP on the PP forum, but I'm not selling anything. I truly believe everyone needs to find a portfolio they are comfortable with, and there's more than one good way to invest. I like to think of PC as a collection of good options for all types of investors.

There is nothing magic about the PP's allocation, but for most people most of the time it will get them better returns than they would have gotten through the standard running from strategy to strategy that most investors seem fond of doing.

In general, I think that most people are more risk averse than they realize. If that weren't the case, you wouldn't see people freaking out so badly when the stock market rolls over like it did in 2001 and 2008, and which it will do again, and people will be just as freaked out about it. The PP gives you a way of stepping off of that ride without having to leave the amusement park.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

- mathjak107

- Executive Member

- Posts: 4742

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: The PP Interviews

What I found interesting is less than 1% of 401k participants totally bailed out of stocks in 2008 and only 1.25% stopped adding money to their funds.

I would have thought it would have been way more but those are the results Reuters had .

I would have thought it would have been way more but those are the results Reuters had .

Re: The PP Interviews

I suspect the vast majority of people forget they even have 401ks, and some plans only let you make changes once a year. And even if only 1% totally bailed on stocks, I'd be interested in what percentage of people sold low while switching funds.mathjak107 wrote: What I found interesting is less than 1% of 401k participants totally bailed out of stocks in 2008 and only 1.25% stopped adding money to their funds.

I would have thought it would have been way more but those are the results Reuters had .

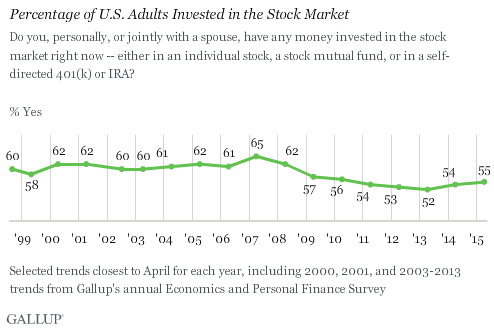

When you look at the broader stock market it's definitely a little worse than that.

Of course, there's more to the declining stock ownership than fear (looking at you, unemployment).

Re: The PP Interviews

Also make sure to look at long term demographic trends--i.e., as people age out of the workforce they go from being regular stock buyers to regular stock sellers.Tyler wrote: Of course, there's more to the declining stock ownership than fear (looking at you, unemployment).

I guess retirement is just another form of unemployment, though, so maybe your statement above captures it all, though "unemployment" typically connotes involuntary unemployment.

You don't typically look at an 85 year old retiree and say: "Poor guy. He's been unemployed for 20 years."

Last edited by MediumTex on Wed Nov 11, 2015 12:06 pm, edited 1 time in total.

Q: “Do you have funny shaped balloons?”

A: “Not unless round is funny.”

A: “Not unless round is funny.”

Re: The PP Interviews

Me too!upside wrote:You have my vote for adding a post like the one you describe. I'd be very interested in reading it.Tyler wrote:I've been 100% Permanent Portfolio for several years now. It works very well for me personally, and conversations on this board inspired many of the tools on my site. I've debated several times starting a small VP with a few alternative assets, but to date I've just stayed the PP course.upside wrote: Tyler,

Excellent website you've built. I'm about halfway through the interview, which is really interesting. If you don't mind me asking, which portfolio are you currently using?

Your question is pretty common, and I've considered eventually writing a detailed post on the site explaining how and why I personally invest the way I do. I've intentionally avoided it to date simply because I don't want to create the perception that I'm advocating for a certain asset allocation. (Because I'm not!) Obviously I'll argue in favor of the PP on the PP forum, but I'm not selling anything. I truly believe everyone needs to find a portfolio they are comfortable with, and there's more than one good way to invest. I like to think of PC as a collection of good options for all types of investors.