Page 1 of 1

Portfolio Moving Average

Posted: Fri Dec 02, 2016 10:40 am

by slk23

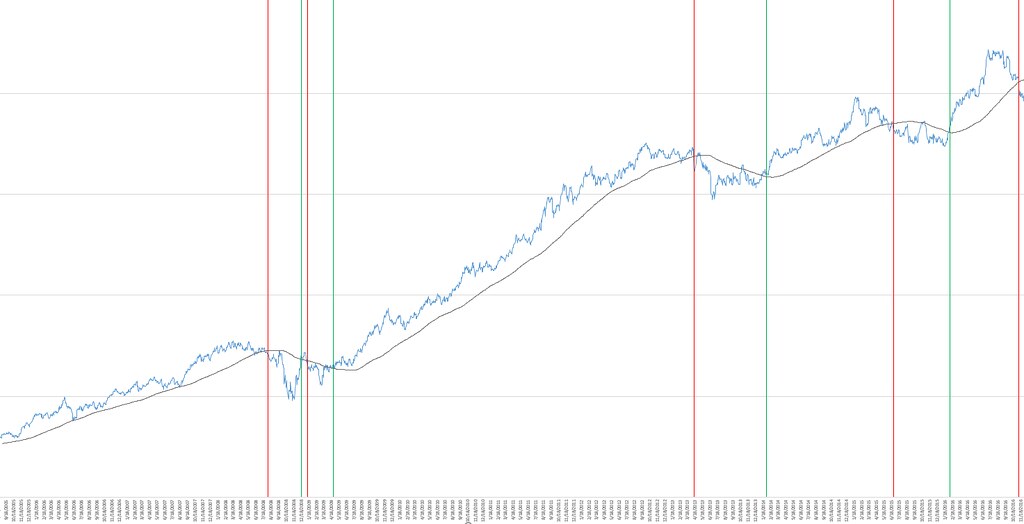

I know moving averages and timing have been discussed with regard to the individual components in a portfolio, but has anyone experimented with an entire portfolio's MA? For example, here's a portfolio composed of equal parts stocks (VTI), gold (GLD), and long term treasuries (TLT). It's indexed so each day is the average of the components' changes which eliminates rebalancing.

When a 200 day simple moving average is applied looks to me like there are fairly clear entry and exit points (green and red lines). I used a simple rule: long when the portfolio index is at least 1% above the 200MA and go to cash when it's 1% under the 200MA. Using this very basic system drawdowns are reduced (especially 'drawdown vs. start'), making it easier to cope with down periods. That might be especially appealing if using a leveraged portfolio.

One thing I notice is that each of three previous periods below the 200MA lasted approx. 6 months. That suggests to me that we may have to wait until next spring before the PP gets back on an upward trajectory.

Nov. 18, 2004 to Dec. 1, 2016:

Re: Portfolio Moving Average

Posted: Fri Dec 02, 2016 12:45 pm

by slk23

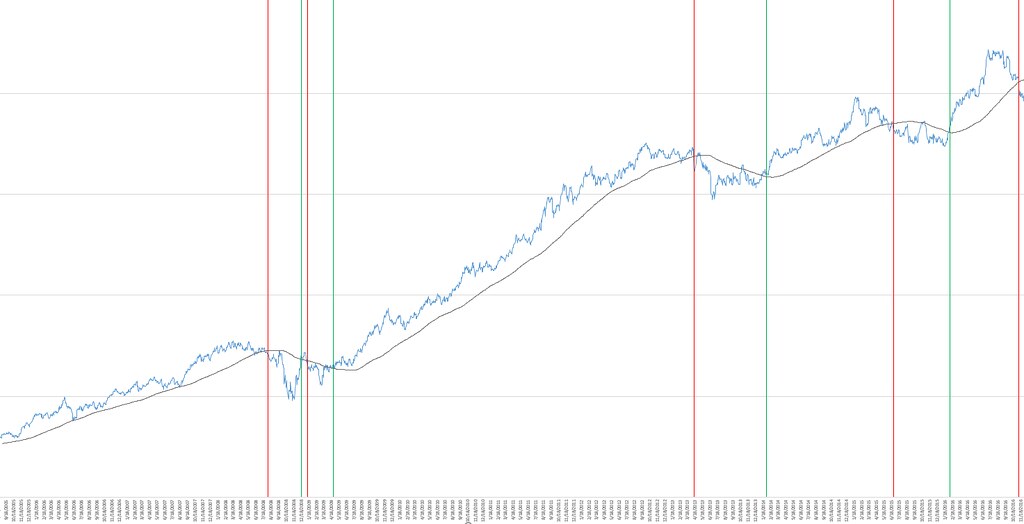

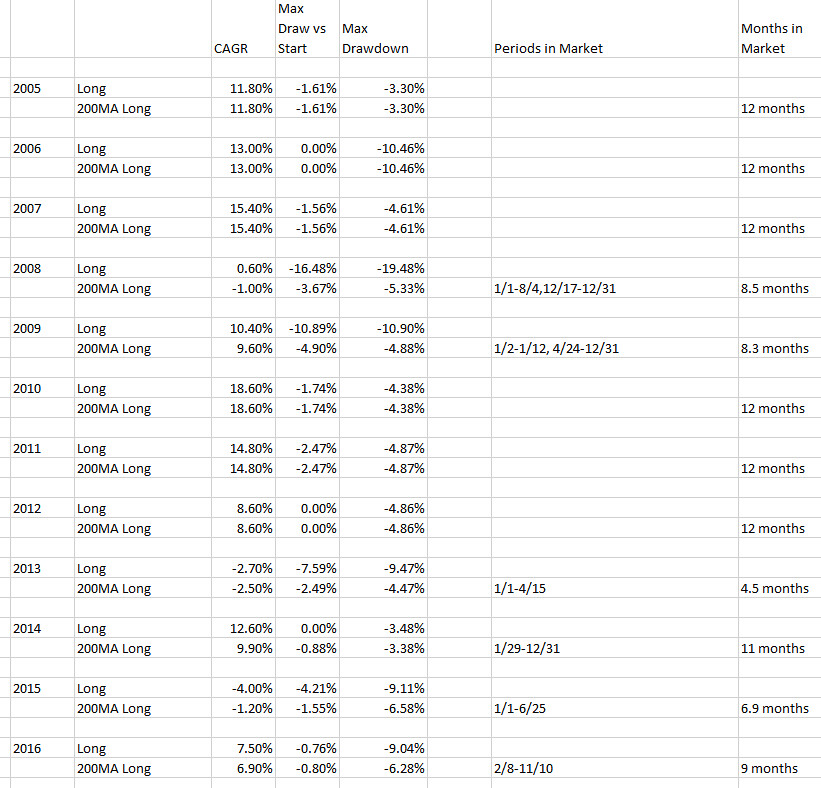

Comparing buy and hold ("Long") with the 200MA long/all cash system ("200MA Long"). Note the CAGR and Max Drawdown vs. Start figures:

Re: Portfolio Moving Average

Posted: Fri Dec 02, 2016 5:18 pm

by modeljc

How much did you make on Paper? vs, no taxes, no commisions and good fills?

Re: Portfolio Moving Average

Posted: Sat Dec 03, 2016 12:32 pm

by ochotona

SLK23, I commend you for doing the work and suggesting the approach, but I think trend-following the three volatile components has been shown to be a better approach.

Why exit good performing assets just because others are doing badly and dragging the whole portfolio down? That's like group punishment in public school, or Socialism.

This was answered more than six years ago here:

http://mebfaber.com/2010/10/28/timing-t ... bernstein/

Re: Portfolio Moving Average

Posted: Sat Dec 03, 2016 1:26 pm

by slk23

ochotona wrote:SLK23, I commend you for doing the work and suggesting the approach, but I think trend-following the three volatile components has been shown to be a better approach.

Why exit good performing assets just because others are doing badly and dragging the whole portfolio down? That's like group punishment in public school, or Socialism.

This was answered more than six years ago here:

http://mebfaber.com/2010/10/28/timing-t ... bernstein/

Thanks for the interesting article. However, he doesn't compare timing the individual components to timing the entire portfolio.

It seems to me that using a timing model (e.g. 200MA) on a low-volativity portfolio will result in fewer false signals and less whipsawing than one would experience when timing the much more volatile individual components. And the smaller number of trades is a lot easier to manage with regard to human behavior and psychology. Timing the portfolio as I proposed is almost like buy & hold but with occasional (1x/year) breaks to avoid drawdowns.

The system I'm proposing doesn't increase returns significantly but it does greatly reduce Max Drawdown vs. Start if one can enter the portfolio on a long signal or near the portfolio 200MA. That seems especially useful if using a leveraged portfolio.

Re: Portfolio Moving Average

Posted: Sat Dec 03, 2016 5:50 pm

by ochotona

Good thoughts. Also try 1-year total return as a momentum indicator, and let us know how it compares to the moving average.

Re: Portfolio Moving Average

Posted: Sun Dec 04, 2016 2:17 pm

by Kbg

Looking at the results I'm not sure why one would do this (just looking at what was posted)? The PP is one of the more stable popular ports that exist. If one can't even handle what the PP dishes out for volatility perhaps go more cash or just don't do a PP.

Re: Portfolio Moving Average

Posted: Sun Dec 04, 2016 5:17 pm

by slk23

Kbg wrote:Looking at the results I'm not sure why one would do this (just looking at what was posted)? The PP is one of the more stable popular ports that exist. If one can't even handle what the PP dishes out for volatility perhaps go more cash or just don't do a PP.

I have a plain vanilla PP which I don't touch unless the rebalancing bands are hit. I posted here in this forum because I also have a variable portfolio that's basically a leveraged, cashless PP. I was looking to a way to decrease the odds of a large drawdown which the leverage would make especially painful.