Page 1 of 1

2020 Permanent Portfolio Return Poll

Posted: Wed Dec 30, 2020 11:58 am

by Cortopassi

One more full trading day left in 2020. Barring some crazy event tomorrow, how did you end the year?

I am currently at the high point for 2020, just under 20%. Amazing. Best year since starting in 2014.

Re: 2020 Permanent Portfolio Return Poll

Posted: Wed Dec 30, 2020 1:33 pm

by pp4me

I transitioned to the GB a few years ago so I'd have to do some figuring to eliminate the SCV part and tell you what the pure PP ROI was. Also, if you're still making contributions through the year (mostly my wife) calculating ROI gets more complicated so I don't usually bother.

I will do my detailed year-end analysis tomorrow night after the market closes, but so far I think this has been a very good year but not as good as last year. I think SCV might have been a drag on the GB, probably due to COVID, but it's been recovering lately.

They say that sequence of returns when you first retire is one of the best predictors of success. My last paycheck being almost exactly 4 years ago I can report that the PP/GB has done very well in that regard. Just one down year and the rest more than making up for it. We had $1M when I retired and now we have almost $1.5M.

Re: 2020 Permanent Portfolio Return Poll

Posted: Wed Dec 30, 2020 4:53 pm

by Vil

Mine is a tad below 15%, but its a kind of special one - implemented in Swiss account with ETFs bought on Euronext, bond part is bullet that's slightly on the short side of the median WA - that explains couple of percents below your performance. Have EUR hedged PP but its even more irrelevant, so havent voted for it.

Re: 2020 Permanent Portfolio Return Poll

Posted: Wed Dec 30, 2020 5:41 pm

by I Shrugged

EDITED, CORRECTED.

12.9% . Probably depressed by my portion that is international stocks. Again.

3 and 5 year returns are 8.3 & 8.5%

10 year is 5.7%

Re: 2020 Permanent Portfolio Return Poll

Posted: Wed Dec 30, 2020 5:51 pm

by Kriegsspiel

Looks like 16.73% here.

Re: 2020 Permanent Portfolio Return Poll

Posted: Fri Jan 01, 2021 6:57 am

by tarentola

My Euro PP of individual Euro HY shares, 15Y+ govt bond ETF, gold ETC and cash: +5.03%.

My other more conventional Euro PP of share ETFs (Dax, Nasdaq and Emerging Markets), 7-10Y bond ETFs, gold ETC and cash: 7.81%.

For comparison, a vanilla 4x25% Euro PP. ETFs traded in Paris, Google Finance symbols:

EPA:CEU -3.29% MSCI Europe

EPA:MTH 16.8% 25 Y govt bonds

EPA:GBS 14.74% Gold ETC

EPA:C13 -0.05% 1-3Y govt bonds

Combined 7.05%

A vanilla 4x25% USA PP of SPY, TLT, GLD, SHY made 14.9% in dollars. In 2020 the Euro gained 7.38% on the dollar, which explains some of the difference: the rest is presumably explained by the absence of FAANGM from the Euro indexes.

Re: 2020 Permanent Portfolio Return Poll

Posted: Fri Jan 01, 2021 8:01 am

by drumminj

Right at 15% here, but I don't bother doing the actual math to deal with contributions during the year as they're small compared to the overall portfolio size.

Re: 2020 Permanent Portfolio Return Poll

Posted: Fri Jan 01, 2021 7:59 pm

by blue_ruin17

10.8% for the Canadian HBPP.

Re: 2020 Permanent Portfolio Return Poll

Posted: Sat Jan 02, 2021 11:35 am

by I Shrugged

I had to correct my earlier post. I had the wrong start date in my calculations.

I got 12.9% for 2020.

2019, 16.3%

2018, -2.9%

2017, 12.2%

2016, 5.4%

2013 to 2016 were fairly lackluster. I blame Obama.

Re: 2020 Permanent Portfolio Return Poll

Posted: Sat Jan 02, 2021 12:01 pm

by Smith1776

12.28%

Re: 2020 Permanent Portfolio Return Poll

Posted: Sat Jan 02, 2021 3:39 pm

by stpeter

21.42%. Rebalancing in early April helped!

Re: 2020 Permanent Portfolio Return Poll

Posted: Sun Jan 03, 2021 3:51 pm

by sophie

Huh. I got 11.7% for the GB, and 16.7% for my Bogleheads 60/40. I suspect that has a lot to do with buying a pile of SCV fund shares at the worst possible time, plus some revert-to-the-mean effects. I got a 20.8% return in 2019.

I think this is just peachy, thanks! Happy to stay the course. So now for the really fun question: Which asset do you think will win in 2021?

My vote: Stocks.

Re: 2020 Permanent Portfolio Return Poll

Posted: Sun Jan 03, 2021 6:19 pm

by blue_ruin17

sophie wrote: ↑Sun Jan 03, 2021 3:51 pm

My vote: Stocks.

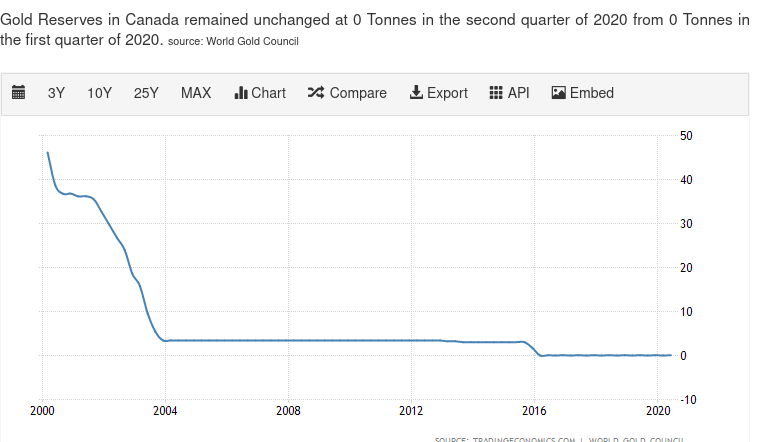

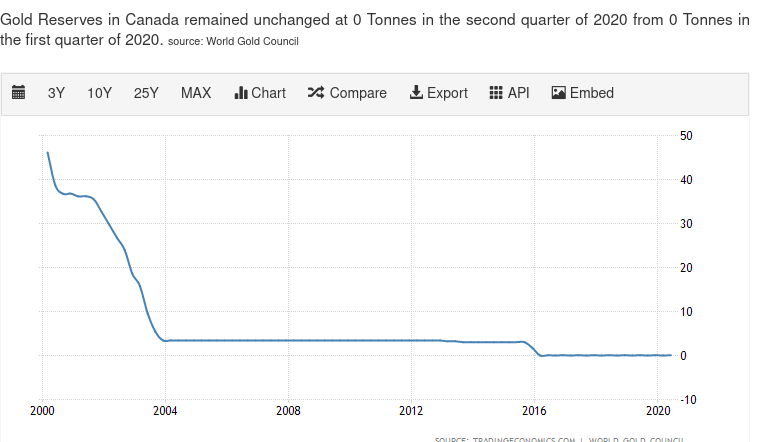

For Canada, I'll bet gold. But of course, I will not be surprised if I'm wrong. Never underestimate just how long a roll of central banking duct-tape is or how long it'll stick.

Re: 2020 Permanent Portfolio Return Poll

Posted: Sun Jan 03, 2021 8:00 pm

by I Shrugged

My guess is gold. But maybe cash.

Re: 2020 Permanent Portfolio Return Poll

Posted: Tue Jan 05, 2021 9:38 pm

by Fredmong

blue_ruin17 wrote: ↑Sun Jan 03, 2021 6:19 pm

Never underestimate just how long a roll of central banking duct-tape is or how long it'll stick.

Brilliant!

blue_ruin17 wrote: ↑Sun Jan 03, 2021 6:19 pm

For Canada, I'll bet gold.

Heard the other day that Trudeau created more debt during this term than every other PMs before him COMBINED! Didn't verify this but I wouldn't be surprised if it were true. My guess is the figure is not inflation adjusted for shock value but then it becomes a testament to inflation.

Interesting times we live in...

Re: 2020 Permanent Portfolio Return Poll

Posted: Wed Jan 06, 2021 10:17 am

by blue_ruin17

Fredmong wrote: ↑Tue Jan 05, 2021 9:38 pm

blue_ruin17 wrote: ↑Sun Jan 03, 2021 6:19 pm

Never underestimate just how long a roll of central banking duct-tape is or how long it'll stick.

Brilliant!

blue_ruin17 wrote: ↑Sun Jan 03, 2021 6:19 pm

For Canada, I'll bet gold.

Heard the other day that Trudeau created more debt during this term than every other PMs before him COMBINED! Didn't verify this but I wouldn't be surprised if it were true. My guess is the figure is not inflation adjusted for shock value but then it becomes a testament to inflation.

Interesting times we live in...

Not surprising given that he literally campaigned on a platform of deficit spending and didn't shy away from saying so. He's a Keynesian, and proud of it.

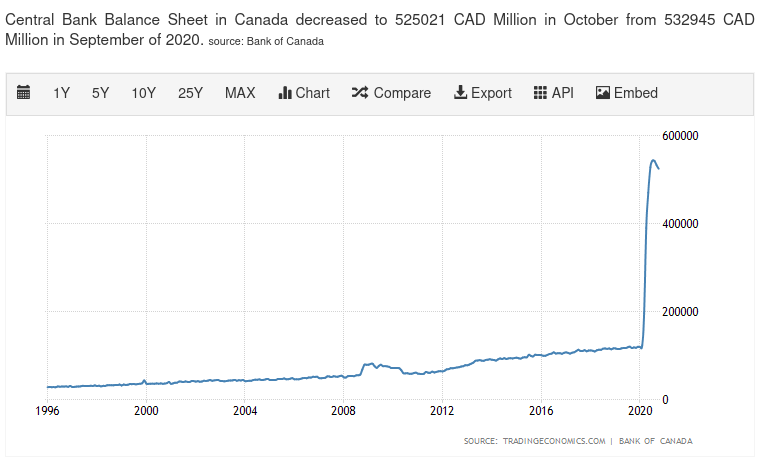

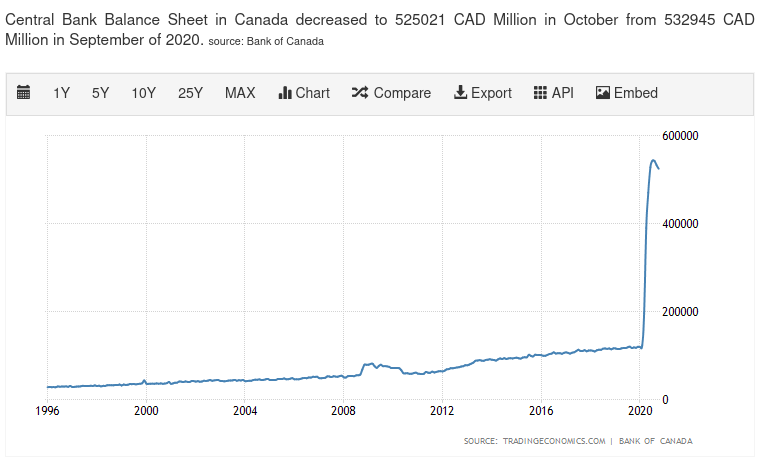

But then again, we'd still be seeing these same general trends in Canada even if, say, Harper were still in power. This is just the nature of fractional reserve banking and debt-based fiat monetary systems. It doesn't matter who the captain of the ship is, really: debt must expand or the system dies.

Sure makes me sweat when I look at my long-term treasuries... but then I remind myself of 30y German bonds that are currently yielding negative rates; still lots of room for Canadian rates to drop when they inevitably take out zero as a hard limit. I guarantee you that the Central Bank of Canada will do so without flinching if/when it becomes necessary.

Hang on to your hat with one hand and clutch your bar of gold with the other, folks!