Page 1 of 2

The Awesome Portfolio

Posted: Thu Dec 03, 2020 9:57 am

by I Shrugged

Not very different from the PP. BTW I enjoy this guy's free weekly email.

https://www.mauldineconomics.com/the-10 ... -portfolio

Re: The Awesome Portfolio

Posted: Thu Dec 03, 2020 11:35 am

by Kriegsspiel

Adding a component of real estate to the 4 PP assets, that's pretty much what I'm doing. I call it the same thing, too

Re: The Awesome Portfolio

Posted: Thu Dec 03, 2020 12:51 pm

by Smith1776

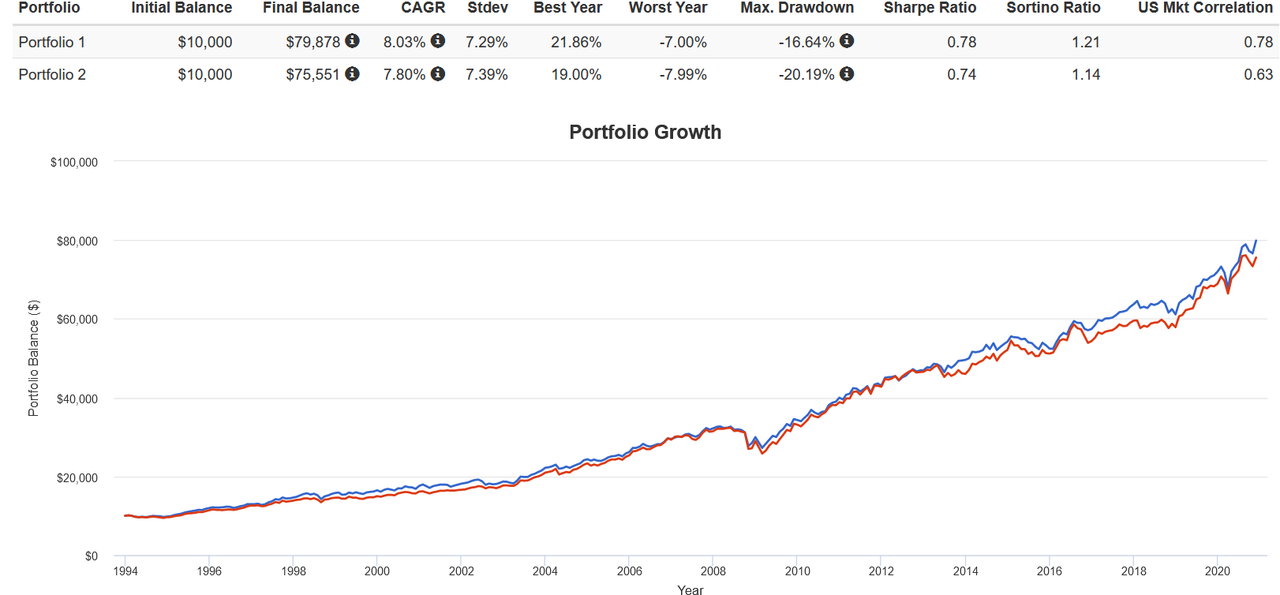

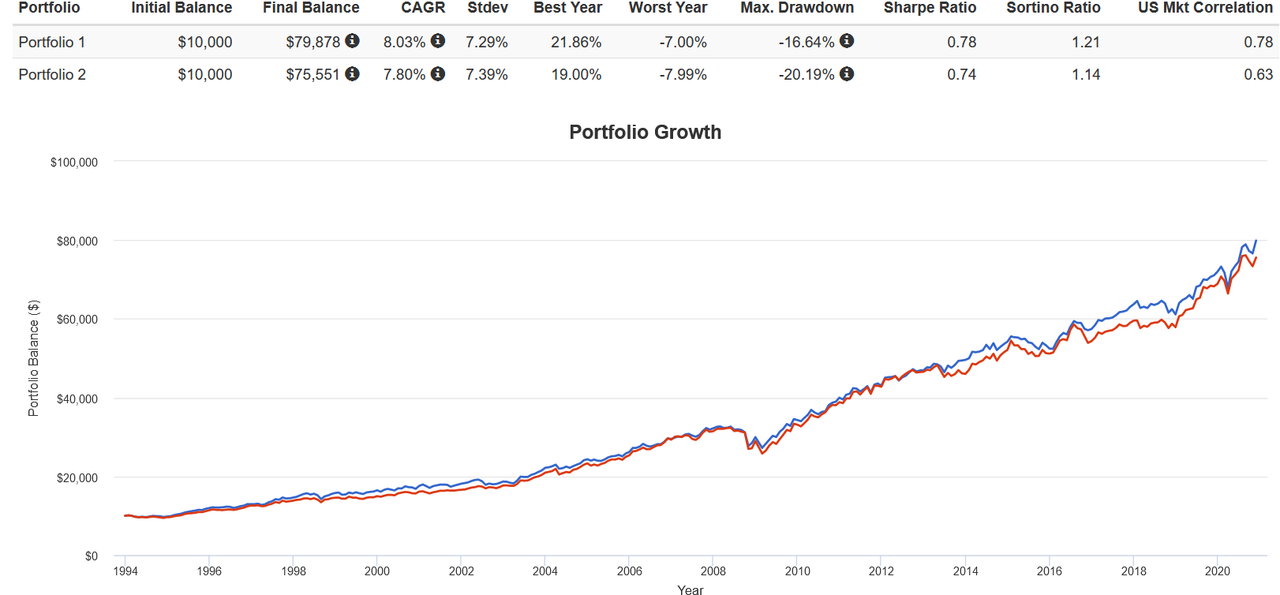

Couldn't resist.

- ap.png (121.66 KiB) Viewed 7946 times

Re: The Awesome Portfolio

Posted: Thu Dec 03, 2020 3:13 pm

by Hal

Heh, that's what this character suggested as well

https://www.youtube.com/watch?v=fswWHYhQSgE

https://www.youtube.com/watch?v=fswWHYhQSgE

Re: The Awesome Portfolio

Posted: Thu Dec 03, 2020 3:55 pm

by I Shrugged

REITs overcome several of those objections, though.

Re: The Awesome Portfolio

Posted: Thu Dec 03, 2020 4:25 pm

by Kriegsspiel

vincent_c wrote: ↑Thu Dec 03, 2020 4:14 pm

REITs are great if you can find one that actually does what you want, you can typically find good options for senior homes, healthcare, office, and apartments. Some of the commercial retail REITs are diversifying themselves into condos and property development.

I have no problem with paying the property management fee equivalent in the trustee and administrative costs associated with REITs which I have found many REITs to be reasonable and this makes it a truly passive investment.

I don't know any REITs that give you pure exposure to low rise multiplex rental properties though and REIT etfs especially VNQ seems to contain not only property REITs but also mortgage REITs and property developers.

I usually think of individual properties a bit like individual stocks, and REITs are a bit like index funds. Although really, it's more like you're starting your own business, and REITs are the corporation's stock, just like any other company except this one is in the real estate business. Just like you'd be, if you did it yourself. If you hire a property manager and they do everything for you, it's kind of a tiny REIT where you own all the shares. Anyways, I'm just rambling now.

Anything real estate-related is in my VP.

Re: The Awesome Portfolio

Posted: Thu Dec 03, 2020 4:36 pm

by PrimalToker

He has a new portfolio now? What happened to the old one?

https://www.mauldineconomics.com/editor ... olio-today

Re: The Awesome Portfolio

Posted: Thu Dec 03, 2020 6:20 pm

by I Shrugged

Re: The Awesome Portfolio

Posted: Thu Dec 03, 2020 6:41 pm

by foglifter

REITS index is pretty much a sector mid cap fund. Meb Faber uses REITS in his

Ivy Portfolio as well. The way I see it, replacing REITS with SC or SCV provides better diversification and allows to capture value and size factors. I just compared this portfolio with GB, not surprisingly GB has higher returns with slightly lower volatility, lower max drawdown, and higher Sharpe ratio:

https://tinyurl.com/yxnhjkva

Re: The Awesome Portfolio

Posted: Fri Dec 04, 2020 12:33 am

by Hal

As a general rule, I would use a variation of the old rule Bond% = 100-age. So VP % = 100 - age. Don't think a 20 year old needs their capital as safe as an 80 year old as they "should" have many productive working years ahead of them. YMMV

Re: The Awesome Portfolio

Posted: Fri Dec 04, 2020 8:21 am

by mathjak107

doing any investing by age is a terrible way to invest .

individual , needs , gals and pucker factor are the only way to do it .

there is zero financial logic to mitigating temporary dips with bonds and permanently hurting long term returns when you have decades to go .

a 65 year old who lives off ss and pension and is interested in growing legacy money can be 100% equities .. they are investing for others .

on the other hand a 20 year old who has no pucker factor likely shouldnt be heavy in equities ..

we saw so many flee their 401ks in my company in 2008 and it took a decade to get them back in.

any investment that tries to fit all in to one number is not going to be a good idea.

when you try to create simple answers to complex questions they are usually going to be the wrong answer

Re: The Awesome Portfolio

Posted: Fri Dec 04, 2020 10:54 am

by Kriegsspiel

I'm pretty comfortable with at least 10 years of expenses in the PP.

Re: The Awesome Portfolio

Posted: Fri Dec 04, 2020 11:27 am

by dualstow

vincent_c wrote: ↑Fri Dec 04, 2020 11:10 am

...age...

It actually doesn't sound too bad and one could certainly do worse. It would be interesting to model this as you pay down the mortgage whether it tracks the age rule in terms of real estate exposure if you choose to put that into the VP.

...

I think it's easier if you have a gambling itch but what about those of us who don't? For a while now I have believed that the PP removes the element of luck in a investing so you are underexposed to the luck factor and hence the VP exposes you to a small amount of idiosyncratic risk which can juice your returns. I just haven't been able to logically determine how much to allocate.

That's a blessing if you don't have the gambling itch. In that case, why not make it 5% or 0%.

I don't think the age rule is such a terrible place to start, and then getting down to pucker factor and the rest that

mj mentioned. I started out in 100% in equities and when I hit my early thirties, my Dad kept bugging me, saying, "you really should have some bonds." I discovered b'heads and got into asset allocation. I have no regrets. I do wish I had discovered precious metals (as a part of the pp) earlier in life.

https://en.wikipedia.org/wiki/Pucker_factor

Re: The Awesome Portfolio

Posted: Fri Dec 04, 2020 11:46 am

by Hal

In addition to the other comments, have a read of the Intelligent Investor.

Especially the section where it describes Enterprising vs Defensive investing.

Any investor who got through the Great Depression with the shirt on his back deserves a read

https://www.scribd.com/document/3505099 ... vestor-pdf

https://www.scribd.com/document/3505099 ... vestor-pdf

Re: The Awesome Portfolio

Posted: Fri Dec 04, 2020 12:16 pm

by Smith1776

You can never go wrong quoting Ben Graham.

Re: The Awesome Portfolio

Posted: Sat Dec 05, 2020 11:57 am

by pmward

vincent_c wrote: ↑Thu Dec 03, 2020 11:42 pm

I’m curious.

How do you guys determine how much to allocate to the VP? I know it’s for money you are willing to lose but can you give me an idea in ratio terms relative to the PP how big a VP should be capped at?

Yeah that's a tough question to answer. While I agree that using age (100-age in PP) is too generic of a proxy, the general theme behind it is solid. If you were to do a standard stock and bond portfolio, what percentage in bonds would be right for you? That percentage in PP. The rest in whatever you feel most confident in. This can be a buy and hold allocation, or it could be some form of an active strategy. Either way, strategy diversification does help in the same way asset diversification helps.

These things are really individual though. It all really depends on individual need and goals. Need is something often overlooked. Someone with great need by definition needs to take more risk to hit their goals. Someone with moderate need really only needs a moderate portfolio (this could be 100% PP coast mode basically). However, an interesting switch happens at the top end of the spectrum. Where your need becomes low, and you're basically in (or on track for) "won the game" territory, the penalty to increasing risk goes down (especially so for younger people like me that can always choose to work longer if worse comes to worse).

I personally reached this point in the last year or so, where I surpassed my planned "won the game" track by a significant margin. Financially, I'm doing much better than I originally anticipated both in my career and in my investment performance, and I had to adjust my model accordingly. I reached a point where it became silly to not increase risk, because even with more risk and a historical string of bad luck, I would still hit my game plan goal early or on time of my original projections. So basically, I crossed into "why not?" territory. As such the amount that I keep in a conservative "diversified portfolio" has dropped from 60% of my portfolio at the start of the year down to 30% of my portfolio.

Now in the last year I've also adjusted the "VP" strategy to a quant strategy that I levered up just to the point of just less than a 30% max historical drawdown (you can see my recent VP section thread for more info). I chose 30% because a 40% future drawdown in that 70% of my portfolio is about the point that I would start to really get queasy, and I always assume the max drawdown of any strategy (PP included) lies in the future not the past. So in my case, since I'm not doing a buy and hold strategy in my VP, I didn't just look at need and goals, I also looked at what I was doing in my VP and how the two portfolios play together.

If I were looking at a VP strategy like buy and hold that would have a much higher assumed max drawdown, then I would have wanted to err on the side of less VP than more. So maybe that would have been going from 60PP/40VP to something more conservative like 50/50 vs my current 30/70. But when I backtest the whole of both PP an VP for my current setup, 30/70 is about the sweet spot of where I want to be risk wise. Hopefully me writing out my thought process in how I arrived at my breakdown might help you in your own process.

Re: The Awesome Portfolio

Posted: Sat Dec 05, 2020 1:55 pm

by mathjak107

vincent_c wrote: ↑Fri Dec 04, 2020 11:37 am

Well just to clarify it's not that I don't have a gambling itch, but more like my gambling itch needs to also follow a strategy.

So first I identify an edge (the regular PP) and then I apply a conservative leverage using a % of the kelly criterion.

Personally I have a paid off home with a HELOC attached which I use for emergency funding instead of using the cash portion of the PP because if you can convince yourself that the size of your portfolio is the total exposure and not only your equity then you don't really need cash, you just need sufficient liquidity to survive drawdowns.

The trick is to eliminate the risk of ruin through portfolio insurance and hedging but the total returns are higher because you can optimize your leverage and remove the drag caused by the cash portion.

Many helocs were closed down in 2008 since banks had no money to loan , just when people needed the money most ..a heloc really is no emergency fund.

When the real emergency hits you can find yourself with no heloc

Re: The Awesome Portfolio

Posted: Sat Dec 05, 2020 2:48 pm

by yankees60

mathjak107 wrote: ↑Sat Dec 05, 2020 1:55 pm

vincent_c wrote: ↑Fri Dec 04, 2020 11:37 am

Well just to clarify it's not that I don't have a gambling itch, but more like my gambling itch needs to also follow a strategy.

So first I identify an edge (the regular PP) and then I apply a conservative leverage using a % of the kelly criterion.

Personally I have a paid off home with a HELOC attached which I use for emergency funding instead of using the cash portion of the PP because if you can convince yourself that the size of your portfolio is the total exposure and not only your equity then you don't really need cash, you just need sufficient liquidity to survive drawdowns.

The trick is to eliminate the risk of ruin through portfolio insurance and hedging but the total returns are higher because you can optimize your leverage and remove the drag caused by the cash portion.

Many helocs were closed down in 2008 since banks had no money to loan , just when people needed the money most ..a heloc really is no emergency fund.

When the real emergency hits you can find yourself with no heloc

I had not known that until reading what you wrote.

A cousin to..."banks will not loan money to you when you need it....only when you don't need it"?

Vinny

Re: The Awesome Portfolio

Posted: Sat Dec 05, 2020 4:38 pm

by yankees60

vincent_c wrote: ↑Sat Dec 05, 2020 4:02 pm

I think this is why when things are bad individuals and companies draw down their helocs and put it in a savings account just to be safe

Except that during a financial crisis like 2008 or earlier this year...things can just happen too suddenly to make adequate preparation...

Vinny

Re: The Awesome Portfolio

Posted: Sat Dec 05, 2020 4:42 pm

by mathjak107

yankees60 wrote: ↑Sat Dec 05, 2020 4:38 pm

vincent_c wrote: ↑Sat Dec 05, 2020 4:02 pm

I think this is why when things are bad individuals and companies draw down their helocs and put it in a savings account just to be safe

Except that during a financial crisis like 2008 or earlier this year...things can just happen too suddenly to make adequate preparation...

Vinny

Exactly , it is like thinking when markets don’t look good I will sell out before the damage .

As a note , in 2008 we sold two of our co-ops in manhattan...when closing time came both buyers banks had no money to loan ....it took six long months before banks came across with funding

Re: The Awesome Portfolio

Posted: Sat Dec 05, 2020 5:31 pm

by mathjak107

vincent_c wrote: ↑Sat Dec 05, 2020 4:02 pm

I think this is why when things are bad individuals and companies draw down their helocs and put it in a savings account just to be safe

So when one is at the point they need their emergency money they should pay a load of interest too on money stockpiled and not even needed yet ?

doesn’t sound like a good emergency plan to me

Re: The Awesome Portfolio

Posted: Sat Dec 05, 2020 6:23 pm

by mathjak107

Personally having been through 2008 I don’t want to depend on loans for my emergency money ..today you Need the same criteria to get a heloc as a mortgage .

One can find themselves at a point with no income to qualify just when they need the money