Page 1 of 1

Free eBook: Charles Gave’s Strategy for Optimizing the Permanent Portfolio

Posted: Mon Dec 29, 2025 3:36 am

by Mayday_I

Hi everyone,

Over the holidays, I came across a short book by Charles Gave, a french economist, that is available online for free: The General Theory of Portfolio Construction (

https://web.gavekal.com/books/the-gener ... struction/). I thought it might be of interest to some of you here.

The book focuses on portfolio construction and presents what Gave considers an improved version of the classic Permanent Portfolio. His approach differs from Harry Browne's original concept in two key ways:

-) He adds 20% energy equities (XLE) as a hedge against oil price shocks.

-) Gave only holds Gold or LTTs at a time, never both. The rational behind that is, that LTTs and Gold are meant to protect the portfolio during diametrically opposed economic phases. The choice is determined by a dual momentum strategy.

In my opinion, a 20% allocation to XLE seems excessive. However, the dual momentum idea for Gold and LTTs is very intriguing. This strategy would have protected investors from both the long gold bear market of the 90s and the massive drawdown in LTTs in 2022/23. That said, I'm not a big fan of holding the remaining three asset classes at a fixed 33% each.

Regardless, Gave’s insights are compelling and the book is definitely worth a read.

Enjoy,

Mayday

Re: Free eBook: Charles Gave’s Strategy for Optimizing the Permanent Portfolio

Posted: Mon Dec 29, 2025 2:56 pm

by Jack Jones

This looks interesting. I will take a closer look. Thanks for sharing.

Re: Free eBook: Charles Gave’s Strategy for Optimizing the Permanent Portfolio

Posted: Mon Dec 29, 2025 3:08 pm

by yankees60

Jack Jones wrote: ↑Mon Dec 29, 2025 2:56 pm

This looks interesting. I will take a closer look. Thanks for sharing.

Same here. Downloaded my copy. Thanks!

Re: Free eBook: Charles Gave’s Strategy for Optimizing the Permanent Portfolio

Posted: Mon Dec 29, 2025 5:54 pm

by dualstow

Interesting!

Re: Free eBook: Charles Gave’s Strategy for Optimizing the Permanent Portfolio

Posted: Thu Jan 01, 2026 12:14 pm

by dopplerdave

Over the years there has been a lot of discussion in this forum regarding how to improve on the Permanent Portfolio. This book offers two ways for doing so. The swap between gold and long term treasuries makes sense to me, but I am not convinced that the addition of energy stocks does. For one thing, it appears that nuclear power is about to make a major comeback, and with AI there will be a new dependency between energy and tech stocks in the S&P 500.

There is a lot of stuff in the book I do not understand, but it is worthy of consideration, especially the gold/LTT momentum swap. The Gavekal 3-Asset portfolio looks almost like a no brainer to pick up over a full percentage in average yield with negligible effect on volatility or drawdown. The following data is taken from the book so it does not include 2024 and 2025.

Re: Free eBook: Charles Gave’s Strategy for Optimizing the Permanent Portfolio

Posted: Thu Jan 01, 2026 9:34 pm

by boglerdude

No ones going to have money to buy when AI takes the jobs. And "AI" is outsourcing, there are billions of people who want white collar jobs in the West. The data centers are only to record everything you do online

Re: Free eBook: Charles Gave’s Strategy for Optimizing the Permanent Portfolio

Posted: Fri Jan 02, 2026 1:56 am

by frugal

Thank you

Let me read

Happy 2026

Re: Free eBook: Charles Gave’s Strategy for Optimizing the Permanent Portfolio

Posted: Fri Jan 02, 2026 11:03 am

by yankees60

boglerdude wrote: ↑Thu Jan 01, 2026 9:34 pm

No ones going to have money to buy when AI takes the jobs. And "AI" is outsourcing, there are billions of people who want white collar jobs in the West. The data centers are only to record everything you do online

There are lots of jobs that cannot be taken by either AI or by China.

Most of them are jobs that need to be done by your hands.

I believe that at one time a huge percentage of our country were farmers? Now it's a relative few?

We had the whole personal computer / internet revolution, both of which led to greatly improved efficiencies. Yet here we are with low unemployment rates.

Re: Free eBook: Charles Gave’s Strategy for Optimizing the Permanent Portfolio

Posted: Fri Jan 02, 2026 4:08 pm

by dopplerdave

This is veering way off topic. Forget AI.

I only mentioned it because it might be relevant to the Energy Adjustment mod to the PP. The author advocates adding energy producer stocks (XLE) to the portfolio in this modification. He argues that a deficiency in the PP is that it does not take into account a massive increase in the price of energy. He uses energy production as a proxy to the economy either growing or contracting. He points out that the S&P500 used to contain 30% energy stocks but is now only 4% and is dominated by tech stocks. So if oil prices increase rapidly, the economy would contract, stocks would decline and rebalancing into say VTI would only add money to tech stocks, not energy stocks. At least that is the way I interpret his Chapter 10 concern. My point was that XLE is primarily fossil fuel companies, not nuclear, and that tech stocks equate to AI which is a big energy consumer. So maybe his argument for adding XLE is still valid, but I don't see it.

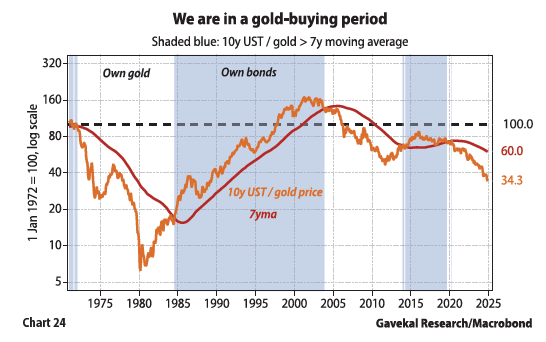

His other PP mod is the gold/LTT momentum triggered swap. He gets a significant improvement in portfolio return with no increase in volatility by eliminating either gold or long term treasuries depending on whether the ratio of treasuries to gold is above or below its 7 year average. I don’t know how he calculates the statistics shown in his Chart 24 which I am pasting below. But I am hoping someone on this forum can explain it so it can be brought up to date and possibly used going forward.

- UST to Gold ratio.png (32.23 KiB) Viewed 2760 times

Re: Free eBook: Charles Gave’s Strategy for Optimizing the Permanent Portfolio

Posted: Sat Jan 03, 2026 2:19 am

by Mayday_I

I have to admit that I have a certain bias toward energy stocks, given my background in the industry. That said, I also believe that XLE might only have been a sensible addition in hindsight. Fossil fuels are steadily losing relevance, and the balance is increasingly shifting toward electricity - driven by the massive CAPEX investments in the AI sector. In my view, the results would have been very similar if, instead of allocating 20% to XLE, an additional 20% had been added to SPY.

On the other hand, inflation is often driven by rising oil and gas prices. The drawdown of a conventional portfolio in 2022 was almost completely offset by the 20% allocation to XLE. Moreover, XLE provides a nice counterweight to today’s AI-heavy indices, which could be advantageous in the event of an AI bubble.

The chart shows exactly what the title describes - the total return of 10-year Treasuries relative to the gold price. This can easily be replicated using various portfolio simulators. Attached is a chart from testfol.io. For my version, I used TLT. Gave refers to 10-year Treasuries in his book, presumably because he also uses them in his portfolio. The difference, however, should be marginal.

Re: Free eBook: Charles Gave’s Strategy for Optimizing the Permanent Portfolio

Posted: Sat Jan 03, 2026 7:10 am

by I Shrugged

Harry Browne was a pretty smart guy, and if I recall correctly, he had decided that charting is of little value. I've always been skeptical of technical analysis, but I do see the attraction. I'm inclined to side with Harry on this one. You could say that I'm basing that on the chart of my investment performance since adopting the PP.

Re: Free eBook: Charles Gave’s Strategy for Optimizing the Permanent Portfolio

Posted: Mon Jan 05, 2026 10:06 am

by Mayday_I

I’ve no doubt Browne was a smart guy—the Permanent Portfolio is still incredibly elegant because it's so simple. And yeah, Browne was pretty clear about holding all four assets at all times. His whole point was that since nobody can foresee the future, you need all four assets to stay protected against any kind of black swan. If you drop one, you're probably leaving the door open for trouble.

The Gavekal version is basically a 'spiced up' PP with a bit more risk for potentially better returns. Whether the dual momentum strategy actually beats the classic version in the long run is anyone's guess. We'll only know that in the rearview mirror.

But honestly, I’m looking at this mainly from a psychological angle. Seeing how many people on this forum (and others) are currently

afraid to rebalance because Long-Term Treasuries (LTTs) are tanking, it might actually make sense to just filter out the worst-performing asset using dual momentum. Never underestimate the psychological toll of holding a 'loser' in your portfolio. And there is Always one loser in the PP.

Re: Free eBook: Charles Gave’s Strategy for Optimizing the Permanent Portfolio

Posted: Tue Jan 06, 2026 3:30 am

by frugal

Hello to all,

I printed to make a quick read in the weekend.

PP is PP and the rest is VP

Problem of PP is low volatility generates low returns

In Europe CAGR for the last 10 years is under 5%

Re: Free eBook: Charles Gave’s Strategy for Optimizing the Permanent Portfolio

Posted: Thu Jan 08, 2026 4:59 pm

by dopplerdave

Mayday you have been really helpful. Can you point me to the portfolio simulator you used to get the TLT to Gold chart? The URL you mentioned does not work and I have been unable to find anything else that provides this ratio over the date range. Thanks.

Re: Free eBook: Charles Gave’s Strategy for Optimizing the Permanent Portfolio

Posted: Sat Jan 10, 2026 12:32 am

by Mayday_I

Hi dopplerdave,

That’s because the site is actually

www.testfol.io. Sorry for the inconvenience — I’ve corrected it above.