Page 1 of 4

How Are You Doing In PP?

Posted: Thu Mar 05, 2015 11:04 am

by portart

PP is guesstimated to give you 9% over the long term with less volatility than a 60% 40% portfolio which is an 11% return with more volatility, as history might suggest. If you are closer to retirement, as I am, I am shying away from the volatility aspect so I am PP. We have a current situation where rates are very low so treasuries and cash could prove problimatic in getting to the 9% number (cash paying next to nothing, long term rates will rise eventually).

Stocks have nearly tripled off their lows so looking for a continuation at that rate is also unreasonable. What is left is gold which is moving back to its "hated status" and we know gold can sit for 20 years and do nothing but "fart and fall back." My portfolio is doing what is supposed to do, protecting the capital but gaining very little over the last few years with gold falling out of bed, cash dead and treasuries out of gas. The equity side is too small of a percentage to pull everything else up with it.

Anyone feeling anemic with PP these days? It's anyone's guess what the future will hold but an urge to push up the equities percentage is a sure sign they are getting long in tooth.

Re: How Are You Doing In PP?

Posted: Thu Mar 05, 2015 11:13 am

by stuper1

Not sure where you got 9% long term. The "expectation" I've heard is 4% real return, after inflation, as a 3- to 5-year average. I think the PP is keeping up with that pretty well, and I don't see why it won't continue to.

Re: How Are You Doing In PP?

Posted: Thu Mar 05, 2015 12:09 pm

by buddtholomew

portart wrote:

PP is guesstimated to give you 9% over the long term with less volatility than a 60% 40% portfolio which is an 11% return with more volatility, as history might suggest. If you are closer to retirement, as I am, I am shying away from the volatility aspect so I am PP. We have a current situation where rates are very low so treasuries and cash could prove problimatic in getting to the 9% number (cash paying next to nothing, long term rates will rise eventually).

Stocks have nearly tripled off their lows so looking for a continuation at that rate is also unreasonable. What is left is gold which is moving back to its "hated status" and we know gold can sit for 20 years and do nothing but "fart and fall back." My portfolio is doing what is supposed to do, protecting the capital but gaining very little over the last few years with gold falling out of bed, cash dead and treasuries out of gas. The equity side is too small of a percentage to pull everything else up with it.

Anyone feeling anemic with PP these days? It's anyone's guess what the future will hold but an urge to push up the equities percentage is a sure sign they are getting long in tooth.

4 continuous days of losses...what's the point? Stocks decline and either gold or treasuries follow suit as well. Stocks go up with gold and treasuries falling. Might as well just hold equities and cash.

Re: How Are You Doing In PP?

Posted: Thu Mar 05, 2015 12:32 pm

by barrett

stuper1 wrote:

Not sure where you got 9% long term. The "expectation" I've heard is 4% real return, after inflation, as a 3- to 5-year average. I think the PP is keeping up with that pretty well, and I don't see why it won't continue to.

Yeah, if you look at real rolling returns over 10-year periods, the PP has always been between 3% and 6% on the plus side. So if we accept as fact that inflation is zero, with the PP we are looking at 4-5% yearly gains. Not very exciting but purchasing power is all that matters unless you like seeing your balance go up a lot (as I think most people do!).

Re: How Are You Doing In PP?

Posted: Thu Mar 05, 2015 12:49 pm

by stuper1

buddtholomew wrote:

4 continuous days of losses...what's the point? Stocks decline and either gold or treasuries follow suit as well. Stocks go up with gold and treasuries falling. Might as well just hold equities and cash.

How many continuous days of losses in equities would it take for you to feel otherwise? Best thing is just not to watch every day. Or if you have to watch every day, also look at long-term performance every day also.

Re: How Are You Doing In PP?

Posted: Thu Mar 05, 2015 12:53 pm

by buddtholomew

stuper1 wrote:

buddtholomew wrote:

4 continuous days of losses...what's the point? Stocks decline and either gold or treasuries follow suit as well. Stocks go up with gold and treasuries falling. Might as well just hold equities and cash.

How many continuous days of losses in equities would it take for you to feel otherwise? Best thing is just not to watch every day. Or if you have to watch every day, also look at long-term performance every day also.

Its completely my own doing, but I don't want to check back in 6 months and find the portfolio has declined by 20%.

Re: How Are You Doing In PP?

Posted: Thu Mar 05, 2015 1:33 pm

by stuper1

buddtholomew wrote:

Its completely my own doing, but I don't want to check back in 6 months and find the portfolio has declined by 20%.

Then, the PP is a good portfolio for you. How many times in the past has it gone down by 20% in 6 months (hint: the answer is a nice, round number that is less than one). Has a stock/cash portfolio ever gone down by 20% in 6 months (I'm guessing the answer is probably "yes, multiple times"). One of the beauties of the PP is that, if you want to, you can leave it be for a long time (as much as two or three years) and be pretty confident that it will still be in fairly good shape when you get back to it.

Re: How Are You Doing In PP?

Posted: Thu Mar 05, 2015 1:53 pm

by MachineGhost

portart wrote:

Anyone feeling anemic with PP these days? It's anyone's guess what the future will hold but an urge to push up the equities percentage is a sure sign they are getting long in tooth.

You need to diversify out of the traditional asset classes. They're all overvalued and not priced to deliver at least average returns over time at this junction. But you should keep in mind the PP is designed to give you a real return above inflation, no matter how low inflation itself may be. Sustainable withdrawal rates in retirement only correspond to the actual/expected rate of inflation, in my view.

Re: How Are You Doing In PP?

Posted: Thu Mar 05, 2015 1:57 pm

by MachineGhost

stuper1 wrote:

Then, the PP is a good portfolio for you. How many times in the past has it gone down by 20% in 6 months (hint: the answer is a nice, round number that is less than one). Has a stock/cash portfolio ever gone down by 20% in 6 months (I'm guessing the answer is probably "yes, multiple times"). One of the beauties of the PP is that, if you want to, you can leave it be for a long time (as much as two or three years) and be pretty confident that it will still be in fairly good shape when you get back to it.

At risk of bringing this can of beans up again, the PP has certainly declined around -25% in real terms in 1980-1981 in a six month period or so. Nominally it was only around -13%. I'm pretty sure that anyone won't be able to ignore double digit inflation rates for adding to a nominal loss. If you don't want losses this severe to happen again, then find a way in that all assets are risk balanced to each other without gold being the fat lady.

Re: How Are You Doing In PP?

Posted: Thu Mar 05, 2015 2:17 pm

by Pointedstick

MachineGhost wrote:

stuper1 wrote:

Then, the PP is a good portfolio for you. How many times in the past has it gone down by 20% in 6 months (hint: the answer is a nice, round number that is less than one). Has a stock/cash portfolio ever gone down by 20% in 6 months (I'm guessing the answer is probably "yes, multiple times"). One of the beauties of the PP is that, if you want to, you can leave it be for a long time (as much as two or three years) and be pretty confident that it will still be in fairly good shape when you get back to it.

At risk of bringing this can of beans up again, the PP has certainly declined around -25% in real terms in 1980-1981 in a six month period or so. Nominally it was only around -13%. I'm pretty sure that anyone won't be able to ignore double digit inflation rates for adding to a nominal loss. If you don't want losses this severe to happen again, then find a way in that all assets are risk balanced to each other without gold being the fat lady.

Then really it's only 13%. Our horror of brief drawdowns is emotional, so we ought to take our emotions into consideration and only look at nominal returns, since those are what our horror-prone emotions see.

Re: How Are You Doing In PP?

Posted: Thu Mar 05, 2015 2:48 pm

by hoost

So, the portfolio is down or something?

Re: How Are You Doing In PP?

Posted: Thu Mar 05, 2015 2:52 pm

by barrett

1/21/80 to 3/27/80 PP was down just over 20% in nominal terms when gold, bonds and stocks were all going down... more than 20% in real terms. But check out on Peak To Trough how quickly it bounced back. It had a nominal gain for the year.

Re: How Are You Doing In PP?

Posted: Thu Mar 05, 2015 2:54 pm

by Pointedstick

It's doing just fine. The performance is absolutely superior to my previous pseudo-random high-expense-ratio allocation, and the smoothness is great. It's certainly a lower-return than 50% or 100% stocks would be, but that was never something I would ever consider, so I don't feel bad that my PP isn't performing as well as that would be. It would just be grass-is-always-greener syndrome.

Re: How Are You Doing In PP?

Posted: Thu Mar 05, 2015 5:30 pm

by sophie

The PP is indeed doing just fine. From etfreplay:

Last 12 months: 5.9%

YTD: 1.2%

Last 6 months: 2.5%

Since the CPI-U was down 0.5% in January, that 1.2% YTD performance is still a positive real return.

It sounds like portart is concerned about the PP's future, with interest rates being so low. I'm not sure, but keep in mind that money has to go somewhere. Where can it go? Until a new primary asset class comes along, the PP's four assets capture every possible answer to that question. So the PP will always reflect the degree to which resources are being generated.

It is certainly possible that a new primary asset class, orthogonal to all the others, will appear one day. That's the thing to watch out for. The only possible candidate that I can see is Bitcoin, but it will take quite a while before that asset is sufficiently well accepted to replace gold, if it ever does. All others are simply a mixture of one of the Basic Four.

Re: How Are You Doing In PP?

Posted: Thu Mar 05, 2015 5:48 pm

by dualstow

portart wrote:

Anyone feeling anemic with PP these days?

So far so good. I feel quite optimistic about the future.

Re: How Are You Doing In PP?

Posted: Fri Mar 06, 2015 7:51 am

by Mike59

Questioning past returns and guessing on future is a major pitfall , long term bonds could go to zero interest rate and you could make a fortune? equities can be irrational and triple again from here? Gold could be $700 next year, or $2500?

To the OP, feeling "anemic" may be a good thing return-wise, suggesting that something's gotta give with this portfolio in the months/years to come.

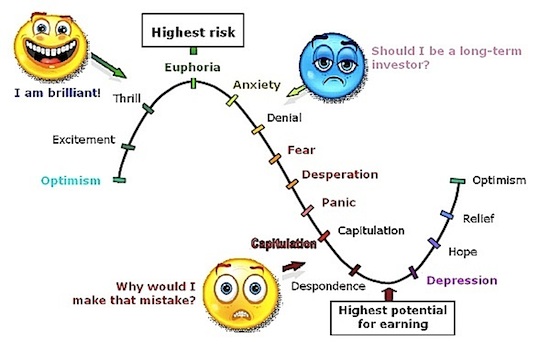

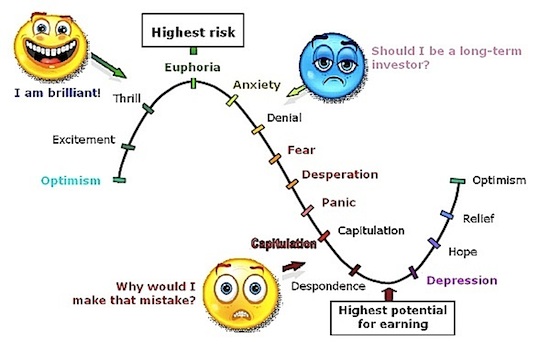

This summarizes things more effectively (credit: thedigeratilife.com), where are you on this?

Id say stop fthinking/feeling, and set your portfolio on autopilot:

Re: How Are You Doing In PP?

Posted: Fri Mar 06, 2015 8:53 am

by buddtholomew

I suppose the portfolio is doing wonderfully today?

Seriously, what a piece of crap.

Re: How Are You Doing In PP?

Posted: Fri Mar 06, 2015 9:14 am

by ochotona

buddtholomew wrote:

I suppose the portfolio is doing wonderfully today?

Seriously, what a piece of crap.

If you were 100% stock, VTI or SCHB, your portfolio would be up year-to-date, that is true... but that would be suicide.

Re: How Are You Doing In PP?

Posted: Fri Mar 06, 2015 9:20 am

by Cortopassi

Oh well, I supposed it was to be expected, now negative for the year. You guys did not realize, once "I" started the PP, this would begin 25 years of negative returns!

Re: How Are You Doing In PP?

Posted: Fri Mar 06, 2015 9:32 am

by dragoncar

Cortopassi wrote:

Oh well, I supposed it was to be expected, now negative for the year. You guys did not realize, once "I" started the PP, this would begin 25 years of negative returns!

I'm going long cardboard boxes

Re: How Are You Doing In PP?

Posted: Fri Mar 06, 2015 9:33 am

by goodasgold

This day (so far) is the worst single day I can recall for the PP.

But, as always, we need to hang in there and think long term.

Think I'll buy some gold. As much as we sometimes complain about the yellow stuff, it may well be our salvation when the *really* bad times roll into town.

Re: How Are You Doing In PP?

Posted: Fri Mar 06, 2015 9:39 am

by Pointedstick

goodasgold wrote:

This day (so far) is the worst single day I can recall for the PP.

But, as always, we need to hang in there and think long term.

Think I'll buy some gold. As much as we sometimes complain about the yellow stuff, it may well be our salvation when the *really* bad times roll into town.

Yep, just bought some TLT. You guys have to understand that days like these are buying opportunities if you're still in the accumulation phase. Absolutely nothing to lose your mind about. If you're withdrawing, sure, it sucks, but what portfolio

doesn't occasionally (or more than occasionally) have days when the whole thing is down 1%? Only all-cash portfolios, basically. And you wouldn't want that.

Re: How Are You Doing In PP?

Posted: Fri Mar 06, 2015 9:53 am

by goodasgold

And at least there is one small ray of sunshine amidst all the financial gloom: The Euro is now at parity with the dollar, for the first time in years. So now is the time to go on that European vacation.

I remember the day, many years ago, when some European merchants refused to exchange dollars because the greenback was dropping so rapidly they were afraid they would lose money.

Re: How Are You Doing In PP?

Posted: Fri Mar 06, 2015 9:55 am

by ochotona

Euro at parity? Today? I thought it was $1.10 this morning

Re: How Are You Doing In PP?

Posted: Fri Mar 06, 2015 10:04 am

by goodasgold

ochotona wrote:

Euro at parity? Today? I thought it was $1.10 this morning

Well, 1.0858 as we speak. Hey, you gotta allow for some poetic license around here.