Since 2013 Yellen has be in part pegging US$ to gold, in a loose manner rather than direct pegging, and not along, to instead a basket that includes gold, resulting in gold remaining range-bound

PV

Fear of a alternative and others opting to reduce/drop the dollar in favor of a alternative, in a large-scale manner (China, India, Russia, S America, Arabia/Iran ...etc. - a large proportion of the global population).

As per the video, 700 trillion of derivatives versus 100 trillion of global GDP is a problem. Paper gold for instance is over 100 times physical gold

https://usdebtclock.org/gold-precious-metals.html

Cap the existing high debt level, peg the dollar (approximately) to gold so trust in dollars is maintained, and buy time to transition over to a crypto-dollar that side steps banks/derivatives to protect the economy whilst seeing largescale bank failures. Use existing US reserves, of which 60% is in the form of gold, along with leveraged based short dollar/long gold or long dollar/short gold to redirect the overall dollar value to somewhat align with the price of gold. If/when gold just flatlines so the inclination is for investors to instead hold dollars and invest those into stocks/bonds.

A factor as also indicated in the video however is that many congressmen/senators are in the pockets of banks. When banks pushed the limits, heads they win, tails they lose and taxpayers bail them out, there was the backstop of taxpayers bailing out banks. That's shifted up a level, to countries, but where there isn't a backstop. So some countries are going to get hurt/suffer, a lot, facilitating other countries to get-by/through.

Physical in-hand gold is insurance. But I wouldn't trust ETF's that claim to be backed by physical gold, instead actual in-hand gold with no counter party risk. I suspect there may be some scandal with physical backed gold ETF's if/when the 118 paper gold to physical ratio does come to 'correct'. Stock/bond wise, and the US is a good bet, more inclined to be gets-by outcome than of enduring much hurt/pain.

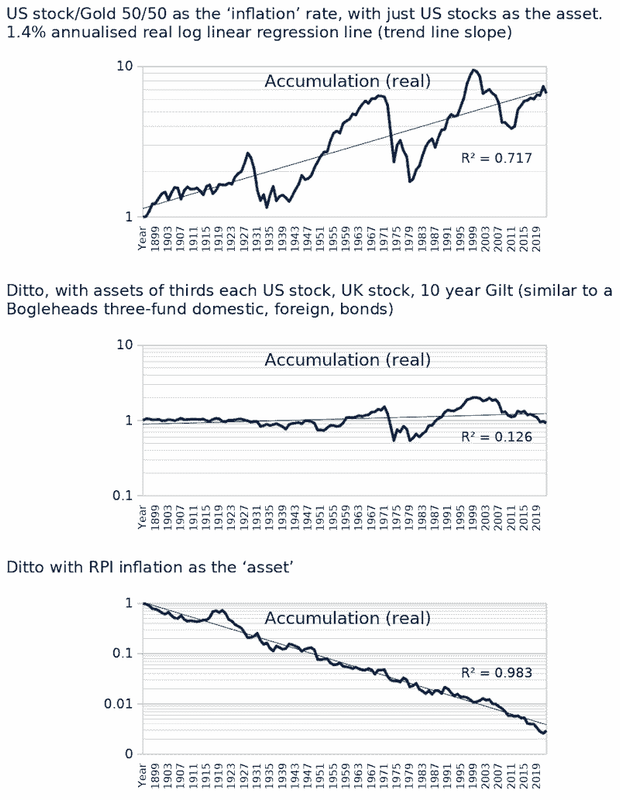

Interest rates are likely to soar under such conditions - so a reasonable asset allocation might be some each of US stocks, gold, short and long dated treasuries. IIRC there's a group somewhere that opt for such a blend, applying a 1/N approach (equal weightings)