50/50 Stock/Gold vs 67/33 stock/bond

Posted: Mon Oct 02, 2023 12:43 pm

This post over on BH https://www.bogleheads.org/forum/viewto ... 6#p7485516 caught my eye, in particular ...

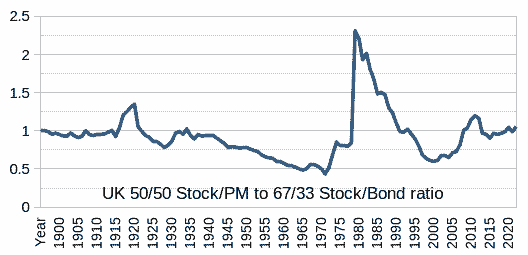

So I ran some figures using Simba spreadsheet for data from 1871 comparing the annualized gains and 30 year withdrawal rates for each of 33/67 TSM/TBM to 50/50 TSM/PM, 50/50 TSM/TBM to 67/33 TSM/PM, and 67/33 TSM/TBM to 75/25 TSM/PM ... i.e. shift bond risk over to the stock side but instead of T-Bills opting for Precious Metals. In each case the TSM/TBM rewarded a bit more, with more volatility. Noteworthy however is that 67/33 TSM/TBM was very close to that of 50/50 TSM/PM, near exactly the same risk (volatility) and reward.Seems like this 75/25 stock/cash AA would be especially valuable in retirement. No interest rate risk.Second, there always has been a segment of Bogleheads (supported by research) that prefers to have a higher stock allocarion and use cash equivalents for their fixed income. So instead of 60/40 stocks/bonds, they use 75/25 stocks/cash