Tactical Asset Allocation + HBPP an intriguing combo

Moderator: Global Moderator

Re: Tactical Asset Allocation + HBPP an intriguing combo

Well I think doing anything like this is really about trying to hedge on the unknown. That’s the whole point. The method behind 3-6-12 is nothing more complex than doubling the prior and with a pinch of human tendencies to trade off these periodicities.

Tax efficiency aside...if you are trading this system you have to pay attention once a month anyway so the 5mins extra to make the trade doesn’t seem to be too onerous.

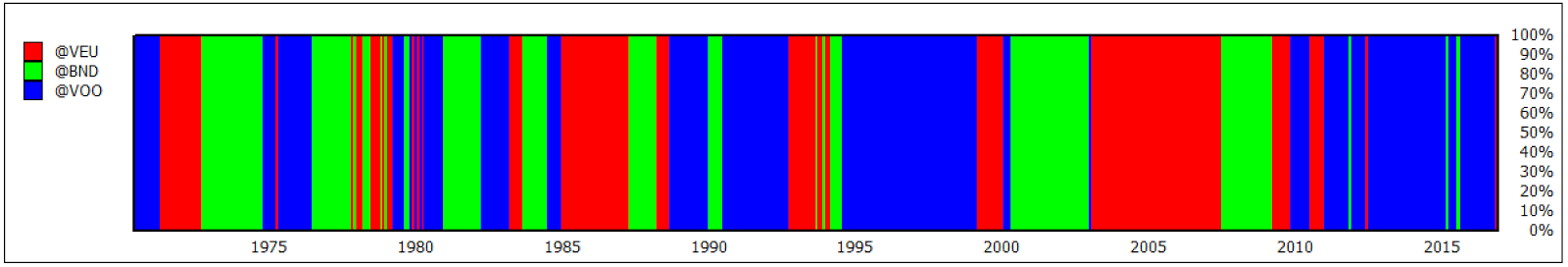

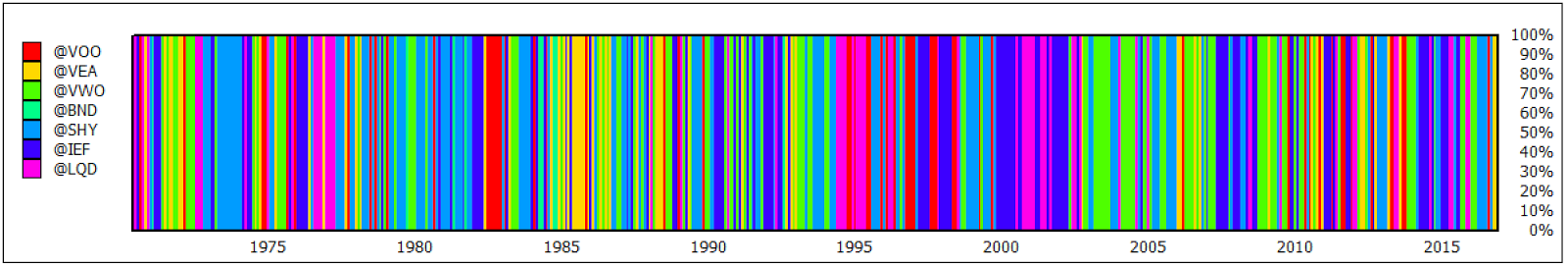

If you look closely at the dates of relative outperformance you will see a distinct pattern that I’ve posted about a couple of times here or elsewhere on the board.

Tax efficiency aside...if you are trading this system you have to pay attention once a month anyway so the 5mins extra to make the trade doesn’t seem to be too onerous.

If you look closely at the dates of relative outperformance you will see a distinct pattern that I’ve posted about a couple of times here or elsewhere on the board.

Re: Tactical Asset Allocation + HBPP an intriguing combo

Ahem sir, this the VP forum. Yes, we're pretty damned funny aren't we. We'll figure it all out by end of month, for sure!

- InsuranceGuy

- Executive Member

- Posts: 425

- Joined: Sun Mar 29, 2015 1:44 pm

Re: Tactical Asset Allocation + HBPP an intriguing combo

[deleted]

Last edited by InsuranceGuy on Mon Mar 08, 2021 6:19 pm, edited 1 time in total.

Re: Tactical Asset Allocation + HBPP an intriguing combo

There is a VAA-P4, not too many assets to trade, sort of a fast, twitchy GEM. Trades a lot. If you had 24 trades a year the friction could be nearly 1% off of your return. 24 * 0.03%. that's not at all funny. That's like giving it up to the ETF providers. Nice theoretical result, tough to do in reality.InsuranceGuy wrote: ↑Sat Feb 16, 2019 10:10 pm It seems like if tax efficiency is not an issue, why not move to DAA(Defensive)/PAA(Protective)/VAA(Vigilant) or other more reactive and trade heavy method that further reduces drawdowns? I also saw AllocateSmartly has a "Meta" strategy that combines several TAA strategies here:https://allocatesmartly.com/meta-strate ... trategies/.

IG

GEM trades

VAA-P4 trades

Last edited by ochotona on Mon Feb 18, 2019 11:19 am, edited 2 times in total.

Re: Tactical Asset Allocation + HBPP an intriguing combo

More pfutzing around. I noticed on Portfoliovisualizers that the 2 and 10 month moving average cross on the S&P500, like on Vanguard VFINX, works very similarly but slightly better than GEM. Backtests to 1987. Also infrequent trades. Your classic "Golden Cross and Death Cross".

NO ONE avoided 1987, that was a cluster****.

Maybe trade 1/2 the portfolio GEM, 1/2 with 2/10 mo MA cross. That's what AlphaArchitect does, but they use the 10 month MA cross itself, not the 2/10 cross itself. The 2/10 cross is better than 10 month MA cross. It gets back to what I was saying... noise cancellation.

How many days until March? Pugchief, at least we're all sitting here in agreement, almost all of the TAA portfolios are in bonds now. No rules have been ignored yet. We're just wondering how to proceed on March 1.

We build the plane as it flies.

NO ONE avoided 1987, that was a cluster****.

Maybe trade 1/2 the portfolio GEM, 1/2 with 2/10 mo MA cross. That's what AlphaArchitect does, but they use the 10 month MA cross itself, not the 2/10 cross itself. The 2/10 cross is better than 10 month MA cross. It gets back to what I was saying... noise cancellation.

How many days until March? Pugchief, at least we're all sitting here in agreement, almost all of the TAA portfolios are in bonds now. No rules have been ignored yet. We're just wondering how to proceed on March 1.

We build the plane as it flies.

Re: Tactical Asset Allocation + HBPP an intriguing combo

A 1000x no. You have rules or you don't.

If you don't have rules you will live by, then just do whatever you feel like doing which is totally ok on an individual freedom level. Just don't expect any backtesting you have done to have any relevance whatsoever to what it is you are doing.

There are an infinite number of things that could be different in the future and likely will be different. What backtesting will do for you is tell you what behavior you can expect under what conditions.

- Kriegsspiel

- Executive Member

- Posts: 4052

- Joined: Sun Sep 16, 2012 5:28 pm

Re: Tactical Asset Allocation + HBPP an intriguing combo

I get what you're saying but I'm pretty sure 1987 is when Taleb's trade paid off and he was a millionaire all of a sudden.

You there, Ephialtes. May you live forever.

Re: Tactical Asset Allocation + HBPP an intriguing combo

My plan for end of month:

Trade 1/2 of portfolio with GEM 12. Trade 1/2 of portfolio with 2/10 mo moving average crossovers ("Golden Cross", "Death Cross").

Why 2/10 MA Cross? It works really well, about the same as GEM 12 from 1987 to now. AlphaArchitect trades 1/2 12-month lookback, and 1/2 200 day MA. But 200 day MA is a much poorer choice than 2/10 MA Cross, when you test them on PortfolioVisualizer.

You guys have shown that Relative Momentum 3 6 12 is better for selecting between US and International equities. But using Vanguard SP500 VFINX fund back to 1987, the case hasn't been made to me that multiple lookbacks are better for Absolute Momentum (the risk switch). They looked better when I was using SWPPX back to 1999, but adding more data negates that. I wish I had more data. There is some fragility, luck, instability, noise, call it what you will, in which case I think it's wise to invoke Occam's Razor and do the simpler thing, which is what Gary is encouraging... KISS. But I mind less about fragility since 1/2 of the trendfollowing will be done using a completely different methods, the MA crosses. I think this kind of diversification will be good.

And my trendfollowing exposure is being limited by my overall asset allocation view, which is quite conservative. 40% equities max, even if trendfollowed. So 20% to GEM, 20% to MA Crosses. I recently found that Ned Davis' monthly reports also point risk-averse investors to 40% equities at this time (40% - 70% is their possible range). I also took a survey the results of which pointed me to 40%. So I think the construction is correct. 40% trend, 10% gold, 10% cash, 40% bonds.

Trade 1/2 of portfolio with GEM 12. Trade 1/2 of portfolio with 2/10 mo moving average crossovers ("Golden Cross", "Death Cross").

Why 2/10 MA Cross? It works really well, about the same as GEM 12 from 1987 to now. AlphaArchitect trades 1/2 12-month lookback, and 1/2 200 day MA. But 200 day MA is a much poorer choice than 2/10 MA Cross, when you test them on PortfolioVisualizer.

You guys have shown that Relative Momentum 3 6 12 is better for selecting between US and International equities. But using Vanguard SP500 VFINX fund back to 1987, the case hasn't been made to me that multiple lookbacks are better for Absolute Momentum (the risk switch). They looked better when I was using SWPPX back to 1999, but adding more data negates that. I wish I had more data. There is some fragility, luck, instability, noise, call it what you will, in which case I think it's wise to invoke Occam's Razor and do the simpler thing, which is what Gary is encouraging... KISS. But I mind less about fragility since 1/2 of the trendfollowing will be done using a completely different methods, the MA crosses. I think this kind of diversification will be good.

And my trendfollowing exposure is being limited by my overall asset allocation view, which is quite conservative. 40% equities max, even if trendfollowed. So 20% to GEM, 20% to MA Crosses. I recently found that Ned Davis' monthly reports also point risk-averse investors to 40% equities at this time (40% - 70% is their possible range). I also took a survey the results of which pointed me to 40%. So I think the construction is correct. 40% trend, 10% gold, 10% cash, 40% bonds.

Re: Tactical Asset Allocation + HBPP an intriguing combo

GEM has another challenge. All of these investment geniuses on at the various wirehouses put in their targets for the S&P500 for the end of 2019, and the average of their sixteen prognoses was... ta-da! Simply the all time high. Was published on CNBC on 1/16/19.

But if GEM does not climb steadily to it's all time high by the end of September, it won't even stay invested. Things get easier by end of October, due to 12 month lookback. We all know that wirehouse gurus are usually overly optimistic; they're talking their book. So the S&P has to do better than the wirehouse chimps think it will do, and 90 days before they say it will do it. A challenge!

But if GEM does not climb steadily to it's all time high by the end of September, it won't even stay invested. Things get easier by end of October, due to 12 month lookback. We all know that wirehouse gurus are usually overly optimistic; they're talking their book. So the S&P has to do better than the wirehouse chimps think it will do, and 90 days before they say it will do it. A challenge!

Re: Tactical Asset Allocation + HBPP an intriguing combo

Fantastic trendfollowing podcast by Meb Faber and his guest -

https://mebfaber.com/2019/02/27/episode ... pt-or-die/

Marty summarizes all of the difficulties this strategy has had in 2018, and puts them in perspective. My biggest take-away is there are periods of time, like 2018, when the volatility is go huge that trendfollowing just doesn't work. So if you know it's not going to anymore why do it? It will come back eventually.

Exactly what has been top of my mind. So the what do you do? Maybe something to do is basically do what the HBPP does... no bets on the future... go to a 25% equity position and hold there until the lookbacks aren't so whacked up by past volatility. You get to participate some, maybe only 1/2 or 1/3 what you'd normally do, but some. And then you only take 1/4 the hit if you really get whacked again, compared to the 100% trend portfolio. He did say he thought trends were starting to re-establish lately, but the very large volatility events in a sigle year basically wrecked every trendfollower in the industry.

https://mebfaber.com/2019/02/27/episode ... pt-or-die/

Marty summarizes all of the difficulties this strategy has had in 2018, and puts them in perspective. My biggest take-away is there are periods of time, like 2018, when the volatility is go huge that trendfollowing just doesn't work. So if you know it's not going to anymore why do it? It will come back eventually.

Exactly what has been top of my mind. So the what do you do? Maybe something to do is basically do what the HBPP does... no bets on the future... go to a 25% equity position and hold there until the lookbacks aren't so whacked up by past volatility. You get to participate some, maybe only 1/2 or 1/3 what you'd normally do, but some. And then you only take 1/4 the hit if you really get whacked again, compared to the 100% trend portfolio. He did say he thought trends were starting to re-establish lately, but the very large volatility events in a sigle year basically wrecked every trendfollower in the industry.

Re: Tactical Asset Allocation + HBPP an intriguing combo

GEM is back into S&P 500 US Stocks for March 2019

https://investingforaliving.us/antonacc ... ortfolios/

I found some really pertinent and timely info in the Economic Pulse end of February newsletter which came out today, also at Investing for a Living, so I'm not using the GEM signals at this time.

https://investingforaliving.us/antonacc ... ortfolios/

I found some really pertinent and timely info in the Economic Pulse end of February newsletter which came out today, also at Investing for a Living, so I'm not using the GEM signals at this time.

-

thisisallen

- Senior Member

- Posts: 126

- Joined: Sat Sep 24, 2016 5:39 pm

- Location: NJ and India

Re: Tactical Asset Allocation + HBPP an intriguing combo

Seems that the machines are struggling to keep pace with the changes in momentum.

https://www.bloomberg.com/news/articles ... ow-failing

https://www.bloomberg.com/news/articles ... ow-failing

- buddtholomew

- Executive Member

- Posts: 2464

- Joined: Fri May 21, 2010 4:16 pm

Re: Tactical Asset Allocation + HBPP an intriguing combo

I thought it was me who didn’t understand..ochotona wrote: ↑Thu Feb 28, 2019 6:09 pm GEM is back into S&P 500 US Stocks for March 2019

https://investingforaliving.us/antonacc ... ortfolios/

I found some really pertinent and timely info in the Economic Pulse end of February newsletter which came out today, also at Investing for a Living, so I'm not using the GEM signals at this time.

Now that GEM got you out -20% and you have missed basically the entire recovery + 20%, GEM has you back in to the SP500. Glad you’re looking elsewhere because that’s 40% in my book.

Re: Tactical Asset Allocation + HBPP an intriguing combo

buddtholomew wrote: ↑Fri Mar 01, 2019 2:02 pmI thought it was me who didn’t understand..ochotona wrote: ↑Thu Feb 28, 2019 6:09 pm GEM is back into S&P 500 US Stocks for March 2019

https://investingforaliving.us/antonacc ... ortfolios/

I found some really pertinent and timely info in the Economic Pulse end of February newsletter which came out today, also at Investing for a Living, so I'm not using the GEM signals at this time.

Now that GEM got you out -20% and you have missed basically the entire recovery + 20%, GEM has you back in to the SP500. Glad you’re looking elsewhere because that’s 40% in my book.

I'd be foolish to judge the performance of GEM or SPY-COMP, DM-COMP based on the last trade. That would be utter folly. Say, aren't you saying the same kinds of things on another thread here? Don't you have more interesting places to be spending your time than here?

Check in with us after the next bear market. 70/30, GEM, SPY-COMP, DM-COMP, and HBPP are all listed here. Performance values going back to 1973 do not lie.

- buddtholomew

- Executive Member

- Posts: 2464

- Joined: Fri May 21, 2010 4:16 pm

Re: Tactical Asset Allocation + HBPP an intriguing combo

Just opening peoples eyes to the folly of all these investing strategies. I am checking in with you after the last bear market since you sat through it you should know. GEM nor the PP did crap.ochotona wrote: ↑Fri Mar 01, 2019 2:09 pmbuddtholomew wrote: ↑Fri Mar 01, 2019 2:02 pmI thought it was me who didn’t understand..ochotona wrote: ↑Thu Feb 28, 2019 6:09 pm GEM is back into S&P 500 US Stocks for March 2019

https://investingforaliving.us/antonacc ... ortfolios/

I found some really pertinent and timely info in the Economic Pulse end of February newsletter which came out today, also at Investing for a Living, so I'm not using the GEM signals at this time.

Now that GEM got you out -20% and you have missed basically the entire recovery + 20%, GEM has you back in to the SP500. Glad you’re looking elsewhere because that’s 40% in my book.

I'd be foolish to judge the performance of GEM or SPY-COMP, DM-COMP based on the last trade. That would be utter folly. Say, aren't you saying the same kinds of things on another thread here? Don't you have more interesting places to be spending your time than here?

Check in with us after the next bear market. 70/30, GEM, SPY-COMP, DM-COMP, and HBPP are all listed here. Performance values going back to 1973 do not lie.

Re: Tactical Asset Allocation + HBPP an intriguing combo

"the folly of all of these investing strategies" - so 70/30 is not an investing strategy? Taking your meds today, mate?buddtholomew wrote: ↑Fri Mar 01, 2019 2:13 pm Just opening peoples eyes to the folly of all these investing strategies. I am checking in with you after the last bear market since you sat through it you should know. GEM nor the PP did crap.

Every strategy has it's time in the sun. They shine most brightly at the end, when things are as good as they can be. If I had been in GEM since my early days of investing, I'd be retired by now, that's a fact. I found it after Antonacci's book came out.

- buddtholomew

- Executive Member

- Posts: 2464

- Joined: Fri May 21, 2010 4:16 pm

Re: Tactical Asset Allocation + HBPP an intriguing combo

The fact is you lost 20% on the upside and 20% on the downside. I on the other hand did not. So you can evaluate your GEM all you want. 70/30 stocks/bonds is conventional, your guessing and hoping is an exercise in futility. Good luck to you and I hope you end up retiring.ochotona wrote: ↑Fri Mar 01, 2019 2:17 pm"the folly of all of these investing strategies" - so 70/30 is not an investing strategy? Taking your meds today, mate?buddtholomew wrote: ↑Fri Mar 01, 2019 2:13 pm Just opening peoples eyes to the folly of all these investing strategies. I am checking in with you after the last bear market since you sat through it you should know. GEM nor the PP did crap.

Every strategy has it's time in the sun. They shine most brightly at the end, when things are as good as they can be. If I had been in GEM since my early days of investing, I'd be retired by now, that's a fact. I found it after Antonacci's book came out.

Re: Tactical Asset Allocation + HBPP an intriguing combo

Budd,

Rather than engage in an ad hominem argument, why don’t you tell us WHY you think that the PP has hit this stretch of underperformance? Do you think it is the result of unprecedented Zero Interest Rate Policy (ZIRP)? Or perhaps something else?

Rather than engage in an ad hominem argument, why don’t you tell us WHY you think that the PP has hit this stretch of underperformance? Do you think it is the result of unprecedented Zero Interest Rate Policy (ZIRP)? Or perhaps something else?

“Groucho Marx wrote:

A stock trader asked him, "Groucho, where do you put all your money?" Groucho was said to have replied, "In Treasury bonds", and the trader said, "You can't make much money on those." Groucho said, "You can if you have enough of them!"

A stock trader asked him, "Groucho, where do you put all your money?" Groucho was said to have replied, "In Treasury bonds", and the trader said, "You can't make much money on those." Groucho said, "You can if you have enough of them!"

- buddtholomew

- Executive Member

- Posts: 2464

- Joined: Fri May 21, 2010 4:16 pm

Re: Tactical Asset Allocation + HBPP an intriguing combo

I have not compared previous PP performance to the current decade and therefore don’t know whether it is under-performing, out-performing or on par with historical returns. What I have witnessed and posted about is the sell-off in Gold and LTT’s when the crisis doesn’t materialize. I have sold down these assets to cash as stocks rebounded in January and will buy into the equity decline with these funds when a pull-back occurs. What I will not do is stand idly by and watch gains in gold and treasuries evaporate. I no longer have faith that these assets will counteract any declines in stocks. If they do, it’s a bonus but I will be a buyer of equity during a decline. That I am sure of.

Re: Tactical Asset Allocation + HBPP an intriguing combo

I love the "ignore list" feature

- buddtholomew

- Executive Member

- Posts: 2464

- Joined: Fri May 21, 2010 4:16 pm

Re: Tactical Asset Allocation + HBPP an intriguing combo

I appreciate the high road more than I can say.buddtholomew wrote: ↑Mon Mar 04, 2019 8:05 pmXan, what’s this?

I apologize on the forum and this is the response.

I will take the high road here although every once of my being says otherwise.

But I really dislike being dragged into things like this. I don't really like being a moderator, but have been forced into it. If every thread turns into a referendum on your presence, Budd, then I'm afraid you're going to lose, just for practical reasons. So it's probably in your interest to keep that from happening.

I'll grant that ochotona's comment was not terribly polite, but it didn't really imply anything other than that he's heard what you have to say and doesn't need to hear it again.

There was another prolific poster here who got relegated to certain sections of the forum because he would turn every conversation into a debate about the same topic, over and over. As I recall, he understood, and continued to contribute in his allocated areas. (Haven't seen him lately, though, hope he's okay.) I really hope this doesn't come to that, but maybe it could be good for everyone?

Please keep on taking that high road, Budd. It'll keep getting easier: not only will practice help, but the less you react the calmer everyone else will get.

Now, back to your regularly scheduled "Tactical Asset Allocation + HBPP" discussion!

Re: Tactical Asset Allocation + HBPP an intriguing combo

Wow, folks are getting feisty on the board.

So how about some live trading data 100% for reals and all that.

I have 5 retirement accounts that trade DM with the an account relook once every five weeks. In other words, I don't trade them all by looking at the return stats on the last day of the month and hitting the trade button on all five accounts. My Excel XIRR returns at the end of 2018 were -7.32, -5.42, -4.36, - 0.91, +5.44%. That's an average of -2.54% and a 12% points range in outcomes! This means I beat a 100% buy and hold of the SPY by a little under 2% points. Thus far in 2019 I have a range of .29 to 2.64 for and average of +1.81% and I am behind the SPY by a little over 6% points.

A couple of points here...

1. Nothing remotely close to a 40% loss.

2. Picking the peak, the bottom and "today" to derive the DD and rebound stats is irrelevant unless you bought at the peak, sold at the bottom and sold again "today". The only thing that matters is what your system timing signals were and what you actually did with those signals. All that motion in between is known as noise.

3. What happened for my systems was they started rotating out late October and I was pretty much out by the end of November and then they started rotating back in mid-Feb.

4. All one should ever expect from a trend system like DM are the following things.

a. To lose slightly if not significantly to the US market when the US market is dominant

b. To beat the US market significantly during a serious draw down via cutting some of the left tail off

c. To beat the US market when foreign markets are dominant

d. To win or lose slightly to significantly if nothing is trending well (totally depends on whipsaw severity or random timing luck)

e. Hmmm...there's a lot of time when you can expect NOT to beat the US market

Now I've posted on this next item either in this thread or elsewhere, but when it comes to my own money I do my home work which involves data procurement and software code writing for investment systems of interest (or borrowing and adapting). My personal opinion is that if you are going to trade something similar to DM you need to diversify both in terms of trading dates and lookback lengths. There is a million ways you can diversify, but it's obvious in the data you should diversify and most professionally managed trend systems diversify.

If you spend enough time doing your own number crunching and backtesting you come to realize that what "works" in terms of specific parameters is never stationary, you really want to see something that is at least statistically sound and has a good theoretical basis for working. You give up all hope of thinking you have a clue as to what the performance is going to be in the future and inevitably it is lower than whatever you backtested. You come to realize that the most significant thing going forward is whatever future market performance is going to be and none of us know that. After that, you simply seek to understand how a system is going to perform in various market conditions and your actual results are going to be whatever the market gods have in store for us.

One could have serious debate as to whether a young person should do something like DM or just buy and hold some allocation. You can make a great case for either and the right answer is whatever a person would stick to. Once you get older and have to worry about draw downs and withdrawal sequence, I think the scale tips in favor of something (anything) that reliably cuts the left tail movements. There are various ways to mitigate left tails and momentum happens to be a pretty option if that is a feature you need or want.

So how about some live trading data 100% for reals and all that.

I have 5 retirement accounts that trade DM with the an account relook once every five weeks. In other words, I don't trade them all by looking at the return stats on the last day of the month and hitting the trade button on all five accounts. My Excel XIRR returns at the end of 2018 were -7.32, -5.42, -4.36, - 0.91, +5.44%. That's an average of -2.54% and a 12% points range in outcomes! This means I beat a 100% buy and hold of the SPY by a little under 2% points. Thus far in 2019 I have a range of .29 to 2.64 for and average of +1.81% and I am behind the SPY by a little over 6% points.

A couple of points here...

1. Nothing remotely close to a 40% loss.

2. Picking the peak, the bottom and "today" to derive the DD and rebound stats is irrelevant unless you bought at the peak, sold at the bottom and sold again "today". The only thing that matters is what your system timing signals were and what you actually did with those signals. All that motion in between is known as noise.

3. What happened for my systems was they started rotating out late October and I was pretty much out by the end of November and then they started rotating back in mid-Feb.

4. All one should ever expect from a trend system like DM are the following things.

a. To lose slightly if not significantly to the US market when the US market is dominant

b. To beat the US market significantly during a serious draw down via cutting some of the left tail off

c. To beat the US market when foreign markets are dominant

d. To win or lose slightly to significantly if nothing is trending well (totally depends on whipsaw severity or random timing luck)

e. Hmmm...there's a lot of time when you can expect NOT to beat the US market

Now I've posted on this next item either in this thread or elsewhere, but when it comes to my own money I do my home work which involves data procurement and software code writing for investment systems of interest (or borrowing and adapting). My personal opinion is that if you are going to trade something similar to DM you need to diversify both in terms of trading dates and lookback lengths. There is a million ways you can diversify, but it's obvious in the data you should diversify and most professionally managed trend systems diversify.

If you spend enough time doing your own number crunching and backtesting you come to realize that what "works" in terms of specific parameters is never stationary, you really want to see something that is at least statistically sound and has a good theoretical basis for working. You give up all hope of thinking you have a clue as to what the performance is going to be in the future and inevitably it is lower than whatever you backtested. You come to realize that the most significant thing going forward is whatever future market performance is going to be and none of us know that. After that, you simply seek to understand how a system is going to perform in various market conditions and your actual results are going to be whatever the market gods have in store for us.

One could have serious debate as to whether a young person should do something like DM or just buy and hold some allocation. You can make a great case for either and the right answer is whatever a person would stick to. Once you get older and have to worry about draw downs and withdrawal sequence, I think the scale tips in favor of something (anything) that reliably cuts the left tail movements. There are various ways to mitigate left tails and momentum happens to be a pretty option if that is a feature you need or want.

- buddtholomew

- Executive Member

- Posts: 2464

- Joined: Fri May 21, 2010 4:16 pm

Re: Tactical Asset Allocation + HBPP an intriguing combo

It was a passive-aggressive comment from Ochotona and that’s fine I really don’t care. AGAIN, no biggie if I am banned from this forum (actually welcome it to close this chapter in my life). At least I own all 4 assets which is more than I can say for many (if not most) of those on this site. Good luck to you all and goodbye. I’ll miss a handful of you but the rest would not give the time of day if I met you on the street.Xan wrote: ↑Mon Mar 04, 2019 9:17 pmI appreciate the high road more than I can say.buddtholomew wrote: ↑Mon Mar 04, 2019 8:05 pmXan, what’s this?

I apologize on the forum and this is the response.

I will take the high road here although every once of my being says otherwise.

But I really dislike being dragged into things like this. I don't really like being a moderator, but have been forced into it. If every thread turns into a referendum on your presence, Budd, then I'm afraid you're going to lose, just for practical reasons. So it's probably in your interest to keep that from happening.

I'll grant that ochotona's comment was not terribly polite, but it didn't really imply anything other than that he's heard what you have to say and doesn't need to hear it again.

There was another prolific poster here who got relegated to certain sections of the forum because he would turn every conversation into a debate about the same topic, over and over. As I recall, he understood, and continued to contribute in his allocated areas. (Haven't seen him lately, though, hope he's okay.) I really hope this doesn't come to that, but maybe it could be good for everyone?

Please keep on taking that high road, Budd. It'll keep getting easier: not only will practice help, but the less you react the calmer everyone else will get.

Now, back to your regularly scheduled "Tactical Asset Allocation + HBPP" discussion!

Re: Tactical Asset Allocation + HBPP an intriguing combo

Agree 100% KBG. DM is meant to reduce the left tail and reduce the extreme timing luck of buy and hold into a set of different timing luck problems, hopefully ones that are easier to live with. That's about it. It's not magic, not a miracle, and it has side effects.