PERM vs PRPFX

Posted: Mon May 07, 2012 2:26 pm

An article discussing the two funds over at Seeking Alpha...

Read the rest here... http://seekingalpha.com/article/565441- ... m-investorThe permanent portfolio is made up of only four asset classes - gold, silver, equities, and US Treasury securities. The ideal permanent portfolio has an nearly equal-weighting of investments, with each asset class making up one-fourth of the portfolio.

The Permanent Portfolio is accentuated with annual rebalancing. In a year where stocks outperform and gold lags, assets would be removed from stocks to be placed in gold. This rebalancing element is the key to the Permanent Portfolio's impressive historical performance.

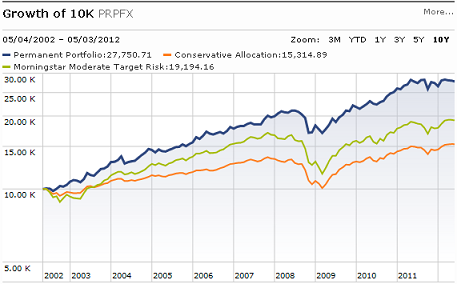

Here's a 10-year chart of the Permanent Portfolio's performance as a mutual fund (PRPFX). MorningStar also includes the performance of benchmarks most relatable to the Permanent Portfolio mutual fund:

permanent portfolio performance, permanent portfolio etf

Keep in mind that this mutual fund, though it operates much like the exchange-traded fund, has a higher expense ratio and some differences in investment methodology.