Dear All,

I hope you’re doing well.

I’m reaching out to ask if anyone here is applying a Return Stacking strategy to HB-PP (Harry Browne’s Permanent Portfolio). I’d love to hear about:

• The specific methods or asset classes used.

• The impact on risk-adjusted returns.

• Any challenges or key considerations in implementation.

Looking forward to your insights!

Best,

Frugal

Return Stacking Strategy Applied to HB-PP

Moderator: Global Moderator

Re: Return Stacking Strategy Applied to HB-PP

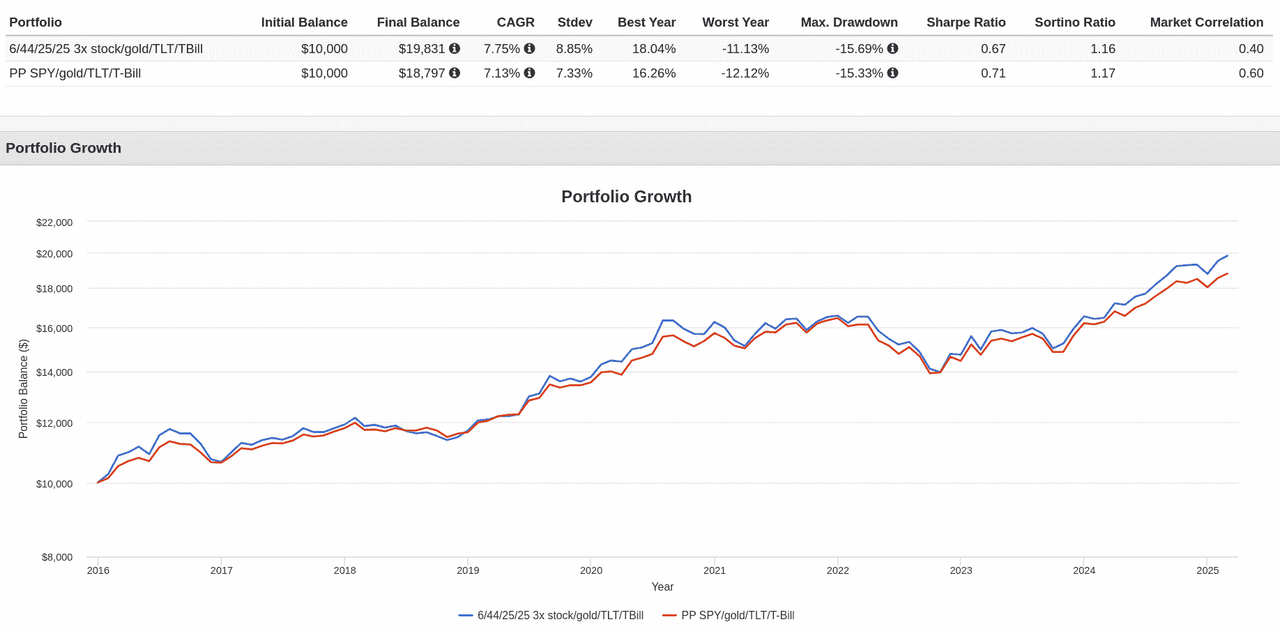

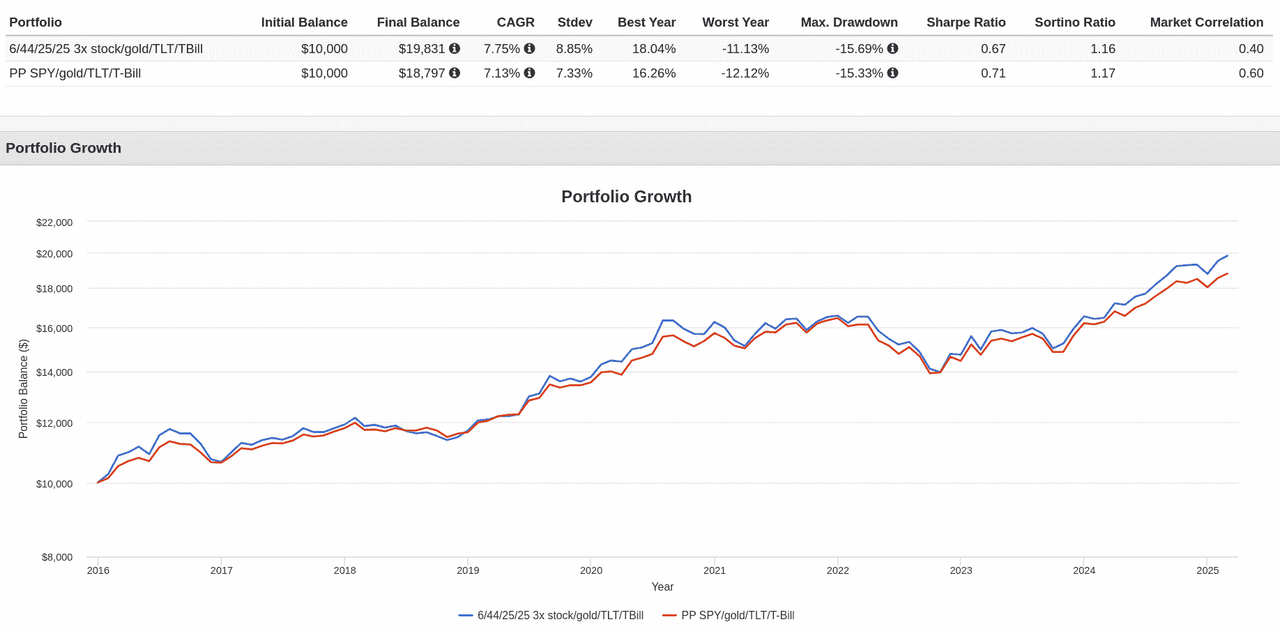

Is that not just a form of leverage? 25/75 3x stock (SPXL)/gold (75% long stock/75% gold, 50% borrowed) instead of 1x stock (100% S&P500). A PP comprised of 6/44/25/25 3x stock/gold/TLT/T-Bills instead of 25% each in S&P500/gold/TLT/T-Bills

Near-as no difference in risk/rewards https://www.portfoliovisualizer.com/bac ... 35bsQ6urRY - excepting less in brokerage/nominee risk (6% in 3x stock rather than 25% in 1x stock, 44% gold in-hand instead of 25%, 50% in Treasury debt risk (relatively safe given they can print/tax rather than default)).

Near-as no difference in risk/rewards https://www.portfoliovisualizer.com/bac ... 35bsQ6urRY - excepting less in brokerage/nominee risk (6% in 3x stock rather than 25% in 1x stock, 44% gold in-hand instead of 25%, 50% in Treasury debt risk (relatively safe given they can print/tax rather than default)).

-

boglerdude

- Executive Member

- Posts: 1571

- Joined: Wed Aug 10, 2016 1:40 am

- Contact:

Re: Return Stacking Strategy Applied to HB-PP

mathjak is doing that. https://www.early-retirement.org/thread ... os.120880/

https://www.bogleheads.org/forum/viewtopic.php?t=442932

The new all-weather ETF is doing that

Vanguard wont allow purchase of levered ETFs. IIRC you can get away with ALLW and PSLDX

https://www.bogleheads.org/forum/viewtopic.php?t=442932

The new all-weather ETF is doing that

Vanguard wont allow purchase of levered ETFs. IIRC you can get away with ALLW and PSLDX

Re: Return Stacking Strategy Applied to HB-PP

Deposit money in a bank and it becomes the banks money. Buy some shares and the stock register doesn't have your name recorded as a shareholder, its the brokers choice of entity/custodian whose name is registered. Buy Treasury's and you're lending to someone who has a money printing press and as such has no real need to borrow.

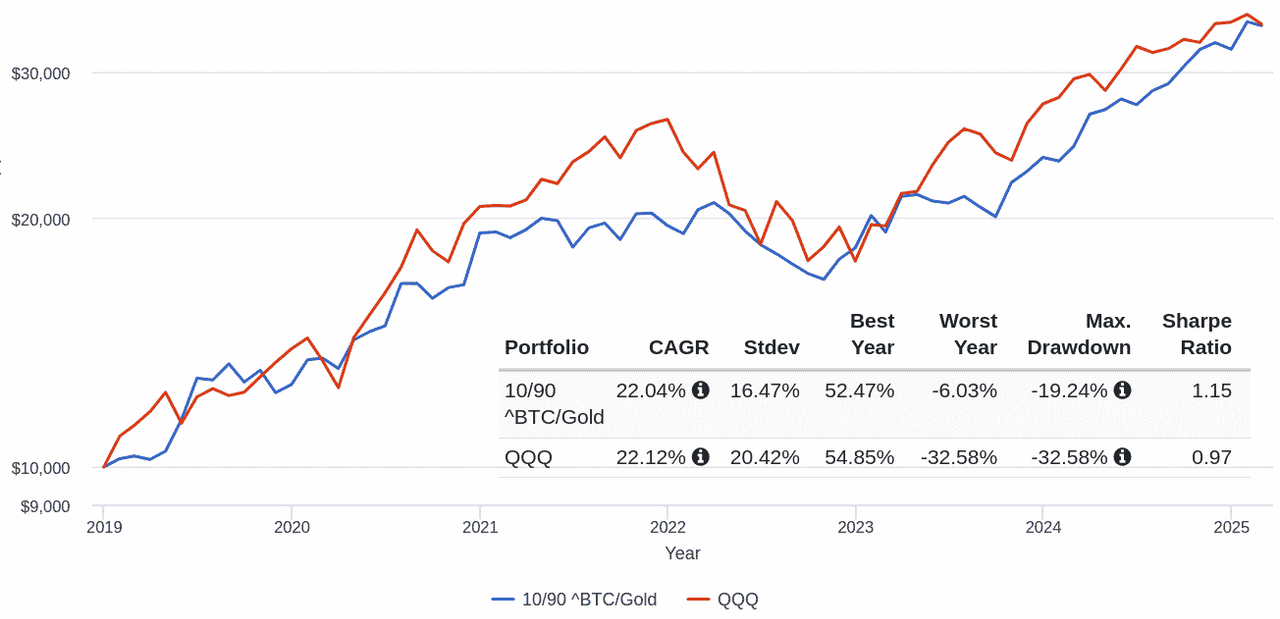

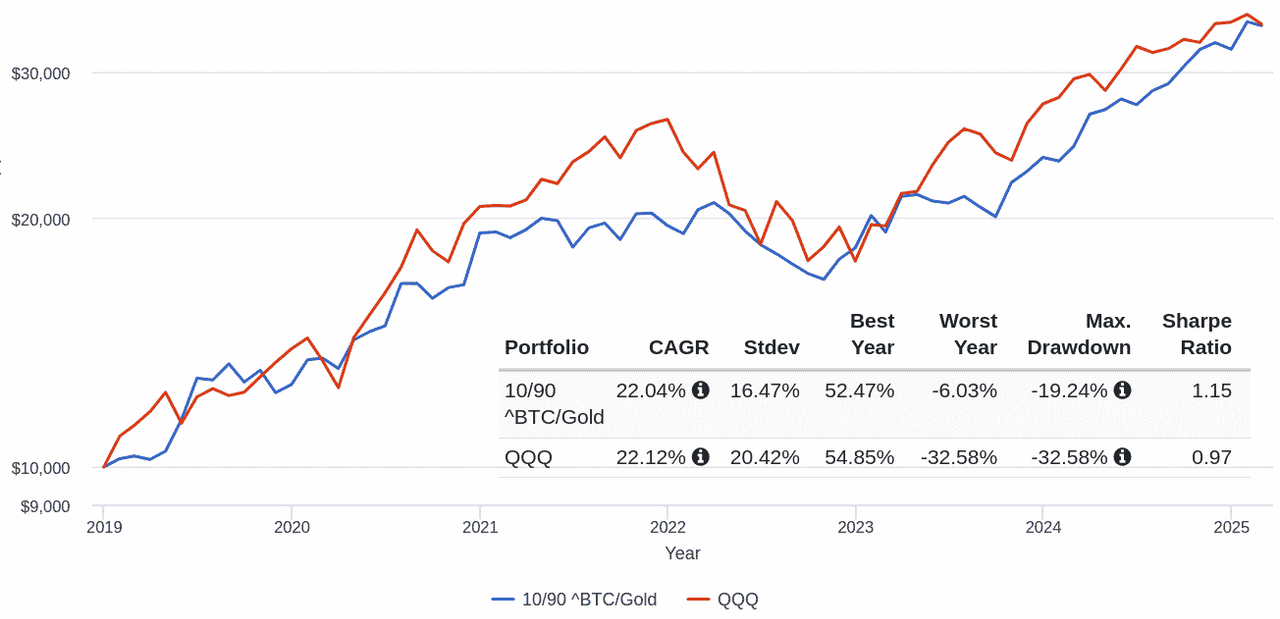

Buy physical gold and its in your hands. Buy bitcoin and move that to a offline paper wallet (literally printed out on paper) and again its in your hands. Since 2019 (prior to that bitcoin was still establishing itself, since 2018 its become more mainstream/accepted) 10/90 Bitcoin/Gold has somewhat compared to 100% QQQ (Nasdaq100)

https://www.portfoliovisualizer.com/bac ... WIw0M2irXM

Is that similarity purely coincidental, or is it somewhat self fulfilling in that more investors are looking to avoid the trust involved in lending their money to others (via cash deposits, buying stock index funds, buying Treasury's)

In the context of the PP, that could perhaps be the 25% you might otherwise have allocated to stocks https://www.portfoliovisualizer.com/bac ... IRwDs6SM9v that holds 50% in-hand (bitcoin and gold), 50% in Treasury (T-Bills/long dated Treasury bonds).

EDIT : To add that its probably better not to store too much bitcoin in a single paper wallet, create multiples instead, preferably having used a offline device/system to create the wallet. Also when you move bitcoin from the paper wallet back to a online wallet/exchange its best to completely sweep out that paper wallet, don't do partial transfers. So generally you might create multiple paper wallets each with perhaps $1000 original value in each for instance. You can pass on those paper wallets to others, but if you do so then the prior holder could still have a copy of the private key and as such the potential to move/sell that bitcoin, so its best to sweep that bitcoin into another wallet (new private/public key). In the case of trusted family or death however and that might not be considered a risk factor.

Buy physical gold and its in your hands. Buy bitcoin and move that to a offline paper wallet (literally printed out on paper) and again its in your hands. Since 2019 (prior to that bitcoin was still establishing itself, since 2018 its become more mainstream/accepted) 10/90 Bitcoin/Gold has somewhat compared to 100% QQQ (Nasdaq100)

https://www.portfoliovisualizer.com/bac ... WIw0M2irXM

Is that similarity purely coincidental, or is it somewhat self fulfilling in that more investors are looking to avoid the trust involved in lending their money to others (via cash deposits, buying stock index funds, buying Treasury's)

In the context of the PP, that could perhaps be the 25% you might otherwise have allocated to stocks https://www.portfoliovisualizer.com/bac ... IRwDs6SM9v that holds 50% in-hand (bitcoin and gold), 50% in Treasury (T-Bills/long dated Treasury bonds).

EDIT : To add that its probably better not to store too much bitcoin in a single paper wallet, create multiples instead, preferably having used a offline device/system to create the wallet. Also when you move bitcoin from the paper wallet back to a online wallet/exchange its best to completely sweep out that paper wallet, don't do partial transfers. So generally you might create multiple paper wallets each with perhaps $1000 original value in each for instance. You can pass on those paper wallets to others, but if you do so then the prior holder could still have a copy of the private key and as such the potential to move/sell that bitcoin, so its best to sweep that bitcoin into another wallet (new private/public key). In the case of trusted family or death however and that might not be considered a risk factor.

Re: Return Stacking Strategy Applied to HB-PP

Re: Return Stacking Strategy Applied to HB-PP

Dear PPeers

Following up on my previous message about Return Stacking in the context of HB-PP (Harry Browne’s Permanent Portfolio), I wanted to share an approach that I’ve seen gaining traction.

Some investors are adding a 5th sleeve to the traditional 4-asset PP by incorporating Trend Following strategies and FX Carry Trades—often through futures or ETFs. The idea is to stack uncorrelated return streams without increasing portfolio volatility.

From what I’ve observed so far, this addition has shown higher returns for a similar level of risk, especially when carefully managed using volatility targeting and/or capital efficiency via margin.

Does anyone here have experience with this kind of implementation? I’d love to better understand:

• How you’re structuring the trend and carry components;

• Which instruments or platforms you’re using;

• Any lessons learned on execution or risk management.

Thanks in advance for sharing your thoughts!

Best regards,

Frugal

Following up on my previous message about Return Stacking in the context of HB-PP (Harry Browne’s Permanent Portfolio), I wanted to share an approach that I’ve seen gaining traction.

Some investors are adding a 5th sleeve to the traditional 4-asset PP by incorporating Trend Following strategies and FX Carry Trades—often through futures or ETFs. The idea is to stack uncorrelated return streams without increasing portfolio volatility.

From what I’ve observed so far, this addition has shown higher returns for a similar level of risk, especially when carefully managed using volatility targeting and/or capital efficiency via margin.

Does anyone here have experience with this kind of implementation? I’d love to better understand:

• How you’re structuring the trend and carry components;

• Which instruments or platforms you’re using;

• Any lessons learned on execution or risk management.

Thanks in advance for sharing your thoughts!

Best regards,

Frugal

Re: Return Stacking Strategy Applied to HB-PP

Beyond reading/listening about, I do not have personal experience with Return Stacking or the products used to implement such a strategy. You asked to share thoughts, so here they are:frugal wrote: ↑Fri Apr 11, 2025 8:49 am Dear PPeers

Following up on my previous message about Return Stacking in the context of HB-PP (Harry Browne’s Permanent Portfolio), I wanted to share an approach that I’ve seen gaining traction.

Some investors are adding a 5th sleeve to the traditional 4-asset PP by incorporating Trend Following strategies and FX Carry Trades—often through futures or ETFs. The idea is to stack uncorrelated return streams without increasing portfolio volatility.

From what I’ve observed so far, this addition has shown higher returns for a similar level of risk, especially when carefully managed using volatility targeting and/or capital efficiency via margin.

Does anyone here have experience with this kind of implementation? I’d love to better understand:

• How you’re structuring the trend and carry components;

• Which instruments or platforms you’re using;

• Any lessons learned on execution or risk management.

Thanks in advance for sharing your thoughts!

Best regards,

Frugal

Have you considered the proposed strategy with respect to Harry Browne's 16 Golden rules of financial safety?

I gather you have previously adopted the Permanent Portfolio philosophy and possess a traditional 4-asset PP that holds the "money that is precious to you". You are following rule 13:

R13 Create a balanced portfolio for protection.

You determine your total money exceeds the amount which is precious to you. And so you decide to incorporate a Variable Portfolio using the excess money and with the understanding you are speculating vs. investing (as Harry Browne defined those terms). You follow rules 7 and 14:

R7 Recognize the difference between investing and speculating.

R14 Speculate only with money you can afford to lose.

Regarding the proposed assets for the VP, how do they square up vs. some of the other rules?

Return Stacking and your comment "capital efficiency via margin" imply leverage. I wonder, does this indirectly run counter to rule 3?:

R3 Don't work with borrowed money.

Maybe it's okay, since if one of these products fails completely you have not lost any more money than you put in. Zero is still your lower bound. HB was really concerned about losing more than you actually have and leading to bankruptcy.

You include the phrases: "Trend Following strategies and FX Carry Trades", "higher returns for a similar level of risk", "when carefully managed". Sounds great! But does any of this run counter to rules 5 and 6?

R5 No one can move you into and out of investments consistently with precise and profitable timing.

R6 No trading system will work as well in the future as it did in the past.

Lastly, do you truly understand what the fund managers are doing in the background? Keep in mind rule 9:

R9 Don't ever do anything you don't understand.

Release the Epstein Files

Re: Return Stacking Strategy Applied to HB-PP

Hi

I will follow your advices.

But they have some new ideas and we have to learn new world

and we have to learn new world

Regards

I will follow your advices.

But they have some new ideas

Regards