Page 1 of 1

What Could Invert the Yield Curve

Posted: Thu Dec 08, 2011 8:57 am

by moda0306

I've been operating under the assumption that long-rates are all-but guaranteed to be higher than short-term rates. Other than 1981 type situations, are there other situations where historically or theoretically short-term rates could/should go higher than long-term rates?

Re: What Could Invert the Yield Curve

Posted: Thu Dec 08, 2011 9:03 am

by MediumTex

Any time the economy is going into a normal recession one would expect to see an inverted yield curve.

Right now, we are obviously not in a "normal" anything (recession or otherwise), so I wouldn't expect the curve to invert any time soon, given that it's basically at zero on the short end.

Re: What Could Invert the Yield Curve

Posted: Thu Dec 08, 2011 9:11 am

by moda0306

MT,

Can you dive into that a bit more? I've heard that, but I think in a fractional reserve system, demand for owned (not loaned) savings also increases the SUPPLY of loanable funds... it's not like all money is created equal in a recession... people today DON'T like money they'll have to pay back at interest, no matter how low the rate.

So in the recessions of the 21st century, people would/do tend to deleverage, preferring "owned" money to "loaned" money, which simultaneously increases the supply of loanable funds (more savings and less investment), and decreases the demand for those same funds (less people/businesses want to borrow).

Could you poke holes where appropriate and explain why in todays economy a recession would cause short-rates to rise, or at least not fall as much as long-rates?

Re: What Could Invert the Yield Curve

Posted: Thu Dec 08, 2011 9:21 am

by Gumby

MediumTex wrote:

Any time the economy is going into a normal recession one would expect to see an inverted yield curve.

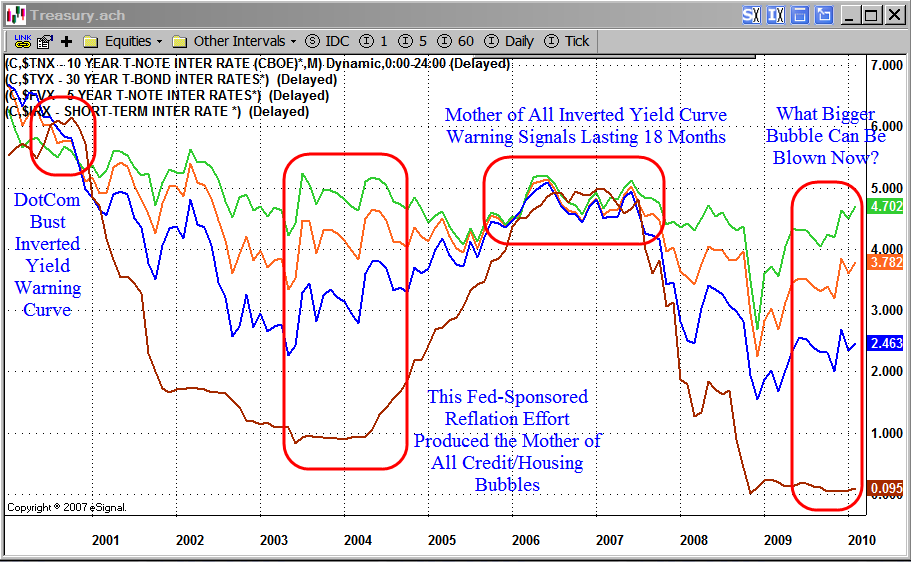

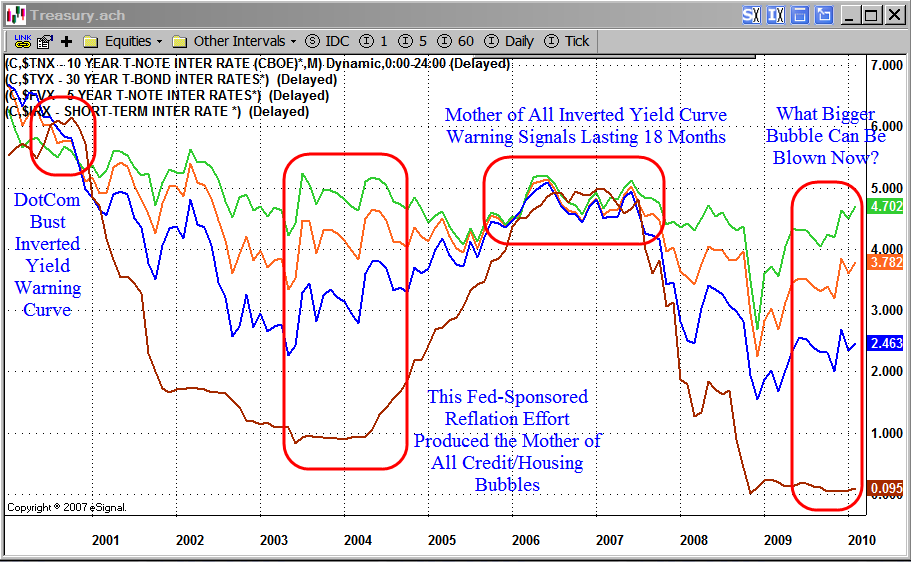

Yes. An inverted yield curve is usually a leading indicator of an oncoming recession.

http://globaleconomicanalysis.blogspot. ... ry-is.html

[align=center]

[/align]

Re: What Could Invert the Yield Curve

Posted: Thu Dec 08, 2011 9:30 am

by moda0306

Why does it behave that way? What causes short rates to rise on treasury debt before a recession?

Re: What Could Invert the Yield Curve

Posted: Thu Dec 08, 2011 9:53 pm

by MachineGhost

Do we have any other examples in history of short term rates rising above long term rates?

Normally, the Fed lags the T-Bill market with its rate changes, but I wonder if years like 1981 were exceptions or if the rule still held up.

MG

MediumTex wrote:

Any time the economy is going into a normal recession one would expect to see an inverted yield curve.

Right now, we are obviously not in a "normal" anything (recession or otherwise), so I wouldn't expect the curve to invert any time soon, given that it's basically at zero on the short end.

Re: What Could Invert the Yield Curve

Posted: Fri Dec 09, 2011 11:50 am

by stone

Machine Ghost, doesn't Gumby's chart show inversion both at the dotcom crash and before the 2008 crash? I suppose long term yields traditionally are set more by the market and short term by the Fed. The Fed would hike short term yields to curtail credit expansion or to strengthen the currency exchange rate. Doing that causes companies to have a hard time servicing debts and so earnings and stock prices fall and that makes LTT attractive so pushing down the yields of LTT.

Very very distressed debt tends to have an inverted yield curve too. If you think that default will happen in months then you need a massive yield for a one year bond to be worth the risk. A ten year bond has several years to pay you over and so the yield need not be so high. The BP corporate bond yield curve was massively inverted in the aftermath of the TransOcean leak.

Re: What Could Invert the Yield Curve

Posted: Fri Dec 09, 2011 12:07 pm

by moda0306

stone,

But the treasury can't default... I see what you're saying with a corp... but why does the yield curve on treasury debt flip right before a recession?

Re: What Could Invert the Yield Curve

Posted: Fri Dec 09, 2011 12:22 pm

by stone

moda, I think the LTT is set by the market and the STT yield is set by the Fed. The hike in the STT yield actually causes the recession. That is why it happens just before the recession. They hike up STT yields to stamp down on inflation. It is recession by design. We now seem to be heading for a recession with zero interest rates but that is a weirdness that signifies the new world we are in I guess. No more "great moderation".

Re: What Could Invert the Yield Curve

Posted: Fri Dec 09, 2011 12:23 pm

by moda0306

stone,

Yeah that makes sense... thanks!

[/align]

[/align]