What if the Congressional crazies fail to raise the debt ceiling?

Moderator: Global Moderator

What if the Congressional crazies fail to raise the debt ceiling?

Given how dysfunctional the controlling party in Congress appears to be (can't elect their own speaker? seriously?), the notion that the debt ceiling might not be raised seems to be sliding into the "thinkable" category. This of course means the US defaults on Treasuries (and lots of other incredibly bad things).

Let's assume this happens - i.e. Congress fails to increase the debt limit and the Treasury stops paying its bills.

What do you want to invest in?

Let's assume this happens - i.e. Congress fails to increase the debt limit and the Treasury stops paying its bills.

What do you want to invest in?

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: What if the Congressional crazies fail to raise the debt ceiling?

Anything but Treasuries.

BTW, the Treasury is going to run out of money a month before the debt ceiling vote is scheduled.

Fun times.

BTW, the Treasury is going to run out of money a month before the debt ceiling vote is scheduled.

Fun times.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: What if the Congressional crazies fail to raise the debt ceiling?

You don't think the stock market crashes?MachineGhost wrote: Anything but Treasuries.

BTW, the Treasury is going to run out of money a month before the debt ceiling vote is scheduled.

Fun times.

Re: What if the Congressional crazies fail to raise the debt ceiling?

IIRC, last time there was a debt ceiling crisis, and S&P even downgraded US debt, the value of our long-term Treasuries went UP, contrary to everyone's expectations. Hard to predict the future.

-

goodasgold

- Executive Member

- Posts: 387

- Joined: Tue Jan 01, 2013 8:19 pm

Re: What if the Congressional crazies fail to raise the debt ceiling?

I, for one, am thankful to the "congressional crazies" for again drawing attention to our ever-spiraling debt and approaching national bankruptcy, before it is too late. Many other developed nations are in the same boat, and they also need a contingent of congressional (and parliamentary) crazies to begin telling the truth.

The earlier we wake up and take serious steps to reduce the size and expense of government, the better off we will be. Unless action is taken, painful as it will necessarily be, we will become the Greece of North America, with all of the chaos, impoverishment, fury and irresponsibility this status entails.

In short, if you think politics is vicious now, just wait until those Social Security checks start bouncing, or, as is far more likely, when Monopoly money, with an ever growing number of zeros stamped onto the end of each bill, starts spewing out of the ATM. Gold will then have its day, at least until the Peasants, Proletarians and Millennial League for Justice, led by Paul Krugman, with flaming torches and pitchforks held high, seizes the safe deposit boxes of us "wicked and greedy rich folks."

I am saddened that Rand Paul, the only presidential candidate who understands the seriousness of our approaching catastrophe, is going nowhere in the polls. Let's hope that the electorate wakes up sooner rather than later to the wisdom of the "congressional crazies."

This concludes the sermon for today. As the Good Book says, "the truth will make us free," but it doesn't say it will make us happy. Amen for now, over and out.

The earlier we wake up and take serious steps to reduce the size and expense of government, the better off we will be. Unless action is taken, painful as it will necessarily be, we will become the Greece of North America, with all of the chaos, impoverishment, fury and irresponsibility this status entails.

In short, if you think politics is vicious now, just wait until those Social Security checks start bouncing, or, as is far more likely, when Monopoly money, with an ever growing number of zeros stamped onto the end of each bill, starts spewing out of the ATM. Gold will then have its day, at least until the Peasants, Proletarians and Millennial League for Justice, led by Paul Krugman, with flaming torches and pitchforks held high, seizes the safe deposit boxes of us "wicked and greedy rich folks."

I am saddened that Rand Paul, the only presidential candidate who understands the seriousness of our approaching catastrophe, is going nowhere in the polls. Let's hope that the electorate wakes up sooner rather than later to the wisdom of the "congressional crazies."

This concludes the sermon for today. As the Good Book says, "the truth will make us free," but it doesn't say it will make us happy. Amen for now, over and out.

Last edited by goodasgold on Fri Oct 09, 2015 12:17 pm, edited 1 time in total.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: What if the Congressional crazies fail to raise the debt ceiling?

Ahhh, scarcity-mentality gold bugs. Love 'em or leave 'em!goodasgold wrote: I, for one, am thankful to the "congressional crazies" for again drawing attention to our ever-spiraling debt and approaching national bankruptcy, before it is too late. Many other developed nations are in the same boat, and they also need a contingent of congressional (and parliamentary) crazies to begin telling the truth.

The earlier we wake up and take serious steps to reduce the size and expense of government, the better off we will be. Unless action is taken, painful as it will necessarily be, we will become the Greece of North America, with all of the chaos, impoverishment, fury and irresponsibility this status entails.

I hate to break it to you, but a government deficit is necessary for the private sector to have any risk-free savings. That is why debt always increases (along with revenues, wages, inflation, etc.). Japan is at 230% Debt-to-GDP with nary a problem, so we got plenty up upside room. Could a banana republic get away with that? Of course not, but we're not a banana republic. We're a highly productive, highly advanced and high wealth economy.

The real risk here is in not increasing the debt ceiling which is the same thing as imposing austerity onto the private sector.

Lets say that 500% Debt-to-GDP is the maximum things can get before rates have to rise and inflation rears its ugly head. Is that a problem then? Not if you have real assets. Look ma, no hands!

The other real risk is that people that believe as you do will destroy systemic confidence. In that case, we don't need to first get to a 500% Debt-to-GDP for the same end results. You dig what I'm saying?

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: What if the Congressional crazies fail to raise the debt ceiling?

The whole point here is that if the debt ceiling is not raised, the Treasury will be unable to pay the US Government's bills. Like, say, Social Security checks. And soldier's salaries. And Medicare bills. And ...goodasgold wrote: In short, if you think politics is vicious now, just wait until those Social Security checks start bouncing, or, ....

It would be the financial of equivalent of trying to shoot yourself in the foot, but missing and shooting yourself in the head instead. Crazy is not nearly strong enough.

But, like I say, it would appear this scenario is perhaps no longer unthinkable. So, if it does happen, what do you want to be invested in?

The last time the crisis was avoided (last minute deal). What we're imagining here is there is no last minute deal and the Treasury is forced to stop issuing checks.Xan wrote: IIRC, last time there was a debt ceiling crisis, and S&P even downgraded US debt, the value of our long-term Treasuries went UP, contrary to everyone's expectations. Hard to predict the future.

My guess is that if this happens the credit market immediately seizes up (like 2008, but worse), the stock market crashes, short term interest rates spike up, and the dollar takes a beating in foreign exchange markets. It's hard to imagine that even the craziest of the crazies would let this go on for more than a day or two, but if they did things would get progressively worse (in a hurry).

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: What if the Congressional crazies fail to raise the debt ceiling?

With Boehner out of the way, I don't think its out of the question now that the craziest of the crazies could hold up raising the debt ceiling.

Although, honestly, there's no reason the Treasury couldn't engage in some extralegal behavior just as the Fed did during the subprime crisis. The Fed and the Primary Dealers would be more the willing to monetize to end an austerity crisis.

Although, honestly, there's no reason the Treasury couldn't engage in some extralegal behavior just as the Fed did during the subprime crisis. The Fed and the Primary Dealers would be more the willing to monetize to end an austerity crisis.

Last edited by MachineGhost on Fri Oct 09, 2015 10:47 pm, edited 1 time in total.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: What if the Congressional crazies fail to raise the debt ceiling?

So everyone is working without pay or what? How does it work without any funds?MangoMan wrote: Illinois has been operating without a budget [and therefore no funds to pay any bills with] since July 1, and there is no resolution in sight between the Governor [R] and the Assembly [D]. Most things are still functioning just as dysfunctionally as they did before the crisis. My guess is it won't be that different for the Feds.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: What if the Congressional crazies fail to raise the debt ceiling?

Isn't that an easy solution? Stop accepting Medicaid patients.MangoMan wrote: I think state employees are still getting paid, but there is no funding for any social programs and they aren't paying any of their bills. I usually wait 4 to 5 months to get paid for state employee dental claims during normal times vs 30 days for private sector patients. Now we have been told that it could be a loooooong wait for reimbursement and we could under no circumstances ask the patient for the money up front. I wonder how much my state senator would enjoy getting paid for his time 8 months after doing the work.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: What if the Congressional crazies fail to raise the debt ceiling?

Interesting, so thats how they do it. All or nothing. Typical.MangoMan wrote: Yes, I could drop the plan, but not without also dropping all other employer groups that use this insurer,a s it is encompaseed as part of the PPO contract. Ugh.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

-

flyingpylon

- Executive Member

- Posts: 1160

- Joined: Fri Jan 06, 2012 9:04 am

Re: What if the Congressional crazies fail to raise the debt ceiling?

Another way Illinois is trying to save some cash:

Illinois Lottery Now Paying IOUs on Wins Bigger than $600

Illinois Lottery Now Paying IOUs on Wins Bigger than $600

- Ad Orientem

- Executive Member

- Posts: 3483

- Joined: Sun Aug 14, 2011 2:47 pm

- Location: Florida USA

- Contact:

Re: What if the Congressional crazies fail to raise the debt ceiling?

I was watching some of the Freedom Caucus denizens talking on TV the other day and was sufficiently disturbed to do a little research. By and large these people are crazier than a pack of fleas trapped in a jar full of moonshine. Popular idea among them include...

*Nullification

*Secession

*Repeal of the 17th amendment

*Birtherism

*Ignoring inconvenient parts of the 14th amendment (birth right citizenship)

*And of course use of the debt limit and the threat of political/economic chaos as a bargaining chip to advance their fringe ideas.

I do not dismiss for one minute the possibility that these wingnuts might actually try and bring the US Government to its knees.

*Nullification

*Secession

*Repeal of the 17th amendment

*Birtherism

*Ignoring inconvenient parts of the 14th amendment (birth right citizenship)

*And of course use of the debt limit and the threat of political/economic chaos as a bargaining chip to advance their fringe ideas.

I do not dismiss for one minute the possibility that these wingnuts might actually try and bring the US Government to its knees.

Trumpism is not a philosophy or a movement. It's a cult.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: What if the Congressional crazies fail to raise the debt ceiling?

The South shall rise again!Ad Orientem wrote: I was watching some of the Freedom Caucus denizens talking on TV the other day and was sufficiently disturbed to do a little research. By and large these people are crazier than a pack of fleas trapped in a jar full of moonshine. Popular idea among them include...

*Nullification

*Secession

*Repeal of the 17th amendment

*Birtherism

*Ignoring inconvenient parts of the 14th amendment (birth right citizenship)

*And of course use of the debt limit and the threat of political/economic chaos as a bargaining chip to advance their fringe ideas.

I do not dismiss for one minute the possibility that these wingnuts might actually try and bring the US Government to its knees.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Re: What if the Congressional crazies fail to raise the debt ceiling?

Have you noticed the "crazies " running the Executive branch too?

-

goodasgold

- Executive Member

- Posts: 387

- Joined: Tue Jan 01, 2013 8:19 pm

Re: What if the Congressional crazies fail to raise the debt ceiling?

So the "congressional crazies" abjectly surrendered yet again by kicking the can down the road re our soon-to-be unpayable debt load. Most people focus on the budget deficit, but few are aware of the true danger posed by our criminally ignored, and ever growing, mountain of unfunded liabilities.

I disagree with Tyler Durden on a lot of things, but he is right on the money when he highlights the devastating testimony of David Walker regarding the monumental folly of refusing to deal with the unfunded debt issue. Greece, Puerto Rico and Zimbabwe, here we come:

http://www.zerohedge.com/news/2015-11-0 ... have-lost-

I disagree with Tyler Durden on a lot of things, but he is right on the money when he highlights the devastating testimony of David Walker regarding the monumental folly of refusing to deal with the unfunded debt issue. Greece, Puerto Rico and Zimbabwe, here we come:

http://www.zerohedge.com/news/2015-11-0 ... have-lost-

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: What if the Congressional crazies fail to raise the debt ceiling?

Greece and Puerto Rico aren't currency issuers and Zimbabwe destroyed its economic productivity with Mugabe's socialist racist anti-colonialist farm grabs.goodasgold wrote: I disagree with Tyler Durden on a lot of things, but he is right on the money when he highlights the devastating testimony of David Walker regarding the monumental folly of refusing to deal with the unfunded debt issue. Greece, Puerto Rico and Zimbabwe, here we come:

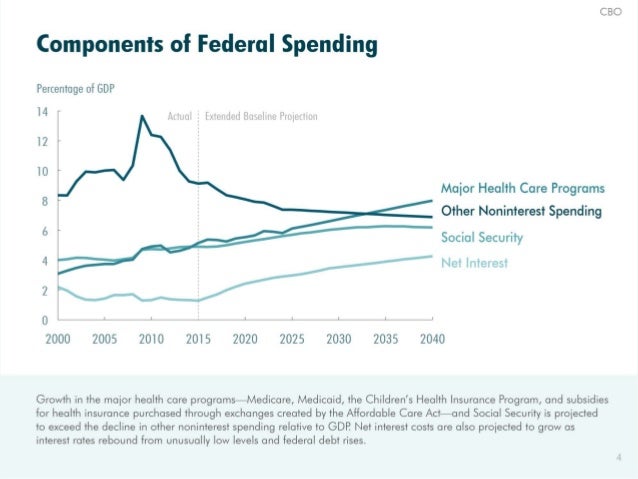

What is important is net interest on the debt, not the total debt outstanding. Sovereign debt is never paid off; it either defaults if you're not a currency issuer or it is inflated away if you are. The point of no return for the USA will be when the net interest alone takes up all the "unfunded revenues" that go along with all those "unfunded liabilities".

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

-

goodasgold

- Executive Member

- Posts: 387

- Joined: Tue Jan 01, 2013 8:19 pm

Re: What if the Congressional crazies fail to raise the debt ceiling?

As long as the Eurozone and the U.S. reward Greece and Puerto Rico for their irresponsibility, the problem will only become worse and worse. And later, when the Eurozone and the U.S. go down the same road as Greece and PR, who will bail us out? The answer is: nobody.MachineGhost wrote:

Greece and Puerto Rico aren't currency issuers and Zimbabwe destroyed its economic productivity with Mugabe's socialist racist anti-colonialist farm grabs.

What is important is net interest on the debt, not the total debt outstanding. Sovereign debt is never paid off; it either defaults if you're not a currency issuer or it is inflated away if you are. The point of no return for the USA will be when the net interest alone takes up all the "unfunded revenues" that go along with all those "unfunded liabilities".

Argentina and Venezuela print their own money. So what? If it's worthless and nobody is willing to accept it, the end result is still the same: bankruptcy. Zimbabwe eventually adopted the U.S. dollar when its currency became worthless. Whose currency will the U.S. adopt when the dollar becomes worthless?

Whose going to accept our Monopoly money when we try to defraud our bondholders by paying our debts with an endlessly inflating currency? Weimar Germany (another currency issuer) got to the point that their multi-trillion deutschmark notes were printed on one side only, because it cost too much in ink to print the multiple zeros on both sides of the paper.

You impress me as an intelligent person, MG, so I am surprised to learn that you are an acolyte of Paul Krugman.

Last edited by goodasgold on Mon Nov 09, 2015 8:26 am, edited 1 time in total.

Re: What if the Congressional crazies fail to raise the debt ceiling?

Stop it with the personal attacks. This forum can be like church sometimes, and a fundamentalist one at that.goodasgold wrote: You impress me as an intelligent person, MG, so I am surprised to learn that you are an acolyte of Paul Krugman.

-

goodasgold

- Executive Member

- Posts: 387

- Joined: Tue Jan 01, 2013 8:19 pm

Re: What if the Congressional crazies fail to raise the debt ceiling?

Dr. Krugman is pleased and impressed, not offended, when he gains a new disciple, so saying someone is a Krugmanite is not a personal attack. If MG is not actually a follower of Paul Krugman and can sustain this disavowal, I would be glad to correct this categorization.ochotona wrote:Stop it with the personal attacks. This forum can be like church sometimes, and a fundamentalist one at that.goodasgold wrote: You impress me as an intelligent person, MG, so I am surprised to learn that you are an acolyte of Paul Krugman.

I am not personally attacking anyone, least of all myself, when I acknowledge being a follower of folks like Milton Friedman, Pete Peterson and David Walker.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: What if the Congressional crazies fail to raise the debt ceiling?

You clearly don't understand what "currency issuer" means.goodasgold wrote: As long as the Eurozone and the U.S. reward Greece and Puerto Rico for their irresponsibility, the problem will only become worse and worse. And later, when the Eurozone and the U.S. go down the same road as Greece and PR, who will bail us out? The answer is: nobody.

You clearly don't understand what "world reserve currency issuer" means.goodasgold wrote: Argentina and Venezuela print their own money. So what? If it's worthless and nobody is willing to accept it, the end result is still the same: bankruptcy. Zimbabwe eventually adopted the U.S. dollar when its currency became worthless. Whose currency will the U.S. adopt when the dollar becomes worthless?

All forms of money inflate. It's a fact of life. There's nothing special about that and it is even required for a positive growth equilibrium due to behavorial biases (just look at the epic failure Japan is). I suggest learning from history about what separates inflation from hyperinflation or non-currency issuer sovereign debt defaults (and stop conflating all three) and then you'll see what apples vs oranges comparisons your examples are. Hint: You're overfocused on what the form of money is and not on underlying reality.goodasgold wrote: Whose going to accept our Monopoly money when we try to defraud our bondholders by paying our debts with an endlessly inflating currency? Weimar Germany (another currency issuer) got to the point that their multi-trillion deutschmark notes were printed on one side only, because it cost too much in ink to print the multiple zeros on both sides of the paper.

I loathe Paul Krugman and rarely read him. But all schools of economic thought have a few empirical real world truths, even though none currently describe operational reality. Don't be ideological. Evolve.You impress me as an intelligent person, MG, so I am surprised to learn that you are an acolyte of Paul Krugman.

Last edited by MachineGhost on Mon Nov 09, 2015 9:24 am, edited 1 time in total.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: What if the Congressional crazies fail to raise the debt ceiling?

That's fine, but they're stuck in pre-1971 era fixed exchange rate monetary system thinking, not current operational reality. So it serves as an ideological drumroll for fiscal conservatives to wring their hands over yet another endless fear like the eternal Chicken Littles that they are. Evolve.goodasgold wrote: I am not personally attacking anyone, least of all myself, when I acknowledge being a follower of folks like Milton Friedman, Pete Peterson and David Walker.

Most of us come to the PP after having been burned by such doom pornsters and losing a fortune on their dystopian vision never materializing. They've been singing their tune over and over ever since 1971. Let me count, that's now 44 years! In fact, the entire decade of the 1970's where the dollar was collapsing into hyperinflationary worthlessness that got to the level of mainstream Boobus thought was all about them. They had their 15 minutes and they were ultimately wrong.

But just in case evolution turns out to be wrong, that's what the gold in the PP is for. It's insurance to tide us over into a new monetary system, not a forecast.

Last edited by MachineGhost on Mon Nov 09, 2015 9:22 am, edited 1 time in total.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

-

goodasgold

- Executive Member

- Posts: 387

- Joined: Tue Jan 01, 2013 8:19 pm

Re: What if the Congressional crazies fail to raise the debt ceiling?

I'm not worried much about current operational reality. It's future operational reality I'm worried about, when the lightbulb goes on and people refuse to buy bonds except at ever-spiraling interest rates, to the point where we cannot possibly pay them back with currency that is worth anything.MachineGhost wrote:That's fine, but they're stuck in pre-1971 era fixed exchange rate monetary system thinking, not current operational reality.goodasgold wrote: I am not personally attacking anyone, least of all myself, when I acknowledge being a follower of folks like Milton Friedman, Pete Peterson and David Walker.

I am glad to see we agree on something, MG. Hallelujah. But during the transition to the new monetary system, it will be bloody indeed, not to mention tragic and chaotic, for the folks who have not invested in the PP portfolio. And what happens when the indignant masses decide to punish the Wicked Rich Folks by confiscating all the gold in safe deposit boxes?MachineGhost wrote: So it serves as an ideological drumroll for fiscal conservatives to wring their hands over yet another endless fear like the eternal Chicken Littles that they are. Evolve.So the present holders of Greek, Venezuelan and Puerto Rican bonds are Chicken Littles?[quote/]

MachineGhost wrote: Most of us come to the PP after having been burned by such doom pornsters and losing a fortune on their dystopian vision never materializing. They've been singing their tune over and over ever since 1971. Let me count, that's now 44 years! In fact, the entire decade of the 1970's where the dollar was collapsing into hyperinflationary worthlessness that got to the level of mainstream Boobus thought was all about them. They had their 15 minutes and they were ultimately wrong.It took a "Chicken Little" like Paul Volcker to impose the tough medicine needed to cure the inflationary death spiral of the 1970s. The longer we wait to cut back on unfunded liabilities, the tougher it will be for the new Volcker to prevent national bankruptcy.[quote/]

MachineGhost wrote: But just in case evolution turns out to be wrong, that's what the gold in the PP is for. It's insurance to tide us over into a new monetary system, not a forecast.

- MachineGhost

- Executive Member

- Posts: 10054

- Joined: Sat Nov 12, 2011 9:31 am

Re: What if the Congressional crazies fail to raise the debt ceiling?

Sigh. A currency issuer cannot ever hard default, so if the currency that the bonds are denominated in become less valuable for whatever reason, so does the real value of the bonds! If yields rise to offset the declining value of the currency, the central bank can just monetize the bonds to keep the yields suppressed. Whereas its more complex to do that in the USA than in Japan which can do it directly, the cause is the same: loss of confidence. Hyperinflation can only exist when economic productivity is destroyed and capital flees in terror. We are "Rome" which collapsed into deflationary irrelevance over hundreds of years. There is no where else for capital to go. The gold market isn't even remotely big enough to handle such capital flows and besides, its no longer money anyway. We have numerous forms of money here and the rule of law to back them up. No other country even compares.goodasgold wrote: I'm not worried much about current operational reality. It's future operational reality I'm worried about, when the lightbulb goes on and people refuse to buy bonds except at ever-spiraling interest rates, to the point where we cannot possibly pay them back with currency that is worth anything.

Greece is not a currency issuer. Even though the citizens voted to say fuck you to the EU and become one, their socialist PM promptly ignored them and stayed under the choking EU yoke of austerity. It's no joke to say people are literally starving in Greece because they're not a currency issuer.goodasgold wrote: So the present holders of Greek, Venezuelan and Puerto Rican bonds are Chicken Littles?

Venezuela is a crony oil socialist basketcase with price controls and a near worthless economy, where people are starving as well. More or less with Argentina except its more crony than socialist.

Puerto Rico is not a currency issuer and it has no productive economic engine. Brain capital flees to the mainland.

If the bondholders (mostly vulture hedge funds) did not understand the above facts before investing in the bonds, they have no one to blame but themselves. Tough titties.

They're called that because they're not real obligations. The government can and will at any time change the terms of these "unfunded liabilities". It's not legally binding debt, except for what is in the SS "lockbox" (i.e. Treasuries).It took a "Chicken Little" like Paul Volcker to impose the tough medicine needed to cure the inflationary death spiral of the 1970s. The longer we wait to cut back on unfunded liabilities, the tougher it will be for the new Volcker to prevent national bankruptcy.

And stop ignoring all the "unfunded revenues" that will come in over the same time frame to match against those "unfunded liabilities" (even though Federal taxes aren't even necessary anymore). But for the pre-1971 thinkers, only maximal pro-growth policies will produce more tax revenues which is why we should elect Trump.

Nor can you compare one year of a cash flow (GDP) to decades of a balance sheet item (debt). Its the debt service that ultimately matters, not the outstanding amount of the debt. We now exist in a debt-based monetary system that requires debt to grow perpetually for the economy to expand. When people need money for an innovative business, the money supply expands by creating it on demand. Its simple and efficient.

Its very unlikely to be bloody for USD asset holders (and less so for PPers). We are in the pole position and dictate the terms. I expect the new world reserve currency will be the IMF's SDR basket. It will reduce transaction costs and facilitate easier trade. Maybe we'll even get a sovereign cryptocurrency out of it?I am glad to see we agree on something, MG. Hallelujah. But during the transition to the new monetary system, it will be bloody indeed, not to mention tragic and chaotic, for the folks who have not invested in the PP portfolio. And what happens when the indignant masses decide to punish the Wicked Rich Folks by confiscating all the gold in safe deposit boxes?

Real estate will be more at risk than gold. It's not portable. It will be taxed into oblivion at worst. Gold is too easy nowadays to monitor and tax (you don't need to confiscate what is not money). You can't even cross borders with it anymore in practical low-risk terms. Buy some Bitcoins, store it on a USB thumb drive and use your stomach or anal cavity if push comes to shove. Point is, diversify your real asset allocation because you never know. The catchet of gold-used-to-be-money will fade over time.

Last edited by MachineGhost on Mon Nov 09, 2015 10:54 am, edited 1 time in total.

"All generous minds have a horror of what are commonly called 'Facts'. They are the brute beasts of the intellectual domain." -- Thomas Hobbes

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

Disclaimer: I am not a broker, dealer, investment advisor, physician, theologian or prophet. I should not be considered as legally permitted to render such advice!

-

goodasgold

- Executive Member

- Posts: 387

- Joined: Tue Jan 01, 2013 8:19 pm

Re: What if the Congressional crazies fail to raise the debt ceiling?

MG, it looks like we are describing alternate realities and/or universes, so this will be my last Message to the World (in this string, at leastMachineGhost wrote:

A currency issuer cannot ever hard default... Greece is not a currency issuer.... Puerto Rico is not a currency issuer... They're.... not real obligations.... Its the debt service that ultimately matters, not the outstanding amount of the debt. We now exist in a debt-based monetary system that requires debt to grow perpetually for the economy to expand.

With all respect, you keep quibbling about hard vs. soft bankruptcies, currency issuing vs. non-currency issuing bankruptcies, the non-reality of bankruptcy for nations that begin spewing out Monopoly money, etc, etc., etc.

The essence of what I am trying to talk about is economic ruin, regardless of how it comes about.

P.S. I can't resist one final word of advice: please do not rush out to buy any of Prof. Krugman's trillion-dollar platinum coins, his proposed miracle solution to stave off national bankruptcy, which he claims can never happen anyway.