Page 1 of 1

Classic ETF Options for Each Asset in the US Permanent Portfolio 📈🧱

Posted: Fri Apr 25, 2025 2:55 pm

by frugal

Dear PP friends,

I’m currently putting together a US-based Permanent Portfolio, and I’d love your help in identifying all the classic ETF options that can be used for each of the four core asset classes in this strategy.

I’m not looking for alternative or creative ideas this time — just the traditional, widely accepted ETFs used in a classic US Permanent Portfolio. Ideally, I’d like to build the whole thing with ETFs only, so please assume no physical gold, no direct bonds, no individual stocks — just ETFs.

Here’s what I’m hoping to gather:

1. Stocks (Equities)

Which US stock market ETFs are commonly used? (e.g., total market, S&P 500, etc.)

2. Long-term Government Bonds

What are the standard ETFs that track long-term US Treasury bonds?

3. Gold

Which ETFs are considered solid, reliable choices for tracking the price of gold?

4. Cash or Cash Equivalents

What ETF options exist here that are commonly used to represent cash or ultra-short-term Treasuries?

If you can share a complete list of the classic go-to ETFs for each of the four, that would be amazing. I’m especially interested in those that are widely available, liquid, and have low fees, and ideally suitable for international investors as well.

Thanks so much for taking the time to help — looking forward to your wisdom and experience!

All the best

Re: Classic ETF Options for Each Asset in the US Permanent Portfolio 📈🧱

Posted: Fri Apr 25, 2025 7:26 pm

by Hal

Portfolio Charts is your friend!

Re: Classic ETF Options for Each Asset in the US Permanent Portfolio 📈🧱

Posted: Sat Apr 26, 2025 1:34 pm

by frugal

Hal wrote: ↑Fri Apr 25, 2025 7:26 pm

Portfolio Charts is your friend!

Ahahah

Didn’t know

Perfect

Thank you

Re: Classic ETF Options for Each Asset in the US Permanent Portfolio 📈🧱

Posted: Sun Apr 27, 2025 9:12 am

by ochotona

I'm trying hard, in my life, to pull people away from the silent pull of "The market is the S&P500".

The S&P500 is a list of 500 large companies chosen by a human committee ranked and weighted using a market-cap weighting scheme. It's currently still highly overweighted to tech and communication services, still overvalued, and therefore ripe for a pullback still. I would not own it.

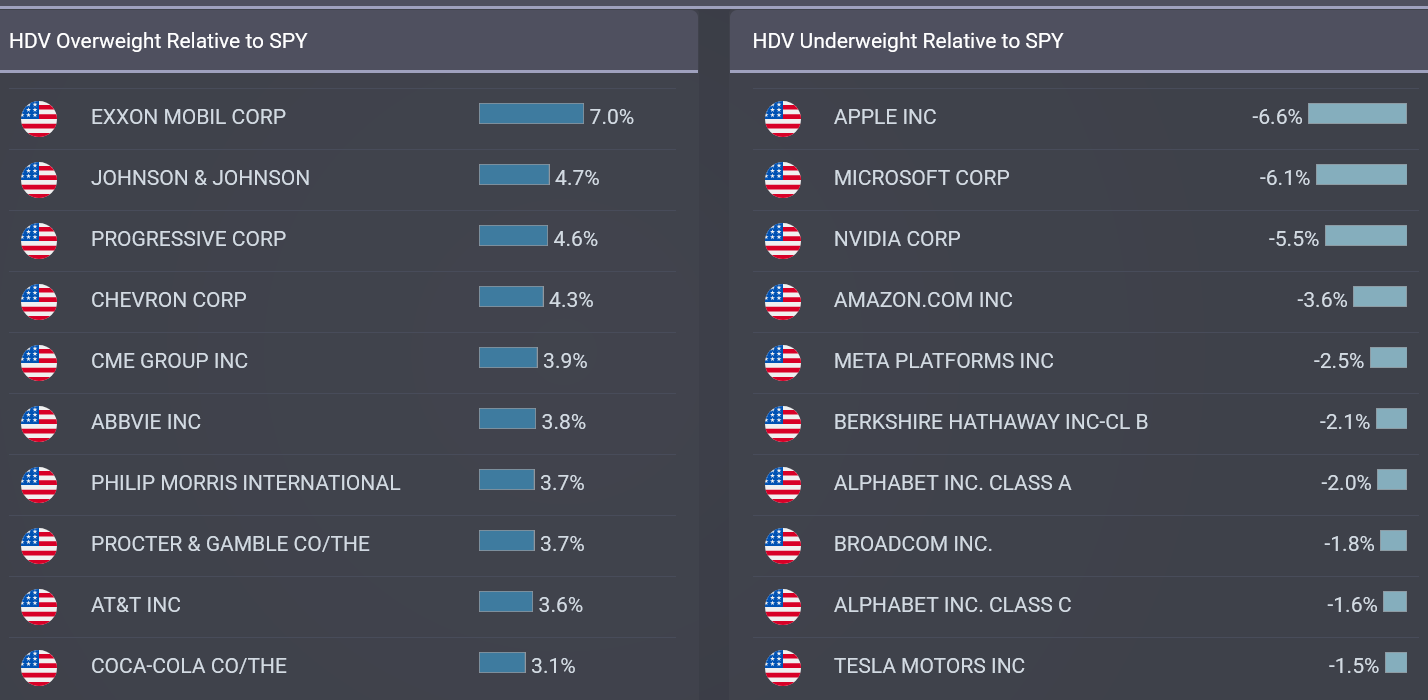

Let's turn the question on its head... if a magical fairy were to gift you an ETF for your portfolio which had these shares in its top ten holdings list, would you complain?

EXXON MOBIL CORP Energy

JOHNSON & JOHNSON Health Care

PROGRESSIVE CORP Financials

CHEVRON CORP Energy

ABBVIE INC Health Care

PHILIP MORRIS INTERNATIONAL INC Consumer Staples

PROCTER & GAMBLE Consumer Staples

CME GROUP INC CLASS A Financials

AT&T INC Communication

COCA-COLA Consumer Staples

That's the top ten list of iShares Core High Dividend ETF, HDV. It has beaten SPY on 12, 6, 3, and 1 month timescales. If we are going to have an economic rough patch, better to have the weighting of this index as opposed to the weightings of SPY / VOO.

It's all the same companies in HDV or SPY... just with different weights. The weights are the key.

Re: Classic ETF Options for Each Asset in the US Permanent Portfolio 📈🧱

Posted: Sun Apr 27, 2025 3:53 pm

by frugal

Hi

Isn’t it stock picking?

Re: Classic ETF Options for Each Asset in the US Permanent Portfolio 📈🧱

Posted: Sun Apr 27, 2025 4:28 pm

by ochotona

Everything in life is "picking". It never ends.

If you go by what somewhat wrote in their book about what should go inside of a lazy, low volatility portfolio, that's allowing someone else to make the choice. That's picking by deciding to not pick. Not actively choosing is a kind of choice.

And that's OK, so long as you know that's what's going on.

Re: Classic ETF Options for Each Asset in the US Permanent Portfolio 📈🧱

Posted: Sun Apr 27, 2025 4:45 pm

by frugal

Hello

Which assets and weights % do you have ?

Regards

Re: Classic ETF Options for Each Asset in the US Permanent Portfolio 📈🧱

Posted: Sun Apr 27, 2025 9:16 pm

by coasting

ochotona wrote: ↑Sun Apr 27, 2025 9:12 am

It's all the same companies in HDV or SPY...

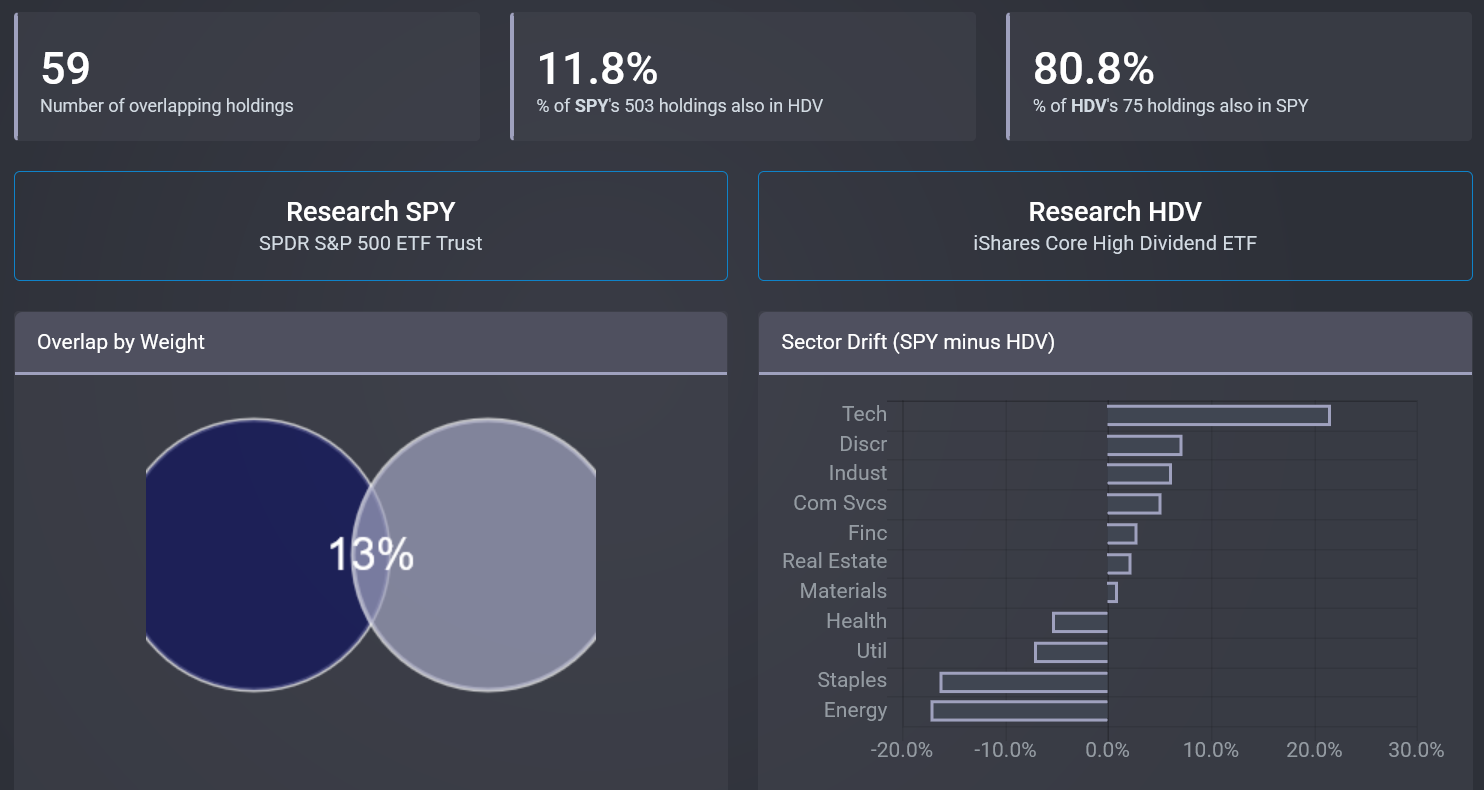

Not really. Per etfrc.com fund overlap tool, HDV has just 75 holdings of which 59 are also found in SPY. With HDV, we can see the heavy sector drift towards Energy and Consumer Staples and away from Tech as compared to SPY:

- HDV-SPY-Overlap.PNG (160.85 KiB) Viewed 8724 times

And yes, I would complain that HDV is missing a lot of prominent US companies and leans "defensive".

- HDV-SPY-OverUnder.PNG (112.6 KiB) Viewed 8724 times

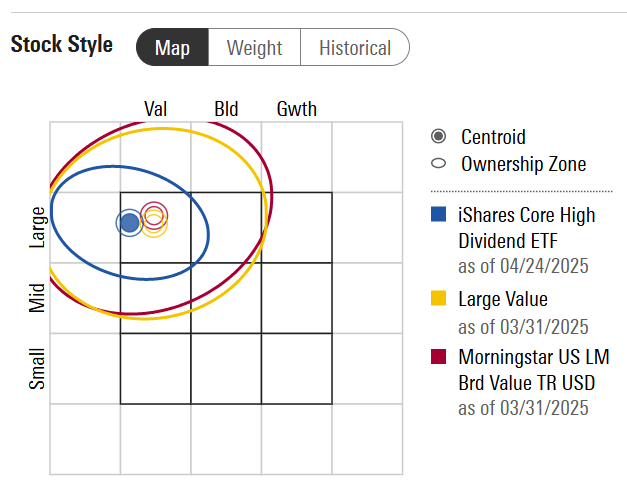

Morningstar style box shows HDV squarely in Large Cap Value:

- HDV-StyleBox.PNG (45.63 KiB) Viewed 8724 times

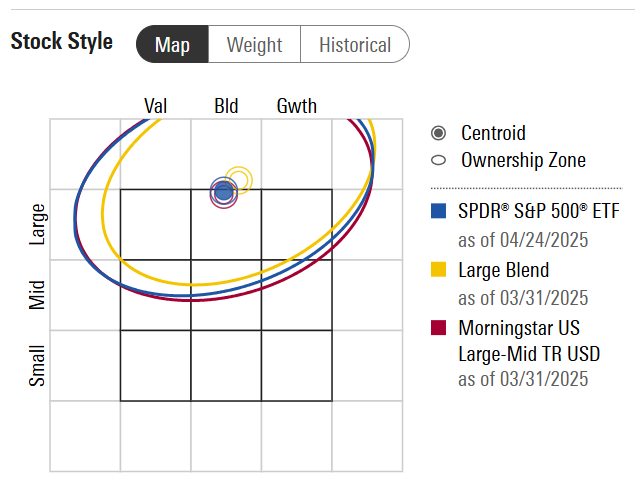

vs. the more balanced SPY Large Cap Blend:

- SPY-StyleBox.PNG (46.17 KiB) Viewed 8724 times

ochotona wrote: ↑Sun Apr 27, 2025 9:12 am

If we are going to have an economic rough patch, better to have the weighting of this index as opposed to the weightings of SPY / VOO.

I am going to disagree here. Per Harry Browne, stocks are in the Permanent Portfolio for times when prosperity is the dominant economic theme, not for times when we hit an economic rough patch. Are we heading for an economic rough patch? Let me check Golden Rule of Financial Safety #4:

R4 - No one can predict the future.

If we are heading for economic downturn, I say let stocks fall hard and perhaps get a re-balance opportunity. If we are not heading for economic downturn, I don't want to be stuck in an underperforming defensive value fund. I want the full market including those "overvalued" tech/growth stocks.

To me, SPY more accurately represents "the market" (for better or worse) than does HDV.

Re: Classic ETF Options for Each Asset in the US Permanent Portfolio 📈🧱

Posted: Mon Apr 28, 2025 1:52 pm

by seajay

ochotona wrote: ↑Sun Apr 27, 2025 9:12 am

I'm trying hard, in my life, to pull people away from the silent pull of "The market is the S&P500".

What about a individual who owns home - as their "equity" exposure, and has a good inflation adjusted pension income - that might be considered as a perfect bond ladder that expires precisely the day they die, and who considers those as three parts of the PP (equity/bonds/cash) - leaving just the gold element to be bought/held. Neither the home nor bonds/cash in that respect are liquid, so predominately involves revising the overall portfolio individual assets exposure levels up/down to band alignment/limits. Such as equity (home) value undervalued - so add to a REIT fund to compensate/adjust.

In that context the ETF's held are more diverse/varied, long or short REIT/bonds, maybe even leveraged versions.