The Buyback Bubble

Posted: Fri Mar 06, 2015 11:42 am

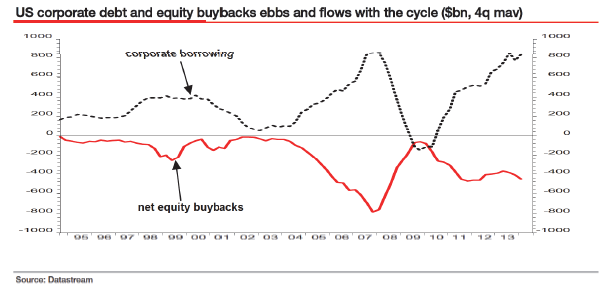

Not highlighted in the below story is how companies are borrowing billions in debt just to buy back their shares. How will this not end badly and any different than the leveraged banks/insurance companies imploding after the subprime bubble?

[quote=http://www.bloomberg.com/news/articles/ ... u-s-market]Not everyone is convinced buybacks are good. They’re used to boost per-share earnings in a way that enhances the pay of chief executives, according to William Lazonick, a professor of economics at the University of Massachusetts Lowell.

“Companies use a phony ideology saying if you maximize your shareholder value you somehow increase the efficiency of the economy,”? Lazonick said in a phone interview. “But the only justification for doing it that holds water is that executives get a lot of their income from buybacks.”? [/quote]

[quote=http://www.bloomberg.com/news/articles/ ... u-s-market]Not everyone is convinced buybacks are good. They’re used to boost per-share earnings in a way that enhances the pay of chief executives, according to William Lazonick, a professor of economics at the University of Massachusetts Lowell.

“Companies use a phony ideology saying if you maximize your shareholder value you somehow increase the efficiency of the economy,”? Lazonick said in a phone interview. “But the only justification for doing it that holds water is that executives get a lot of their income from buybacks.”? [/quote]

[/align]

[/align]