Page 1 of 1

EE Bonds = 3.5% 20-Year Treasury

Posted: Wed Apr 08, 2020 11:06 am

by moda0306

Anybody been re-exploring the idea of using EE Bonds as a sort of deep-bond/cash hedge for an accumulation strategy?

The big idea was a few years ago that the doubling of value of an EE bond over 20 years represents a 3.5% compound RoR vs the 1.13% currently paying out on actual treasuries, and has no "principal risk" beyond the early withdrawal penalty of a few months interest.

Nice for accumulators who won't be doing a ton of re-balancing most-likely over the coming years... and of course, the volatility of treasury bonds is in-some-ways a feature, not a bug, so it wouldn't be something you'd want to do with all your LTT allocation.

With the HUGE gains of the PP over the last 12 months, I'm pretty tempted to stay completely out of the "volatile" assets and throw everything new into cash until the PP goes pear-shaped, so I'll probably be using these as a bit of a hedge on interest rates in the meantime.

Re: EE Bonds = 3.5% 20-Year Treasury

Posted: Wed Apr 08, 2020 11:08 am

by Kriegsspiel

I have some that my grandparents bought me when I was younger, but I haven't looked at them much lately. Maybe I should.

Re: EE Bonds = 3.5% 20-Year Treasury

Posted: Wed Apr 08, 2020 11:28 am

by AdamA

If you hold EE bonds for 20 years they are guaranteed to double.

So they have a guaranteed rate of 3.5% (if held that long).

Re: EE Bonds = 3.5% 20-Year Treasury

Posted: Wed Apr 08, 2020 11:31 am

by yankees60

AdamA wrote: ↑Wed Apr 08, 2020 11:28 am

If you hold EE bonds for 20 years they are guaranteed to double.

So they have a guaranteed rate of 3.5% (if held that long).

Obviously not a good deal if we ever had a reoccurrence of that inflation similar to the mid-60s to early 80s time period.

Vinny

Re: EE Bonds = 3.5% 20-Year Treasury

Posted: Wed Apr 08, 2020 12:02 pm

by AdamA

If you hold EE bonds for 20 years they are guaranteed to double.

So they have a guaranteed rate of 3.5% (if held that long).

Too bad you can only buy $10K/year.

Re: EE Bonds = 3.5% 20-Year Treasury

Posted: Wed Apr 08, 2020 12:04 pm

by yankees60

AdamA wrote: ↑Wed Apr 08, 2020 12:02 pm

If you hold EE bonds for 20 years they are guaranteed to double.

So they have a guaranteed rate of 3.5% (if held that long).

Too bad you can only buy $10K/year.

Somewhat similar limit to iBonds, then?

I assume you can exercise the limit for each and there is no limit looking at purchases for both in a given year?

Vinny

Re: EE Bonds = 3.5% 20-Year Treasury

Posted: Wed Apr 08, 2020 1:32 pm

by moda0306

yankees60 wrote: ↑Wed Apr 08, 2020 11:31 am

AdamA wrote: ↑Wed Apr 08, 2020 11:28 am

If you hold EE bonds for 20 years they are guaranteed to double.

So they have a guaranteed rate of 3.5% (if held that long).

Obviously not a good deal if we ever had a reoccurrence of that inflation similar to the mid-60s to early 80s time period.

Vinny

Well of course any long-term bond, or even just cash in-general, is going to suffer to some degree in an inflationary and increasing-rate environment. But since a large portion of any PP'er's portfolio is going to be said bonds/cash, it behooves us to hedge our bets if we can. My EE bond is going to age FAR better after, say, 3 years, than a 20-year bond at 1.13% if rates on a 17-year bond after that period are at 3 or 4% for some reason (inflation/growth, most-likely), that bond's going to lose a ton of value, while my EE will be sellable at par plus its measly stated interest.

Re: EE Bonds = 3.5% 20-Year Treasury

Posted: Wed Apr 08, 2020 1:47 pm

by yankees60

moda0306 wrote: ↑Wed Apr 08, 2020 1:32 pm

yankees60 wrote: ↑Wed Apr 08, 2020 11:31 am

AdamA wrote: ↑Wed Apr 08, 2020 11:28 am

If you hold EE bonds for 20 years they are guaranteed to double.

So they have a guaranteed rate of 3.5% (if held that long).

Obviously not a good deal if we ever had a reoccurrence of that inflation similar to the mid-60s to early 80s time period.

Vinny

Well of course any long-term bond, or even just cash in-general, is going to suffer to some degree in an inflationary and increasing-rate environment. But since a large portion of any PP'er's portfolio is going to be said bonds/cash, it behooves us to hedge our bets if we can. My EE bond is going to age FAR better after, say, 3 years, than a 20-year bond at 1.13% if rates on a 17-year bond after that period are at 3 or 4% for some reason (inflation/growth, most-likely), that bond's going to lose a ton of value, while my EE will be sellable at par plus its measly stated interest.

Seems like buying them fits into the Variable Portfolio concept and NOT the Permanent Portfolio concept?

Vinny

Re: EE Bonds = 3.5% 20-Year Treasury

Posted: Wed Apr 08, 2020 2:21 pm

by moda0306

yankees60 wrote: ↑Wed Apr 08, 2020 1:47 pm

moda0306 wrote: ↑Wed Apr 08, 2020 1:32 pm

yankees60 wrote: ↑Wed Apr 08, 2020 11:31 am

AdamA wrote: ↑Wed Apr 08, 2020 11:28 am

If you hold EE bonds for 20 years they are guaranteed to double.

So they have a guaranteed rate of 3.5% (if held that long).

Obviously not a good deal if we ever had a reoccurrence of that inflation similar to the mid-60s to early 80s time period.

Vinny

Well of course any long-term bond, or even just cash in-general, is going to suffer to some degree in an inflationary and increasing-rate environment. But since a large portion of any PP'er's portfolio is going to be said bonds/cash, it behooves us to hedge our bets if we can. My EE bond is going to age FAR better after, say, 3 years, than a 20-year bond at 1.13% if rates on a 17-year bond after that period are at 3 or 4% for some reason (inflation/growth, most-likely), that bond's going to lose a ton of value, while my EE will be sellable at par plus its measly stated interest.

Seems like buying them fits into the Variable Portfolio concept and NOT the Permanent Portfolio concept?

Vinny

I mean if you're being strict, yes. Very few people follow a strict PP (physical gold, physical cash, Individual LT Bonds, etc). But if you know you're looking at the fundamentals of why we own long-term treasuries, the risks of doing so, and how we accumulate inside the PP, I think it's a good hack to get more out of it.

And like I said, it fares far-better against the inflation/interest-rate risk that you mention due to its fixed-value nature. Most people don't run true-PP's anyway, but try to stick to some of the fundamentals of the philosophy. I think EE's do a pretty good job of abiding by some of those fundamentals pretty well, as do many of the other imperfect substitutes people discuss the risks/rewards of.

Re: EE Bonds = 3.5% 20-Year Treasury

Posted: Wed Apr 08, 2020 4:21 pm

by ppnewbie

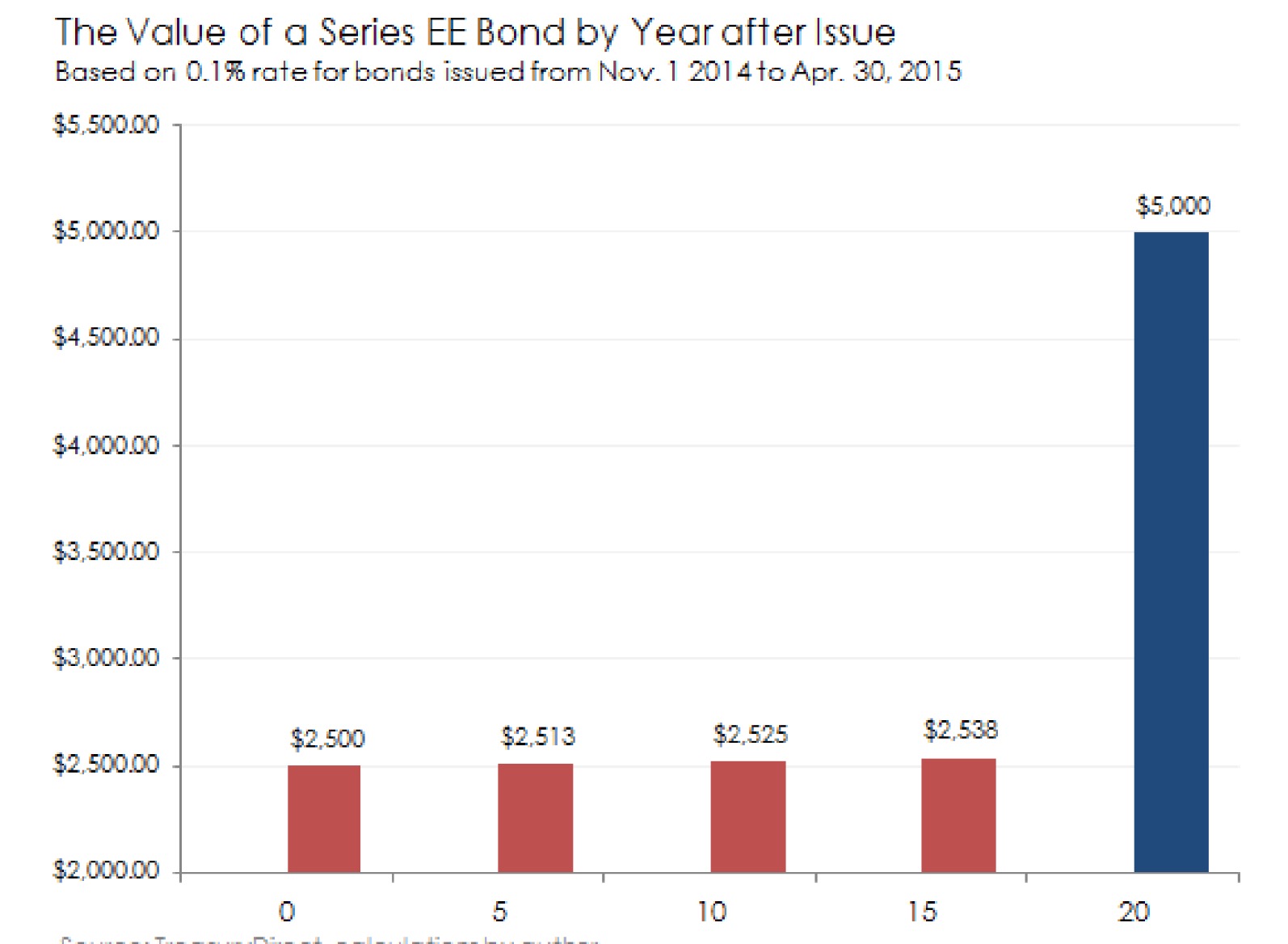

How do EE bonds work if you do not hold them to maturity. If I sell after 10 years is my effective interest rate still approximately 3.5% per year minus the penalties or is there some kind of a curve that incentivizes holding for 20 years?

Re: EE Bonds = 3.5% 20-Year Treasury

Posted: Wed Apr 08, 2020 4:25 pm

by ochotona

ppnewbie wrote: ↑Wed Apr 08, 2020 4:21 pm

How do EE bonds work if you do not hold them to maturity. If I sell after 10 years is my effective interest rate still approximately 3.5% per year minus the penalties or is there some kind of a curve that incentivizes holding for 20 years?

You get the same as holding money at a major bank, almost no interest. You have to hold for 20. I wish I'd found out about this earlier, I'd have bought more. I will make my last buy in 2021 when I turn 60.

Re: EE Bonds = 3.5% 20-Year Treasury

Posted: Wed Apr 08, 2020 4:25 pm

by ppnewbie

I just answered my own question:

- EE_bond_chart.jpg (155.47 KiB) Viewed 6772 times

Re: EE Bonds = 3.5% 20-Year Treasury

Posted: Wed Apr 08, 2020 4:29 pm

by ppnewbie

It's funny in the early 2000's I bought I-bonds randomly - that have now more than doubled. I wish someone shook me then and said "just keep buying those every year and whatever else you do does not really matter".

Re: EE Bonds = 3.5% 20-Year Treasury

Posted: Thu Apr 09, 2020 1:40 pm

by jhogue

I bought my last EE bonds when I turned 65.

Anything more than that amounts to a well-thought out gift to my heirs.