Page 1 of 2

PP protection against financial repression

Posted: Thu Jun 16, 2011 8:03 pm

by doodle

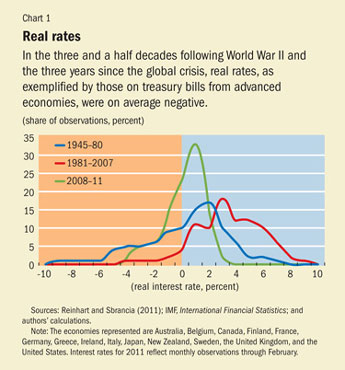

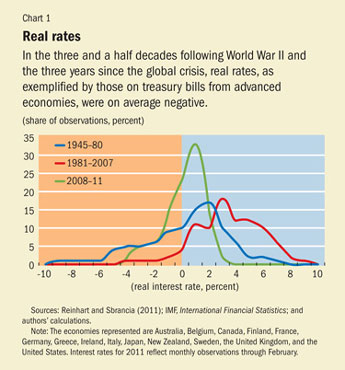

I think this author makes a good argument that we are looking at an era of financial repression:

http://blogs.reuters.com/jim-saft/2011/ ... repressed/

Most of you are probably aware of what that means but essentially it is a situation where a highly indebted government artificially holds interest rates below the rate of inflation as a way to slowly inflate away debt. This seems to me to be a very likely long term scenario for the United States and the larger western economies. The question is...with 50% of the PP assets being slowly chewed away by negative real interest rates is there some other way to counteract this effect? How does one find real return in a highly indebted world where the govt is trying to reduce debt without having to resort to austerity measures?

I think in the scenario where the Fed caps interest rates LT treasuries might give you a pop up to a certain point but after that you are just going to watch your money slowly get eaten away. A deflationary situation will not be allowed to persist in the United States as long as we have a central bank, and highly indebted government..... even more so when Ben Bernanke is at the helm.

Re: PP protection against financial repression

Posted: Thu Jun 16, 2011 8:05 pm

by MediumTex

As long as the PP continues to work as a package, I wouldn't worry about it.

Re: PP protection against financial repression

Posted: Thu Jun 16, 2011 8:10 pm

by doodle

So if LT treasuries decline to 2% yields and stay stuck there due to Fed intervention you are going to feel comfortable with 25% of your assets there even if real inflation (not doctored CPI) is running like 4% a year?

At a certain point the potential downside outweighs the upside. At this point you are losing money...not making money. And if interest rates rise to match the real rate of inflation, you will lose even more money.

If this does happen are you going to still stay in the traditional PP?

In my young investing life I have seen two bubbles in tech and housing. But LT treasuries are different than this because there is a limited upside to this particular bubble. Whereas tech or housing could theoretically keep climbing to more ridiculous heights...LT treasuries cant.

Re: PP protection against financial repression

Posted: Thu Jun 16, 2011 8:15 pm

by Pkg Man

The yield on treasuries couldn't stay lower than inflation for very long. The situation you describe where LTT rates are that low is likely to be deflationary, so inflation would be negative or at least very low.

Because no one would hold 30 year bonds at a rate below inflation - at least for very long - it isn't a situation that will occur.

Re: PP protection against financial repression

Posted: Thu Jun 16, 2011 8:23 pm

by Storm

I don't think you understand the way the PP works, no offense intended. If the Fed bought so many treasuries that it pushed the 30 year yield from 4% or whatever it is now down to 2%, the value of our LT treasuries would double.

Let's say hypothetically you started the year with $25K in each asset class, like this:

The Fed pushes bond yields to 2%. Essentially, what was 25% of your portfolio, would now be 40%:

This triggers a rebalancing band, and you now have $31,500 in each asset class. You just locked in $18,500 in profits and are up 25% for the year. Congratulations, the PP worked!

edit: Also, your bonds were purchased with a 4% coupon rate - they continue to pay 4% as long as you hold them, even if interest rates are 2%.

MT is right, long term bond yields always fluctuate to match the long term interest rates, except in cases of extreme manipulation. But, the purpose of the LT Treasuries in the PP is not for coupon payments - those are a nice side effect of owning treasuries. The purpose of LT treasuries in the PP is because they react dramatically to fear of deflation and other investor panic type events.

Re: PP protection against financial repression

Posted: Thu Jun 16, 2011 8:33 pm

by Storm

One other thing to mention - just like gold is a leveraged play on inflation expectations - long term treasuries are a leveraged play on deflation expectations.

Re: PP protection against financial repression

Posted: Thu Jun 16, 2011 8:34 pm

by Pkg Man

doodle the following link explains a bit about real and nominal interest rates that might be useful.

http://www.econlib.org/library/Enc/InterestRates.html

Basically the nominal rate of interest is made of the real rate and the expected rate of inflation. So while bond holders can get fooled, rates could never stay below the inflation rate in perpetuity.

Re: PP protection against financial repression

Posted: Thu Jun 16, 2011 8:37 pm

by MediumTex

I think the key to understanding LT treasuries is understanding that LT rates will never be zero. If rates are always above zero, there is always room for them to fall, even if it begins to LOOK very tight.

Whether LT rates are currently at 6% or 3%, there is still plenty of money to be made if rates fall.

I think the example I gave of a game of tennis turning into a game of ping pong is a good one.

Keep your eye on the PP as a package--don't get too hung up on what any one of the PP assets is doing. One or more of the PP assets will always look like a terrible investment.

Re: PP protection against financial repression

Posted: Thu Jun 16, 2011 8:39 pm

by doodle

I apologize for beating this topic to death....

I think I have a decent grasp on the PP but I am very much struggling with LT treasuries.

LT treasuries are good for a deflationary environment...at least according to the PP. However with a huge amount of debt and the need for big tax revenues to fund this debt our central bank could not allow a deflationary environment to persist for very long. I think the Great Depression taught us a lesson regarding this.

It might take a few years but sooner or later rates have to rise to meet the natural rate of inflation which if we already agreed we wont have deflation because of central bank interventions has to be some positive number.

I hate to take this argument to absurdity but lets say LT rates drop to .2%. At some point you have to say that the risk / reward of this asset no longer makes sense.

Re: PP protection against financial repression

Posted: Thu Jun 16, 2011 8:43 pm

by doodle

Basically the nominal rate of interest is made of the real rate and the expected rate of inflation. So while bond holders can get fooled, rates could never stay below the inflation rate in perpetuity.

Not in perpetuity but for a while.

Govts can screw with the natural market price of things for a long time by capping prices. When they eventually have to remove this cap the price however will usually explode upward.

In the case of LT bonds the idea of forcing pensions or banks to buy LT treasuries could be one way of accomplishing this.

Re: PP protection against financial repression

Posted: Thu Jun 16, 2011 8:50 pm

by MediumTex

doodle wrote:

I apologize for beating this topic to death....

I think I have a decent grasp on the PP but I am very much struggling with LT treasuries.

LT treasuries are good for a deflationary environment...at least according to the PP. However with a huge amount of debt and the need for big tax revenues to fund this debt our central bank could not allow a deflationary environment to persist for very long. I think the Great Depression taught us a lesson regarding this.

The central bank doesn't necessarily get to decide. Ask the Japanese.

It might take a few years but sooner or later rates have to rise to meet the natural rate of inflation which if we already agreed we wont have deflation because of central bank interventions has to be some positive number.

I think you are assuming central banks have an inflationary power in a deflationary environment that may be illusory. Ask the Japanese.

I hate to take this argument to absurdity but lets say LT rates drop to .2%. At some point you have to say that the risk / reward of this asset no longer makes sense.

That's like saying that if gold got to $10,000 an ounce it wouldn't make sense to own it, and thus it doesn't make any sense to buy it at today's prices.

Re: PP protection against financial repression

Posted: Thu Jun 16, 2011 8:56 pm

by Pkg Man

doodle wrote:

Basically the nominal rate of interest is made of the real rate and the expected rate of inflation. So while bond holders can get fooled, rates could never stay below the inflation rate in perpetuity.

Not in perpetuity but for a while.

Govts can screw with the natural market price of things for a long time by capping prices. When they eventually have to remove this cap the price however will usually explode upward.

In the case of LT bonds the idea of forcing pensions or banks to buy LT treasuries could be one way of accomplishing this.

I'll try to get around to reading the IMF publication referenced in the link you posted and think about this issue some more. But my first thought is that such a policy described above would not work since they can't make everyone do this (think China). But perhaps it is not as simple as I am making it out to be.

Re: PP protection against financial repression

Posted: Thu Jun 16, 2011 8:58 pm

by doodle

That's like saying that if gold got to $10,000 an ounce it wouldn't make sense to own it, and thus it doesn't make any sense to buy it at today's prices.

If LT treasury rates hit .2% the difference between holding cash and LT treasuries would be completely negligible.

Come on MT tell me you wouldnt dump LT treasuries if the yield hit .1%. I wont stop until you cry UNCLE!

There is precedence for negative real interest rates according to IMF. See image above.

Re: PP protection against financial repression

Posted: Thu Jun 16, 2011 9:06 pm

by Storm

I said it before and I'll say it again - the purpose of LT treasuries in the PP is not for coupon payments. It is because the value goes up as the yield drops.

Personally I would be very happy to continue to hold 4% coupon LT treasuries when yields drop to .1% - mine are still paying 4% and I just sold a bunch for a huge profit!

Re: PP protection against financial repression

Posted: Thu Jun 16, 2011 9:11 pm

by MediumTex

But doodle, what is the relevance of talking about what we would do if LT rates were .1% when there is no reason to think that is going to happen?

OTOH, LT rates at 2% is very easy to imagine, and with the PP you will be prepared for the unpleasant conditions that would accompany 2% LT rates.

Re: PP protection against financial repression

Posted: Thu Jun 16, 2011 9:26 pm

by doodle

I really think that Japan is an anomaly.

I think the perspective below is worth a thought. I really do agree that the PP is one of the safest and best ways to invest however I don't think an investor should ever totally turn off their brain and go on autopilot. So I will continue to assess this situation. At a point a rational investor can say that the risk greatly outweighs the reward.

The BOJ has been “zero bound”? for the last 15 years – meaning, it has been lending money as cheaply as it possibly could. If monetary policy were a pair of pants it would be around Japan’s ankles. And fiscal policy? The country already has $20 of debt for every dollar of tax receipts. What’s left? Thirty dollars, surely – or bankruptcy.

There’s unconventional stimulus too. That’s right…the old printing press…is getting a good workout.

Onward!

The Japanese camel has a remarkably strong back. He’s held up to more than two decades of counter-cyclical stimulus programs…and central government debt that now measures 200% of GDP.

The poor long-suffering beast has seen everything. The Japanese trusted the government with their retirement money. The government spent the money. And yet, bond buyers seem none the wiser. They still lend to the Japanese government at less than 2% yield.

And now the old-timers are beginning to dis-save. That is, after saving so much for their retirements, now they are retired. And now they are drawing down their savings.

This puts the Japanese government is in a real fix. Net savings in Japan are now negative. So, who will buy the bonds Japan needs to sell in order to rebuild its economy? Who will buy the bonds Japan needs to sell in order to rebuild its infrastructure? Who will buy the bonds Japan needs to sell in order to fund its government? Who will buy the bonds Japan needs to sell in order to pay back the people who bought bonds last year…and the year before…and all the way back to 1990?

The answer is likely to be: no one.

Instead, Japan will be forced into more QE, forced to print money to make up for the money she can no longer borrow.

This will have a couple knock-on effects. First, the Japanese famously helped Europe and America finance their deficits and bailouts. Recently, Japan funded a major part of Europe’s bond sales – helping to hold down rates. Also, the last time we looked, Japan had the largest stash of US bonds in the world.

Under pressure to bring money back to the home island, you can expect Japan to be doing some selling – which might be the final straw.

Second, the Japanese are making such an obvious mess of their finances that they are bound to attract attention. Investors might notice that the Japanese aren’t the only ones. As we’ve pointed out several times, the developed economies all now count on low interest rates, huge deficits, and printing press money. Even with these massive in-puts of cash and credit grease, the economy still barely creaks forward. Without the extra grease, they will probably slip backward.

Re: PP protection against financial repression

Posted: Thu Jun 16, 2011 11:31 pm

by Gumby

doodle wrote:If LT treasury rates hit .2% the difference between holding cash and LT treasuries would be completely negligible.

That's not true. If LT Treasuries were at .2%, short term treasuries would be in negative territory. In other words, you would actually lose money by keeping your cash in short term Treasuries. You may not realize this, but even Japan had negative interest rates at one point. And yes, people actually bought government bonds at those rates.

Zen Banking: Japan's Negative Interest Rates

Here's a short quote from the article that tells you everything you need to know about negative interest rates:

...Some investors have become so downbeat about the Japanese economy that they are willing to invest only in Government bonds, the safest bets in the country.

Furthermore, from mid-1932 through mid-1942, the vast majority of coupon-bearing U.S. government securities bore negative nominal yields as they neared maturity. Treasury bonds with less than a year to maturity reached a magnitude as low as -1.7%.

But, more importantly Doodle, have you even bothered to imagine what the world would look like if LT Treasuries were at .2%??? You're talking about a Mad Max style deflation — a complete collapse in confidence about the economy. I really don't think you can appreciate how desirable Treasuries would be to someone in that situation.

Believe me, you would be clinging to your LT Treasuries yielding 4%, for dear life, if new 30-year Treasuries were yielding .2%...

Re: PP protection against financial repression

Posted: Fri Jun 17, 2011 8:14 am

by AdamA

Gumby wrote:

But, more importantly Doodle, have you even bothered to imagine what the world would look like if LT Treasuries were at .2%??? You're talking about a Mad Max style deflation — a complete collapse in confidence about the economy. I really don't think you can appreciate how desirable Treasuries would be to someone in that situation.

You'd make a small fortune on the way down from 4% to .2%, and at .2%.

.2% on 30 year government bonds would also be indicicative of a very strange investment world. It would essentially mean that every other investment was just too risky. That's the only way the government could get away setting rates so low.

What would happen when rates started to go up? Hopefully, your T-bills would kick in...similar to what happened in the early 80's when they were yielding close to 20% a year.

Re: PP protection against financial repression

Posted: Sat Jun 18, 2011 4:42 pm

by AgAuMoney

Adam1226 wrote:

.2% on 30 year government bonds would also be indicicative of a very strange investment world. It would essentially mean that every other investment was just too risky. That's the only way the government could get away setting rates so low.

What would happen when rates started to go up? Hopefully, your T-bills would kick in...similar to what happened in the early 80's when they were yielding close to 20% a year.

Either you get rich when LTT rates decline and then on the reverse the yield on short term T-bills doesn't make enough difference to matter, or it doesn't make that much difference when LTT rates decline and then on the reverse the yield on ST is nice. You can't have it both ways... And I think it is more likely the former -- declining rates help you a lot more with LTTs than rising rates will help you with T-Bills. (When rates are rising there is no yield premium on T-bills, but there is a definite yield discount on your LTTs that is mathematically the same magnitude as the yield premium that "made a small fortune" on the way down.)

Would you start a PP (buying LTTs) if LTT rates were at 0.2%?

And the gov't would not have to set rates that low, it doesn't "set rates" on LTTs. The auction sets the rates. In the modern world, that means the Fed does or could set LTT rates. The Fed could just bid enough that rates would be that low. If you didn't like it, you don't buy LTTs. Everybody could avoid buying LTTs and the rate would still be that low and all the bills would be sold. BTW, that is called Quantitative Easing aka QE aka "printing money."

Re: PP protection against financial repression

Posted: Sat Jun 18, 2011 4:55 pm

by AgAuMoney

Storm wrote:If the Fed bought so many treasuries that it pushed the 30 year yield from 4% or whatever it is now down to 2%, the value of our LT treasuries would double.

Double? How do you figure?

If new bonds yield 2% and your old bonds yield 4%, the yield to maturity difference isn't big enough to double the price.

Compare a $1000 new bond yielding 2% per year for 30 years to an older $1000 bond yielding 4% per year for 25 more years.

The new bond will yield $20 per year multiplied by 30 years, or $600.

The old bond will yield $40 per year multiplied by 25 years, or $1000.

The difference in yield to maturity (YTM) is $400.

It is highly unlikely that a buyer would pay more than breakeven for your old bond so your old bond could sell for $1400. (the market is highly liquid, so there might be +/- a very small amount on that figure. '+' because the shorter term might be worth a premium, '-' because transaction costs might be more of a detriment with a shorter term, etc)

For you, 1400 is a 40% appreciation, not a 100% (double is a 100% appreciation).

EDIT: the new bond should probably be figured on a 25 year scale, same as the old bond. That would make the new bond yield $500, for a difference of $500, for a peak price on the old bond of $1500 or an appreciation of 50%. Still a far cry from the 100% needed to double.

Re: PP protection against financial repression

Posted: Sat Jun 18, 2011 5:00 pm

by AgAuMoney

Pkg Man wrote:

doodle wrote:

In the case of LT bonds the idea of forcing pensions or banks to buy LT treasuries could be one way of accomplishing this.

I'll try to get around to reading the IMF publication referenced in the link you posted and think about this issue some more. But my first thought is that such a policy described above would not work since they can't make everyone do this (think China). But perhaps it is not as simple as I am making it out to be.

The idea has already been floated that people should be forced to buy treasuries with their 401(k) and IRA money instead of investing it in the stock market. (Because after all, the stock market is just too risky and the people must be protected!)

If the gov't did that it would have a significant negative impact on the yield of LTTs and on stock prices. (Perhaps they would offset the stock prices thru efforts and spending of the plunge protection team.)

Many people have theorized that a large part of the 1980's-1990's market boom was due to the influx of new 401(k) and IRA dollars into stocks as those programs reached more and more people over a 20 year period and companies discontinued their pension programs and people were steered to the new 'tax advantaged' approach(es) to saving for retirement. The correlation is clear. Causation? Not so clear to me anyway.

Re: PP protection against financial repression

Posted: Sat Jun 18, 2011 5:43 pm

by AdamA

AgAuMoney wrote:

Either you get rich when LTT rates decline and then on the reverse the yield on short term T-bills doesn't make enough difference to matter, or it doesn't make that much difference when LTT rates decline and then on the reverse the yield on ST is nice. You can't have it both ways...

But you're rebalancing all the way down, so I think you could have it both ways. Unless I misunderstand what you're saying.

And the gov't would not have to set rates that low, it doesn't "set rates" on LTTs. The auction sets the rates. In the modern world, that means the Fed does or could set LTT rates. The Fed could just bid enough that rates would be that low. If you didn't like it, you don't buy LTTs. Everybody could avoid buying LTTs and the rate would still be that low and all the bills would be sold. BTW, that is called Quantitative Easing aka QE aka "printing money."

You're right, the government doesn't set the rates, the auction does.

Re: PP protection against financial repression

Posted: Sun Jun 19, 2011 2:30 pm

by AgAuMoney

Adam1226 wrote:

AgAuMoney wrote:

Either you get rich when LTT rates decline and then on the reverse the yield on short term T-bills doesn't make enough difference to matter, or it doesn't make that much difference when LTT rates decline and then on the reverse the yield on ST is nice. You can't have it both ways...

But you're rebalancing all the way down, so I think you could have it both ways. Unless I misunderstand what you're saying.

That is the "small fortune on the way down" part. I agree with that.

The problem is on the way up. With rising rates the higher yield on short term will not make up for the small fortune you will be losing in the LTTs. LTTs are affected the same amount when rates go down or when rates go up. The magnitude is the same, only the direction is different.

For example, if you have a $1000 LTT yielding 2% and it is good for 25 more years, you have a yield to maturity of $500, and if you are lucky your short term is yielding 1%. (Most likely not that high.)

If LTT rates go to 4%, a new $1000 LTT has a 25 yr yield of $1000 or a YTM of $1200. That is a difference of $500-$700 which means your LTT will be discounted to $500 -today-. That is a 50% loss of capital. Your short-term yield will grow from 1% to 3% (again, if you are lucky, most likely it will be lower!!!) which means you will gain 3% (2% more) AFTER ONE YEAR.

50% loss today vs 3% gain over a year will not make you happy.

Re: PP protection against financial repression

Posted: Sun Jun 19, 2011 3:12 pm

by Storm

AgAuMoney wrote:

Storm wrote:If the Fed bought so many treasuries that it pushed the 30 year yield from 4% or whatever it is now down to 2%, the value of our LT treasuries would double.

Double? How do you figure?

If new bonds yield 2% and your old bonds yield 4%, the yield to maturity difference isn't big enough to double the price.

Compare a $1000 new bond yielding 2% per year for 30 years to an older $1000 bond yielding 4% per year for 25 more years.

The new bond will yield $20 per year multiplied by 30 years, or $600.

The old bond will yield $40 per year multiplied by 25 years, or $1000.

The difference in yield to maturity (YTM) is $400.

It is highly unlikely that a buyer would pay more than breakeven for your old bond so your old bond could sell for $1400. (the market is highly liquid, so there might be +/- a very small amount on that figure. '+' because the shorter term might be worth a premium, '-' because transaction costs might be more of a detriment with a shorter term, etc)

For you, 1400 is a 40% appreciation, not a 100% (double is a 100% appreciation).

EDIT: the new bond should probably be figured on a 25 year scale, same as the old bond. That would make the new bond yield $500, for a difference of $500, for a peak price on the old bond of $1500 or an appreciation of 50%. Still a far cry from the 100% needed to double.

My mistake - I was thinking of what would happen to my 4.75% bonds with 2041 maturity if a sudden deflationary event happened that caused yields to cut in half. I thought it would double, but actually a 50% increase is what would happen, correct?

Re: PP protection against financial repression

Posted: Sun Jun 19, 2011 3:14 pm

by Storm

The point I was trying to make is mainly that if the bond yields dramatically plunge, you'll get rich on the way down, then you'll continue to collect those 4+% coupon payments on the way back up. So yes, the PP would work just fine.