Page 1 of 1

The Funny Thing About This Gold Rally

Posted: Tue Oct 05, 2010 9:45 pm

by MediumTex

Is that no matter how many people talk about gold or how excited they get, most people have never owned and will never own gold as an investment.

Those who do own gold typically seem to own 5%-15% of their overall portfolio in gold.

It's funny that the conservative PP has this huge chunk of gold exposure (more than most gold bugs even) that would appear to be a very risky bet. Of course it's not risky at all as part of the PP, but for those who don't understand the strategy well, I'm sure it looks crazy.

Re: The Funny Thing About This Gold Rally

Posted: Tue Oct 05, 2010 10:07 pm

by craigr

I can't complain about gold because the past few years it's really been the main asset doing the heavy lifting. Its Sun will set some time, but I thank it for the service so far.

Re: The Funny Thing About This Gold Rally

Posted: Wed Oct 06, 2010 7:47 am

by Bonafede

I 100% agree with you there CraigR. I gotta say...the emotional journey I went on in trying to 'modify' the 'permanent' portfolio was a tough one. But once I reached the conclusion of simplicity, glad I went with it. The gold portion has been great. But like anything, will have it's day end too. But that's whey we have other parts of the portfolio!

Re: The Funny Thing About This Gold Rally

Posted: Wed Oct 06, 2010 8:56 am

by Storm

I think it's important to keep in mind the historical perspective of the PP. Harry Browne was a gold bug, and precious metals served him extremely well throughout the hyperinflation of the 70s. When he developed the PP he was looking for a way to diversify out of precious metals in the early 80s.

History does repeat itself and there are a number of ways the next decade could go. We could have hyperinflation ala the 70s where bonds do terrible, but gold pulls it's weight, or we could have deflation ala Japan.

What is most interesting to me is that gold seems to do well in deflationary as well as inflationary times. The rush to safety effect gold has seems to perform well in any type of fearful market.

Re: The Funny Thing About This Gold Rally

Posted: Wed Oct 06, 2010 9:25 am

by Lone Wolf

I couldn't agree more. I'd long thought of gold as an extremely powerful investment but its volatility and history of long, deep slumps made me feel faint every time I considered it seriously. Powerful but scary as hell -- like some kind of chainsaw that was all blades and no handle. Until I discovered the Permanent Portfolio, I'd thought the only way to do much with gold was to hold a really wimpy 5% or so allocation.

Gold is (IMO) a horrible 100% "all-in" investment but a fantastic diversifier, especially given the right rebalancing strategy. It seems completely intuitive now, but until Harry Browne explained it, I failed to understand that you harness gold's power by bringing in other scary, volatile instruments. These instruments (stocks and long-term bonds) can carry gold when it falters (which, given enough time, it will do again.)

I am not one to predict the future but I think that subtlety like this will keep the Permanent Portfolio from ever being a truly "mainstream" allocation. It is one of the most profoundly conservative portfolios around in terms of preserving and safely building real purchasing power. Yet I believe that its wild and woolly exterior will leave it mostly hiding in plain sight.

Re: The Funny Thing About This Gold Rally

Posted: Wed Oct 06, 2010 9:42 am

by Reido

When I first came across the idea of investing in gold, it seemed like absolute garbage - and 25% of your portfolio?? I figured this came from some historical strategy which would have been outdated for hundreds of years.

Either way, I think you're right about the strategy being undiscovered - no one in their right mind would invest 25% of their assets in gold and 25% in long-term government bonds... with only 25% in stock - except us!

Re: The Funny Thing About This Gold Rally

Posted: Wed Oct 06, 2010 7:48 pm

by MediumTex

Lone Wolf wrote:I am not one to predict the future but I think that subtlety like this will keep the Permanent Portfolio from ever being a truly "mainstream" allocation. It is one of the most profoundly conservative portfolios around in terms of preserving and safely building real purchasing power. Yet I believe that its wild and woolly exterior will leave it mostly hiding in plain sight.

I think you hit the nail right on the head.

The PP will sit right in front of people with its safety and stability on full display and all but a few will never even see it.

It's taken me a long time to fully internalize this concept. I always figured that if I ran across something that worked the rest of the world would figure it out soon enough. With the PP, though, I am beginning to see that part of what makes it work is that so few people do seem to figure it out (even though HB made the case for it in very clear terms).

It's a weird feeling to be in possession of knowledge that I know would be helpful to others, and which I am always happy to share, but which I know VERY few people will ever act on.

Part of it, too, is that the PP is well suited to my temperament, so it feels very right to me. I'm sure that there are many investors with higher or lower risk tolerances than me for whom it would not be as good a fit, even if they did fully grasp the subtlety of its design.

Re: The Funny Thing About This Gold Rally

Posted: Wed Oct 06, 2010 8:54 pm

by Snowman9000

I have a friend who is a true gold bug. He loves it that I have such a high percentage in gold. But he is driven crazy by my LT bonds. And my stocks for that matter. I've explained the concept to him but he cannot get past the "obvious, huge" overvaluation of bonds, and stocks to a lesser extent. He's a definite market timer, and not a particularly good one, which places him in good company. I think the passive concept offends the market timers who would not be averse to gold, and the gold offends the typical passive "conservative investor" who cannot come to grips with the "no yield" and "no intrinsic value" aspects.

Re: The Funny Thing About This Gold Rally

Posted: Thu Oct 07, 2010 10:09 am

by Storm

The funny thing about the PP is that I can tell friends and relatives about it, "9.3% average annual returns over the last 40 years," they say "wow, that's pretty good", but for some reason either they think it sounds too good to be true, don't understand it, or don't believe it. I say "run the numbers for yourselves", but it seems like most people care little at all about their 401k, and just stick money in whatever default crap option their company chooses for them and hope it will be worth something when they retire.

I guess the laziness of the average retail investor comes into play here. If you're too lazy to educate yourself on what options are out there, you'll probably be stuck at retirement age living off a combination of social security, whatever meager housing equity you might have, and whatever is left of a small 401k.

Me, I have set strict goals for myself, and if everything goes according to plan I won't actually have to work beyond the age of 50. I will probably continue to work, just because work brings satisfaction and I enjoy it, and who wouldn't want to retire with a little extra and leave more for your kids education, etc. I think I would have a lot more satisfaction at the age of 50 having reached the F-you money phase. By F-you money, I don't mean being wealthy, but simply being able to walk away from any unpleasant job and still support your current lifestyle. I believe once you reach this phase it will have a profound impact on your life in general. People are willing to put up with a lot of situations in the work force that they would not normally put up with, if they didn't have to. This gives you the freedom to look elsewhere or take a hiatus if you so desire.

Re: The Funny Thing About This Gold Rally

Posted: Thu Oct 07, 2010 10:45 am

by BobS

I've been telling friends for awhile now to put at least 10% into gold. Or get some safety with

the PRPFX. None of them listen. One moved everything into TIPS, even after I pointed out the

11% rise in PRPFX this year. Of course he has an investment advisor.

Even Jim Cramer has been telling people to put part of their portfolio into gold. Turns out

even he is very conservative with his retirement funds. In his books he writes that one

shouldn't speculate with retirement accounts.

Bob

Re: The Funny Thing About This Gold Rally

Posted: Thu Oct 07, 2010 11:05 am

by MediumTex

One of the sort of sad and enduring aspects of retail investor activity (as well as a lot of institutional advisors) is a basic bewilderment when confronted with the following two simple questions:

1. How will I know when to buy?

2. How will I know when to sell?

One of the most appealing aspects of the PP to me is that it provides clear and unambiguous answers to these two questions.

I was talking to what seemed like an intelligent and well-informed institutional money manager at an even a while back and he was sharing some exotic sounding approaches to money management. After describing one approach to me I casually asked him how I would know when it was time to sell. His whole demeanor changed and he suddenly looked like a tourist in a casino at 4:00am trying to find his way back to his hotel room. "We all wish we knew the answer to that question" he replied. I thought to myself "not all of us--I know exactly when to buy and exactly when to sell", but I didn't say anything.

The unfortunate thing about this gold rally is that I suspect a lot of people who are buying gold today have no clue about what would make them sell and when.

Re: The Funny Thing About This Gold Rally

Posted: Thu Oct 07, 2010 2:52 pm

by Wonk

MediumTex wrote:

One of the sort of sad and enduring aspects of retail investor activity (as well as a lot of institutional advisors) is a basic bewilderment when confronted with the following two simple questions:

1. How will I know when to buy?

2. How will I know when to sell?

One of the most appealing aspects of the PP to me is that it provides clear and unambiguous answers to these two questions.

I was talking to what seemed like an intelligent and well-informed institutional money manager at an even a while back and he was sharing some exotic sounding approaches to money management. After describing one approach to me I casually asked him how I would know when it was time to sell. His whole demeanor changed and he suddenly looked like a tourist in a casino at 4:00am trying to find his way back to his hotel room. "We all wish we knew the answer to that question" he replied. I thought to myself "not all of us--I know exactly when to buy and exactly when to sell", but I didn't say anything.

The unfortunate thing about this gold rally is that I suspect a lot of people who are buying gold today have no clue about what would make them sell and when.

Excellent points MT. If you are familiar with Van Tharp's books on trading, the primary theme with the most successful traders over the long term is their exit strategy, NOT their entry strategy. For amateur gold bugs, I have no doubts that most will hold on way too long and have no idea when to get out (if they are surfing the wave rather than rebalancing). Fortunately, gold gives us a lot of historical data to analyze--unlike previous bubbles like .com stocks and to a certain extent housing.

Curiously, for all the chirping in the mainstream press about a gold bubble, I've yet to see mass investor participation--which is an absolute prerequisite for a major bubble. There are, of course, rumblings from the large players. But I haven't talked to Joe Sixpack yet about how much he made buying gold and gold stocks. As they say, "There's no mania like gold mania." The hardest part of exiting a major gold position will be the perception of reality. In a major gold bubble, the entire world will look like it's falling apart. For those with strong intestinal fortitude, it will also be the time to sell.

Re: The Funny Thing About This Gold Rally

Posted: Thu Oct 07, 2010 4:10 pm

by MediumTex

Wonk wrote:

Curiously, for all the chirping in the mainstream press about a gold bubble, I've yet to see mass investor participation--which is an absolute prerequisite for a major bubble. There are, of course, rumblings from the large players. But I haven't talked to Joe Sixpack yet about how much he made buying gold and gold stocks.

Wonk, you follow the miners more closely than me, but it seems to me that the mining stocks have a lot of catching up to do with the price of gold, and most mining stocks are not priced for an extended period of $1,300+ gold.

From here, it seems like the miners are likely to double (at least) in the coming months and years if gold holds its gains or continues rising.

Re: The Funny Thing About This Gold Rally

Posted: Thu Oct 07, 2010 7:53 pm

by Pkg Man

Storm wrote:

I guess the laziness of the average retail investor comes into play here. If you're too lazy to educate yourself on what options are out there, you'll probably be stuck at retirement age living off a combination of social security, whatever meager housing equity you might have, and whatever is left of a small 401k.

Perhaps, but I think a lot of luck is involved as well. By that I mean that is was mostly luck that I stumbled upon the PP. While I was searching for something different, I would never have decided to invest in the PP mix on my own. You certainly will not hear about it from your 401K plan.

Re: The Funny Thing About This Gold Rally

Posted: Fri Oct 08, 2010 9:45 am

by Wonk

MediumTex wrote:

Wonk, you follow the miners more closely than me, but it seems to me that the mining stocks have a lot of catching up to do with the price of gold, and most mining stocks are not priced for an extended period of $1,300+ gold.

From here, it seems like the miners are likely to double (at least) in the coming months and years if gold holds its gains or continues rising.

Miners act as a slingshot, which makes sense. Because of the underlying volatility of the metal, most investors are hesitant to bid up stock unless earnings reflect sustained fundamentals. So if the price of gold shoots up to $1500 and back down to $1200, investors in mining companies can get burned if they overextend. Just as you mentioned MT, sustained bullish movements in the underlying metals (especially relative to operating costs such as oil & labor) is usually great for earnings a quarter or two down the road. Since oil and labor have been muted, if the gold price stays high you should see either better stock performance or better valuations.

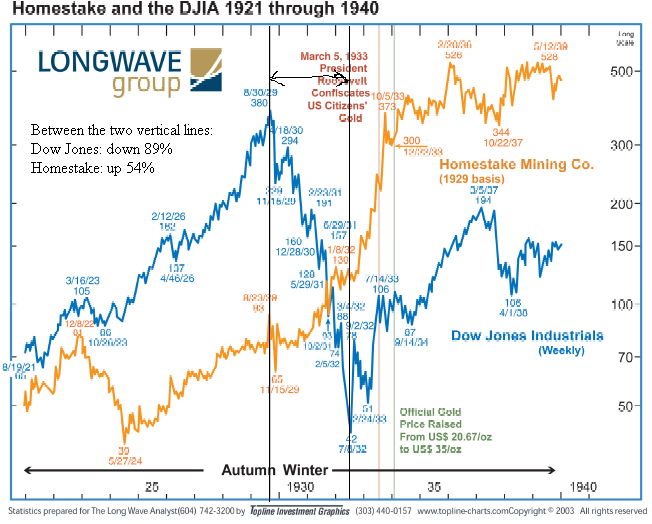

The real fun begins at the end of a parabolic gold run. It's like having extra boosters on a rocket. Gold miners went ballistic in Q3-Q4 1980 (not Q1 at the gold peak) because of the sustained higher price of gold. Gains of 300%-1000% were common depending on whether you were invested in majors or juniors. If you go back to 1929-1934, gold miners experienced the same dramatic gains due to the gains in "real" earnings in a deflationary environment. One of my favorite charts is Homestake circa 1929-1934:

As you can see, Homestake gained 300% from the top of the stock bubble to just before Roosevelt nationalized gold--all while most U.S. stocks cratered. Of course, Homestake again doubled within two years after revaluation of the dollar, but the performance prior to nationalization is striking (but very easy to comprehend why).

The late 70s were a great example of an inflationary parabola. The early 30s were an example of a deflationary parabola. Measured in real terms, it was all the same and had the same effect on gold first and gold miner performance shortly thereafter.

.

Re: The Funny Thing About This Gold Rally

Posted: Mon Oct 11, 2010 10:09 am

by Reido

Storm wrote:

The funny thing about the PP is that I can tell friends and relatives about it, "9.3% average annual returns over the last 40 years," they say "wow, that's pretty good", but for some reason either they think it sounds too good to be true, don't understand it, or don't believe it. I say "run the numbers for yourselves", but it seems like most people care little at all about their 401k, and just stick money in whatever default crap option their company chooses for them and hope it will be worth something when they retire.

I guess the laziness of the average retail investor comes into play here. If you're too lazy to educate yourself on what options are out there, you'll probably be stuck at retirement age living off a combination of social security, whatever meager housing equity you might have, and whatever is left of a small 401k.

Me, I have set strict goals for myself, and if everything goes according to plan I won't actually have to work beyond the age of 50. I will probably continue to work, just because work brings satisfaction and I enjoy it, and who wouldn't want to retire with a little extra and leave more for your kids education, etc. I think I would have a lot more satisfaction at the age of 50 having reached the F-you money phase. By F-you money, I don't mean being wealthy, but simply being able to walk away from any unpleasant job and still support your current lifestyle. I believe once you reach this phase it will have a profound impact on your life in general. People are willing to put up with a lot of situations in the work force that they would not normally put up with, if they didn't have to. This gives you the freedom to look elsewhere or take a hiatus if you so desire.

I agree with virtually all of this statement - I have close friends and relatives who will literally drive from one super-market to the next in order to buy the cheapest foods and take only what's on sale. Meanwhile they lose hundreds of thousands of dollars by investing after reading Money magazine or Forbes. Incredible. I just can't believe that so many people sweat the small stuff - only to miss-out on the things that REALLY matter... I had to LOOK hard to find the Permanent Portfolio - I had to investigate it myself... I just don't understand why so few people take on responsibility for their own financial management. After all, you're the one's who lose your house and retirement - not your financial advisor!

About the "F-you" money - this is what excites me about the portfolio - having the ability to save reliably and know that I won't lose significant buying-power. It gives an incredible sense of freedom.

Here's my question to you guys - how long do we estimate gold will have to be trading above $1300 for those gold mining stocks to double?? Does anyone have the numbers for that??

Re: The Funny Thing About This Gold Rally

Posted: Mon Oct 11, 2010 10:49 am

by MediumTex

Reido wrote:Here's my question to you guys - how long do we estimate gold will have to be trading above $1300 for those gold mining stocks to double?? Does anyone have the numbers for that??

I think that when the market begins to believe that $1300+ gold will be with us for a while and perhaps even form some kind of price floor, that will be when the miners' valuations will be re-visited.

Right now, I think a lot of the sentiment with the miners is that the price of gold is bubbly and will fall down into the high single digits at some point. When this belief begins to fade, I think investors will look at the miners through a different lens.

Re: The Funny Thing About This Gold Rally

Posted: Mon Oct 11, 2010 1:49 pm

by Wonk

MediumTex wrote:

Reido wrote:Here's my question to you guys - how long do we estimate gold will have to be trading above $1300 for those gold mining stocks to double?? Does anyone have the numbers for that??

I think that when the market begins to believe that $1300+ gold will be with us for a while and perhaps even form some kind of price floor, that will be when the miners' valuations will be re-visited.

Right now, I think a lot of the sentiment with the miners is that the price of gold is bubbly and will fall down into the high single digits at some point. When this belief begins to fade, I think investors will look at the miners through a different lens.

Spot on Tex. Reido, I would add if you are interested in the mining sector, you should also be watching other input costs as they will have an impact on earnings. Miners are roller coaster rides. Unless you are ready to thoroughly research management and projects, I would stick to the sector play with GDX or GDXJ. Also, be prepared for 50% sell-offs during corrections.

Re: The Funny Thing About This Gold Rally

Posted: Tue Oct 12, 2010 12:41 am

by Storm

Speaking of GDX... I bought about $10k last week in my VP. I've seen people making a lot of money off junior miners in the last year or so but I don't know enough about how to research them to feel comfortable investing in individual miners. As Wonk alluded to, the inputs such as oil play a big part in profitability, and you have to worry about currency fluctuations as well.