Page 1 of 1

Random observation

Posted: Mon May 16, 2022 11:49 am

by Hal

For those with no access to LTT's in their retirement account.

Re: Random observation

Posted: Mon May 16, 2022 9:24 pm

by I Shrugged

But, in 2008-09, corporates got killed while treasuries went up. Exactly why HB chose the treasuries.

Re: Random observation

Posted: Tue May 17, 2022 3:18 am

by Hal

I Shrugged wrote: ↑Mon May 16, 2022 9:24 pm

But, in 2008-09, corporates got killed while treasuries went up. Exactly why HB chose the treasuries.

Yet the Max drawdown for the two allocations are within 1/2%. Am I missing something?

Re: Random observation

Posted: Tue May 17, 2022 2:47 pm

by Kbg

Explained by the fact that the US TBM is 60%+ in USG bonds. I think Hal's observation is basically sound and a good choice if one doesn't have LTTs as an option which was his main point.

Re: Random observation

Posted: Tue May 17, 2022 9:40 pm

by I Shrugged

Okay, yes. I’m all for simpler as long as it works as intended.

Re: Random observation

Posted: Wed May 18, 2022 9:42 am

by Kbg

I Shrugged wrote: ↑Tue May 17, 2022 9:40 pm

Okay, yes. I’m all for simpler as long as it works as intended.

The main thing to be aware of is that TBM pushes you firmly into intermediate bonds vs. long-term bonds. However, as noted in a different thread I don't think that's a bad thing if one ditches cash and goes to just straight intermediate bonds/ITTs.

Re: Random observation

Posted: Wed May 18, 2022 10:59 am

by Vil

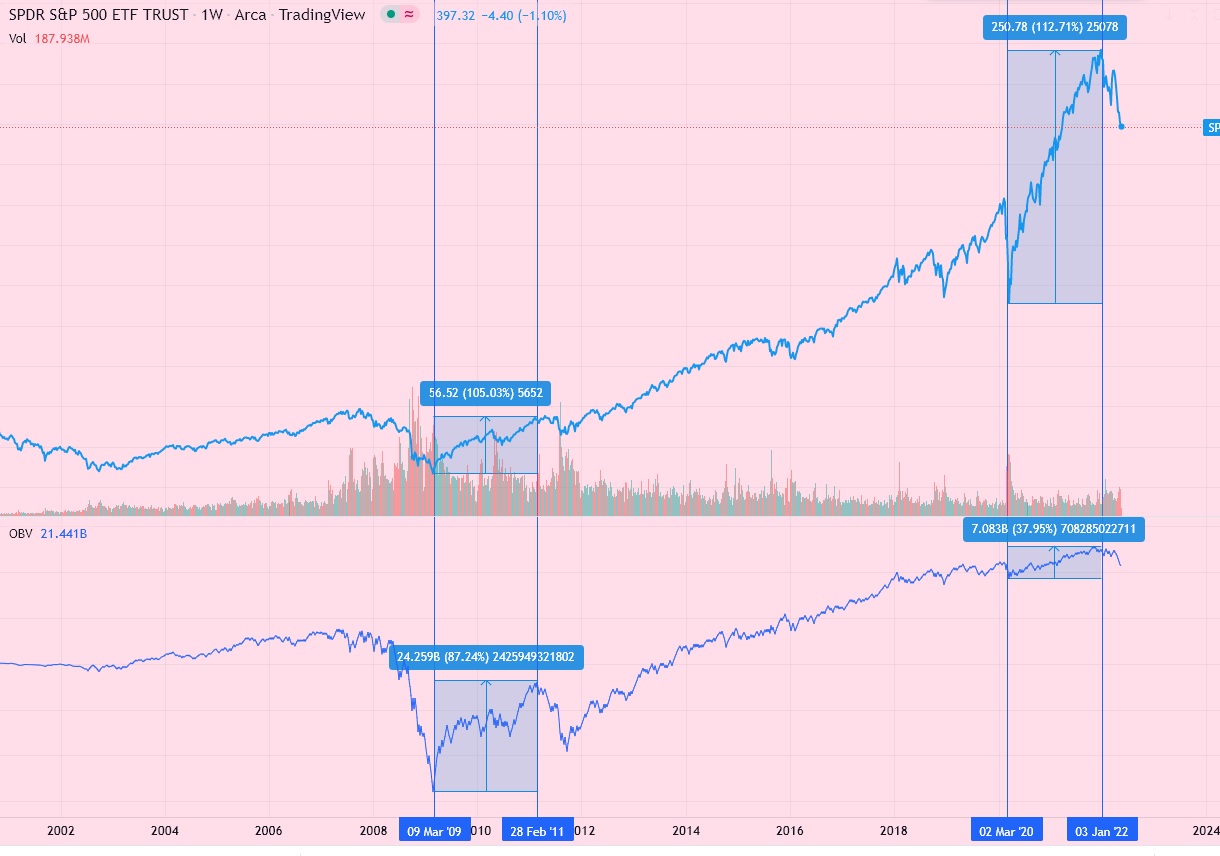

In my US-PP (in USD) I have been using US7 for the bond allocation and it's combination of several durations averaging ~8 yr. Feel comfortable with it and do not plan to shift. As another random observation, I do think the sentiment will change to full blown bearish at some point as stock market does not look very promising. IMHO in the last rally (following the bottom of the COVID sell-off) there were less 'smart money' involved, just did a quick comparison on below with the first rally following the Great Recession (using Weekly, not Daily frame). If I am not mistaken also, after 28 Mar this is the 7th consecutive 'red' week (something that is not quite frequently observed...). Well, it might be that piling cash will be the new smart way of investing ...

- Comparison.jpg (169.03 KiB) Viewed 3805 times

Re: Random observation

Posted: Wed May 18, 2022 1:58 pm

by dualstow

Vil wrote: ↑Wed May 18, 2022 10:59 am

Well, it might be that piling cash will be the new smart way of investing ...

Say it isn’t so, Vil

Re: Random observation

Posted: Wed May 18, 2022 2:10 pm

by joypog

dualstow wrote: ↑Wed May 18, 2022 1:58 pm

Vil wrote: ↑Wed May 18, 2022 10:59 am

Well, it might be that piling cash will be the new smart way of investing ...

Say it isn’t so, Vil

If cash is the best investment with 8% inflation...that's a gloomy forecast.

Re: Random observation

Posted: Wed May 18, 2022 2:11 pm

by dualstow

I agree.

Re: Random observation

Posted: Thu May 19, 2022 1:54 am

by Vil

And as completely opposite to a random observation - I am completely certain that new PP investors will get better prices. One could ask - better compared to what? Well, compared to me who did rebalancing/contribution at the beginning of this year

So,

joypog, you may have good opportunities ahead of you. For me - good I have swallowed the 'PP will not make you rich and do not rely on it for that' pill. The pill 'PP can have multi-year abysmal results' I haven't taken yet and not looking forward to it...

Re: Random observation

Posted: Thu May 19, 2022 6:38 am

by joypog

Vil wrote: ↑Thu May 19, 2022 1:54 am

And as completely opposite to a random observation - I am completely certain that new PP investors will get better prices. One could ask - better compared to what? Well, compared to me who did rebalancing/contribution at the beginning of this year

So,

joypog, you may have good opportunities ahead of you. For me - good I have swallowed the 'PP will not make you rich and do not rely on it for that' pill. The pill 'PP can have multi-year abysmal results' I haven't taken yet and not looking forward to it...

Ha! Fair enough. I've tried to deal with both pills...by reducing my PP. At first it was going to be the majority of my portfolio, then 80% with the GB because I really like a "propsperty tilt", then slowly sliding down through half until landing at 40% with my "final" portfolio from last weekend (with ten percent gold).

With Kevin and Kbg's recent conversation about ITT's > than LTT's (and given LTT's abysmal rates barely better than a 3 year bond) the PP may land at being only 20% of our overall portfolio....(5% LTTs X 4 = 20%).

Admittedly, with a pension (as long as I last at my gig at least 14 months) so I'm realizing that it makes sense to increase my stock exposure as I earn more pension credits with my job - very counter intuititive but I think the logic is sound. Nothing as crazy as the bogleheads subreddit but I might actually end up with an overall AA of "age-minus-10 in bonds with the rest in stocks" by the end of this a decade.

Or maybe I'll revert to mean and be real conservative - why shoot for big gains if you don't have to? Personal psychology is weird.

So, joypog, you may have good opportunities ahead of you. For me - good I have swallowed the 'PP will not make you rich and do not rely on it for that' pill. The pill 'PP can have multi-year abysmal results' I haven't taken yet and not looking forward to it...