Clive

Posted: Thu Nov 22, 2012 11:19 am

Did Clive conclude that the PP was not the optimal investment he once believed?

Permanent Portfolio Forum

https://www.gyroscopicinvesting.com/forum/

https://www.gyroscopicinvesting.com/forum/viewtopic.php?t=3606

Thanks MediumTex. I frequent the Boglehead site and noticed his disdain for the PP. I do however remember him endorsing the portfolio on this site for a period of time. Did he provide his rationale for switching investments and what, if any, strategy is he currently following? I'm more interested in the conclusions he reached to persuade himself that the PP was not the strategy for him (or others).MediumTex wrote: Clive has posted a lot of Permanent Portfolio-related stuff lately over at the Bogleheads site.

Clive used the PP for a portion of his investments in recent years, but decided to exit the strategy at some point in the last few months (or it may have been longer).

After Clive decided to exit the strategy with his own money (even though his returns were apparently very satisfactory), he seems to have decided that the rest of the world would be wise to exit the strategy as well.

Since I don't view the PP as something that people should be trading in and out of based upon their own perceptions of what the market is likely to do next, Clive's strategy doesn't resonate with me.

My sense is that he thinks that gold is due for a major correction and that it will sink the whole portfolio.buddtholomew wrote:Thanks MediumTex. I frequent the Boglehead site and noticed his disdain for the PP. I do however remember him endorsing the portfolio on this site for a period of time. Did he provide his rationale for switching investments and what, if any, strategy is he currently following? I'm more interested in the conclusions he reached to persuade himself that the PP was not the strategy for him (or others).MediumTex wrote: Clive has posted a lot of Permanent Portfolio-related stuff lately over at the Bogleheads site.

Clive used the PP for a portion of his investments in recent years, but decided to exit the strategy at some point in the last few months (or it may have been longer).

After Clive decided to exit the strategy with his own money (even though his returns were apparently very satisfactory), he seems to have decided that the rest of the world would be wise to exit the strategy as well.

Since I don't view the PP as something that people should be trading in and out of based upon their own perceptions of what the market is likely to do next, Clive's strategy doesn't resonate with me.

Thanks for the synopsis. It's a good thing that Rick doesn't frequent this site...yet.buddtholomew wrote:Thanks MediumTex. I frequent the Boglehead site and noticed his disdain for the PP. I do however remember him endorsing the portfolio on this site for a period of time. Did he provide his rationale for switching investments and what, if any, strategy is he currently following? I'm more interested in the conclusions he reached to persuade himself that the PP was not the strategy for him (or others).MediumTex wrote: Clive has posted a lot of Permanent Portfolio-related stuff lately over at the Bogleheads site.

Clive used the PP for a portion of his investments in recent years, but decided to exit the strategy at some point in the last few months (or it may have been longer).

After Clive decided to exit the strategy with his own money (even though his returns were apparently very satisfactory), he seems to have decided that the rest of the world would be wise to exit the strategy as well.

Since I don't view the PP as something that people should be trading in and out of based upon their own perceptions of what the market is likely to do next, Clive's strategy doesn't resonate with me.

Me too.gizmo_rat wrote: I thank him for his help and wish him well.

The PP hasn't held up in certain historical periods in real return terms. It was particularly disastrous in the UK. What I don't understand though, is why he doesn't adopt tactical allocation to mitigate that risk rather than throwing the baby out with the bathwater. But such seems to be the Boglehead way of obsession with lazyness.buddtholomew wrote: Thanks MediumTex. I frequent the Boglehead site and noticed his disdain for the PP. I do however remember him endorsing the portfolio on this site for a period of time. Did he provide his rationale for switching investments and what, if any, strategy is he currently following? I'm more interested in the conclusions he reached to persuade himself that the PP was not the strategy for him (or others).

I think he did like tactical changes at times. If I recall he found merit in the decision moose system which functions kind of like the PP but with a huge momentum component.MachineGhost wrote:The PP hasn't held up in certain historical periods in real return terms. It was particularly disastrous in the UK. What I don't understand though, is why he doesn't adopt tactical allocation to mitigate that risk rather than throwing the baby out with the bathwater. But such seems to be the Boglehead way of obsession with lazyness.buddtholomew wrote: Thanks MediumTex. I frequent the Boglehead site and noticed his disdain for the PP. I do however remember him endorsing the portfolio on this site for a period of time. Did he provide his rationale for switching investments and what, if any, strategy is he currently following? I'm more interested in the conclusions he reached to persuade himself that the PP was not the strategy for him (or others).

Do his arguments have any merit? I too am concerned with rebalancing into a falling asset over an extended period of time, but this could happen with equities and long-term treasuries in addition to gold. He obviously didn't agree with the idea that one investment can fall to zero (limited downside), while another one increases 100, 200 or even 300% (unlimited upside) to buoy the overall portfolio. Is there something special about gold that invalidates the above?gizmo_rat wrote: Clive gave me an awful lot of help with the implementation of a UK PP a couple of years ago. Although simple in hindsight it's not obvious how to hold the assets in the UK efficiently, if your only experience of investing is from mainstream shill.

At that time he was completely upfront that he no longer held those assets as he had doubts that the PP could sustain a 4% real return. IIRC his chief concern was rebalancing into a long term gold decline.

Also if IIRC he's been sustaining himself and family for the last decade or so by active investment using whatever strategies seem appropriate at the time.

I thank him for his help and wish him well.

Sometimes when a person is really sour on an asset, it's hard not to think that it is inevitable that the asset is going to do what he thinks it should do.buddtholomew wrote: Do his arguments have any merit? I too am concerned with rebalancing into a falling asset over an extended period of time, but this could happen with equities and long-term treasuries in addition to gold. He obviously didn't agree with the idea that one investment can fall to zero (limited downside), while another one increases 100, 200 or even 300% (unlimited upside) to buoy the overall portfolio. Is there something special about gold that invalidates the above?

"Everyone knows stocks will go back up sooner or later!"MediumTex wrote: For whatever reason, people never seem troubled at the idea of buying into stocks when they are declining, even though it is stocks that have actually seen the largest declines in history of all of the PP assets, with over 90% declines in value following the 1929 crash.

And Zero Hedge, of course.murphy_p_t wrote: as an aside, anyone who thinks gold will be in any long-term downtrend should spend some time @ kingworldnews.com and jsmineset.com

Don't forget the Ludwig von Mises Institute!MediumTex wrote:And Zero Hedge, of course.murphy_p_t wrote: as an aside, anyone who thinks gold will be in any long-term downtrend should spend some time @ kingworldnews.com and jsmineset.com

Gold, bitches!

Interesting discussion... I decided to test this idea based on the daily closing values of the 4 HBPP assets since 1972. This analysis assumes you're watching the assets daily and rebalance immediately when an asset is more than 35% of the portfolio or less than 15%.MediumTex wrote:As far as rebalancing into a falling asset, if you look at the history of PP rebalancing events, it is virtually always triggered by a rising asset (as opposed to a falling asset). Thus, if you ever rebalanced because of a falling asset even once it would be unusual.

The idea of repeatedly rebalancing into a falling asset is unprecedented for a U.S. PP investor. IMHO, it's not something worth worrying about until the first falling asset-triggered rebalancing event occurs. I would think that the first occurrence of such an event would be a good signal to start worrying about it happening more than once.

Plugging that into the Simba database I get a CAGR of 8.87% and a ST DEV of 5.80% (I used total stock market rather than small value). So, lower return and standard deviation than PP. However, it produced a real return of 0% from 1972 to 1982, that would hurt, especially if withdrawing 4% a year.Slotine wrote: It looks like Clive's responded by posting an example conservative 12.5/75/12.5 portfolio made of stock/5-10 year bonds/gold.

http://www.bogleheads.org/forum/viewtop ... 0#p1538818

I don't have a ladder data handy, so just substituting 10-year bonds into the mix and it performs remarkably robustly for US, CA, UK, IE, DE, IS, ES, AU, and even JP. Technically, you could say this is the PP that's just consistently pushing the lower/upper rebalancing bands but so far it tracks or beats the PP with far less volatility.

One note though: it fails horribly for Greece.

Has anyone else taken a look at this allocations in the past?

From 2007 to 2012 the ten year yield dropped from 5% to 1.6%, which is quite good for bond holders. As for Japan, well, they have had an average inflation rate of -0.50% (a rough guess from this chart. So this puts Japan in a positive real interest rate environment.Slotine wrote:Thanks, my sim only goes back to 77. That said, it seems to do fine since 2007 so it's not just simply short-term interest rate related. Just coming off the Japan data, it does a respectable 3.3% real over 2000-2010. That's during a long stretch with ~0.5% interest rate. It seems to be pulling most of it from the term premium on a positive yield curve plus the GDP.Gosso wrote:Plugging that into the Simba database I get a CAGR of 8.87% and a ST DEV of 5.80% (I used total stock market rather than small value). So, lower return and standard deviation than PP. However, it produced a real return of 0% from 1972 to 1982, that would hurt, especially if withdrawing 4% a year.Slotine wrote: It looks like Clive's responded by posting an example conservative 12.5/75/12.5 portfolio made of stock/5-10 year bonds/gold.

http://www.bogleheads.org/forum/viewtop ... 0#p1538818

I don't have a ladder data handy, so just substituting 10-year bonds into the mix and it performs remarkably robustly for US, CA, UK, IE, DE, IS, ES, AU, and even JP. Technically, you could say this is the PP that's just consistently pushing the lower/upper rebalancing bands but so far it tracks or beats the PP with far less volatility.

One note though: it fails horribly for Greece.

Has anyone else taken a look at this allocations in the past?

That portfolio requires positive real interest rates to be effective. If one thinks we will return to that environment, then it would makes sense to overweight 1-10 year bonds. I think that is a bad bet...can anyone else see the Fed increasing short term rates to 4-5%, while inflation remains at 2%?

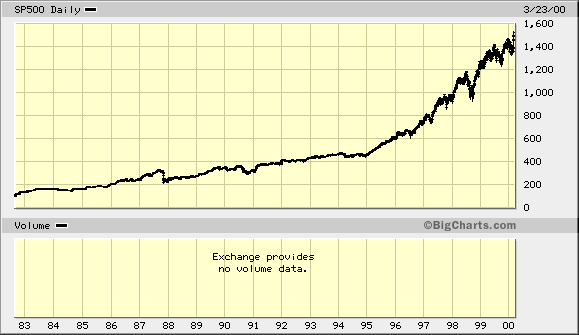

So true. Which is why I find it funny when Clive compares the PP to a 1-5 year bond ladder from 1980 to 2000. Of course STT were incredible over this time period, the government was handing out risk free money. STT were receiving on average a 5% real return! I would have been tempted to go all STT and then return to the PP once the gravy train was over. Although, I wouldn't count on a repeat of this occurring in the near to medium term...unless we fall into 2-3% deflation.Slotine wrote: The gold cuts both ways though. Which one wins depends on which side of the gold spike you start measuring from.