meeting your retirement goals with the pp

Moderator: Global Moderator

- mathjak107

- Executive Member

- Posts: 4747

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

meeting your retirement goals with the pp

for those closer to retirement and using the pp , how close to meeting your retirement needs has the pp taken you ?

how did you decide how much you will need ? the old rule of thumb of 80% of your salary is totally inaccurate for lots of reasons.

a retirement budget should be based on spending needs.

so curious how you all feel like you are doing and how did you decide that goal ?

how did you decide how much you will need ? the old rule of thumb of 80% of your salary is totally inaccurate for lots of reasons.

a retirement budget should be based on spending needs.

so curious how you all feel like you are doing and how did you decide that goal ?

- mathjak107

- Executive Member

- Posts: 4747

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: meeting your retirement goals with the pp

i guess i will answer first , although i didn't use the pp .

what i did is add up all our non discretionary bills , the ones we have no say in. then i multiplied that by 2x to come up with a comfortable spending budged that included all other spending.

so hypothetically if my non discretionary bills were 30k i would set a budget of 60k.

i would hen subtract out any social security or pension income so lets say it is 20k. that means you need 40k from savings to start year 1.

if i multiply 40k x 25 i get the fact i would need about 1 million saved and a quick check on the chart of trinity study results says a 50/50 mix of equities and bonds and cash should allow a 40k income inflation adjusted which stands an excellent chance of staying consistent through all the worst conditions we had.

what you don't really want to do is work backwards trying to see what you can support with your savings . you really want to attack it from the expense side.

by having a comfortable non discretionary budget you have room to cut back if we have conditions far worse than ever before.

which is why i am of the opinion that those with little discretionary spending where everything is a need should not be in equities at all -period.

with no where to cut back on they can be in real trouble.

the good thing about working from expenses backwards is like in our case we ended up finding our portfolio could potentially spin off a whole lot more income than our budget called for.

now we have a comfortable amount of slack in the plan for emergencies ,trips and unintended spending .

as far as drawing out the money we will start with the budget amount and each year look at our portfolio balance.

our maximum spending would be 4% of each years actual balance or if markets are down less 5% then we had taken prior , which ever is higher the 4% or the less 5% from last years draw .

so how did you figure your plan ?

what i did is add up all our non discretionary bills , the ones we have no say in. then i multiplied that by 2x to come up with a comfortable spending budged that included all other spending.

so hypothetically if my non discretionary bills were 30k i would set a budget of 60k.

i would hen subtract out any social security or pension income so lets say it is 20k. that means you need 40k from savings to start year 1.

if i multiply 40k x 25 i get the fact i would need about 1 million saved and a quick check on the chart of trinity study results says a 50/50 mix of equities and bonds and cash should allow a 40k income inflation adjusted which stands an excellent chance of staying consistent through all the worst conditions we had.

what you don't really want to do is work backwards trying to see what you can support with your savings . you really want to attack it from the expense side.

by having a comfortable non discretionary budget you have room to cut back if we have conditions far worse than ever before.

which is why i am of the opinion that those with little discretionary spending where everything is a need should not be in equities at all -period.

with no where to cut back on they can be in real trouble.

the good thing about working from expenses backwards is like in our case we ended up finding our portfolio could potentially spin off a whole lot more income than our budget called for.

now we have a comfortable amount of slack in the plan for emergencies ,trips and unintended spending .

as far as drawing out the money we will start with the budget amount and each year look at our portfolio balance.

our maximum spending would be 4% of each years actual balance or if markets are down less 5% then we had taken prior , which ever is higher the 4% or the less 5% from last years draw .

so how did you figure your plan ?

Last edited by mathjak107 on Tue Jul 07, 2015 5:18 am, edited 1 time in total.

- Pointedstick

- Executive Member

- Posts: 8886

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: meeting your retirement goals with the pp

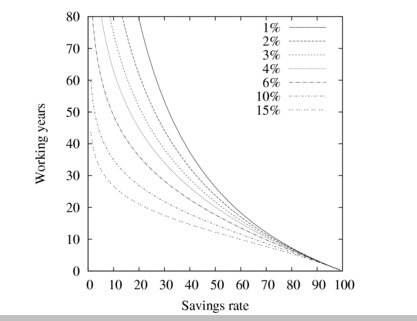

For me it was easy. Maximize savings rate, stabilize yearly expenses, accumulate 25x that much, then withdraw 4% each year. Historically, the PP has supported a 4.7% withdrawal rate without reducing the principal at all. I don't think about social security or end-of-life expenses since I (hopefully) have 40-50 years before those things will start to become important, and I do expect to continue making money after becoming financially independent.

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

- mathjak107

- Executive Member

- Posts: 4747

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: meeting your retirement goals with the pp

a 4.70 % withdrawal rate is very different from a safe withdrawal rate (swr ) saying it supported a 4.7 % withdrawal rate through less than the worst of times would not be accurate if comparing it to a safe withdrawal rate since it couldn't test against the time frames that are the benchmarks for determining what a swr is . meaning 1907 ,1929,1937 , 1966.

those exact time frames are what a safe withdrawal rate references.

without those 4 worst case time frames frames a 60/40 mix can support 6.50% over every other time frame in history. but you have no consideration if things go poorly figured in that rate.

those exact time frames are what a safe withdrawal rate references.

without those 4 worst case time frames frames a 60/40 mix can support 6.50% over every other time frame in history. but you have no consideration if things go poorly figured in that rate.

Last edited by mathjak107 on Tue Jul 07, 2015 10:22 am, edited 1 time in total.

- Pointedstick

- Executive Member

- Posts: 8886

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: meeting your retirement goals with the pp

While it's true that the PP didn't and couldn't exist during those timeframes because gold was coupled to the dollar, it seems to me that we can do a pretty good job of guessing. Those kinds of disasters are where gold and long bonds will shine and cash will save your bacon, allowing you to avoid selling volatile assets at an importune time. You're constantly pointing out that the PP holds too many safety assets and not enough growth assets. It seems silly to then turn around and say that the PP might not work during a time when you really really need safety assets.

I have zero worries about the PP being able to survive those kinds of crises. My worry is your other one: that the PP will miss out on a lot of growth during good times. But you can't have it both ways. The PP isn't going to grow more slowly than a stock-heavy portfolio during prosperity and then fell on its face when the markets crash or inflation picks up or interest rates rise.

I have zero worries about the PP being able to survive those kinds of crises. My worry is your other one: that the PP will miss out on a lot of growth during good times. But you can't have it both ways. The PP isn't going to grow more slowly than a stock-heavy portfolio during prosperity and then fell on its face when the markets crash or inflation picks up or interest rates rise.

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

Re: meeting your retirement goals with the pp

This is incorrect. Since 1972 there have been 14 full 30-year periods. A 60/40 portfolio with a 6.5% WR failed 4 times. I'm sure it's failed many times before that as well.mathjak107 wrote: a 4.70 % withdrawal rate is very different from a safe withdrawal rate (swr ) saying it supported a 4.7 % withdrawal rate through less than the worst of times would not be accurate if comparing it to a safe withdrawal rate since it couldn't test against the time frames that are the benchmarks for determining what a swr is . meaning 1907 ,1929,1937 , 1966.

those exact time frames are what a safe withdrawal rate references.

without those 4 worst case time frames frames a 60/40 mix can support 6.50% over every other time frame in history. but you have no consideration if things go poorly figured in that rate.

Let's put it this way. By my calculations, and while I absolutely do not recommend it, since 1972 the PP has yet to fail a 30-year retirement even with a 5.5% WR. A 60-40 portfolio did 3 times. At a 4% WR, the PP does not have a single retirement period where it lost real principal value after 30 years. A 60/40 portfolio has two over the same timeframe (quite large losses -- about 50%).

It's true that we cannot backtest the PP back to the worst of times for the 60/40 portfolio. But it's also true that in the post-gold-standard monetary regime for which it applies, the PP has been safer than a 60-40 portfolio. Perhaps it would have struggled mightily in 1929. Perhaps it would have flourished. We don't know. How far back you need to backtest a portfolio before you believe it is good enough for your purposes is up to you.

My personal SWR conclusion for the Permanent Portfolio is to stick to 4%. At that rate, it is tremendously stable even over short and mid-term timeframes. Much moreso than a 60-40 portfolio. If 4% is considered safe for 60-40, I'm willing to bet that it's even safer for the PP. And I can pretty much guarantee you'll sleep better than your 60-40 buddies when the markets are struggling.

[img width=500]http://s24.postimg.org/b4ridmzmd/PP_Retirement_10.jpg[/img]

[img width=500]http://s12.postimg.org/z67eqwtwt/60_40_ ... ent_10.jpg[/img]

BTW, pay attention to the line colors. Lighter colors are from more recent time periods. A 60-40 portfolio has been trending poorly for retirees. The PP is a lot more evenly distributed.

(EDIT: I changed the scale on the charts for better direct comparison.)

Last edited by Tyler on Tue Jul 07, 2015 1:48 pm, edited 1 time in total.

Re: meeting your retirement goals with the pp

OK, but... if someone had used the PP as their accumulation phase portfolio, their portfolio size is likely smaller at retirement. So the PP has a higher SWR on a smaller amount. But if we forgot about the SW RATE and go after the SW absolute amount, based on a $10,000 investment made four decades before retirement, probably the 60/40 does not fail more than the PP.

- Pointedstick

- Executive Member

- Posts: 8886

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: meeting your retirement goals with the pp

We've gone over this too. A sane 60/40 investor doesn't keep 100% of his liquid assets in his portfolio during accumulation, while a PP investor can. So the PP investor is likely starting out with a higher sum in the first place.ochotona wrote: OK, but... if someone had used the PP as their accumulation phase portfolio, their portfolio size is likely smaller at retirement. So the PP has a higher SWR on a smaller amount. But if we forgot about the SW RATE and go after the SW absolute amount, based on a $10,000 investment made four decades before retirement, probably the 60/40 does not fail more than the PP.

Last edited by Pointedstick on Tue Jul 07, 2015 11:16 am, edited 1 time in total.

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

Re: meeting your retirement goals with the pp

To answer the original question, I totally agree with Mathjak that one should build their retirement plan based on expenses and not savings. My philosophy is that one should seek the minimum expense level that supplies maximum sustainable real happiness. Then constantly look for ways to eliminate waste.

Two years before we pulled the plug we had a pretty good idea what our future expenses would look like. Our burn rate in Northern California was about 6% and thought we could get to 4% relatively quickly by moving to Texas. In retrospect, the move alone got us there immediately!

But we didn't like guessing, so we found jobs in our retirement city and started living like retirees expense-wise. Smaller house, more walking, cutting the cable -- that kind of thing. Our happiness increased tremendously even as our expenses dropped, but we weren't shy about spending when it truly made us happy. After two years of spending data where we had a great feel for our happy steady-state, our savings had ballooned from 25x expenses to 35x (another benefit of spending less). After leaving work (and learning to really minimize taxes and maximize ACA subsidies), we surprisingly are currently at about 40x expenses. That's a 2.5% WR. That would work with all kinds of portfolios.

At that level, we have tons of buffer up to my 4% cap for unexpected expenses or planned trips or ACA cost changes without ever worrying about money. If we ever start to creep near 4%, I'll start reevaluating things and look for other ways to optimize. High on my list is moving to the mountains in Colorado where the property taxes are much lower than where I am now. Proactive life improvements are way more empowering than reactive portfolio fretting!

Two years before we pulled the plug we had a pretty good idea what our future expenses would look like. Our burn rate in Northern California was about 6% and thought we could get to 4% relatively quickly by moving to Texas. In retrospect, the move alone got us there immediately!

But we didn't like guessing, so we found jobs in our retirement city and started living like retirees expense-wise. Smaller house, more walking, cutting the cable -- that kind of thing. Our happiness increased tremendously even as our expenses dropped, but we weren't shy about spending when it truly made us happy. After two years of spending data where we had a great feel for our happy steady-state, our savings had ballooned from 25x expenses to 35x (another benefit of spending less). After leaving work (and learning to really minimize taxes and maximize ACA subsidies), we surprisingly are currently at about 40x expenses. That's a 2.5% WR. That would work with all kinds of portfolios.

At that level, we have tons of buffer up to my 4% cap for unexpected expenses or planned trips or ACA cost changes without ever worrying about money. If we ever start to creep near 4%, I'll start reevaluating things and look for other ways to optimize. High on my list is moving to the mountains in Colorado where the property taxes are much lower than where I am now. Proactive life improvements are way more empowering than reactive portfolio fretting!

Last edited by Tyler on Tue Jul 07, 2015 11:28 am, edited 1 time in total.

- mathjak107

- Executive Member

- Posts: 4747

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: meeting your retirement goals with the pp

Tyler wrote:This is incorrect. Since 1972 there have been 14 full 30-year periods. A 60/40 portfolio with a 6.5% WR failed 4 times. I'm sure it's failed many times before that as well.mathjak107 wrote: a 4.70 % withdrawal rate is very different from a safe withdrawal rate (swr ) saying it supported a 4.7 % withdrawal rate through less than the worst of times would not be accurate if comparing it to a safe withdrawal rate since it couldn't test against the time frames that are the benchmarks for determining what a swr is . meaning 1907 ,1929,1937 , 1966.

those exact time frames are what a safe withdrawal rate references.

without those 4 worst case time frames frames a 60/40 mix can support 6.50% over every other time frame in history. but you have no consideration if things go poorly figured in that rate.

Let's put it this way. By my calculations, and while I absolutely do not recommend it, since 1972 the PP has yet to fail a 30-year retirement even with a 5.5% WR. A 60-40 portfolio did 3 times. At a 4% WR, the PP does not have a single retirement period where it lost real principal value after 30 years. A 60/40 portfolio has two over the same timeframe (quite large losses -- about 50%).

It's true that we cannot backtest the PP back to the worst of times for the 60/40 portfolio. But it's also true that in the post-gold-standard monetary regime for which it applies, the PP has been safer than a 60-40 portfolio. Perhaps it would have struggled mightily in 1929. Perhaps it would have flourished. We don't know. How far back you need to backtest a portfolio before you believe it is good enough for your purposes is up to you.

My personal SWR conclusion for the Permanent Portfolio is to stick to 4%. At that rate, it is tremendously stable even over short and mid-term timeframes. Much moreso than a 60-40 portfolio. If 4% is considered safe for 60-40, I'm willing to bet that it's even safer for the PP. And I can pretty much guarantee you'll sleep better than your 60-40 buddies when the markets are struggling.

[img width=500]http://s27.postimg.org/kj5ps5j2r/PP_Retirement_10.jpg[/img]

[img width=500]http://s12.postimg.org/z67eqwtwt/60_40_ ... ent_10.jpg[/img]

BTW, pay attention to the line colors. Lighter colors are from more recent time periods. A 60-40 portfolio has been trending poorly for retirees. The PP is a lot more evenly distributed.

the failures were part of the group that retired in 1965-1966 . that is accounted for however you can't go back to 1965-1966 with the pp and that is the problem. I have the exact numbers for the first 15 years which I posted in another thread and they were awful.

not surprisingly though if you go out the full 30 year time frame for those who retired in 1965 -1966 the averages are respectable but it Is the horrible first 15

years that did them in .

you can make no assumption as to what would have happened since the damages were caused by the years leading up to those failures in the 70's. .

Last edited by mathjak107 on Tue Jul 07, 2015 11:35 am, edited 1 time in total.

- mathjak107

- Executive Member

- Posts: 4747

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: meeting your retirement goals with the pp

average safe withdrawal rate when the 4 time frames above were removed is 6.50% .

here is Michael kitce's findings

https://www.kitces.com/blog/what-return ... ased-upon/

here is Michael kitce's findings

https://www.kitces.com/blog/what-return ... ased-upon/

Last edited by mathjak107 on Tue Jul 07, 2015 11:38 am, edited 1 time in total.

Re: meeting your retirement goals with the pp

Dang it -- did it again. I know better than to delete posts.  This one goes right above MJ's

This one goes right above MJ's

By my calculations, a 60-40 portfolio failed at a 6.5% WR in 30-year retirement periods starting in 72, 73, 74, and 77. I can tell you exactly what happened -- inflation.mathjak107 wrote:

the failures were part of the group that retired in 1965-1966 . that is accounted for however you can't go back to 1965-1966 with the pp sand that is the problem.

you can make no assumption as to what would have happened .

Last edited by Tyler on Tue Jul 07, 2015 11:42 am, edited 1 time in total.

Re: meeting your retirement goals with the pp

mathjak107 wrote: average safe withdrawal rate when the 4 time frames above were removed is 6.50% .

- mathjak107

- Executive Member

- Posts: 4747

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: meeting your retirement goals with the pp

did you check out kitce's findings ? I think that is one very very enlightening article

Re: meeting your retirement goals with the pp

If one establishes their needed portfolio size based on expenses, then the issue is not how large the portfolio is at retirement but how long it takes to reach your "number".ochotona wrote: OK, but... if someone had used the PP as their accumulation phase portfolio, their portfolio size is likely smaller at retirement. So the PP has a higher SWR on a smaller amount. But if we forgot about the SW RATE and go after the SW absolute amount, based on a $10,000 investment made four decades before retirement, probably the 60/40 does not fail more than the PP.

Starting from zero and saving $2k/month, a 60-40 portfolio would get you to $1mm (in today's dollars) in 16-24 years. That's an 8-year window, and market dives right before retirement can push it out 8 years. Under the same conditions, the PP hits $1mm in 21-24 years. A 3-year window. So it's true that a 60-40 portfolio could get you there faster than the PP. But they both pretty much guarantee retirement the same year.

So IMHO it may come down to where you are in life. I would have absolutely no problem with a younger investor preferring a 60-40 portfolio for the long haul. It's a perfectly fine way to invest and has a chance for excellent returns. I discovered the PP several years before retirement, and found the lower volatility a godsend for making my own plans. While others stressed about whether markets may dive in their final few years of accumulation, I could predict my exit date pretty accurately within a few months.

Again, note the color distribution.

As an aside, the higher your savings percentage relative to your income, the more irrelevant investment returns are to how fast you reach your goal. My secret to retiring very early honestly had nothing to do with investments. When I saw this chart, I cut the wasteful spending that wasn't making me happy anyway and upped my savings rate to 80%. Even the worst markets couldn't hold me back at that point.

Last edited by Tyler on Tue Jul 07, 2015 12:47 pm, edited 1 time in total.

- mathjak107

- Executive Member

- Posts: 4747

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: meeting your retirement goals with the pp

it really depends on the actual portfolio and the time frame .

as I posted above in my 27 year time frame 10k in the pp was 67k. 10k in the very conservative wellesley income I think was 167k . my own portfolio 10k was 203k . you really can't compare in general terms nor imply amounts.

as you can see in my case we are talking 670k vs over 2 million during the same time frame.

personally I would not use a 60/40 mix through the accumulation stage , only retirement.

as I posted above in my 27 year time frame 10k in the pp was 67k. 10k in the very conservative wellesley income I think was 167k . my own portfolio 10k was 203k . you really can't compare in general terms nor imply amounts.

as you can see in my case we are talking 670k vs over 2 million during the same time frame.

personally I would not use a 60/40 mix through the accumulation stage , only retirement.

Last edited by mathjak107 on Tue Jul 07, 2015 12:18 pm, edited 1 time in total.

Re: meeting your retirement goals with the pp

[img width=500]http://s13.postimg.org/e2azbp4iv/accumulation_VWINX.jpg[/img]mathjak107 wrote: as I posted above in my 27 year time frame 10k in the pp was 67k. 10k in the very conservative wellesley income I think was 167k . my own portfolio 10k was 203k . you really can't compare in general terms nor imply amounts.

- Pointedstick

- Executive Member

- Posts: 8886

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: meeting your retirement goals with the pp

What am I missing, Mathjak? If I go to http://www.firecalc.com and plug in a 6.5% withdrawal rate on a 50/50 or 60/40 portfolio, I get success rates under 50% for all time periods since 1871. At 4%, the success rate goes up to 80-95%.

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

Re: meeting your retirement goals with the pp

Yes. I agree that it's good insight. But it's still very stock-bond centric.mathjak107 wrote: did you check out kitce's findings ? I think that is one very very enlightening article

I do find his perspective that stocks surely will not languish for 15 years to be uncomfortably optimistic for my tastes. Even as recently as 2000, the TSM had a negative annualized real return for 13 years running.

Last edited by Tyler on Tue Jul 07, 2015 2:01 pm, edited 1 time in total.

- Pointedstick

- Executive Member

- Posts: 8886

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: meeting your retirement goals with the pp

You keep using this $67k number but that's based on investing in PRPFX. PRPFX is NOT the PP. It's a crappy earlier version of the PP that is obsolete.mathjak107 wrote: it really depends on the actual portfolio and the time frame .

as I posted above in my 27 year time frame 10k in the pp was 67k. 10k in the very conservative wellesley income I think was 167k . my own portfolio 10k was 203k . you really can't compare in general terms nor imply amounts.

as you can see in my case we are talking 670k vs over 2 million during the same time frame.

personally I would not use a 60/40 mix through the accumulation stage , only retirement.

Your own returns were admirable, but, as has been said, were a product of great timing. In another thread, you admitted that your type of portfolio would have made only 5-6% a year for the last 15 years, and the PP would have beaten it. You gambled on better returns than the PP and won. Good for you! But people who have taken that same gamble anytime in the last decade and a half have not won, and for their trouble, they've gotten nothing but more stress and volatility. Those downsides are only irrelevant if you have many years left before retirement and are not stressed out by volatility or lousy returns. That profile fits very few of us here.

Last edited by Pointedstick on Tue Jul 07, 2015 12:48 pm, edited 1 time in total.

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

- mathjak107

- Executive Member

- Posts: 4747

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: meeting your retirement goals with the pp

nope , in another thread I forgot who ran the actual numbers for me but that was for the 4 part diy.

I did say above the results will depend on your own time frame and exact portfolio. as always your own results are what counts.

the last 15 years have been a pretty rare exception for the stock markets. I do not think there are many 15 year periods that returned under 2% real return like we had with 2 back to back recessions.

I did say above the results will depend on your own time frame and exact portfolio. as always your own results are what counts.

the last 15 years have been a pretty rare exception for the stock markets. I do not think there are many 15 year periods that returned under 2% real return like we had with 2 back to back recessions.

Last edited by mathjak107 on Tue Jul 07, 2015 1:14 pm, edited 1 time in total.

- Pointedstick

- Executive Member

- Posts: 8886

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: meeting your retirement goals with the pp

Remind me again what your timeframe was? We can get a definitive answer using http://www.peaktotrough.com/hbpp.cgi

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

- mathjak107

- Executive Member

- Posts: 4747

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: meeting your retirement goals with the pp

I started in 1987

- Pointedstick

- Executive Member

- Posts: 8886

- Joined: Tue Apr 17, 2012 9:21 pm

- Contact:

Re: meeting your retirement goals with the pp

Okay, so January 1st, 1987 to today with the PP = $81,922. Clearly you're right that that's less than 200-something K. But you have to admit that the period from 1987-1999 was ridiculously good for stocks. Going all in during that time was a fantastic decision, but doing so anytime in the past 15 years… not so much.

Human behavior is economic behavior. The particulars may vary, but competition for limited resources remains a constant.

- CEO Nwabudike Morgan

- CEO Nwabudike Morgan

- mathjak107

- Executive Member

- Posts: 4747

- Joined: Fri Jun 19, 2015 2:54 am

- Location: bayside queens ny

- Contact:

Re: meeting your retirement goals with the pp

the problem was , for most americans the time leading up to that time frame was one of the worst. it was near impossible to save a dime with the high inflation and poor markets . don't forget 401k's didn't even exist. it was all well and good the party was here but few had money.

but isn't that typical of life ha ha ha

but isn't that typical of life ha ha ha