dualstow wrote: ↑Mon Jul 29, 2024 6:22 am

Interesting. Imagine if we could actually buy gold

with silver, and vice versa, with no friction.

I would definitely participate in that.

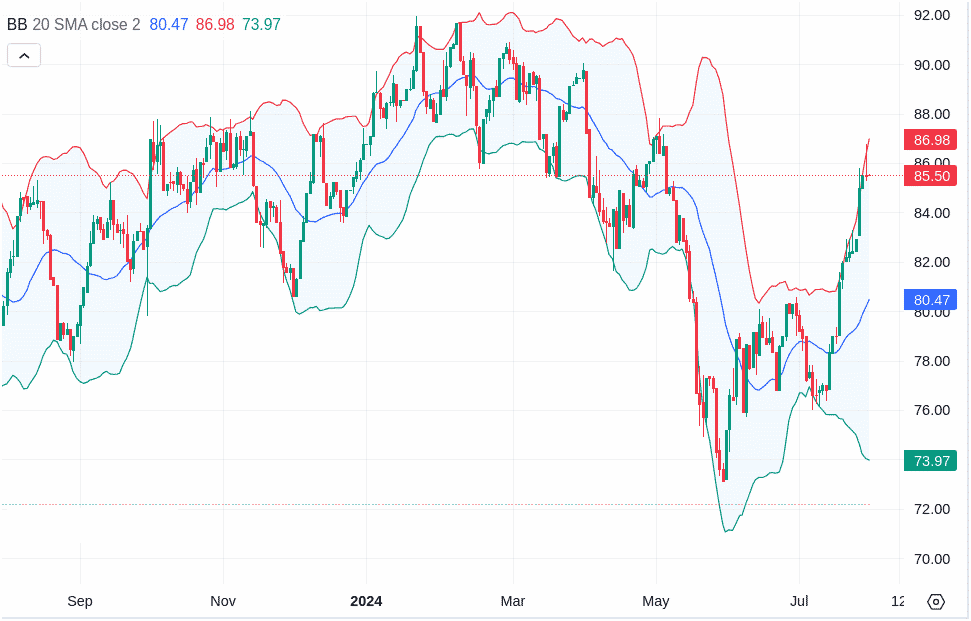

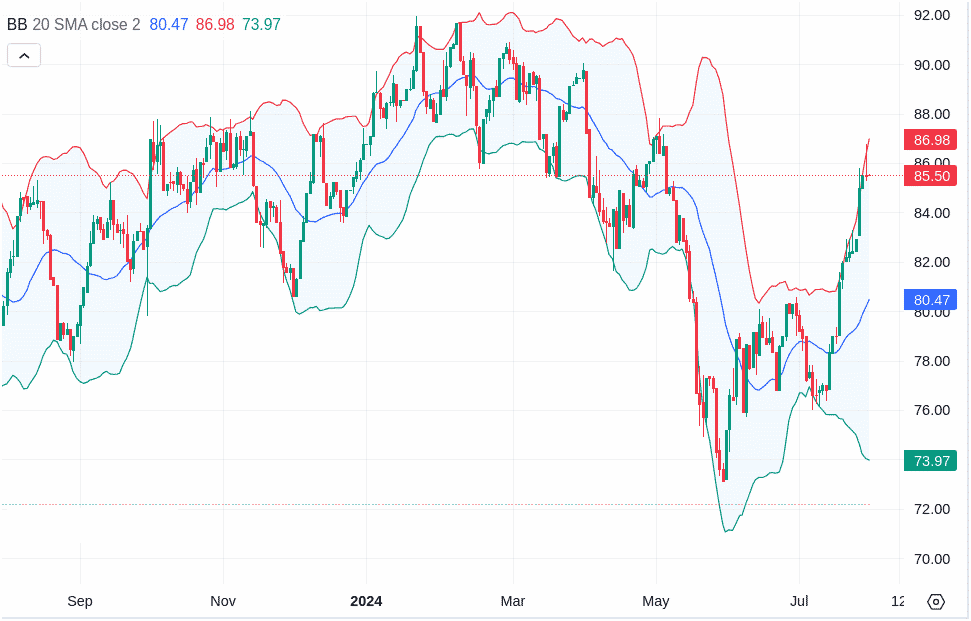

When a price chart has Bollinger Bands added and the price has rattled along the upper (or lower) BB level for a while, the BB range widened, that can lead to a reversal of the price down to the opposite end BB. For instance recently the GSR is up at the upper BB and the BB range (red and green lines) has widened

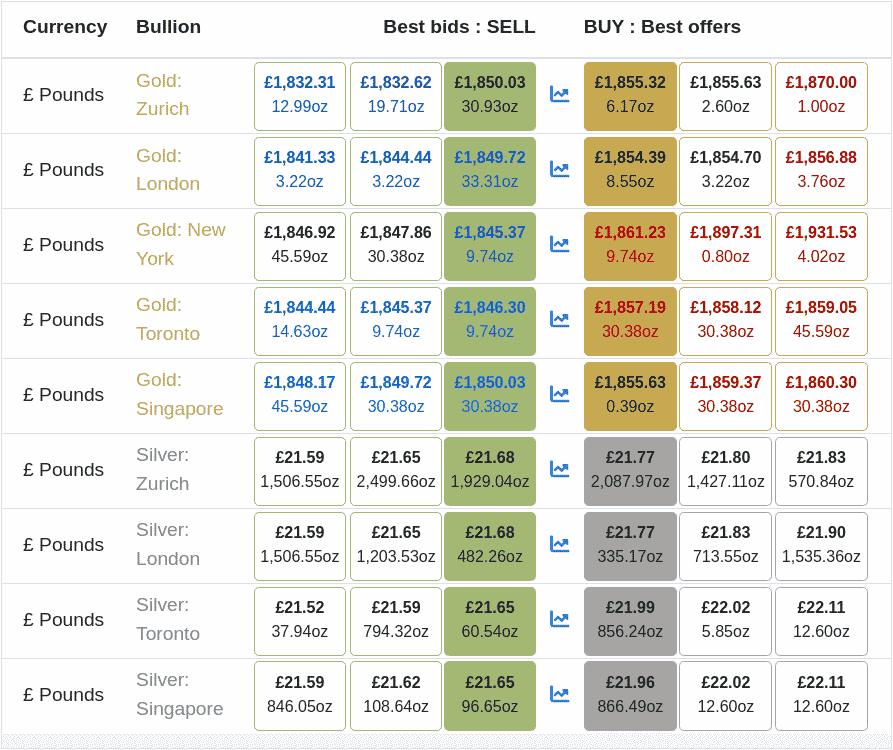

With Bullonvault the first $75K/year of trade value incurs a 0.5% cost, thereafter that drops to 0.1% (and further down to 0.5% at $750K/year)

https://www.bullionvault.com/help/QuickStart.html Which might be considered as a 0.4% x $75K = $300 yearly membership fee and a 0.1% trade cost, Within that link they claim the average spread is zero.

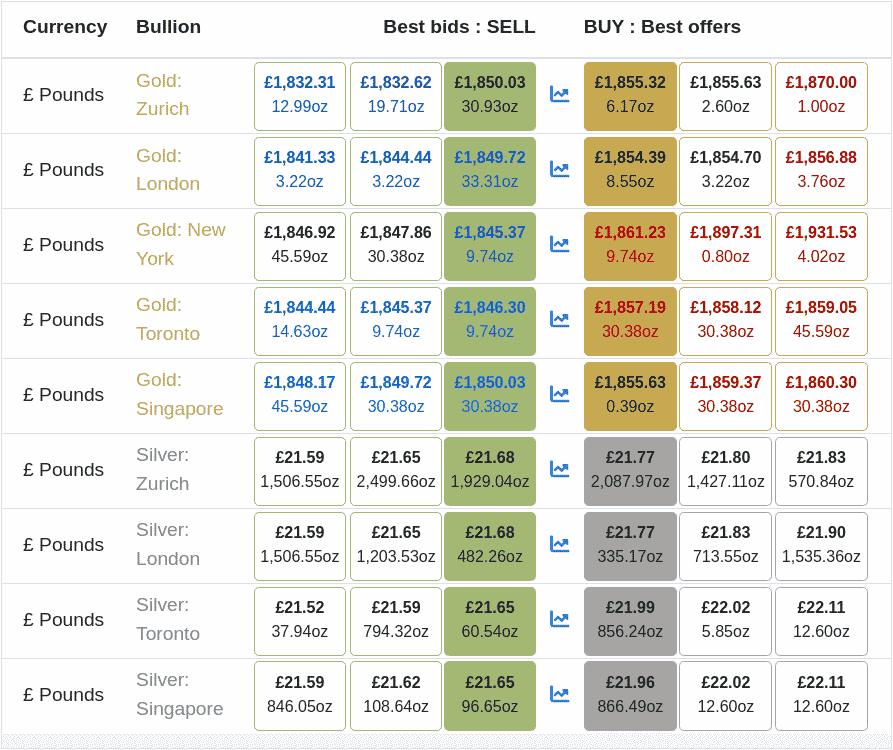

Looking at a recent snapshot

https://www.bullionvault.co.uk/order-board.do

the best Buy price for gold is 1854.39 (London vault) and best Sell 1850.93 (Zurich vault) so 0.1% fee to buy in Zurich and 0.187% spread 0.1% fee to sell in London i.e. < 0.4% full round trip (ignoring the $300/year 'membership fee'). The same can obviously be applied to silver, sell gold from one vault, buy silver in another (or even same) vault.

For a 'golden membership' that costs the equivalent of £1050/year, trade costs of 0.05% narrow the conceptual sell gold to buy silver round trip to 0.287% i.e. < 0.3%. (two 0.05% commissions + 0.187% spread).

Perhaps half your gold in 'bottom draw' physical/in-hand (bought and left), half in BullionVault or suchlike - for 'trading'. With maybe periodic (infrequent) moves to/from physical. Here in London the likes of Tavex

https://tavexbullion.co.uk/ that is a relatively short (and free coz I'm old (60's)) subway ride away typically has a spot+2% buy (10+ one ounce gold coins), spot -1% sell back spread, but where if you're selling a reasonable number they may offer spot (or maybe more such as if they're running low of stock that might otherwise lose them 'out-of-stock' business).

For single coins gold/silver groups might typically buy/sell coins at spot, seller pays the <1% secure/insured postage cost. Oh and here legal tender gold is exempt from capital gains taxation (nor can losses be offset, but for other gold losses can be claimed).

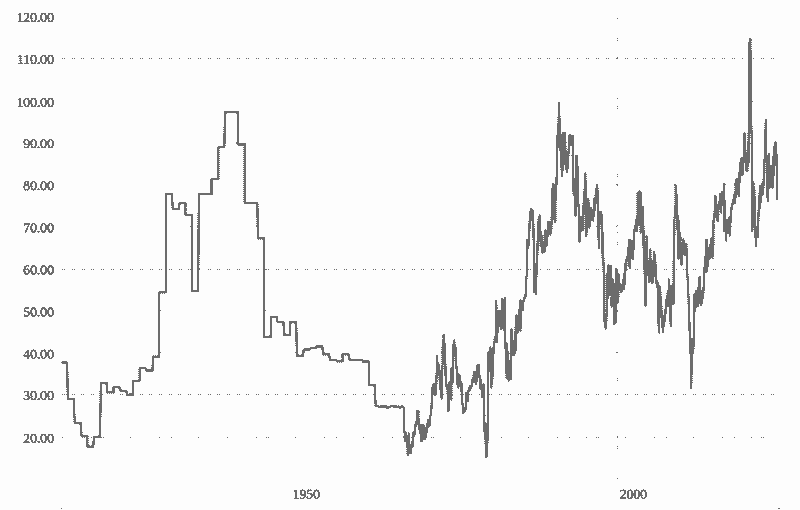

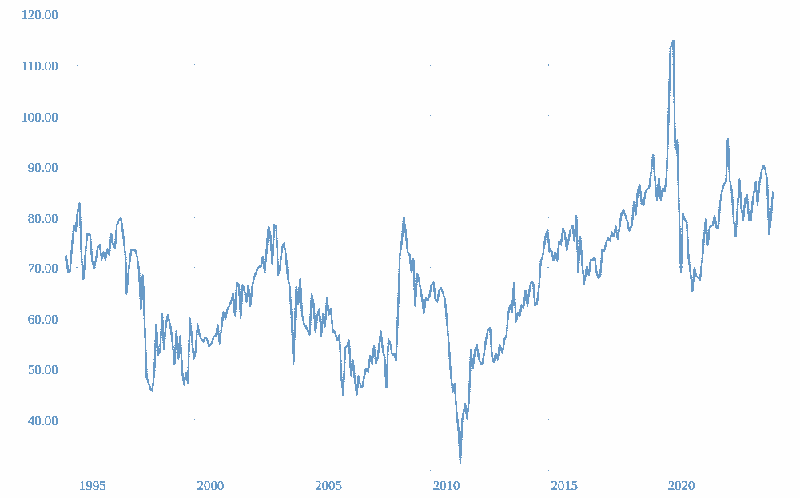

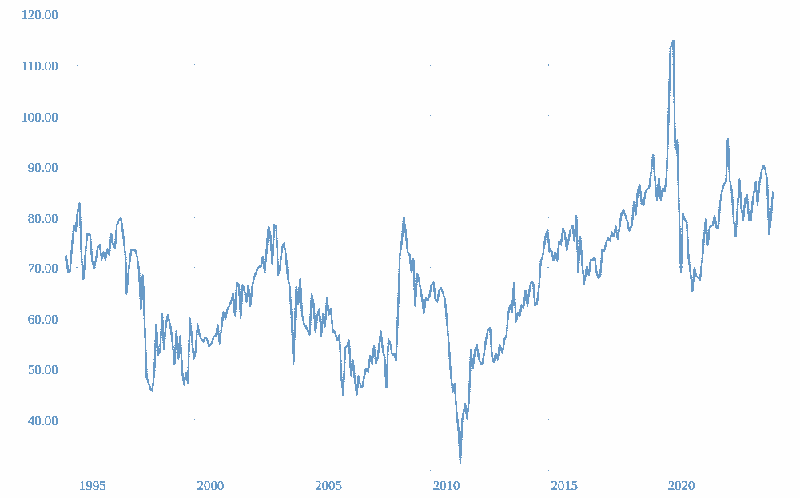

Worth it? Well looking at the GSR chart

https://www.macrotrends.net/1441/gold-to-silver-ratio and in 1984 it was down at 50 levels. Setting simple/crude 60 upper/50 lower trade range, swap silver for gold at GSR 50, swap gold forsilver at GSR 60

and before 1995 (start of the above chart) you would have rotated into silver at some point (60 GSR), and subsequently gone on to full-flip 3 more times since as the GSR transitioned through 60+ and 50- levels. Each full-flip = 60/50 benefit = 20% more gold per full-flip. 1.2 compounded 3.5 times = 100% more gold, since 1985 and bearing in mind we're half way through a 4th flip ... and of the order 1985-2024 = 1.65% annualized benefit (gross). For very low effort/slow swing trading.

Combined with stock and that in itself will add more ounces/reduce stock shares, or add more shares/reduce ounces in a add-low/reduce-high trading style manner if you just periodically rebalance the two. Additionally I 'trade' two forms of shares that are both 'world' type stock fund holdings, one a ETF the other is like a Mutual that at times may trade at premium/discount to net asset value. Flip into the 'Mutual' when at a -10% discount (at a level where the specific fund itself looks to buy back shares), flip into the ETF when the Mutuals price to NAV discount closes to 0% ... type rotations.

The other account worthwhile opening is a margin account. Perhaps a CME Futures account. Primarily for short duration leveraged shorts, infrequently used. A available option to short stocks and/or gold to some/all of your total exposure levels if/when breaking news might suggest it to be a reasonable time to be out of the market - without having to close/dump all your actual holdings.

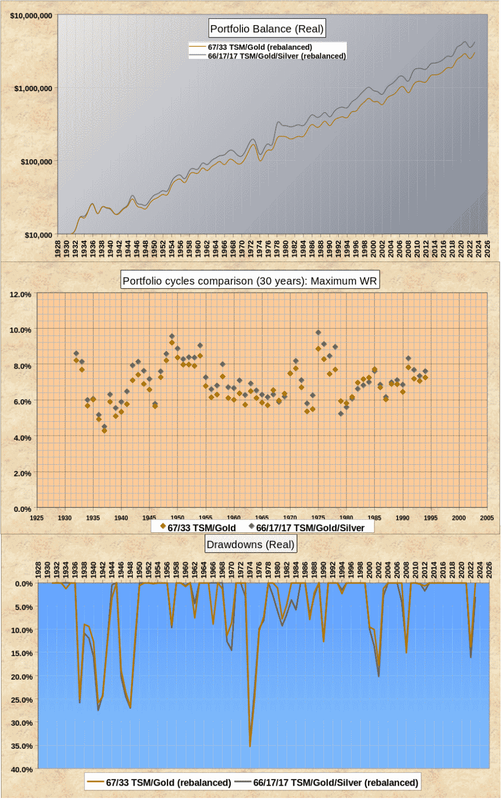

If you can add 1% or 2% alpha, 'trading' gains, then that's like uplifting the worst cat SWR by 1 or 2%, potentially just as safe to draw a 5% or 6% SWR instead of a 4% SWR. Which for some might be worthwhile. Personally I don't bother with bonds, just hold stocks and gold (silver). I don't like the idea of lending to someone who has a money printing press.