Page 1 of 6

Correlations

Posted: Sun Jul 28, 2013 6:24 pm

by Fragile Bill

Until recently I had never heard of Harry Browne's Permanent Portfolio and I've ordered his book on the topic. I take the "Past performance does not guarantee future results" caveat seriously and have wondered whether today's economic environment is a bad time for an investor to be buying into the PP from scratch. Those of you who have participated for years have seen some nice results. However, the 27 page thread "Not Even Harry Browne Thought It Was Going to Be This Bad" prompted me to re-measure some correlations to see if they still work the way they're supposed to. Like a lot of people, I fear that rising interest rates in today's economy could slam both TLT and VTI, with only IAU to buffer things. I measured the correlation coefficient of VTI and TLT since 5/30/07 and got .4727 (acceptably low). However, measured since 1/1/08, 6/30/08, 1/1/09, and 6/30/09, I'm getting correlations of .6132, .6742, .6962, and .7122, respectively. Isn't 71% a little high?

Re: Correlations

Posted: Sun Jul 28, 2013 8:52 pm

by Tyler

Re: Correlations

Posted: Sun Jul 28, 2013 9:38 pm

by Pointedstick

It's probably a better time to get in right now than it's been in a long while, actually. Gold and bonds are down rather substantially from their highs.

Correlations shouldn't even really be on your radar screen because they change all the time. For a while, gold and bonds moved in lockstep; for years, bonds and stocks did. And so on and so forth.

As for rising interest rates, ask yourself why interest rates might rise. What economic conditions are there that would support high rates? Inflation? Nah. Low unemployment? Nah. Extremely high GDP growth? Nah. Excessive bank lending? Nah.

Some or all of those things are going to have to change before interest rates are going to have a meaningful rise.

Re: Correlations

Posted: Mon Jul 29, 2013 9:10 am

by Libertarian666

Pointedstick wrote:

It's probably a better time to get in right now than it's been in a long while, actually. Gold and bonds are down rather substantially from their highs.

Correlations shouldn't even really be on your radar screen because they change all the time. For a while, gold and bonds moved in lockstep; for years, bonds and stocks did. And so on and so forth.

As for rising interest rates, ask yourself why interest rates might rise. What economic conditions are there that would support high rates? Inflation? Nah. Low unemployment? Nah. Extremely high GDP growth? Nah. Excessive bank lending? Nah.

Some or all of those things are going to have to change before interest rates are going to have a meaningful rise.

I can think of two other "economic conditions" that would cause interest rates to increase:

1. The Fed slowing or stopping their purchases of bonds.

Not that I expect they will ever do that, but if they did...

2. The Fed continuing to buy bonds until the dollar blows up.

That's what I expect to happen.

Re: Correlations

Posted: Mon Jul 29, 2013 9:17 am

by Pointedstick

Well we'll see, won't we? But if and when the dollar blows up, I expect to place the blame squarely at the feet of Congress, not the Fed. That would be like blaming the gun for the actions of its wielder.

Re: Correlations

Posted: Mon Jul 29, 2013 3:53 pm

by Mdraf

Pointedstick wrote:

Well we'll see, won't we? But if and when the dollar blows up, I expect to place the blame squarely at the feet of Congress, not the Fed. That would be like blaming the gun for the actions of its wielder.

The Fed could (but will not) slow or cease buying government debt to keep congress in check and demonstrate its supposed independence

Re: Correlations

Posted: Mon Jul 29, 2013 4:20 pm

by Pointedstick

Mdraf wrote:

Pointedstick wrote:

Well we'll see, won't we? But if and when the dollar blows up, I expect to place the blame squarely at the feet of Congress, not the Fed. That would be like blaming the gun for the actions of its wielder.

The Fed could (but will not) slow or cease buying government debt to keep congress in check and demonstrate its supposed independence

They could, but why would they? One of the major reasons for their existence is to facilitate congressional fiscal policy. Their supposed independence is worth about as much as the fourth amendment prevents the police from stealing your stuff.

Re: Correlations

Posted: Mon Jul 29, 2013 4:43 pm

by notsheigetz

Pointedstick wrote:

It's probably a better time to get in right now than it's been in a long while, actually. Gold and bonds are down rather substantially from their highs.

Agreed. If you follow MT's way of thinking all the negativity in the forum should be a signal that the time is ripe.

Re: Correlations

Posted: Mon Jul 29, 2013 5:05 pm

by MediumTex

Libertarian666 wrote:

I can think of two other "economic conditions" that would cause interest rates to increase:

1. The Fed slowing or stopping their purchases of bonds.

Not that I expect they will ever do that, but if they did...

They already have in the intervals between the QE programs in recent years, and yields

declined in each case after QE ended.

2. The Fed continuing to buy bonds until the dollar blows up.

That's what I expect to happen.

Since every seller of dollars must, necessarily, be a buyer of something else, what do you think they would be buying if "the dollar blows up"?

Every major economy in the world is seeing similar actions by central banks to prevent deflationary forces from gaining serious traction. It's not like it's just the U.S. doing this. In other words, if the dollar blew up, would it be because everyone suddenly preferred to hold pounds, yen or euros? That seems very unlikely to me, given that in some cases these other currencies should, in theory, be far weaker than the U.S. dollar if central bank bond purchases were the criteria we used to measure currency strength.

I also wonder when pondering dollar destruction scenarios, wouldn't

some inflation be expected prior to a currency becoming worthless? As it is with the U.S. dollar, though, it is about 15% stronger than it was five years ago in relation to other world currencies.

Before anyone says "The whole world would pile into Australia's currency because it's strong", consider what happened in 2011 when everyone started doing this with the Swiss franc. The Swiss government saw that the effect of this currency strengthening would be to quickly destroy the ability of Swiss exporters to sell their goods abroad, and it headed this off by pegging its currency to the euro, which put an end to the chaotic capital stampeding into the Swiss franc. When it comes to any major world currency, nothing happens in a vacuum, and the whole world is in on trying to maintain an orderly devaluation of ALL world currencies at a low and steady single digit pace.

No one wants a strong currency anymore.

The Zimbabwe and Weimar Germany currency disasters that are cited so often have, IMHO, virtually no relevance or applicability to anything that is happening today in any of the world's major western economies (plus Japan). I would say that these hyperinflation events

might have some lessons for certain Latin American nations and maybe India and other nations in that part of the world, but that's about it.

From my perspective, comparing Zimbabwe to the U.S. is like comparing some guy who gets drunk on his fishing boat to an aircraft carrier battle group. In both cases, the boats can certainly sink, but the reasons that the boat might sink in the former case have virtually nothing to do with what might cause one of the boats to sink in the latter case.

Re: Correlations

Posted: Mon Jul 29, 2013 5:42 pm

by moda0306

The fed's mandate around inflation and unemployment is obviously in favor of expansionary policies... 2% inflation against 7% unemployment... Hmmm.

The fed's job isn't to keep Congress "in check." It's to manage balance those two things via their influence on the credit markets.

Re: Correlations

Posted: Mon Jul 29, 2013 6:13 pm

by Mdraf

MediumTex wrote:

They already have in the intervals between the QE programs in recent years, and yields declined in each case after QE ended.

According to the Hoisington report posted a few days ago that's because of the dollar strengthening and commodity prices dropping.

Re: Correlations

Posted: Mon Jul 29, 2013 7:28 pm

by Pointedstick

MediumTex wrote:

The Swiss government saw that the effect of this currency strengthening would be to quickly destroy the ability of Swiss exporters to sell their goods abroad, and it headed this off by pegging its currency to the euro, which put an end to the chaotic capital stampeding into the Swiss franc. When it comes to any major world currency, nothing happens in a vacuum, and the whole world is in on trying to maintain an orderly devaluation of ALL world currencies at a low and steady single digit pace.

No one wants a strong currency anymore.

Like I said in another thread, globalization in action. It was an absolute revelation to me when I realized that the global monetary threat is not hyperinflation but deflation. Aging populations and downward wage and price pressures are going to rule the coming age.

Time to buy stock in sweatshops and nursing homes, I guess.

Re: Correlations

Posted: Mon Jul 29, 2013 8:31 pm

by MediumTex

Mdraf wrote:

MediumTex wrote:

They already have in the intervals between the QE programs in recent years, and yields declined in each case after QE ended.

According to the Hoisington report posted a few days ago that's because of the dollar strengthening and commodity prices dropping.

A certain way of thinking would suggest that yields are only low because of QE, and thus when QE ends they must rise.

And yet when each round of QE has ended, yields have fallen.

We can always create a narrative around how any market move aligns with an existing worldview, but the bottom line is that when each round of QE ended, yields fell. The same thing happened in Japan.

I suspect that QE doesn't have nearly as much to do with low yields as many suspect. There are much larger secular forces at work, with the largest probably being demographic shifts that are occurring in many developed economies.

With favorable demographics (i.e., expansion of the most productive age segments--basically the age 45-54 cohort--in relation to the overall population), any economy will enjoy structural tailwinds for economic growth, while unfavorable demographics will create a similar structural

headwind that makes sustained economic growth much more difficult.

Here is an interesting chart to think about:

Re: Correlations

Posted: Mon Jul 29, 2013 8:55 pm

by MediumTex

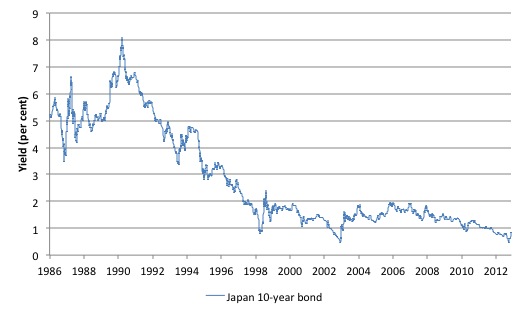

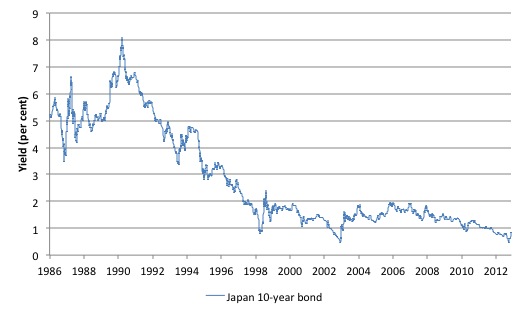

Here is what the demographics of Japan's structural economic contraction looks like. Take a look at what started happening around 1990.

Check out what started happening to the Nikkei around 1990.

And finally take a look at Japanese bond yields starting around 1990.

Demographics turn bad ---> Economic growth gets sticky and stock market stalls ---> Bond market begins anticipating structural economic contraction ---> Cycle continues until demographics improve.

Re: Correlations

Posted: Mon Jul 29, 2013 9:34 pm

by Kriegsspiel

MT are you a fan of Harry Dent? I've read a couple of his books and they are basically what you just posted, plus some migratory trends.

Re: Correlations

Posted: Mon Jul 29, 2013 9:58 pm

by Gumby

Libertarian666 wrote:2. The Fed continuing to buy bonds until the dollar blows up.

That's what I expect to happen.

Yawn. The Fed converting trillions of dollars of Treasury debt is not going to "blow up" the dollar.

The overwhelming majority of our money supply comes from private credit — to the tune of roughly $56 trillion. So, in order for the dollar to "blow up" the Treasury would need to

frivolously issue tens of trillion dollars in brand new Treasury debt — in a very short amount of time — to even make a little bump in the broad money supply. And then all that money would need to get into the hands of most consumers — most likely via jobs and consumption that would stimulate the economy back to full capacity before we saw much inflation.

Whether the Fed buys the new debt or not makes absolutely no difference.

The Primary Dealers are obligated to buy all of the Treasury's debt whether the Fed buys it or not. And the Primary Dealers are more than capable and willing to buy all of the Treasury's debt without the Fed's help because it drains their reserves into interest bearing assets.

Inflation would come have to come from massive Treasury spending (i.e.

fiscal spending) — not the Fed (which only conducts monetary policy). As the past few years — as well as decades of QE in Japan shows us — it's extremely difficult for the Fed to create meaningful inflation.

Consider this....

If the Fed converted all of the $16 trillion in Treasury Debt into pure cash, it would not create any meaningful inflation. It's only the

new Treasury spending (via debt issuance) that creates any meaningful inflation.

Re: Correlations

Posted: Mon Jul 29, 2013 10:04 pm

by Mdraf

Gumby you keep repeating the same thing over and over again. Those that don't agree with you have tired of replying

Re: Correlations

Posted: Mon Jul 29, 2013 10:12 pm

by Gumby

Mdraf wrote:

Gumby you keep repeating the same thing over and over again. Those that don't agree with you have tired of replying

Funny, I have yet to see anyone correct anything I've said on Fed/Treasury operations.

All I've done is explain the operational realities of why the Fed cannot create any meaningful inflation.

The Fed could swap every Treasury on the planet for cash and it wouldn't create any meaningful inflation because the private and foreign sectors would be no richer after the swap was done.

The private and foreign sectors would be left with the exact same amount of savings —

to the penny — after their Treasuries were swapped for cash.

I'd love to see someone reply to that argument. My guess is no one can. The reason why people aren't replying isn't because they are "tired". It's because no one can articulate why the Fed converting massive amounts of Treasuries into cash should result in real inflation.

Re: Correlations

Posted: Mon Jul 29, 2013 10:55 pm

by Mdraf

Gumby wrote:

Mdraf wrote:

Gumby you keep repeating the same thing over and over again. Those that don't agree with you have tired of replying

Funny, I have yet to see anyone correct anything I've said on Fed/Treasury operations.

All I've done is explain the operational realities of why the Fed cannot create any meaningful inflation.

The Fed could swap every Treasury on the planet for cash and it wouldn't create any meaningful inflation because the private and foreign sectors would be no richer after the swap was done.

The private and foreign sectors would be left with the exact same amount of savings —

to the penny — after their Treasuries were swapped for cash.

I'd love to see someone reply to that argument. My guess is no one can. The reason why people aren't replying isn't because they are "tired". It's because no one can articulate why the Fed converting massive amounts of Treasuries into cash should result in real inflation.

We've discussed this ad nauseam in other threads. Because they cannot do so at a rate that is faster than GDP growth without inflating the currency. Remember my question? Why stop at 16 trillion? Why not 160 trillion?

Re: Correlations

Posted: Tue Jul 30, 2013 6:38 am

by Gumby

Mdraf wrote:

Gumby wrote:

Mdraf wrote:

Gumby you keep repeating the same thing over and over again. Those that don't agree with you have tired of replying

Funny, I have yet to see anyone correct anything I've said on Fed/Treasury operations.

All I've done is explain the operational realities of why the Fed cannot create any meaningful inflation.

The Fed could swap every Treasury on the planet for cash and it wouldn't create any meaningful inflation because the private and foreign sectors would be no richer after the swap was done.

The private and foreign sectors would be left with the exact same amount of savings —

to the penny — after their Treasuries were swapped for cash.

I'd love to see someone reply to that argument. My guess is no one can. The reason why people aren't replying isn't because they are "tired". It's because no one can articulate why the Fed converting massive amounts of Treasuries into cash should result in real inflation.

We've discussed this ad nauseam in other threads. Because they cannot do so at a rate that is faster than GDP growth without inflating the currency. Remember my question? Why stop at 16 trillion? Why not 160 trillion?

Well then some people haven't learned the lessons of that thread because when people go around fear-mongering — saying that the Fed will "blow up" the dollar — they are misunderstanding what the Fed does. The Fed does not conduct helicopter drops. The only way $160 trillion in new debt could come into existence is if Congress voted to spend that kind of money — which isn't going to happen since Congress is gridlocked.

Secondly, anyone who implies that the government would be unable to sell its bonds if the Fed did not buy them from Primary Dealers does not understand that the Primary Dealers are obligated to purchase every single remaining Treasury Bond, at auction, regardless of whether the Fed buys them later or not — and the Primary Dealers are fully willing to do this to drain their excess reserves (that are created from previous deficit spending).

The only situation where the Primary Dealers would conceivably revolt is in a hyperinflation scenario (which you describe) but that, once again, could only be caused by Congressional spending, via the Treasury. The Fed has really nothing to do with the hyperinflation scenario. The Fed can't "blow up" the dollar because hyperinflation would have to come from Congressional spending via the Treasury.

Re: Correlations

Posted: Tue Jul 30, 2013 8:19 am

by Gumby

TennPaGa wrote:

Gumby wrote:

Well then some people haven't learned the lessons of that thread because when people go around saying that the Fed will "blow up" the dollar, they are misunderstanding what the Fed does. The Fed does not conduct helicopter drops. The only way $160 trillion in new debt could come into existence is if Congress voted to spend that kind of money — which isn't going to happen since Congress is gridlocked.

It isn't surprising that so many people (like Mdraf) misunderstand the Fed's role. No one in the media talks about the Fed correctly. Just this morning, I heard a report on NPR that refered to the Fed's "economic stimulus" and how they were "injecting $88 billion into the economy every month".

[Facepalm]

I don't think Mdraf is misunderstanding the Fed's role so much. My corrections are aimed at Libertarian666 who continues to erroneously say that the Fed could somehow be responsible for hyperinflation. It's impossible.

Hyperinflation could only come from Congressionally approved Treasury spending.

After all the hullabaloo of QE I, II and III, the Fed holds about $2 trillion dollars in Treasury debt that was simply swapped for reserves. A complete non-event in terms of the broad money supply,

which already includes Treasuries.

The total of QE I, II and III was a pittance compared to the size of the broad money supply — which contains over $16 Trillion in Treasury debt and $57 Trillion in private credit. And even if the Fed had swapped all $16 trillion in Treasury debt for freshly printed cash, the public

would not be a penny richer after the fact.

The $160 Trillion scenario is a fantasy since Congress would never vote to do that kind of spending.

Re: Correlations

Posted: Tue Jul 30, 2013 10:37 am

by Mdraf

TennPaGa wrote:

Gumby wrote:

Well then some people haven't learned the lessons of that thread because when people go around saying that the Fed will "blow up" the dollar, they are misunderstanding what the Fed does. The Fed does not conduct helicopter drops. The only way $160 trillion in new debt could come into existence is if Congress voted to spend that kind of money — which isn't going to happen since Congress is gridlocked.

It isn't surprising that so many people (like Mdraf) misunderstand the Fed's role. No one in the media talks about the Fed correctly. Just this morning, I heard a report on NPR that refered to the Fed's "economic stimulus" and how they were "injecting $88 billion into the economy every month".

Of course. Nobody understands anything except you guys on this forum.

Re: Correlations

Posted: Tue Jul 30, 2013 11:25 am

by Gumby

Mdraf wrote:

TennPaGa wrote:

Gumby wrote:

Well then some people haven't learned the lessons of that thread because when people go around saying that the Fed will "blow up" the dollar, they are misunderstanding what the Fed does. The Fed does not conduct helicopter drops. The only way $160 trillion in new debt could come into existence is if Congress voted to spend that kind of money — which isn't going to happen since Congress is gridlocked.

It isn't surprising that so many people (like Mdraf) misunderstand the Fed's role. No one in the media talks about the Fed correctly. Just this morning, I heard a report on NPR that refered to the Fed's "economic stimulus" and how they were "injecting $88 billion into the economy every month".

Of course. Nobody understands anything except you guys on this forum.

Happy to hear you prove otherwise. That's what these discussions are all about — trying to share different ideas and perspectives. If I'm wrong, I want to hear about it, and I want to hear

why so I can change my thinking. That's how we evolve. That's how we learn.

If people aren't willing to have a dialog about potential flaws in our thinking, then we can't learn from each other. And if that's the case, then what's the point of having a forum?

So far no one has corrected anything I've said with respect to Fed and Treasury operations, but I'm all ears.

Re: Correlations

Posted: Tue Jul 30, 2013 12:47 pm

by Mdraf

It is no longer a dialogue when opposing views are ridiculed. This controversy about the Fed is not limited to this forum. There is another, equally valid (if not more so), point of view shared by many economists.

You slap each other on the back and adopt a haughty attitude towards other views. Instead of broadening the discussion in your own words you keep badgering with the same mantra cut & pasted from the web sites you follow. We did have a nice long meandering discussion in the "Not even Harry Brown thread..." and it exhausted itself. But my impression is that you want to re-start that debate at every opportunity.

"Ah, because it's THE TRUTH" is what you'll probably say...that in my mind is simply dogma.

Re: Correlations

Posted: Tue Jul 30, 2013 12:57 pm

by Pointedstick

Gumby can be forceful and abrasive at times, but can you refute his points? I found that I could not, which is why I now subscribe to MR's descriptions of the operational facts of our monetary system. If someone can refute MR to my satisfaction, then I'll believe that instead.

The flip side of keeping an open mind during a debate is being willing to admit that your debate partner may have the superior argument. If you're not willing to do that, then you're not really interested in having a debate and there's no point in engaging.