Page 1 of 1

Re: Replicating the PP using Futures Contracts

Posted: Wed Mar 10, 2021 3:10 pm

by Cortopassi

Can I arbitrage my physical gold or GLD holdings with GC and make money without risk? While still holding onto the underlying.

Re: Replicating the PP using Futures Contracts

Posted: Wed Mar 10, 2021 3:48 pm

by Cortopassi

vincent_c wrote: ↑Wed Mar 10, 2021 3:26 pm

Cortopassi wrote: ↑Wed Mar 10, 2021 3:10 pm

While still holding onto the underlying.

No.

Not for me. Thanks, though, these are interesting discussions.

Sort of like about 15 years ago when I was convinced covered calls were the way to go. Then 2008. Ooops.

And somewhere along the way I sold OTM puts. And ended up with stock I didn't want. Oops.

Only place I haven't dabbled is futures. And it will remain that way...!

Re: Replicating the PP using Futures Contracts

Posted: Thu Jun 17, 2021 2:03 pm

by Mark Leavy

vincent_c wrote: ↑Thu Jun 17, 2021 1:44 pm

If you use a futures portfolio instead of ETFs, you need to remember than any gains that you don't have additional cash to fully fund the position actually increases your leverage. What this meant for me was that as the futures portfolio increased in USD, if I did not increase my USD exposure then I am essentially further short the USD as a % of the portfolio.

This adds another degree of complexity when managing this kind of portfolio vs an unlevered portfolio.

Interesting. I haven't looked at it that way. Is it a Canadian / US dollar thing?

In my mind, my leverage is the

contract purchase price divided by my daily marked to market cash position. Thus, if the futures contract gains in value while I am holding it, my leverage is

reduced.

You've been doing this a lot longer than I have. Are you talking about Forex risk or is it something that I also need to address?

Thanks,

Mark

Re: Replicating the PP using Futures Contracts

Posted: Thu Jun 17, 2021 3:08 pm

by Mark Leavy

Gotcha! And thanks for the correction. My leverage would remain constant.

Re: Replicating the PP using Futures Contracts

Posted: Fri Jun 18, 2021 2:07 pm

by Mark Leavy

vincent,

When do you normally roll your futures? Last time, I did it a few weeks before expiration and it seemed like the futures that I was rolling into weren't as liquid as I would like. Better to wait until just before expiration - or even let IBKR automatically liquidate at expiration?

Thanks

Re: Replicating the PP using Futures Contracts

Posted: Fri Jun 18, 2021 3:02 pm

by Mark Leavy

That's perfect. Thank you.

Re: Replicating the PP using Futures Contracts

Posted: Sun Aug 08, 2021 1:40 pm

by Mark Leavy

vincent,

I have been modeling adding real estate to my futures based portfolio (ala the Jakob Fugger thread) and it appears that

CUS would be a logical choice. An even mix of Nasdaq/Housing/Long Bonds/Gold appears to be incredibly stable and a prime target for very safely leveraging up to about 2x (assuming that all of the assets were in futures contracts and all in the same account)

Have you looked at real estate futures and do you have any recommendations?

Thanks,

Mark

Re: Replicating the PP using Futures Contracts

Posted: Sun Aug 08, 2021 3:55 pm

by Mark Leavy

Excellent points, thank you. When the market opens I'm going to check out liquidity and spread.

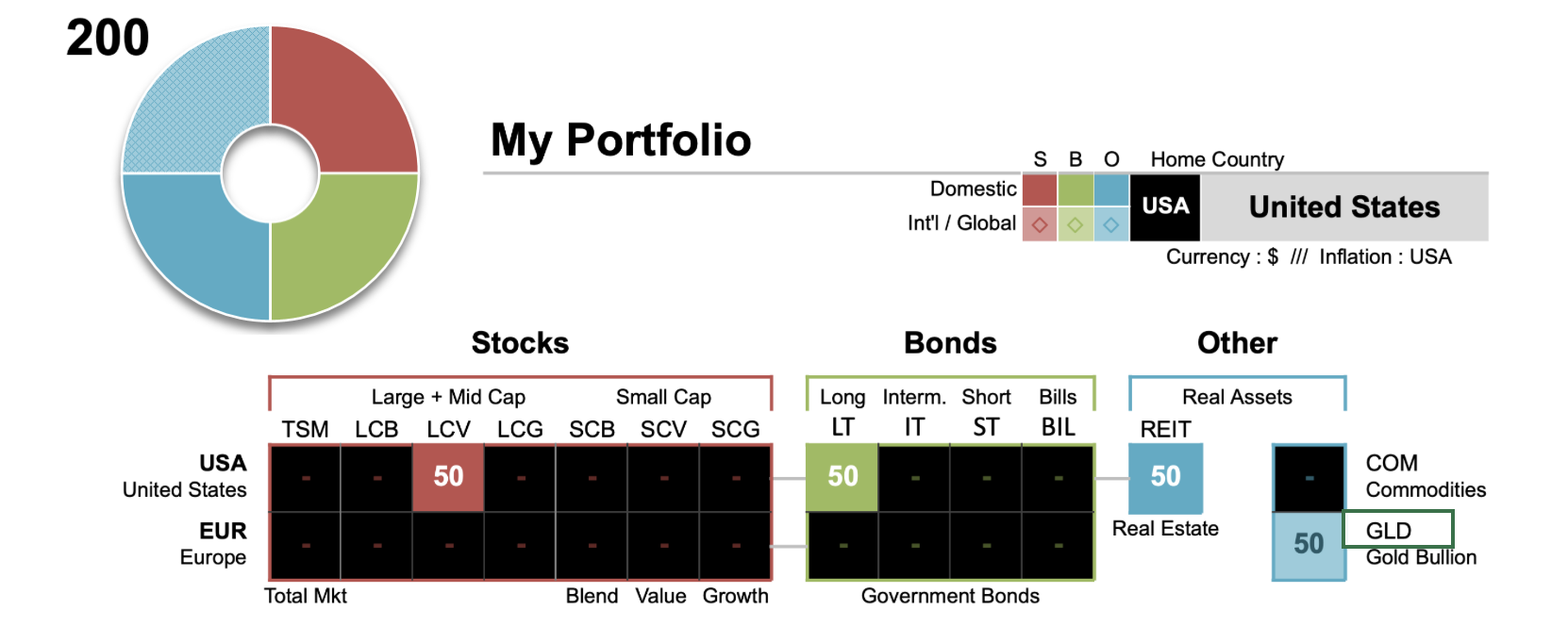

I haven't run any hard simulations yet, but I've done a handful of comparison's using Tyler's

Portfolio Charts site.

He had suggested that "Large Cap Value" is a reasonable proxy for the Nasdaq 100. So... if I allocate 50% for each of the asset classes,

- Screen Shot 2021-08-08 at 1.46.14 PM.png (203.48 KiB) Viewed 3123 times

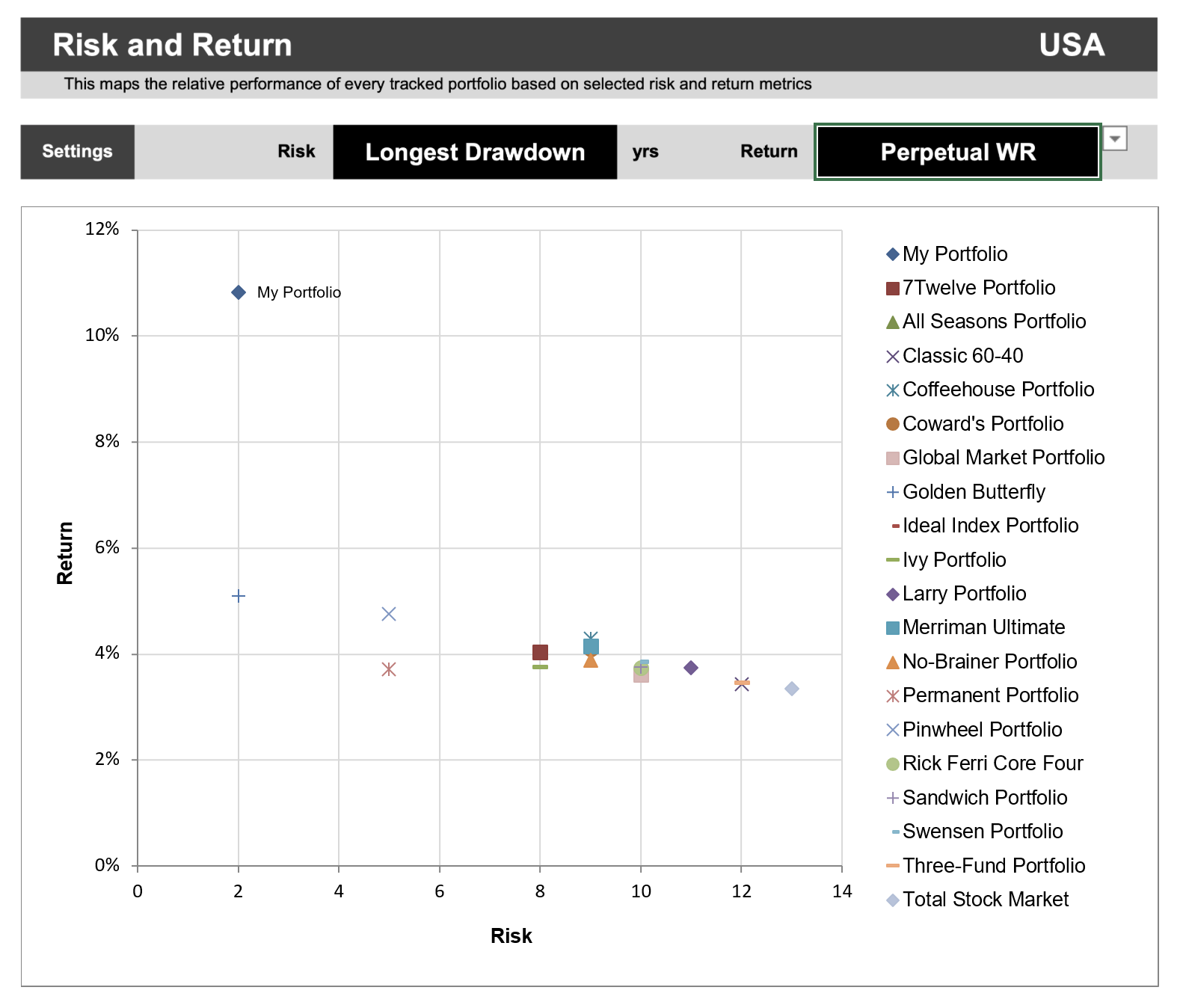

Then all of the charts and calculators show some very nice, stable returns.

This is one of my favorites.

- Screen Shot 2021-08-08 at 1.46.37 PM.png (208.88 KiB) Viewed 3123 times

I like the idea of doing the implementation in futures as it allows me to 'sort of' keep all of my cash available at the same time and it provides maximum margin safety by having all of the uncorrelated assets secured by the same pot of cash.

I just started poking around this morning, looking for a way to gain real estate exposure via futures - and came across CUS.

Obviously, this whole idea would take a lot more testing and drilling down into the details. Your comments about the difference between the index and actual real estate holdings are extremely valid and worth a lot more study.

Re: Replicating the PP using Futures Contracts

Posted: Sun Aug 08, 2021 6:37 pm

by D1984

Mark Leavy wrote: ↑Sun Aug 08, 2021 3:55 pm

Excellent points, thank you. When the market opens I'm going to check out liquidity and spread.

I haven't run any hard simulations yet, but I've done a handful of comparison's using Tyler's

Portfolio Charts site.

He had suggested that "Large Cap Value" is a reasonable proxy for the Nasdaq 100. So... if I allocate 50% for each of the asset classes,

Screen Shot 2021-08-08 at 1.46.14 PM.png

Then all of the charts and calculators show some very nice, stable returns.

This is one of my favorites.

Screen Shot 2021-08-08 at 1.46.37 PM.png

I like the idea of doing the implementation in futures as it allows me to 'sort of' keep all of my cash available at the same time and it provides maximum margin safety by having all of the uncorrelated assets secured by the same pot of cash.

I just started poking around this morning, looking for a way to gain real estate exposure via futures - and came across CUS.

Obviously, this whole idea would take a lot more testing and drilling down into the details. Your comments about the difference between the index and actual real estate holdings are extremely valid and worth a lot more study.

Large Cap Value is actually not a reasonable proxy for the NASDAQ-100 at all. Large cap value is mostly banks, energy and oil producers, healthcare and drug co stocks, consumer staples stocks, railroads, utilities, and telcos. Wouldn't large cap growth be a much better proxy for the NASDAQ-100?

Re: Replicating the PP using Futures Contracts

Posted: Sun Aug 08, 2021 9:31 pm

by Mark Leavy

D1984 wrote: ↑Sun Aug 08, 2021 6:37 pm

Large Cap Value is actually not a reasonable proxy for the NASDAQ-100 at all. Large cap value is mostly banks, energy and oil producers, healthcare and drug co stocks, consumer staples stocks, railroads, utilities, and telcos. Wouldn't large cap growth be a much better proxy for the NASDAQ-100?

My mistake. Tyler may have actually said that and I misremembered.