Page 1 of 1

Re: Gold and real interest rates

Posted: Thu Nov 21, 2013 11:29 pm

by rickb

TennPaGa wrote:

Interestingly, gold price is far below what one would predict based on the model. That is, in the current environment, one would expect gold prices to be rising, and yet it isn't. Why not?

You're not suggesting the price of gold might be

manipulated, are you?

Re: Gold and real interest rates

Posted: Thu Nov 21, 2013 11:34 pm

by bronsuchecki

I think the relationship is only if real interest rates go below 2% that gold becomes attractive, not that there is some direct correlation between the rates.

Re: Gold and real interest rates

Posted: Thu Nov 21, 2013 11:45 pm

by Pointedstick

rickb wrote:

TennPaGa wrote:

Interestingly, gold price is far below what one would predict based on the model. That is, in the current environment, one would expect gold prices to be rising, and yet it isn't. Why not?

You're not suggesting the price of gold might be

manipulated, are you?

All I'm hearing is GREAT TIME TO BUY!

Re: Gold and real interest rates

Posted: Thu Nov 21, 2013 11:56 pm

by fnord123

TennPaGa wrote:That is, in the current environment, one would expect gold prices to be rising, and yet they aren't. Why not?

Negative real interest rates have historically been present when the central banks are trying to use monetary policy to offset an economic dislocation (recession). Investor psychology at such times is negative and often there is significant uncertainty. Negative sentiment and uncertainty causes dropping stock prices and increasing gold prices, because gold is seen as a safe haven.

We are in a strange period now where investors are somewhat optimistic, mostly because they believe in QE4ever and the endless Bernanke Put. This is the case precisely because of the negative real interest rates - rather than an emergency measure applied during a time of panic, it has become the norm. This helps stock prices up, and reduces uncertainty (because the Bernanke Put implies stock prices will be supported) - thus causing gold to go down.

No conspiracy needed.

Re: Gold and real interest rates

Posted: Fri Nov 22, 2013 4:46 am

by Thomas Hoog

fnord123 wrote:

TennPaGa wrote:That is, in the current environment, one would expect gold prices to be rising, and yet they aren't. Why not?

Negative real interest rates have historically been present when the central banks are trying to use monetary policy to offset an economic dislocation (recession). Investor psychology at such times is negative and often there is significant uncertainty. Negative sentiment and uncertainty causes dropping stock prices and increasing gold prices, because gold is seen as a safe haven.

We are in a strange period now where investors are somewhat optimistic, mostly because they believe in QE4ever and the endless Bernanke Put. This is the case precisely because of the negative real interest rates - rather than an emergency measure applied during a time of panic, it has become the norm. This helps stock prices up, and reduces uncertainty (because the Bernanke Put implies stock prices will be supported) - thus causing gold to go down.

No conspiracy needed.

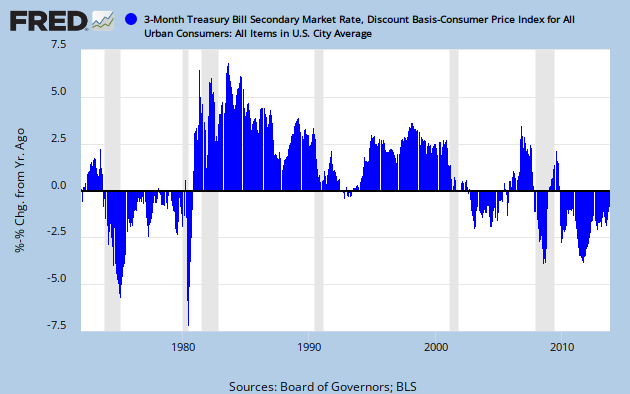

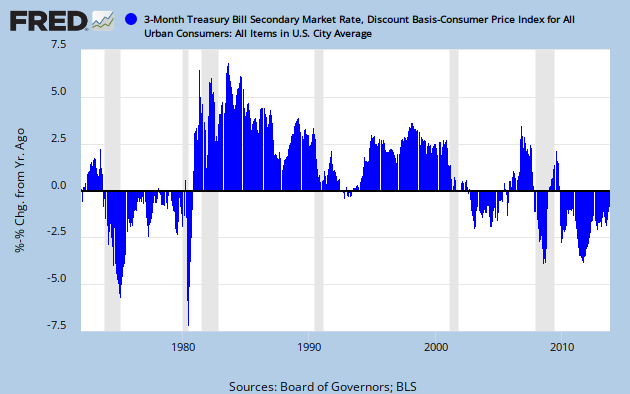

+1: Not the Gold price is manipulated, but the interest rates. Nice Graph.

Re: Gold and real interest rates

Posted: Fri Nov 22, 2013 9:06 am

by Libertarian666

TennPaGa wrote:

fnord123 wrote:

TennPaGa wrote:That is, in the current environment, one would expect gold prices to be rising, and yet they aren't. Why not?

Negative real interest rates have historically been present when the central banks are trying to use monetary policy to offset an economic dislocation (recession). Investor psychology at such times is negative and often there is significant uncertainty. Negative sentiment and uncertainty causes dropping stock prices and increasing gold prices, because gold is seen as a safe haven.

We are in a strange period now where investors are somewhat optimistic, mostly because they believe in QE4ever and the endless Bernanke Put. This is the case precisely because of the negative real interest rates - rather than an emergency measure applied during a time of panic, it has become the norm. This helps stock prices up, and reduces uncertainty (because the Bernanke Put implies stock prices will be supported) - thus causing gold to go down.

No conspiracy needed.

Interesting. Here is the real interest rate time series:

So you are saying that the current NRI (negative real interest) environment is different because the market perceives that it will last forever? It just seems odd to me, because the NRI in the 1970's seemed to actually last a fairly long time, and it wasn't that great an environment for stocks, was it?

The difference is that, in the 1970's, no one thought that the Fed would keep the pedal to the metal until the dollar imploded, so the easy money would have to be followed by tight money.