Page 1 of 2

I Think The Doom Is Getting a Little Overdone

Posted: Fri Aug 20, 2010 12:37 pm

by MediumTex

I am by nature more of a doomer type. I see silly humans tempting the gods at virtually every turn with hubris, arrogance, hypocrisy, and everyday foolishness, with predictably tragic outcomes.

However, there is a voice in the back of my head that is telling me that the current sense of foreboding and gloom has gotten a little ahead of itself. Thus, I think the next few weeks and months may be less bad than people are imagining, which would suggest a higher S&P 500, flat or higher gold (due to higher inflation expectations, as opposed to fear), and a higher yield on the 30 year bond.

I think that sometimes, even if the macro picture hasn't changed much, people just get tired of being pessimistic and begin to the move in the other direction for a while.

We'll see how my prediction pans out.

I will come back to this post in a month or so.

Numbers at the time of my prediction:

S&P 500: 1067

Gold: 1226.50

LT Treasury: 3.62%

Re: I Think The Doom Is Getting a Little Overdone

Posted: Mon Aug 23, 2010 9:50 pm

by SmallPotatoes

I think being optimistic is easier than being cynical. That said I'm predicting a double-dip recession.

Re: I Think The Doom Is Getting a Little Overdone

Posted: Mon Aug 23, 2010 10:43 pm

by MediumTex

SmallPotatoes wrote:

I think being optimistic is easier than being cynical. That said I'm predicting a double-dip recession.

I don't think the first recession ever ended, so I think the term "double dip" is a bit misleading.

Unemployment certainly never improved if the recession was supposed to have ended. To me, if you print a positive GDP number for a couple of quarters in the wake of gigantic government stimulus but unemployment, foreclosures and credit contraction doesn't improve, then I don't think it really counts as the end of the recession that began in 2007.

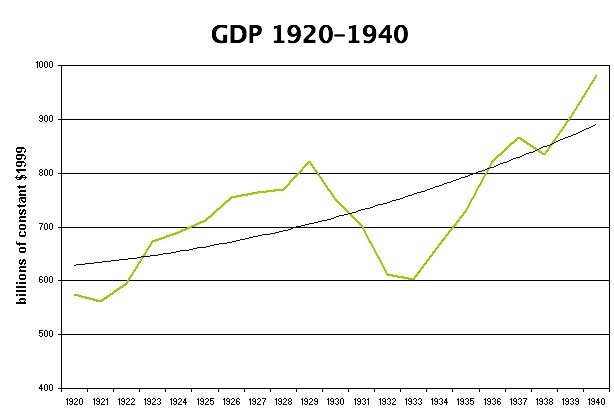

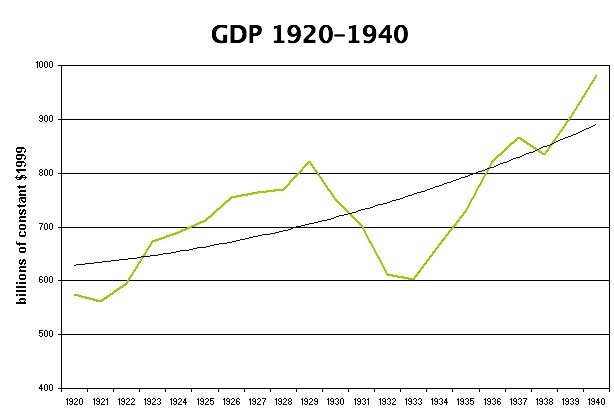

If you look at the 1930s, what we know as the Great Depression was actually two deep recessions, the first of which was about three years long (1930-1933) and the second of which was about two years long (1937-1938). If you compare the 2007-2010 period to 1930-1933, then I think you could argue that the Fed may have helped mitigate what might otherwise have been a larger disaster (or at least pushed the pain farther into the future).

The whole concept of the "Great Depression" is, IMHO, one of those historian created curve-fitting hatchet jobs.

I think what we are going through right now will be different from the 1930s, but I am amazed that people are still talking about it as if it were a normal recession where inventories just get a little ahead of demand.

Re: I Think The Doom Is Getting a Little Overdone

Posted: Tue Aug 24, 2010 5:58 am

by Pkg Man

Economists are an odd group (I should know), but according to the way they measure recessions then the recession that began 12/07

probably ended sometime during the summer of '09.

The rule of thumb definition of a recession is two consecutive quarters of negative GDP growth. But that is only a rule of thumb and for the current and previous recession did not hold. The official definition, according to the National Bureau of Economic Research Business Cycle Dating Committee, is "a significant decline in economic activity spreads across the economy and can last from a few months to more than a year". They look at a range of indicators, including GDP, employment, industrial production, etc. to make their determination. Note that the NBER is NOT a government agency, they are a private group.

The most recent statement from the committee was in April:

NBER COMMITTEE CONFERS: NO TROUGH ANNOUNCED

CAMBRIDGE, April 12 -- The Business Cycle Dating Committee of the National Bureau of Economic Research met at the organization’s headquarters in Cambridge, Massachusetts, on April 8, 2010. The committee reviewed the most recent data for all indicators relevant to the determination of a possible date of the trough in economic activity marking the end of the recession that began in December 2007. The trough date would identify the end of contraction and the beginning of expansion. Although most indicators have turned up, the committee decided that the determination of the trough date on the basis of current data would be premature. Many indicators are quite preliminary at this time and will be revised in coming months. The committee acts only on the basis of actual indicators and does not rely on forecasts in making its determination of the dates of peaks and troughs in economic activity. The committee did review data relating to the date of the peak, previously determined to have occurred in December 2007, marking the onset of the recent recession. The committee reaffirmed that peak date.

The way I read the data, most (though certainly not all) economic indicators began to turn up last summer. I would say that most all economists would agree. But the statement by Medium Tex may have some merit, as given by this Q&A:

Q: Why did the committee not declare the end of the recession when in met on April 8, 2010 even though, as it noted in its announcement, most indicators have turned up?

A: The committee does not judge in real time. Rather, once all the relevant data are in and the early revisions have occurred, it looks back on history and determines in what month the economy reached bottom and began to expand again. The committee also has to guard against the possibility, even if very small, that what seems to be the beginning of an expansion is actually just an interruption in a longer contraction.

So it appears that the committee may also be waiting to ensure that the economy does not turn back down before pronouncing an end to the recession.

Link for NBER Q&A:

http://www.nber.org/cycles/recessions_faq.html

Re: I Think The Doom Is Getting a Little Overdone

Posted: Tue Aug 24, 2010 8:08 am

by MediumTex

I am certainly ready for better times, but from where I sit nothing has really been fixed that led us into this recession in the first place, which seems to have been too much debt at the governmental, corporate and individual household level relative to the value of either the underlying assets or the future income streams.

History is pretty clear that when there is no orderly liquidation and/or marking down methodology to either forgive or re-value bad loans, it creates a strong headwind for the economy that can be VERY hard to overcome.

The fact that financial institutions are being considered healthy based upon a silly accounting rule that doesn't require them to value their loan portfolios based upon the value of the underlying assets is to me a sign of deep structural problems.

I think that the Japan experience (i.e., years of weak growth and monetary authority impotence) is probably a best case scenario for the U.S. (though I hope I am wrong).

Here is a question I might ask an economist: if the analytical tools used by economists did not provide a means of identifying the credit crisis and its likely fallout even after it was underway, why should the rest of society listen to those economists when they tell us what is needed to get the economy back on track in the wake of the credit crisis? Adding a little "Master of the Universe" hubris to the mix in the form of people like Larry Summers and others of his ilk reduces my confidence in our leaders even more.

Von Mises answered my question above by saying that since most economists are either employed by the government or employed by the private sector for the express purpose of trying to predict what the government is going to do next, there are very few economists who actually study (or have a strong grasp of) the underlying dynamics of an economy in the absence of multiple layers of distortion provided by the government and monetary authorities. It would be a bit like a doctor whose patients consisted solely of heroin addicts--such a doctor might have a weak grasp of what a healthy patient even looked like.

Re: I Think The Doom Is Getting a Little Overdone

Posted: Tue Aug 24, 2010 9:56 am

by Wonk

MediumTex wrote:

I think that the Japan experience (i.e., years of weak growth and monetary authority impotence) is probably a best case scenario for the U.S. (though I hope I am wrong).

I would see a best case (for Americans as a whole) as more of that 70s show. Higher employment, higher inflation, higher asset values that are allowed to depreciate in real terms rather than nominal terms. It would allow the U.S. a stealth default on debt obligations both domestically and internationally. The Japan scenario suggests higher debt burden in real terms and increases the likelihood of outright default and the economic shocks that come with it.

I think Japan will be the subject of international news at some point in the next 5-10 years when growth continues to slow under the burden of debt servicing and absence of inflation. Consider Japan a case study of the profligate spender in aggregate. You take an individual who has a high paying job and moderate debt. All of the sudden, the guy's extended family falls on hard times and looks to him to support them all. Since he has a good income, low debt and lots of savings, he shoulders the burden. His friends look at all of the debt he's amassing--300% of his income--and say he'll default. He says he can handle it because interest payments are low. He proves them wrong for longer than they thought possible. To him, the debt doesn't matter--only the interest payments matter. Since he has a good job and good income, the total debt burden is manageable. But at some point, the debt service makes up a sizable portion of his monthly income. Then he falls on hard times and his income drops, making it even more difficult to service the debt. He continues to try everything until he reaches a breaking point and eventually has to declare bankruptcy to get out from under the burden.

It took a lot longer to happen because the mindset went from "paying off the debt" to "servicing the debt" to "I'm drowning in debt." At some point, Japan will be forced to default. I'm crossing my fingers that Japan's default doesn't trigger a global bond crisis as investors look to the U.S. and the rest of the developed world as Japan -10 years and attempt to get out while they have purchasing power left. Then we'll

really see what doom is.

My first preference would have been an early crash and liquidation event for the U.S., while salvaging reserve status. Now that we've chosen this path, my only hope is that we can create an orderly devaluation and maintain a reasonable bond market in the process. The only problem is the latter scenario would result in USD eventually losing reserve status, which has national security implications of its own.

Re: I Think The Doom Is Getting a Little Overdone

Posted: Tue Aug 24, 2010 11:27 am

by SmallPotatoes

In one of his radio shows Harry Browne explained recession, his reasoning for the PP cash component, and the expected outcomes of recession: people get used to a new standard of living or the Fed prints more money. Please correct me if I'm wrong.

He also explained why 1-2 years was the expected duration for a recession to last, which prompted my double-dip comment.

Whatever the case I've explained to my wife that present times call for us to buckle down and be conservative, something we do already. Our standard of living has changed, but so long ago it's hard to remember anything past the last few years.

Re: I Think The Doom Is Getting a Little Overdone

Posted: Tue Aug 24, 2010 12:05 pm

by MediumTex

SmallPotatoes wrote:

In one of his radio shows Harry Browne explained recession, his reasoning for the PP cash component, and the expected outcomes of recession: people get used to a new standard of living or the Fed prints more money. Please correct me if I'm wrong.

You will hear many perspectives on this matter, but here is mine:

A recession is what happens when businesses produce more than the market is willing to consume at current prices. As a result, inventories accumulate, prices fall, profits are pinched, the economy contracts and the excess inventory is eventually soaked up, at which point prices stabilize and the economy begins to expand again.

A so-called "balance sheet recession", or what historians might call a depression, is a different animal altogether. A balance sheet recession occurs when businesses and individuals collectively realize (normally in response to the collapse in the value of an asset class) that the value of their assets is actually much lower than they previously thought, while the debt that has been taken out against those assets is exactly the same as it was before the crisis began. The response to a balance sheet recession is the slow process of paying down debt to the point that the debt and the value of the underlying assets are more in harmony. As you might imagine, if more of a nation's income is being re-directed to paying down debt, there is less income available for current consumption, which looks like a recession, but tends to last much longer than a garden variety recession.

What can be done to short circuit a balance sheet recession? One option it to try to restore asset prices to previous bubble levels. This approach always fails, since bubble prices are by definition unsustainable. Another option is to provide for the orderly liquidation and/or re-pricing of debt to levels that more nearly match the value of the underlying assets. Since this approach basically requires that all financial institutions take enormous losses, in a system where financial institutions are able to exert significant control over the political process (e.g., giving discount mortgages to members of Congress is one of countless examples), such an approach is also extremely unlikely to occur in a timely manner (though over time, of course, un-repayable debt will not be repaid).

The market and public have not yet fully grasped the difference between a balance sheet recession and a garden variety recession. Thus, many are patiently waiting for demand to take up the slack capacity in the economy, which is not going to happen any time soon (if ever). An Austrian economist would say that what has happened is that artificially low interest rates over a long period resulted in a structural misallocation of capital accross the entire economy. When people began to realize that there was a misallocation of capital (e.g., too many McMansions in the sunbelt states), it wasn't just a matter of reallocating the capital elsewhere since the capital was no longer liquid and the non-productive assets that resulted from the misallocated capital had giant liens against them in the form of debt.

I cringe when I hear people say that Bernanke isn't going to allow deflation to occur. To me, that is the central banker equivalent of the rooster saying that he isn't going to let the sun rise. Bernanke seems like a very intelligent and humble man, but I think history will show that he was like a brave firefighter spraying water into an approaching tsunami. What he is doing may mitigate matters in some way, but the basic set of effects that have already been set in motion are going to take a long time (perhaps a generation) to fully play out.

Re: I Think The Doom Is Getting a Little Overdone

Posted: Tue Aug 24, 2010 1:10 pm

by Storm

Hey guys, I'm new to the forum, glad I found this place since I am only 36 and have been too heavily invested in equities during the first 10 years of my retirement saving.

MediumTex, I just had to create an account and reply that your comment is probably the most insightful and amazingly factual account of what is going on in the greater economy today. We are currently going through what you accurately call a "balance sheet recession" in the form of trillions of dollars in housing equity that was never there being deleveraged. It's ridiculous that Bernanke thinks he can inflate his way out of this massive deflation by increasing the money supply. Even if you increase the money supply by trillions you're still left with a population that does not want to borrow it, so it just sits at the banks, and doesn't really enter the economy or cause inflation.

What are your predictions for the next decade or so? I'm predicting Japan style deflation and generally flat or worse unemployment. Not that it matters for PP, as we should do well regardless with bonds and cash.

I just went all in on PP yesterday - and I have to admit I was a little scared buying LT Treasuries with a 3.6 yield, but I suppose even if I bought in at the wrong time I just have to let the PP take care of it.

Re: I Think The Doom Is Getting a Little Overdone

Posted: Tue Aug 24, 2010 3:47 pm

by MediumTex

Storm wrote:

What are your predictions for the next decade or so? I'm predicting Japan style deflation and generally flat or worse unemployment. Not that it matters for PP, as we should do well regardless with bonds and cash.

Since you asked...

The crowd will not do well. In a world that is deleveraging, there can't be as many winners as during a period of economic expansion with increasing levels of leverage. Picture a game of musical chairs where 30 participants think they are competing for 29 chairs, only to find when the music stops that there are only 3 chairs. Realizations like this can cause profound economic, political and social disruptions.

Gold is likely to do well, though it will probably be a bumpy ride. Treasurys could provide solid inflation-adjusted returns for many years as deflation begins to make people feel like they are having the same nightmare every time they go to sleep. The stock market is likely to trade in a range for at least another decade (with the occasional bear market rallies). The Fed will do everything in its power to create inflation. If it succeeds, it will probably be bittersweet, since the evils of inflation are well known.

I don't see any dire Mad Max-type scenarios, but instead I think we will just see increasing levels of tension throughout society as fantasies continue to grind against reality like two tectonic plates, occasionally resulting in dramatic seismic movements that will be impossible to predict beforehand, just as HB would have reminded us.

Overall, I expect we will continue to see the PP stress-tested from every imaginable angle, and it will probably take it all in stride.

Re: I Think The Doom Is Getting a Little Overdone

Posted: Tue Aug 24, 2010 5:01 pm

by SmallPotatoes

As a side note: I do appreciate that the PP allows one peace of mind enough to speculate about which Doomsday will occur and how our investments will benefit from it.

We now return you to your regular thread.

Re: I Think The Doom Is Getting a Little Overdone

Posted: Tue Aug 24, 2010 8:10 pm

by Pkg Man

MediumTex wrote:

Here is a question I might ask an economist: if the analytical tools used by economists did not provide a means of identifying the credit crisis and its likely fallout even after it was underway, why should the rest of society listen to those economists when they tell us what is needed to get the economy back on track in the wake of the credit crisis? Adding a little "Master of the Universe" hubris to the mix in the form of people like Larry Summers and others of his ilk reduces my confidence in our leaders even more.

Von Mises answered my question above by saying that since most economists are either employed by the government or employed by the private sector for the express purpose of trying to predict what the government is going to do next, there are very few economists who actually study (or have a strong grasp of) the underlying dynamics of an economy in the absence of multiple layers of distortion provided by the government and monetary authorities. It would be a bit like a doctor whose patients consisted solely of heroin addicts--such a doctor might have a weak grasp of what a healthy patient even looked like.

MT you are correct that very few economists saw this coming (Roubini was one notable exception), so I share your view about their predictive and prescriptive abilities. Perhaps the only profession held in lower esteem would be lawyers

That said, not all economists are alike; they come in all flavors. As a result there's are a variety of views about what should be done. Personally I do not claim to have the right answers, although I worry seriously about going deeper and deeper into debt (which is the source of my greatest trepidation about the PP since it holds so much in LTB).

A year and a half ago I was saying that this would be a more severe recession than the garden variety, since it was accompanied by a financial crisis. They are always more severe and longer lasting than the garden variety type. Eventually we will get back to normal growth, unless we suffer another shock (particularly something like another 11 Sep 01). That is the biggest fear right now among at least one member of the Fed, and I share that concern.

Re: I Think The Doom Is Getting a Little Overdone

Posted: Wed Aug 25, 2010 2:52 pm

by MediumTex

Pkg Man wrote:

MT you are correct that very few economists saw this coming (Roubini was one notable exception), so I share your view about their predictive and prescriptive abilities. Perhaps the only profession held in lower esteem would be lawyers ;)

I like it.

If you would care to, tell us more about your background and how it informs your ideas about the markets and what your thoughts are on the structure of the PP.

On the issue of long term government debt, every time I look at Japan I am reminded (to paraphrase Keynes) that "in a fiat money world governments can stay solvent longer than you can stay rational."

This may be a controversial perspective, but one thing to bear in mind when thinking about government debt is that it is just an abstraction--it's just an idea. No one has a lien on any property of the U.S. government or any other government. Thus, no bondholder has any of the traditional rights that a creditor would have vis-a-vis a borrower. Now, it is certainly true that a lender is free not to loan any MORE money to a government that no longer looks like a good credit risk, but the matter of creditworthiness is also something that is a bit of an abstraction, and ultimately is something we evaluate on a

relative basis--i.e., if everyone in the world had a junk credit rating then any entity with a rating above junk should be able to borrow money in the same way as a AAA borrower can today.

Stated in a slightly different way, in the world economy there are two kinds of assets--(1) real assets that produce rents or are otherwise an efficient allocation of available natural resources, labor and technology, and (2) other assets that consist of promises, financial instruments, insurance-type arrangements, etc. emanating from the assets in category (1).

Government debt falls squarely into category (2), and has the added feature of having no underlying collateral subject to a security interest. Assets in class (2) could go to zero in value and the amount of capital in the world available for economic activity would be exactly the same (i.e., the amount of natural resources, labor, knowledge, plant and equipment would be exactly the same), though a more likely scenario would be that some financial assets would decline in value more than others, and ultimately the only debt that anyone would be interested in would be that which was issued by the entity with the most economic, political and military power,

on a relative basis (guess who that would be).

Alternatively, if all of the real assets in the economy were to disappear, the world economy would truly come to a standstill (assuming that there weren't resources and time available to re-build them) because the class of financial assets are really nothing more than software (i.e., an abstraction or set of ideas) that runs on the hardware of the real assets of the world economy.

I am interested in your opinions on this armchair analysis (there may be a little slack in it--it has a lot of moving parts). In a sense, it is a fairly optimistic take on the future of an overleveraged world. I would rather live in a world with too much leverage and too many claims on the same underlying collateral than in a world where it was mathematically impossible to provide all of the people enough calories to keep from starving.

Also, what are your thoughts on the Austrian economics view of things? I find Von Mises analysis of the effects of artifically low interest rates to be pretty persuasive. It's not that we are getting poorer, it's just that we are more deeply coming to understand that we were never as rich as we thought in the first place.

Re: I Think The Doom Is Getting a Little Overdone

Posted: Wed Aug 25, 2010 3:01 pm

by MediumTex

Storm wrote:

I just went all in on PP yesterday - and I have to admit I was a little scared buying LT Treasuries with a 3.6 yield, but I suppose even if I bought in at the wrong time I just have to let the PP take care of it.

BTW, congratulations. I think you will be happy with your decision.

Re: I Think The Doom Is Getting a Little Overdone

Posted: Wed Aug 25, 2010 10:35 pm

by Pkg Man

MediumTex wrote:

Pkg Man wrote:

MT you are correct that very few economists saw this coming (Roubini was one notable exception), so I share your view about their predictive and prescriptive abilities. Perhaps the only profession held in lower esteem would be lawyers

I like it.

If you would care to, tell us more about your background and how it informs your ideas about the markets and what your thoughts are on the structure of the PP.

I am of the Chicago/UCLA school of economic thought - very free-market and efficient-market oriented. I have not had much exposure to the Austrian school, but due to one of your posts I ordered

Human Action. One of my fields was actually financial economics, although I haven't touched it since graduate school. I think that Taleb (

Fooled by Randomness and

The Black Swan) and Shiller (

Irrational Exuberance) have valid points, but I am still of the opinion that in general the capital markets are efficient, at least to the extent that I can't earn a riskless return by exploiting publicly available information, charts, etc. As such I have always been a big fan of index funds. For some reason though this belief in efficient markets doesn't come as easy for the government debt portion of the PP. I realize I'm not quite consistent in that regard.

Much like an overweight doctor who smokes, I was way too heavily invested in equities, even though I knew better. This was partly a result of neglect and partly due to a unique situation of holding a fairly large amount of stable company stock, with risk/return characteristics somewhat like a bond (until black swans appear, of course). I thought the best approach in my situation was to diversify through stock and bond index funds. But 2008 showed that previously low-correlated assets can become highly correlated when panic strikes. After the 2008 debacle I realized that I needed to do something different, and somehow stumbled upon the PP.

The thing that struck me about the PP was that it was built around the various around economic scenarios; I am not aware of any other portfolio constructed in such a way. Of course I immediately wanted to modify it (25% in equities seemed

too low for someone of my age), but eventually came around to appreciate it as is. HB's view of trying to divine the future was something I already subscribed to in the context of stocks, hence my belief in index funds, but I hadn't thought it through to other asset classes or how it should affect one's investing over a lifetime. I think that the unique structure of the PP combines the thinking of the efficient markets hypothesis, the Black Swan thinking of Taleb, and Shiller's belief in the frequency of bubbles. The futility of trying to predict the future and the use of index funds is a direct influence of the EMH, low/non correlated assets deliver a portfolio that is at least less susceptible to Black Swans than any conventional approach, and firmly-adhered-to rebalancing bands provide some protection against bubbles. In a sense the PP hedges against the various financial economic theories.

MT I think you may be on to something in your analysis of the different types of capital. Certainly there is a difference between a default on a promise to pay and a destruction of physical capital. One is simply a transfer of wealth and the other a reduction in wealth. I will give it some more thought.

Thanks for the thought provoking post.

Re: I Think The Doom Is Getting a Little Overdone

Posted: Thu Aug 26, 2010 8:57 am

by MediumTex

Pkg Man wrote:

I am of the Chicago/UCLA school of economic thought - very free-market and efficient-market oriented. I have not had much exposure to the Austrian school, but due to one of your posts I ordered Human Action.

Human Action is really an amazing and sweeping book. Although it is over 1,000 pages, you feel like you are just getting a basic overview of his thinking on the topics he covers.

Von Mises had a deep and subtle understanding of human nature and he was able to write about it with great clarity.

I hope you enjoy it.

Re: I Think The Doom Is Getting a Little Overdone

Posted: Thu Aug 26, 2010 10:29 am

by MeDebtFree

FYI: I was able to get a free pdf copy of Von Mises Human Action at the Von Mises Institute website.

Re: I Think The Doom Is Getting a Little Overdone

Posted: Thu Aug 26, 2010 8:54 pm

by Storm

Interesting topic of conversation. I tend to subscribe more to the Austrian school of economics, and Mises is a great example. Didn't Mises say most bubbles were caused by the misallocation of resources? Specifically easy money that leads people to make bad business decisions and invest in companies or areas of the economy that aren't sound? I think Peter Schiff had a great example in one of his books about a restaurant owner that has a large conference come through his town and doesn't have enough tables to fit all the customers. He misinterprets this as an increase in demand, without enough supply (tables) so he borrows money to expand his restaurant. After that week the conference was in town his restaurant is empty and has way more tables than it needs. This was a misallocation of resources, because the business owner incorrectly interpreted a short-term uptick in business as an increase in long-term demand. Businesses like this should be allowed to file bankruptcy and fail. After all, the business owner should have done more market research before making such a huge investment with borrowed money.

What worries me the most is that in order to try and prevent deflation, our central banking policy seems to be to inflate our way out of it. Right now they can't really do much, because QE is only buying treasury bonds from themselves and lending money back to banks where it sits doing nothing. However, I'm worried that Bernanke may decide to lower the interest rate paid on this money the banks are parking at the Fed. In fact, there has been speculation that he may not only lower the rate from 25 basis points to 0, but also to -25 basis points, effectively charging the banks to park their money at the Fed in order to encourage borrowing.

Such a Fed policy would surely cause numerous bad loans to be made, creating bubbles in many other areas of the economy. It's hard to predict where these bubbles might form, but my guess is that they could be in renewable energy, healthcare IT, or any number of other industries that are hot right now. Anyway, I was just thinking how ironic it is that in order to try and inflate our way out of the hangover from one bubble, the best the central bank can do is create countless others.

I do agree with what you said also about how markets/governments can stay irrational longer than you can bet against them... I think people like Schiff and Paul would never invest in Treasuries, mainly because they always talk about the coming insolvency of the Fed, but the simple fact is that the dollar is still the reserve currency and I can't see anything changing that in the near term, short of a catastrophic failure of some kind. Sure, it might get devalued in 30-40 years to the point that we are all trading million dollar bills (megabucks with the gipper on the front) as in Snowcrash but I don't see it happening in the next 5-10 years.

Re: I Think The Doom Is Getting a Little Overdone

Posted: Thu Aug 26, 2010 9:39 pm

by MediumTex

I was talking about this with someone the other day...

When people talk about the decline of Rome, they never talk about the effect this had on the rest of the world. I suspect that however much Rome suffered, the rest of the world suffered more (the Dark Ages and all).

Schiff and company act like the U.S. is the new Rome and as soon as it passes away someone else will step into its place. It sometimes works that way (the U.S. took Britain's place about 100 years ago), but often the decline of the dominant political and economic force leads to a chaotic vacuum that isn't really good for anyone.

On the subject of Bernanke, I think he is simply a disciple of a flawed system.

I assume everyone has seen the Keynes/Hayek rap. If not, it's worth a few minutes of your time:

http://cafehayek.com/2010/01/keynes-vs- ... video.html

Re: I Think The Doom Is Getting a Little Overdone

Posted: Fri Aug 27, 2010 8:45 am

by Storm

Great video... Funny and still informative.

I assume you've probably also seen this Carrie Underwood parody video "Before He Trades"

http://www.youtube.com/watch?v=wU1pD4xPe2M

Re: I Think The Doom Is Getting a Little Overdone

Posted: Sun Aug 29, 2010 9:57 pm

by Wonk

MediumTex wrote:

I was talking about this with someone the other day...

When people talk about the decline of Rome, they never talk about the effect this had on the rest of the world. I suspect that however much Rome suffered, the rest of the world suffered more (the Dark Ages and all).

Schiff and company act like the U.S. is the new Rome and as soon as it passes away someone else will step into its place. It sometimes works that way (the U.S. took Britain's place about 100 years ago), but often the decline of the dominant political and economic force leads to a chaotic vacuum that isn't really good for anyone.

I really like Jim Rickard's insight and he's mentioned "The Collapse of Complex Societies" as an interesting read. I haven't read it yet but the Rome references provide an interesting case study.

http://www.amazon.com/Collapse-Complex- ... 052138673X

Re: I Think The Doom Is Getting a Little Overdone

Posted: Sun Aug 29, 2010 11:15 pm

by MediumTex

I've read Tainter's book. He has an interesting argument (though it actually only takes a few pages, not a whole book, to make).

I think there are some Tainter articles on the web that basically give you the book in a nutshell.

Re: I Think The Doom Is Getting a Little Overdone

Posted: Mon Aug 30, 2010 10:59 am

by Storm

Re: I Think The Doom Is Getting a Little Overdone

Posted: Mon Sep 13, 2010 4:14 pm

by MediumTex

MediumTex wrote:I think the next few weeks and months may be less bad than people are imagining, which would suggest a higher S&P 500, flat or higher gold (due to higher inflation expectations, as opposed to fear), and a higher yield on the 30 year bond.

I think that sometimes, even if the macro picture hasn't changed much, people just get tired of being pessimistic and begin to the move in the other direction for a while.

We'll see how my prediction pans out.

I will come back to this post in a month or so.

Numbers at the time of my prediction:

S&P 500: 1067

Gold: 1226.50

LT Treasury: 3.62%

I'm going to call this one a "hit" and close out my prediction today, with the following numbers as of 9/13/2010:

S&P 500: 1121

Gold: 1245.10

LT Treasury: 3.85%

Re: I Think The Doom Is Getting a Little Overdone

Posted: Tue Sep 14, 2010 6:19 pm

by Storm

I would call that a hit as well. Who could have predicted things would go the other way? It was looking a little "doomy" a month ago. Although the next month could put us back in "doom" territory. It started today with a big pop in gold, drop in bond yields, and rumors of QE2 heating up:

http://www.reuters.com/article/idUSN149625720100914

"A string of stories that suggest the (U.S. Federal Reserve) is closer to QE2 than the market might appreciate offers by far the best explanation for the price action in the last 24 hours, including: higher gold, broad-based USD weakness, rallying Treasuries, curve flatteners and modest positive risk trades," said Alan Ruskin, global head for G10 FX at Deutsche Bank in New York.