Year end gold prices in British Pounds, and Pound/US dollar FX rates.

Code: Select all

1933,6.21,4.237

1934,6.88,5.038

1935,7.11,4.902

1936,7.02,4.970

1937,7.04,4.943

1938,7.13,4.890

1939,7.77,4.435

1940,8.84,3.830

1941,8.40,4.032

1942,8.38,4.036

1943,8.38,4.036

1944,8.38,4.036

1945,8.61,4.031

1946,8.61,4.032

1947,8.61,4.029

1948,8.61,4.031

1949,8.59,3.687

1950,12.40,2.801

1951,12.40,2.800

1952,12.40,2.793

1953,12.51,2.813

1954,12.54,2.809

1955,12.57,2.791

1956,12.56,2.796

1957,12.51,2.793

1958,12.56,2.810

1959,12.50,2.809

1960,12.56,2.808

1961,12.58,2.802

1962,12.55,2.808

1963,12.53,2.800

1964,12.57,2.792

1965,12.56,2.796

1966,12.58,2.793

1967,12.72,2.750

1968,16.16,2.394

1969,14.66,2.390

1970,15.62,2.396

1971,17.06,2.552

1972,27.66,2.348

1973,48.30,2.323

1974,79.35,2.347

1975,69.30,2.024

1976,78.99,1.701

1977,86.02,1.917

1978,110.68,2.042

1979,229.39,2.219

1980,246.29,2.389

1981,208.83,1.915

1982,281.52,1.618

1983,264.18,1.452

1984,264.86,1.158

1985,226.94,1.445

1986,265.03,1.483

1987,260.66,1.886

1988,229.00,1.809

1989,247.81,1.615

1990,201.41,1.929

1991,188.85,1.866

1992,219.74,1.513

1993,265.23,1.478

1994,245.53,1.567

1995,248.64,1.554

1996,218.36,1.712

1997,175.15,1.643

1998,172.18,1.663

1999,179.61,1.615

2000,184.24,1.496

2001,191.23,1.454

2002,216.43,1.610

2003,233.81,1.784

2004,226.85,1.916

2005,298.20,1.719

2006,322.61,1.959

2007,418.49,1.984

2008,599.62,1.462

2009,682.97,1.617

2010,909.53,1.539

2011,992.67,1.554

2012,1027.21,1.626

2013,730.44,1.657

2014,775.21,1.558

2015,714.75,1.475

2016,937.12,1.234

2017,959.86,1.353

2018,1008.24,1.276

2019,1152.57,1.327

2020,1387.39,1.366

Calculate US dollar gold price from those, and the yearly changes, and drop those yearly change figures into

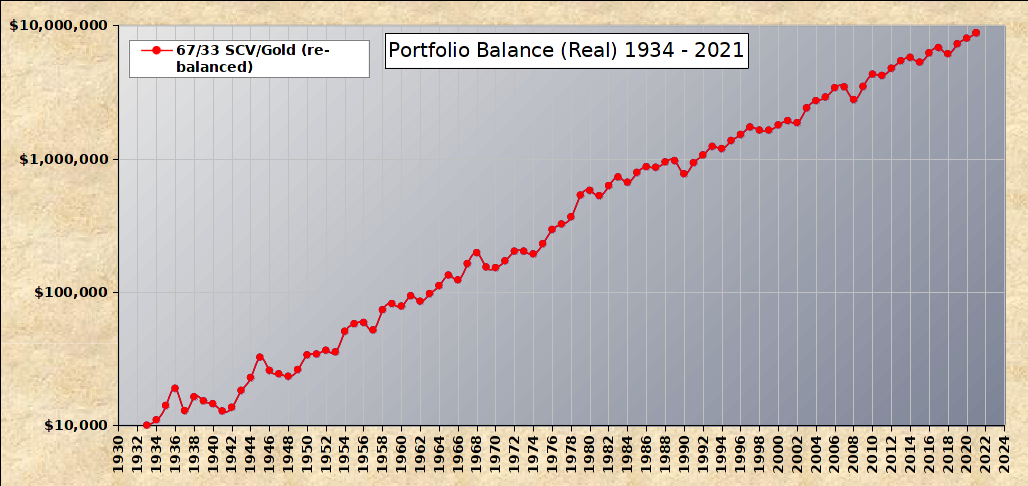

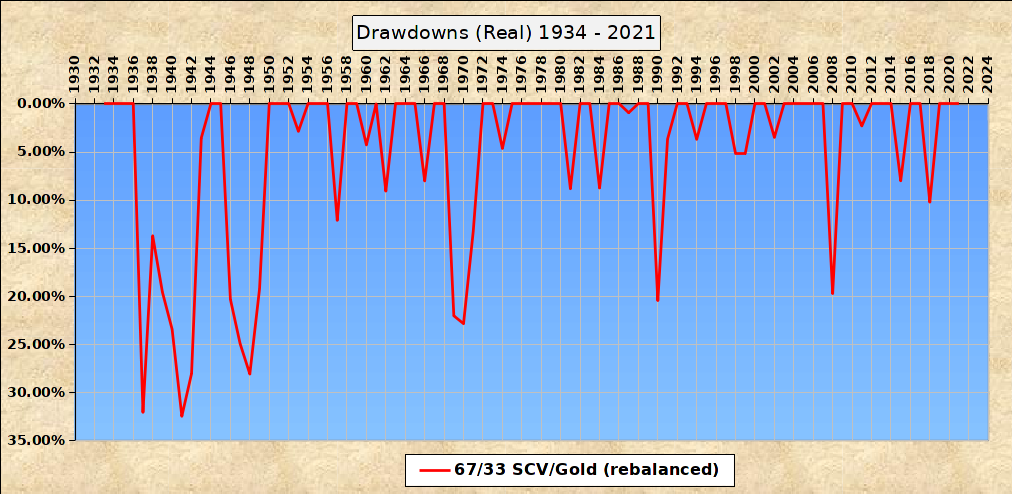

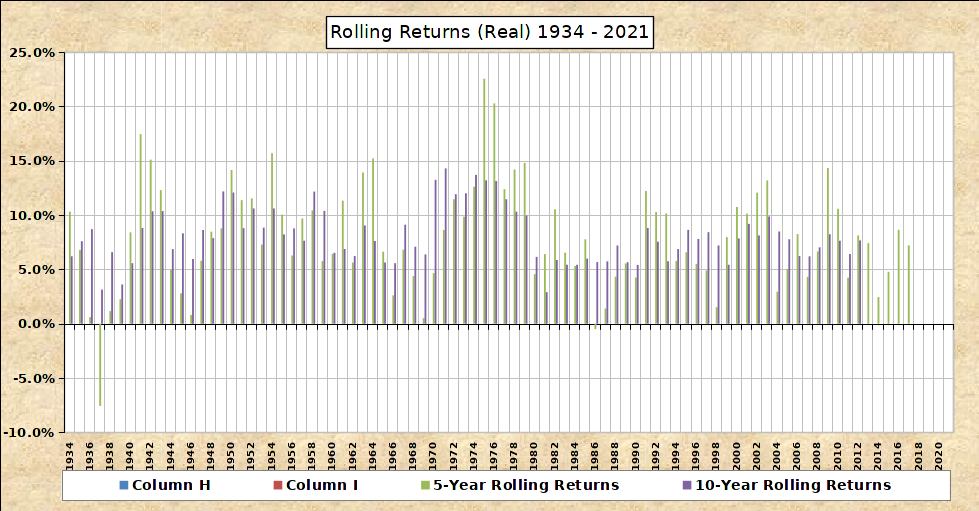

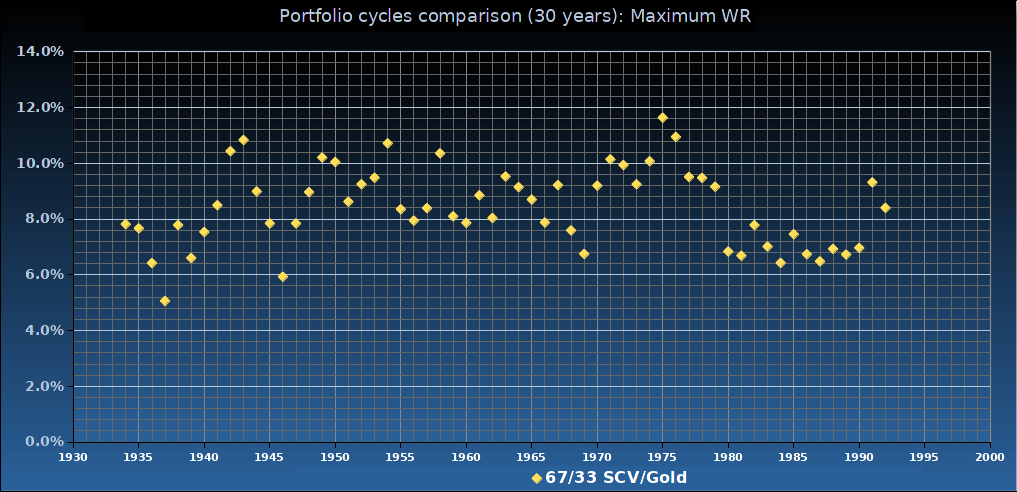

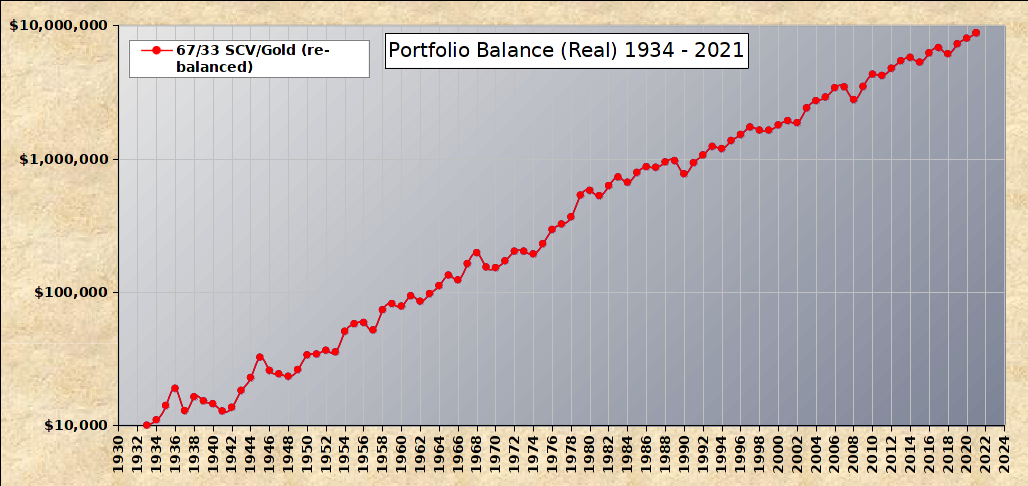

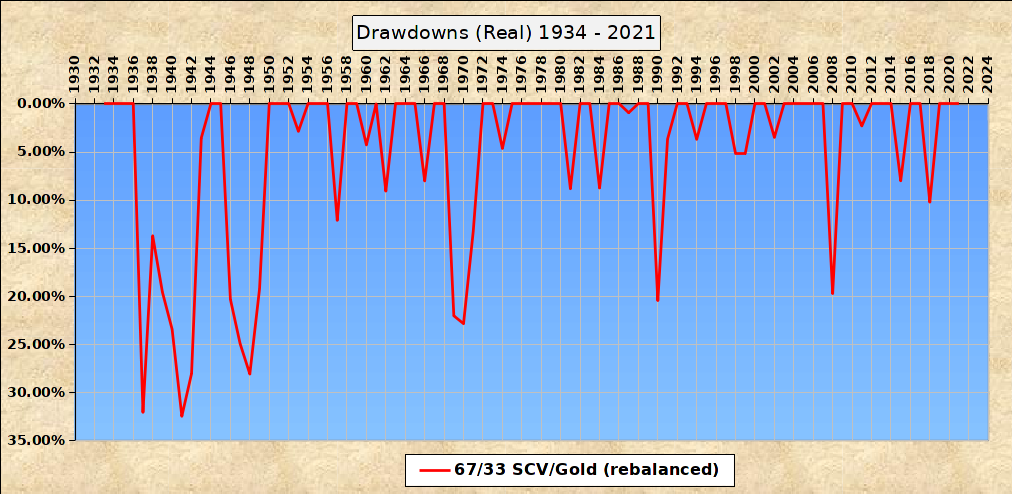

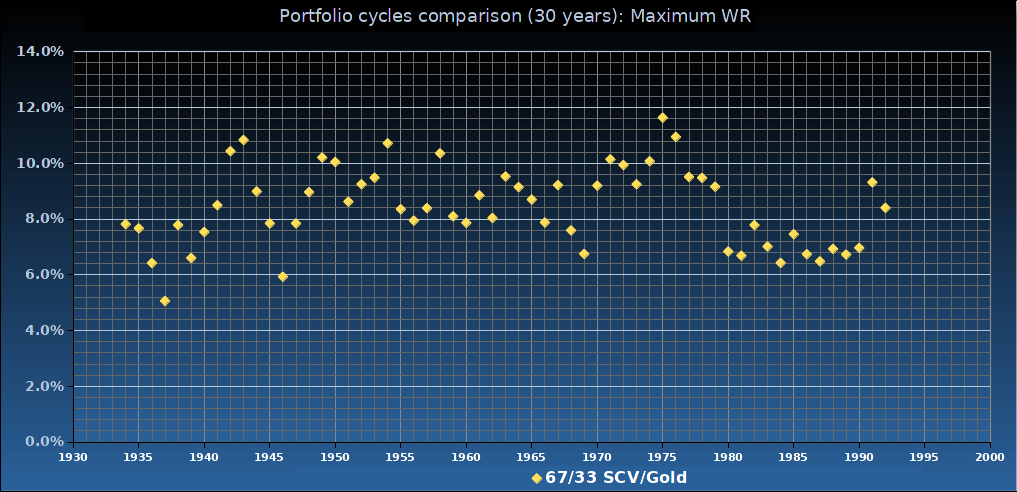

Simba's backtest spreadsheets Data worksheet for gold, and then in the Analysis worksheet set a start date of 1934 for 67 SCV, 33 gold and in the lower charts within that worksheet you'll see that only had a single 30 year 6% SWR failure start year of 1937.

1934 as a start year as that was the year following physical gold becoming illegal to hold in the US, but not elsewhere such as London. Prior to the 1930's gold was money and investors were more inclined to just hold bonds, as inflation broadly averaged 0% and bonds (lending your gold such as gold Sovereign Pound coins in the UK that one Pound (paper) notes could be converted to sovereigns in banks)) paid interest - that was like a real rate of return.

If instead of lumping into retirement, you averaged in over two timepoints, a year apart, then the worst case 1937 would have been diluted down. a.k.a don't lump all in at a single point in time, but perhaps start your retirement portfolio 6 months before you actually retire, and transition fully into that retirement pot 6 months after you've actually retired.

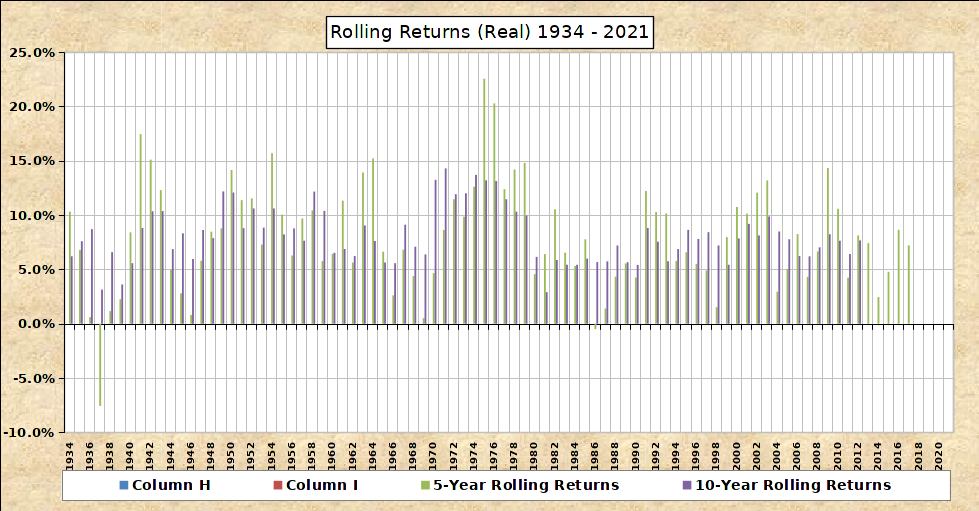

So 67/33 SCV/Gold 30 year 6% SWR has historically had a high success rate both in the UK and US.

PV MC indicates a 90% success rate. For failures the portfolio still did sustain many years and in the worst cases there would have been some pre-warning in early years that the portfolio value was declining and possibly likely to fail at sustaining a 6% SWR, where reducing your withdrawals in reflection of that would have been more inclined to succeed overall (at sustaining income over a total of 30 years).

I don't know how to use FireCalc, but suspect its somewhat like PV MC where it may be less inclined to factor in the likes of multi-year inverse correlations such as between stocks and gold. The circumstances that might see stocks halve - such as high inflation, faltering domestic currency, domestic geopolitical risks ..etc. are inclined to see the price of gold rise in domestic currency terms. When you apply a Martingale type 'betting sequence' you can be ahead even with 50/50 coin flip outcomes. The main risk of Martingale for gamblers is that of two many repeated losing flips in a row, where their bankroll becomes exhausted and they can't double up their prior stake on the next play. With 67/33 SCV/gold however you in effect have a infinite bankroll. 66 stock value halves to 33, 33 gold doubles to 66, rebalancing back to 67/33 has you double up on the number of shares being held in the post-rebalanced 67/33 SCV/gold portfolio. Not that its as clear cut/linear as that, or such regular large moves, but more micro and progressive/transitionary when applied to 67/33 SCV/gold and periodic withdrawals.

One option might be to apply a 6% SWR, but don't spend all of that, invest/save some. In which case the circumstances that induced a SWR failure (averaging-out) often can prove to have been good for those accumulating (averaging-in). But if you use the same asset allocation to average-into then in practice you don't make any such trades (its just using the same asset allocation but with a lower SWR). So basically judgemental. If things aren't looking great (as the average case outcomes even after 6% SWR saw multiples more of the inflation adjusted start date portfolio value still available at the end of 30 years), then revise your withdrawals downwards (cut back on spending/save some).

But that is more for those that are interested in investing. For heirs that just want simplicity/ease, then set them up with a lower SWR value figure, 4% or 5% of the initial amount, and draw monthly income as I defined in a prior post. For that paper (ETF) gold is simpler, having both SCV and gold ETF's in the same brokerage account. For others physical gold can be superior as can applying more dynamics (such as a higher SWR with potential judgemental reductions - that the disinterested would be far less inclined to apply/manage). For the disinterested SWR can like a inflation adjusted regular income type annuity, with relatively simple management (withdrawals) and without having 'spent' the money (potential sizeable pot still remaining at the end of 30 years rather than having spent the money in order to buy a regular inflation adjusted income).

In practice you'll soon know if 6% SWR is at risk of failure, as typically a bad-run in the first few/handful of years will be a big red flag. In other cases you may become more confident if those first few/handful of years result in a good-run.